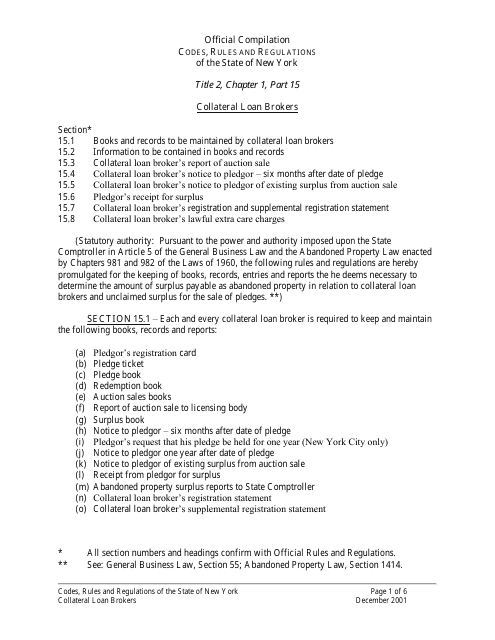

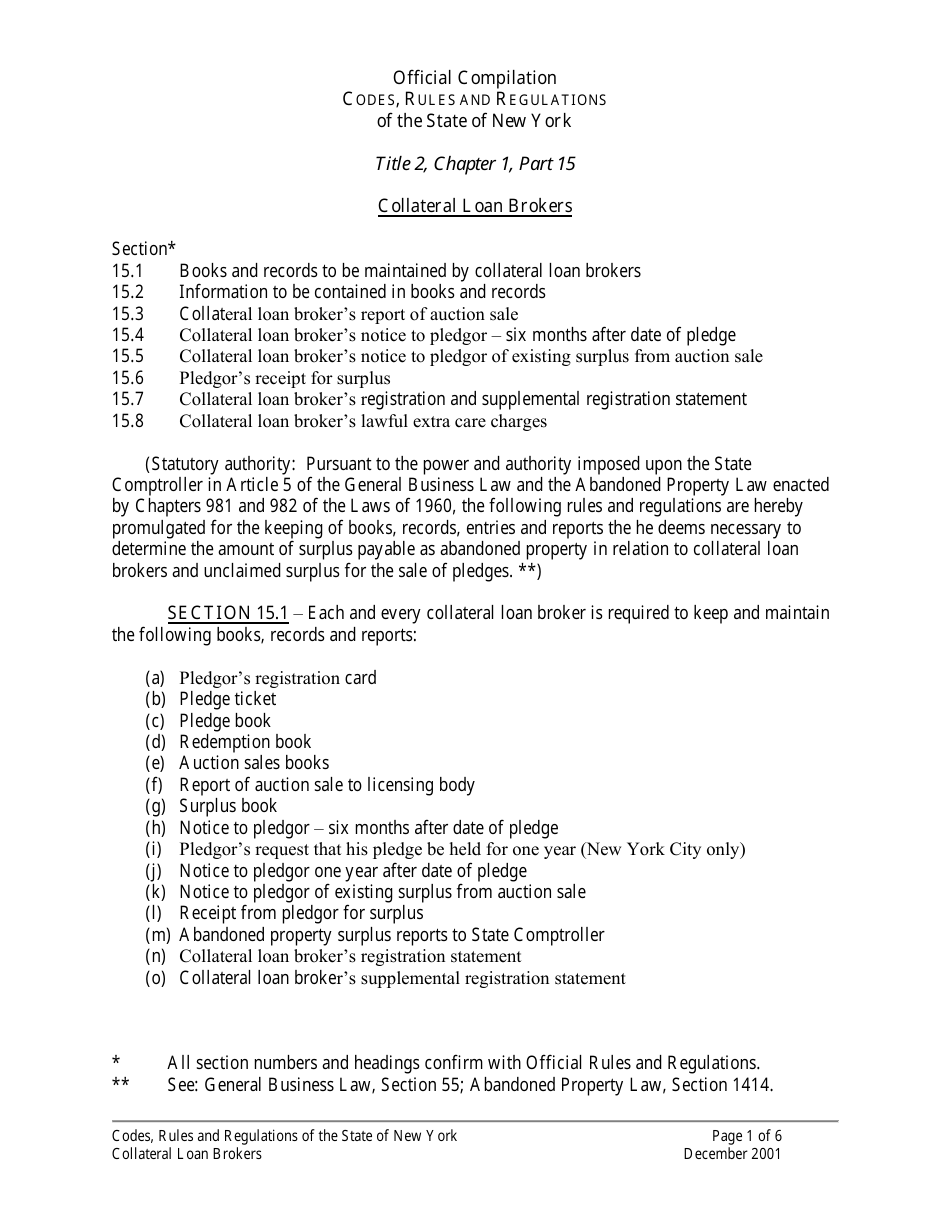

Collateral Loan Brokers Codes, Rules and Regulations - New York

Collateral Loan Brokers Codes, Rules and Regulations is a legal document that was released by the Office of the New York State Comptroller - a government authority operating within New York.

FAQ

Q: What is a collateral loan?

A: A collateral loan is a loan that is secured by valuable assets such as property or jewelry.

