This version of the form is not currently in use and is provided for reference only. Download this version of

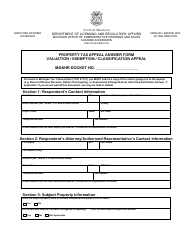

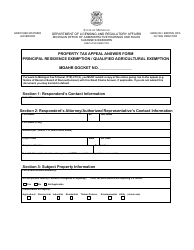

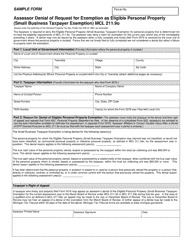

Form 5076

for the current year.

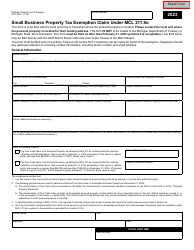

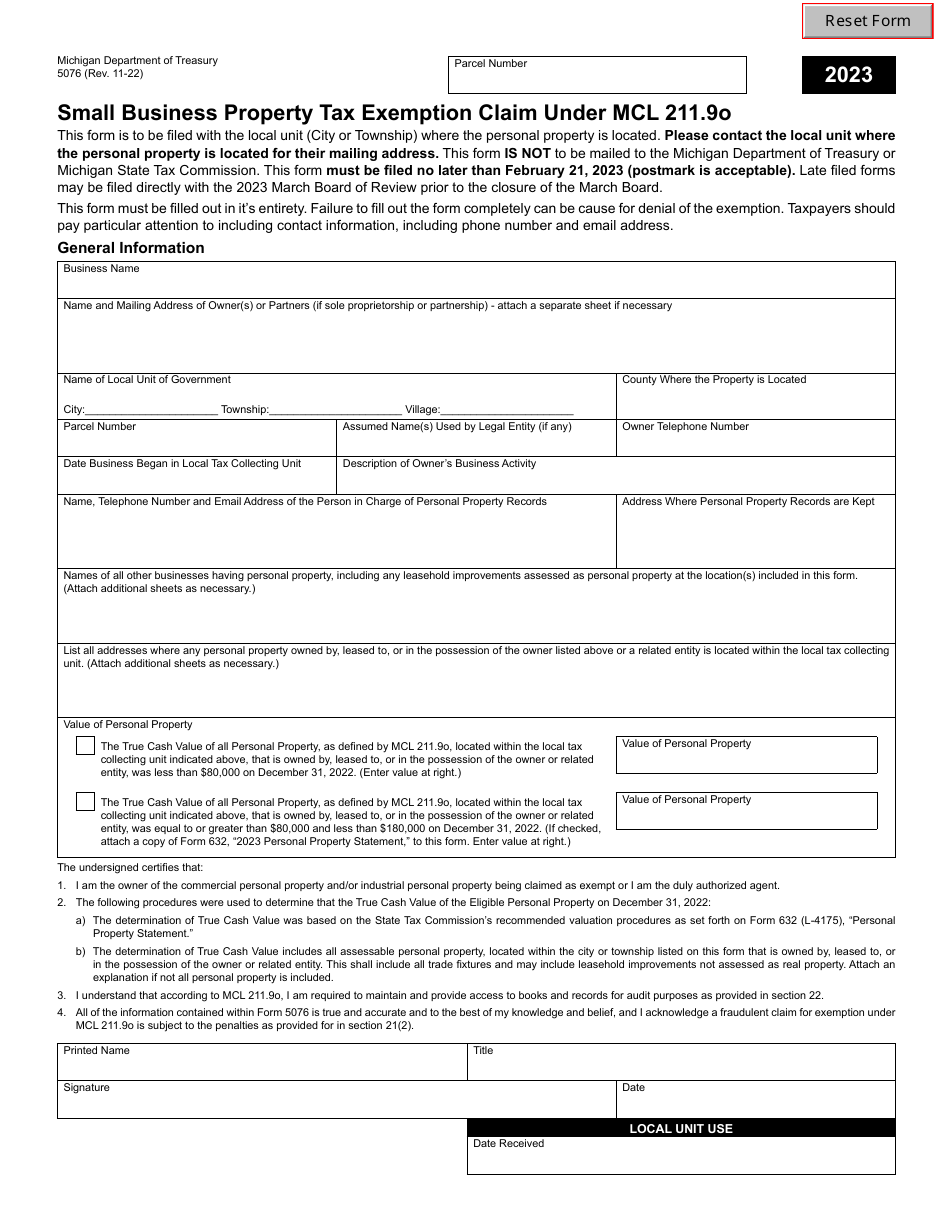

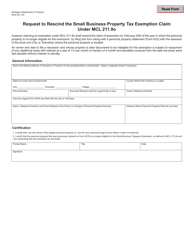

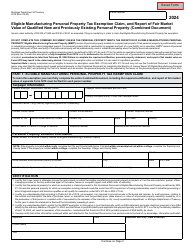

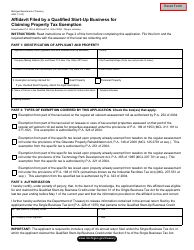

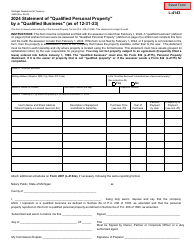

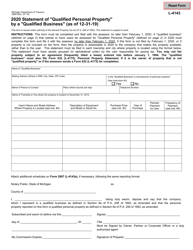

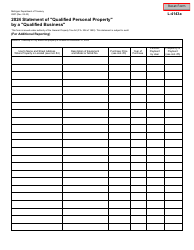

Form 5076 Small Business Property Tax Exemption Claim Under Mcl 211.9o - Michigan

What Is Form 5076?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5076?

A: Form 5076 is the Small Business Property Tax Exemption Claim under MCL 211.9o in Michigan.

