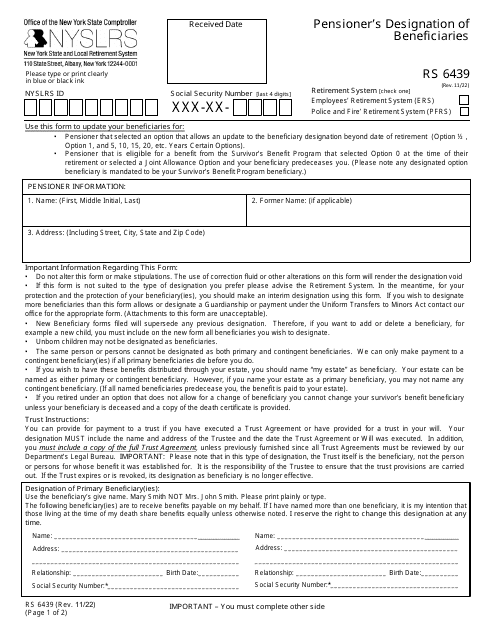

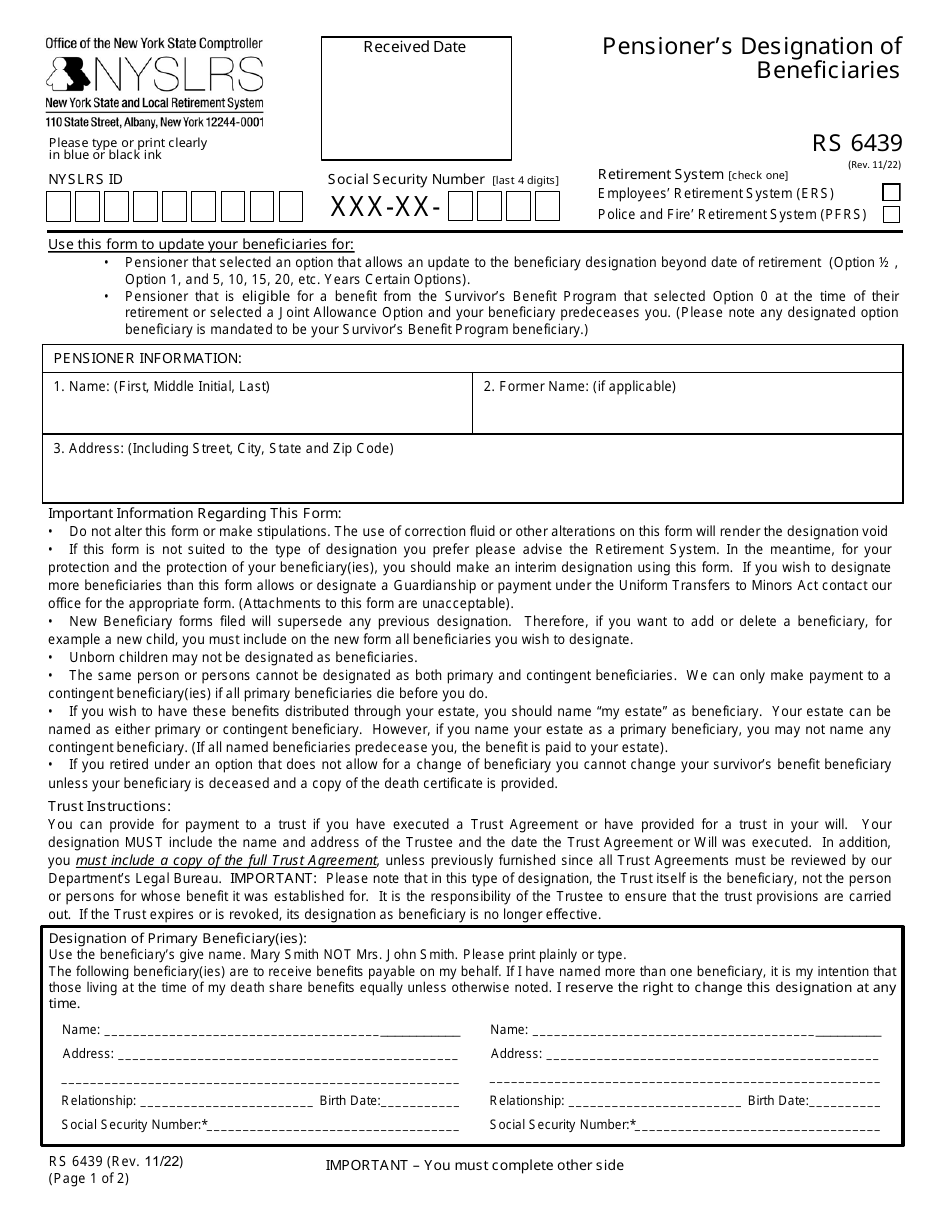

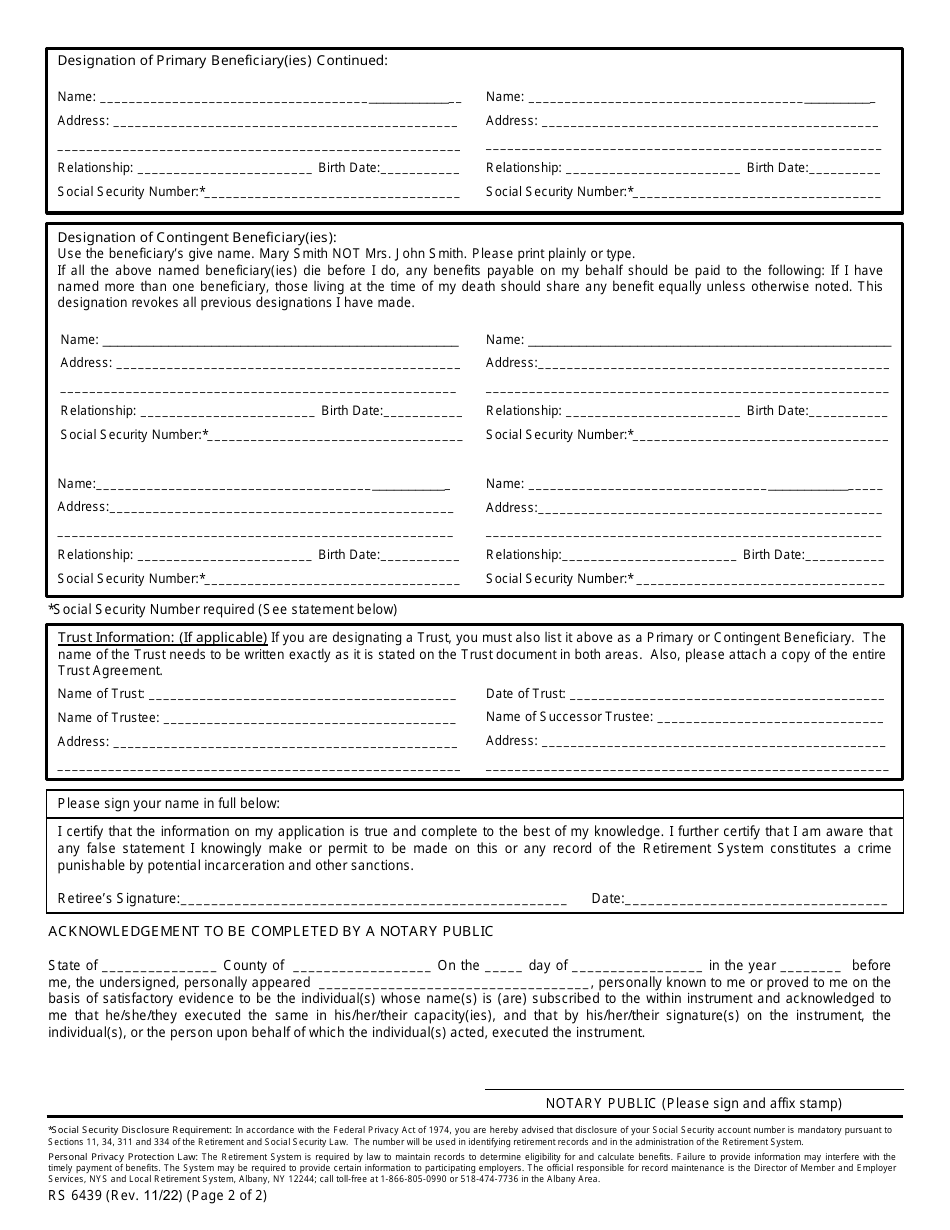

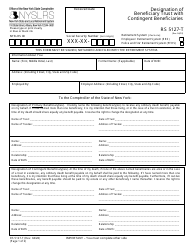

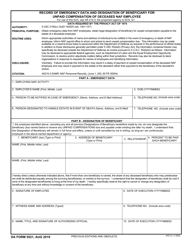

Form RS6439 Pensioner's Designation of Beneficiaries - New York

What Is Form RS6439?

This is a legal form that was released by the Office of the New York State Comptroller - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RS6439?

A: The Form RS6439 is the Pensioner's Designation of Beneficiaries form in New York.

Q: What is the purpose of the Form RS6439?

A: The purpose of the Form RS6439 is to designate beneficiaries for a pension plan in New York.

Q: Who needs to fill out the Form RS6439?

A: Pensioners in New York who want to designate beneficiaries for their pension plan need to fill out the Form RS6439.

Q: How can I obtain the Form RS6439?

A: You can obtain the Form RS6439 from your pension plan provider or from the New York State Department of Civil Service.

Q: Is the Form RS6439 specific to New York?

A: Yes, the Form RS6439 is specific to pensioners in New York.

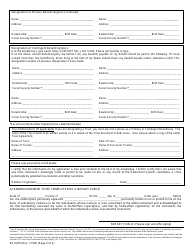

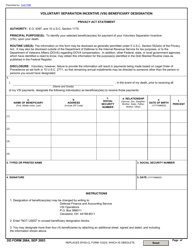