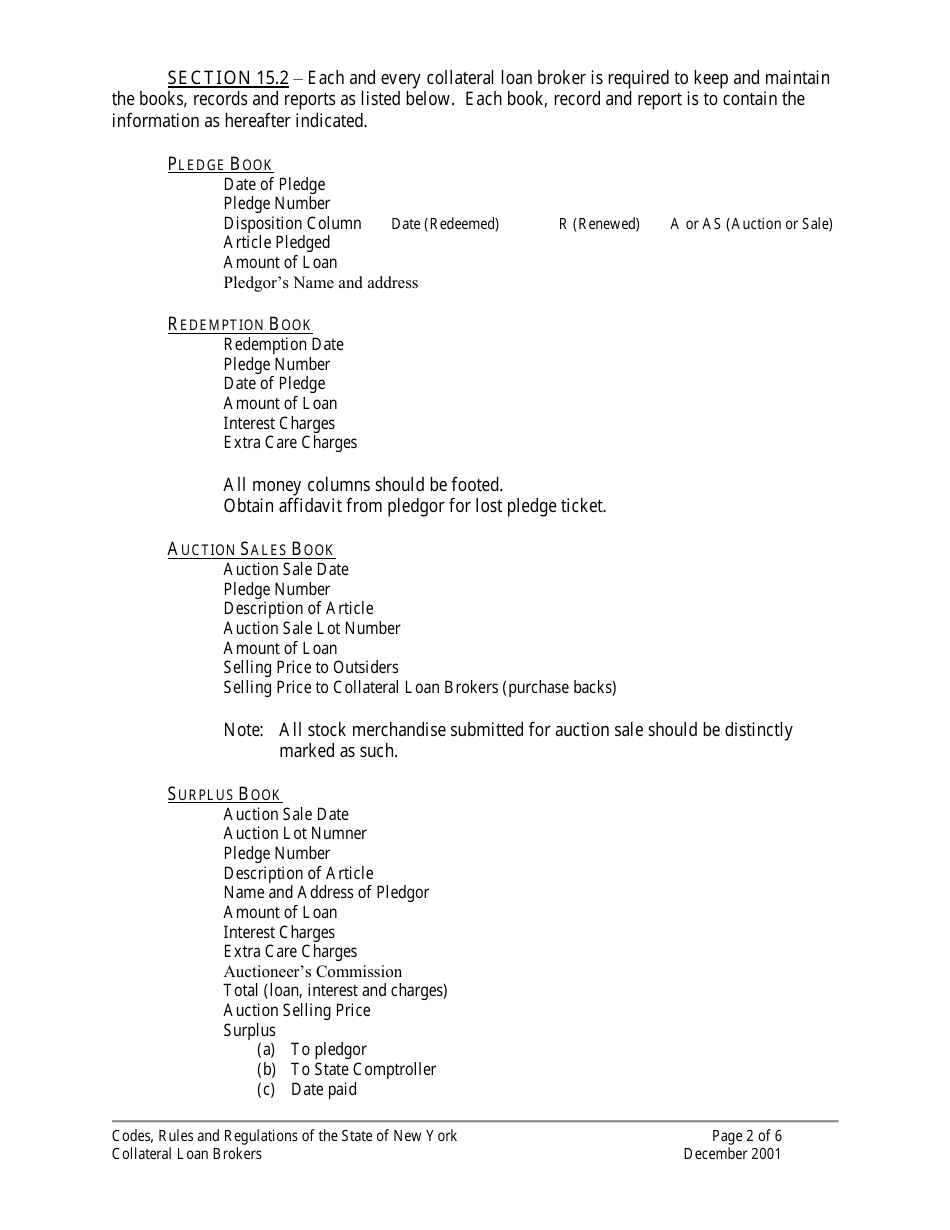

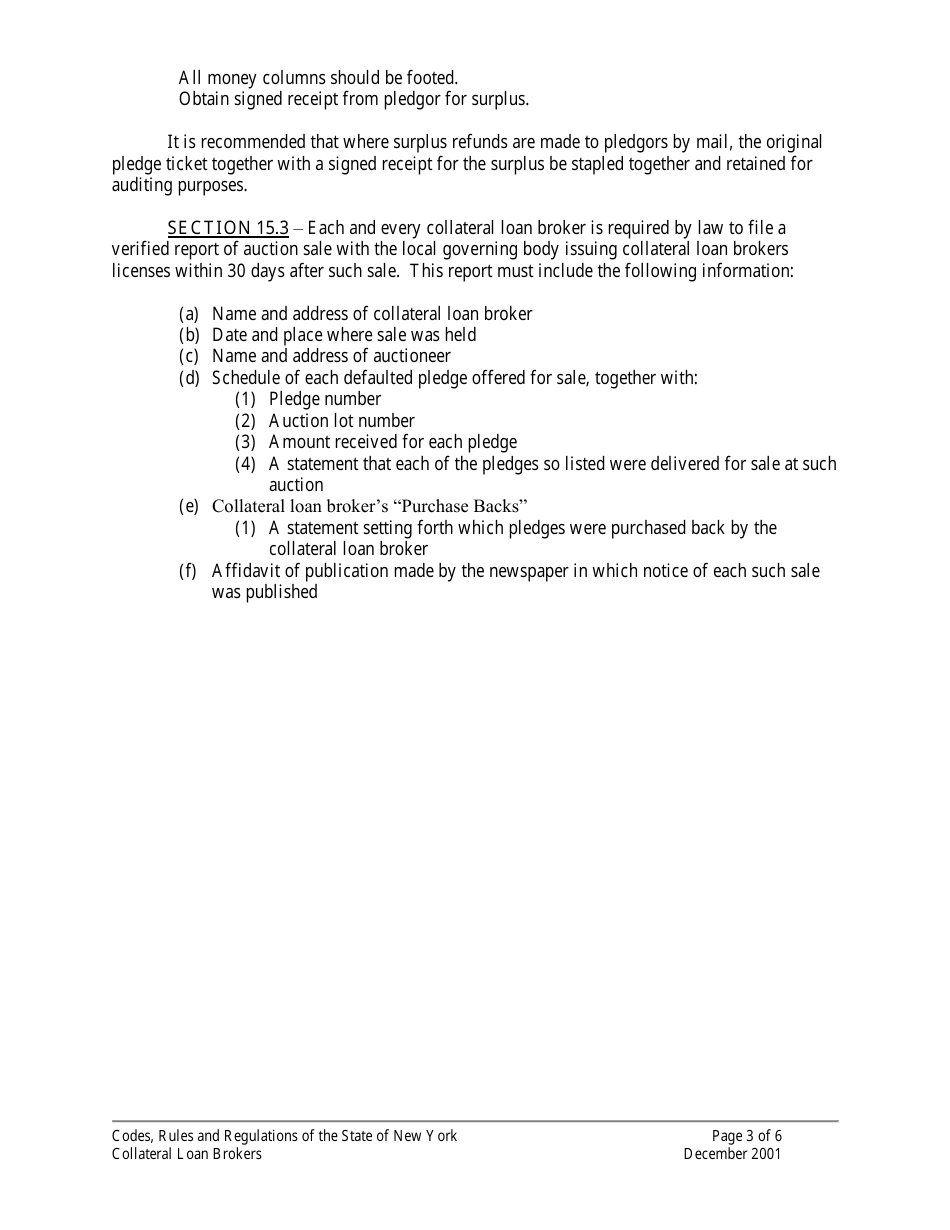

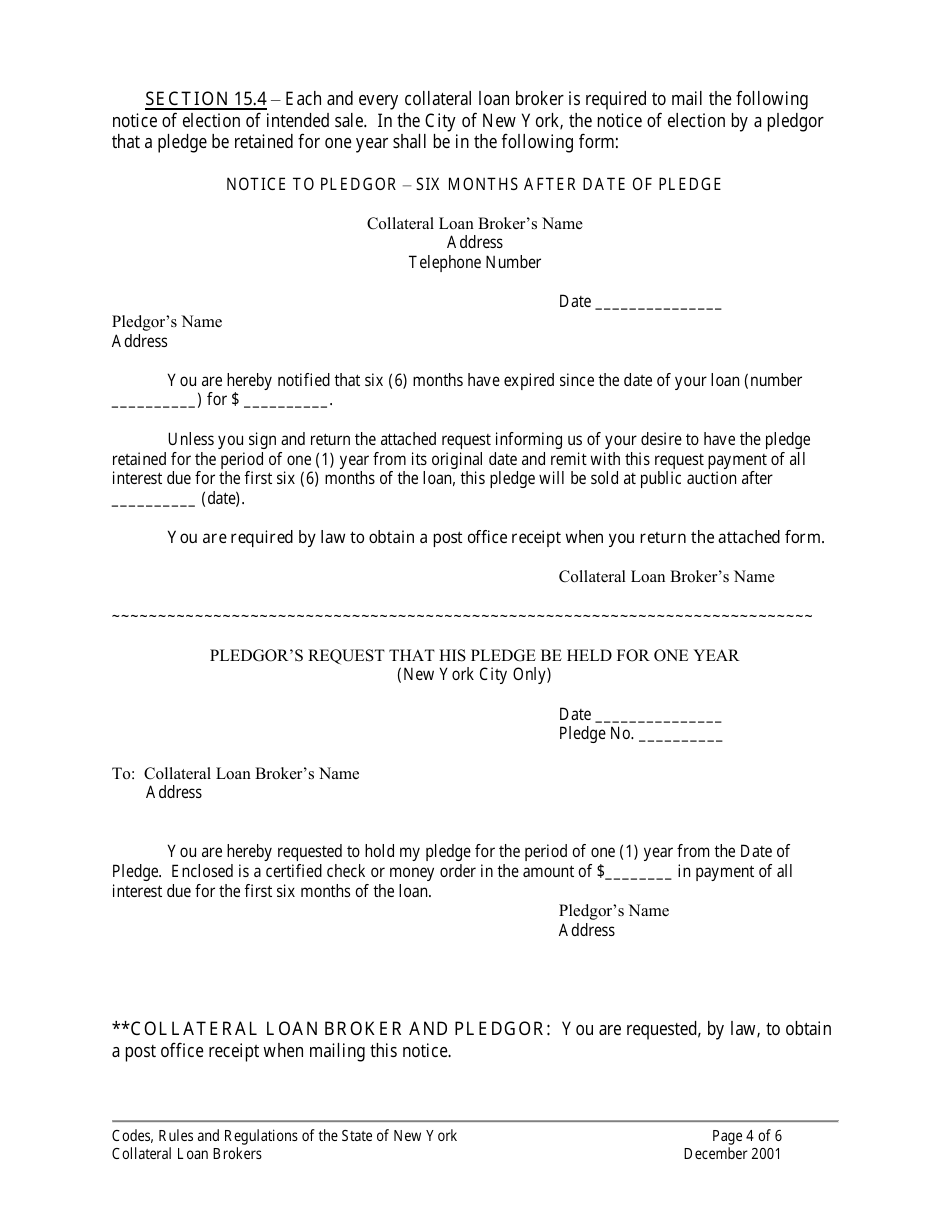

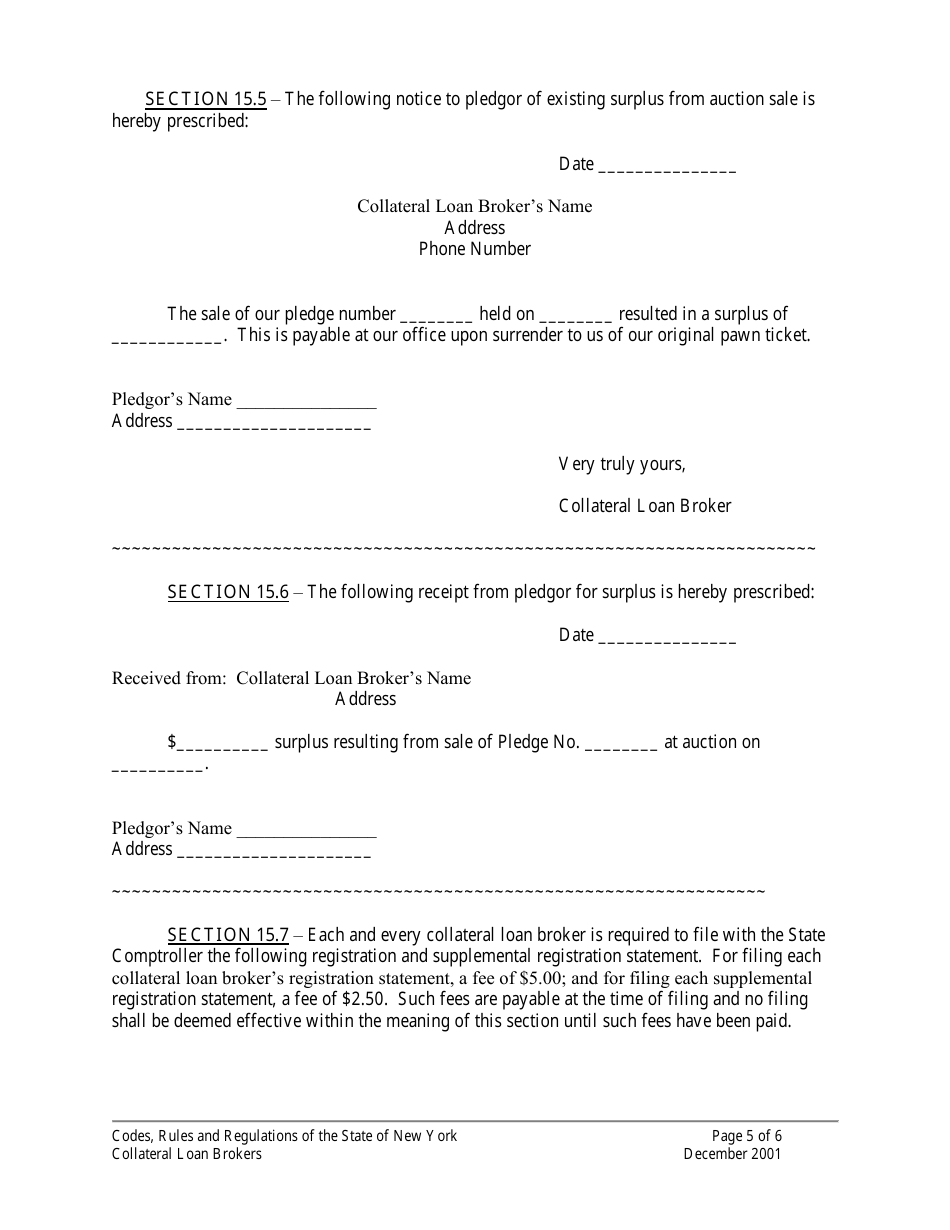

Q: What are collateral loan broker codes, rules, and regulations?

A: Collateral loan broker codes, rules, and regulations refer to the laws and guidelines set by the state of New York to govern the activities of collateral loan brokers.

Q: Who is a collateral loan broker?

A: A collateral loan broker is a professional who connects borrowers in need of a collateral loan with lenders who are willing to offer such loans.

Q: What is the purpose of collateral loan broker codes, rules, and regulations?

A: The purpose of these codes, rules, and regulations is to ensure the fair and ethical operation of collateral loan brokers, as well as the protection of borrowers and lenders.

Q: What are some common regulations for collateral loan brokers in New York?

A: Common regulations for collateral loan brokers in New York may include licensing requirements, disclosure of loan terms and fees, and restrictions on unfair practices.

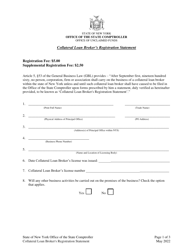

Form Details:

- Released on December 1, 2001;

- The latest edition currently provided by the Office of the New York State Comptroller;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Office of the New York State Comptroller.