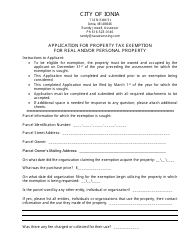

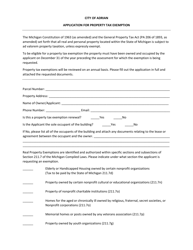

Q: Who can use Form 5076?

A: Small businesses in Michigan can use Form 5076 to claim a property tax exemption.

Q: What is the purpose of Form 5076?

A: The purpose of Form 5076 is to request a property tax exemption for eligible small businesses.

Q: What is the eligibility criteria for the small business property tax exemption?

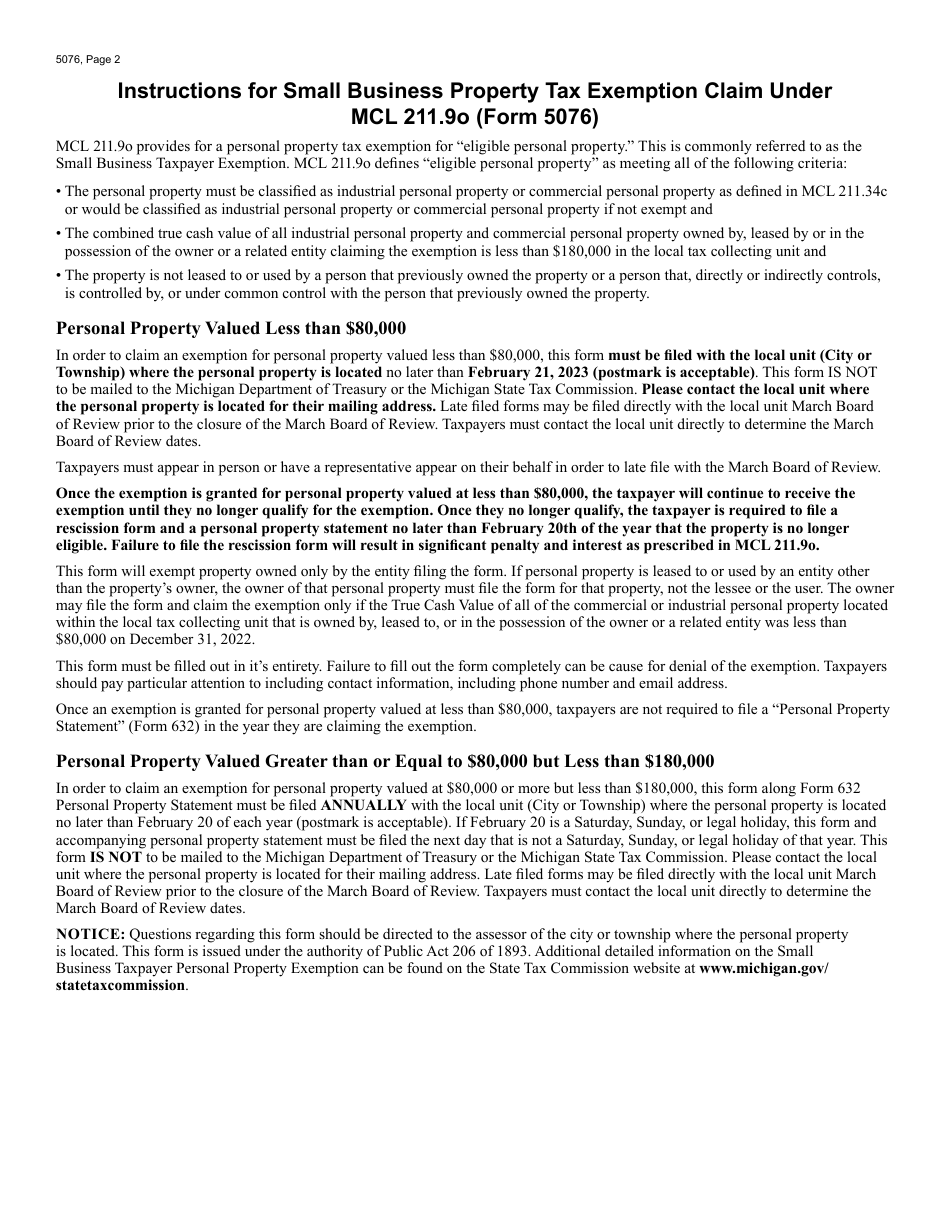

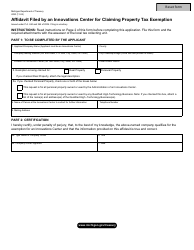

A: The eligibility criteria for the small business property tax exemption in Michigan are specified in MCL 211.9o. Small businesses must meet certain criteria related to size, use, and ownership of the property.

Q: Are there any deadlines for submitting Form 5076?

A: Yes, Form 5076 must be filed with the local assessing officer by February 10th of the year for which the exemption is sought.

Q: What documents do I need to submit along with Form 5076?

A: You may be required to submit supporting documents such as financial records, tax returns, and lease agreements to demonstrate your eligibility for the small business property tax exemption.

Q: Can I claim the small business property tax exemption if I have multiple locations?

A: Yes, you can claim the small business property tax exemption for each eligible location.

Q: What happens after I submit Form 5076?

A: After you submit Form 5076, the local assessing officer will review the application and determine whether you are eligible for the small business property tax exemption.

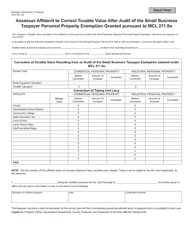

Q: What should I do if my claim is approved?

A: If your claim is approved, you will receive a reduction in the taxable value of your property, resulting in lower property taxes for the eligible portion of your property.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5076 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.