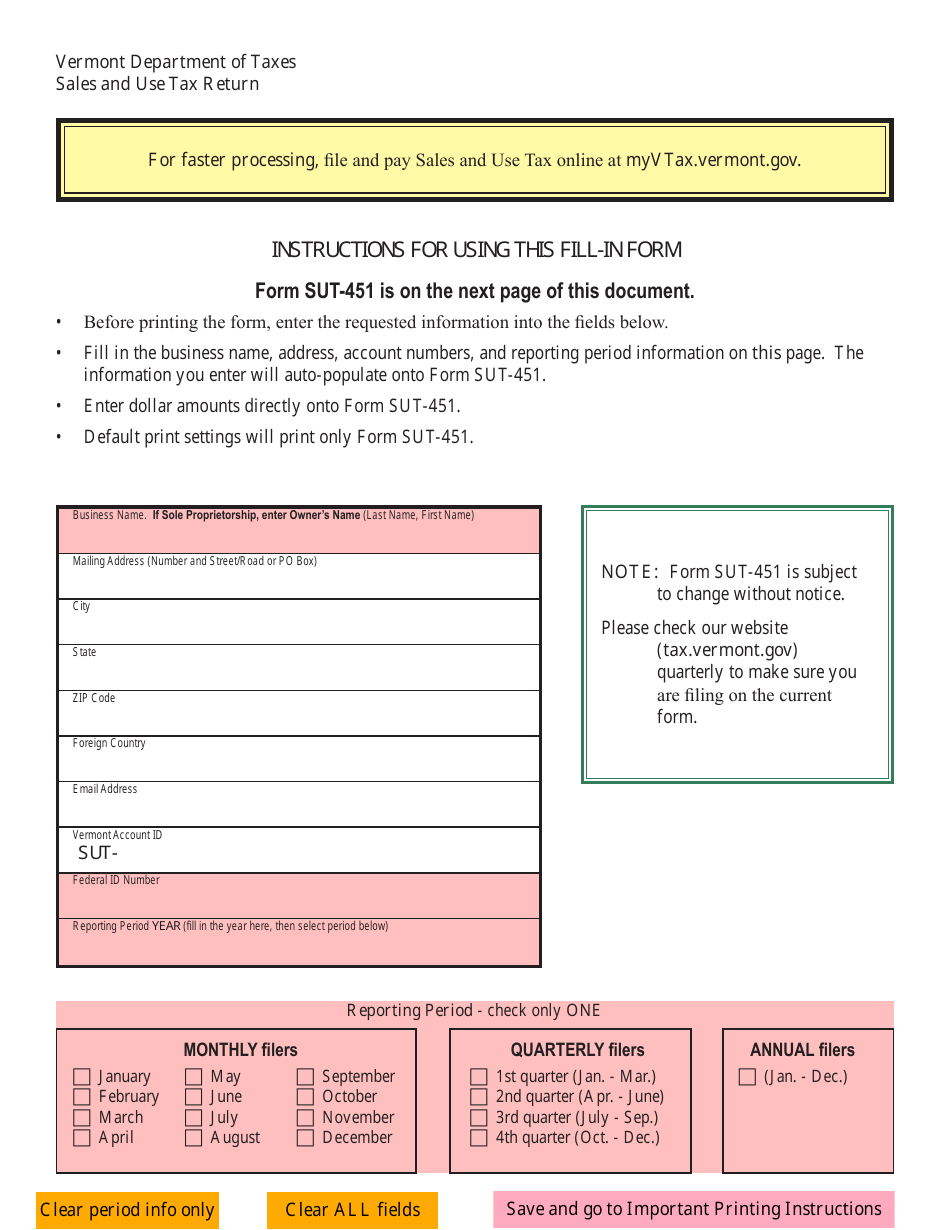

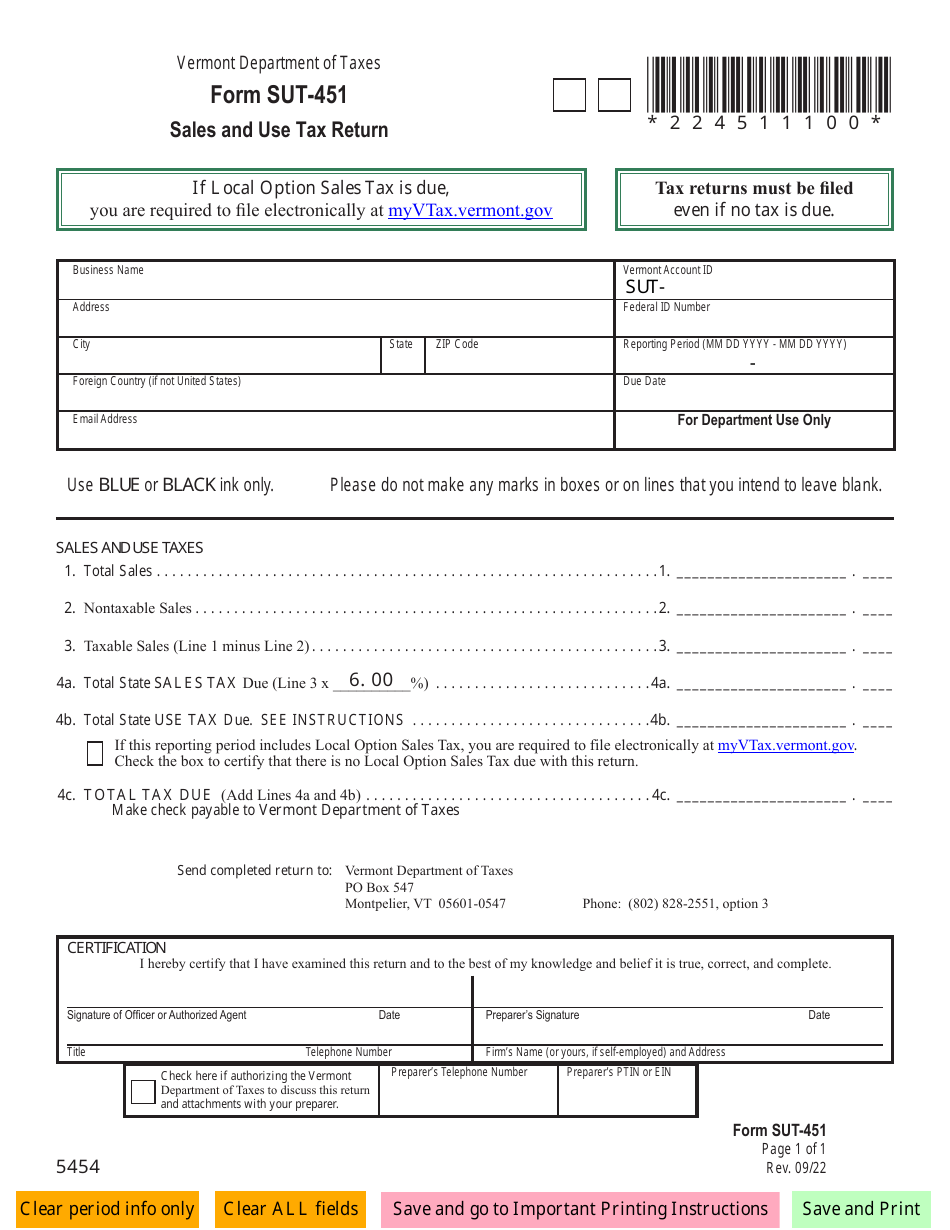

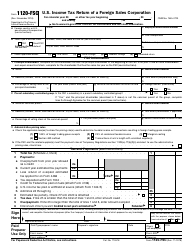

Form SUT-451 Sales and Use Tax Return - Vermont

What Is Form SUT-451?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form SUT-451?

A: Form SUT-451 is the Sales and Use Tax Return for Vermont.

Q: Who needs to file form SUT-451?

A: Anyone who sells or uses taxable goods or services in Vermont needs to file form SUT-451.

Q: What is the purpose of form SUT-451?

A: Form SUT-451 is used to report and remit sales and use tax owed to the state of Vermont.

Q: When is form SUT-451 due?

A: Form SUT-451 is due on a monthly basis and must be filed by the last day of the following month.

Q: Are there any penalties for late filing of form SUT-451?

A: Yes, there are penalties for late filing and late payment of sales and use tax owed.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SUT-451 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.