Q: Can I change my designated beneficiaries after submitting the Form RS6439?

A: Yes, you can change your designated beneficiaries after submitting the Form RS6439 by submitting a new form.

Q: Is there a deadline for submitting the Form RS6439?

A: There may be a deadline for submitting the Form RS6439, so it's important to check with your pension plan provider.

Q: Are there any fees for submitting the Form RS6439?

A: There are no fees for submitting the Form RS6439.

Q: What happens if I don't fill out the Form RS6439?

A: If you don't fill out the Form RS6439, your pension plan may default to a predetermined beneficiary or follow state laws regarding inheritance.

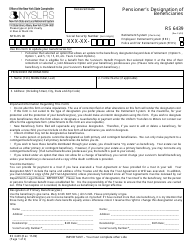

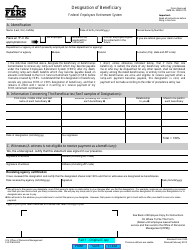

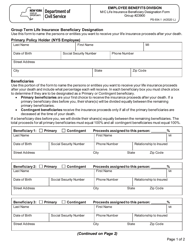

Q: Can I designate multiple beneficiaries on the Form RS6439?

A: Yes, you can designate multiple beneficiaries on the Form RS6439.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Office of the New York State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RS6439 by clicking the link below or browse more documents and templates provided by the Office of the New York State Comptroller.