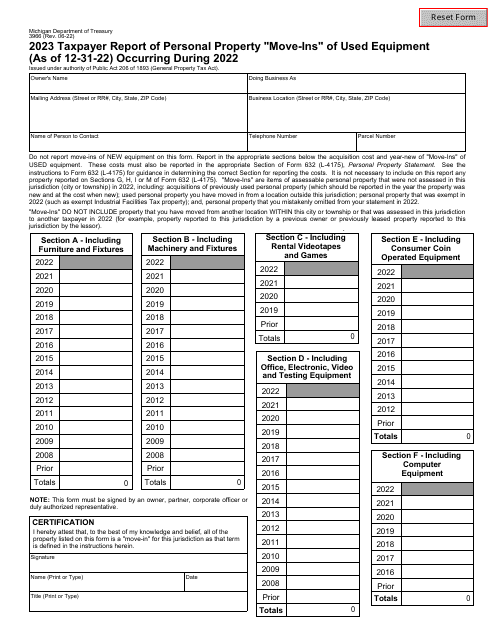

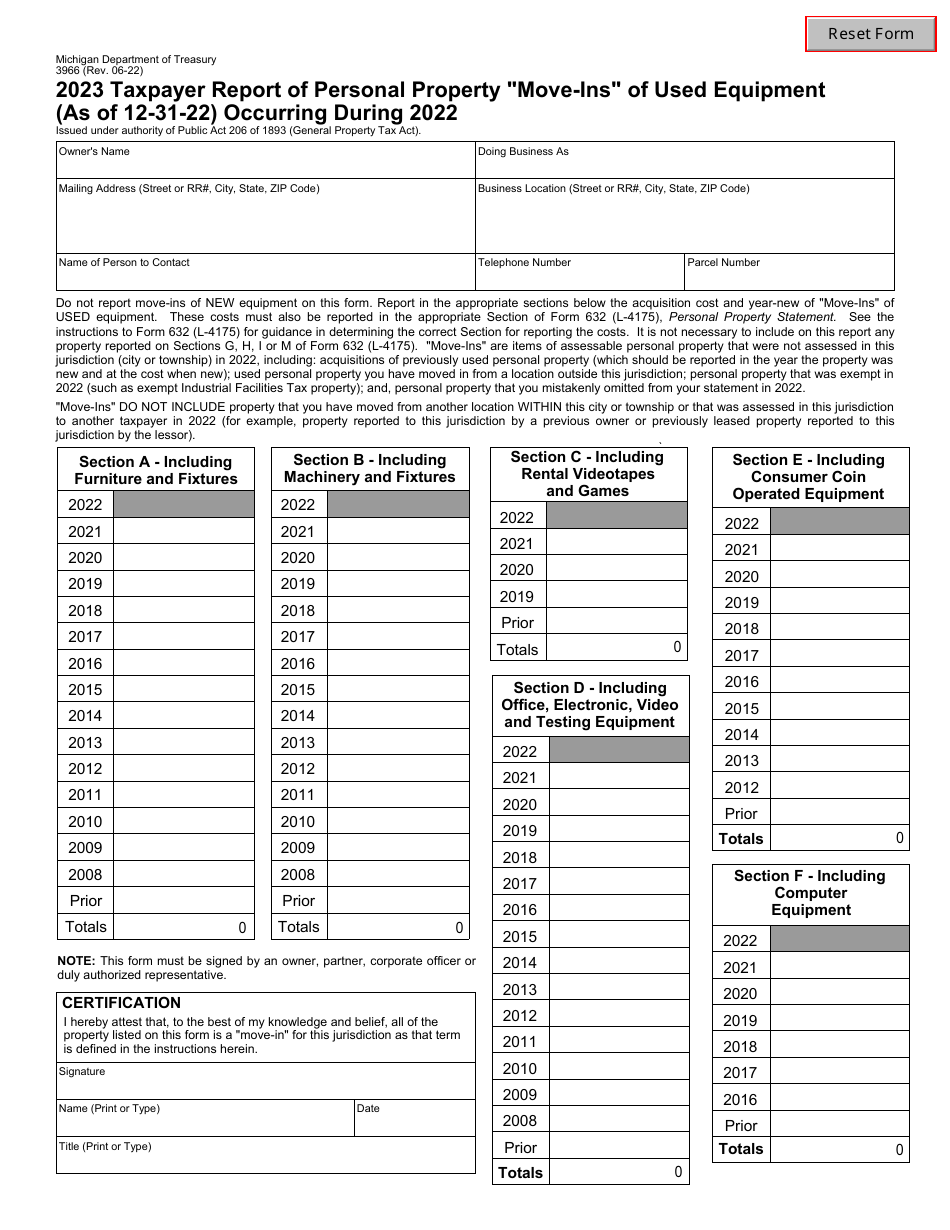

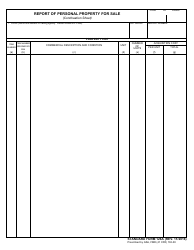

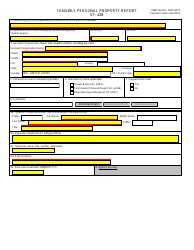

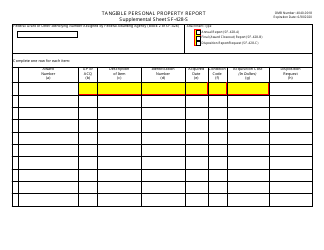

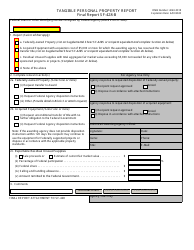

Form 3966 Taxpayer Report of Personal Property "move-Ins" of Used Equipment (As of 12-31-22) Occurring During 2022 - Michigan

What Is Form 3966?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3966?

A: Form 3966 is the Taxpayer Report of Personal Property 'move-Ins' of Used Equipment.

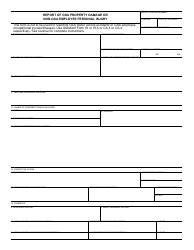

Q: What is the purpose of Form 3966?

A: The purpose of Form 3966 is to report the 'move-ins' of used equipment for tax purposes.

Q: What is the reporting period for Form 3966?

A: The reporting period for Form 3966 is the year 2022.

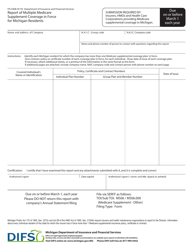

Q: What is the deadline for filing Form 3966?

A: The deadline for filing Form 3966 is December 31, 2022.

Q: Who is required to file Form 3966?

A: Taxpayers who have 'move-ins' of used equipment in Michigan during 2022 are required to file Form 3966.

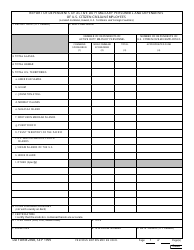

Q: What information is required on Form 3966?

A: Form 3966 requires information such as the description of the equipment, the purchase price, and the date of 'move-in'.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3966 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.