ODOT Form 734-5225 Short Line Railroad Rehabilitation Tax Credit Application for Preliminary Certification - Oregon

What Is ODOT Form 734-5225?

This is a legal form that was released by the Oregon Department of Transportation - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ODOT Form 734-5225?

A: ODOT Form 734-5225 is the Short Line Railroad Rehabilitation Tax Credit Application for Preliminary Certification in Oregon.

Q: What is the purpose of the form?

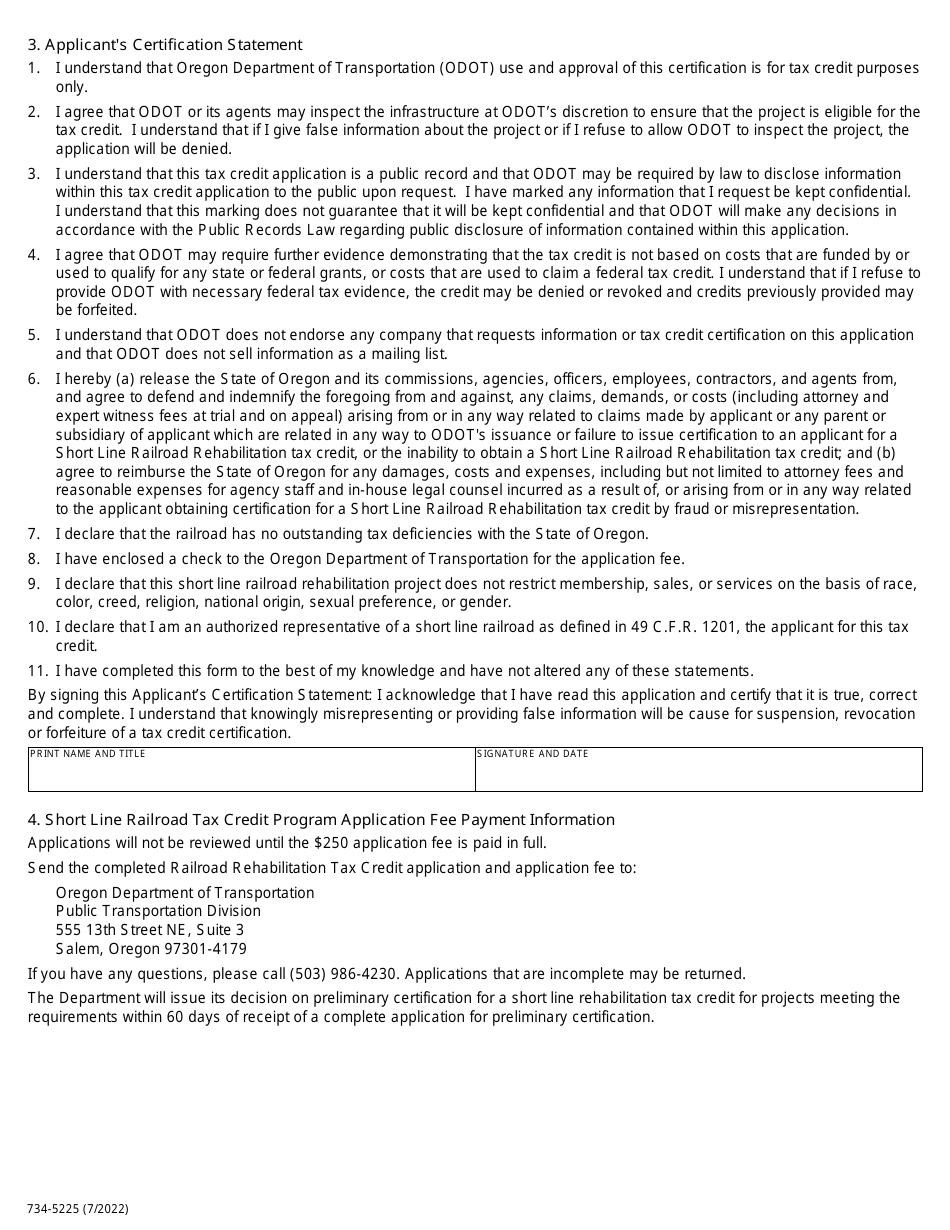

A: The form is used to apply for preliminary certification for the Short Line Railroad Rehabilitation Tax Credit in Oregon.

Q: Who can submit this form?

A: Railroad companies or entities operating short line railroads in Oregon can submit this form.

Q: What is the Short Line Railroad Rehabilitation Tax Credit?

A: The Short Line Railroad Rehabilitation Tax Credit is a tax credit provided to encourage the rehabilitation of short line railroads in Oregon.

Q: What is preliminary certification?

A: Preliminary certification is the initial step in the application process for the Short Line Railroad Rehabilitation Tax Credit.

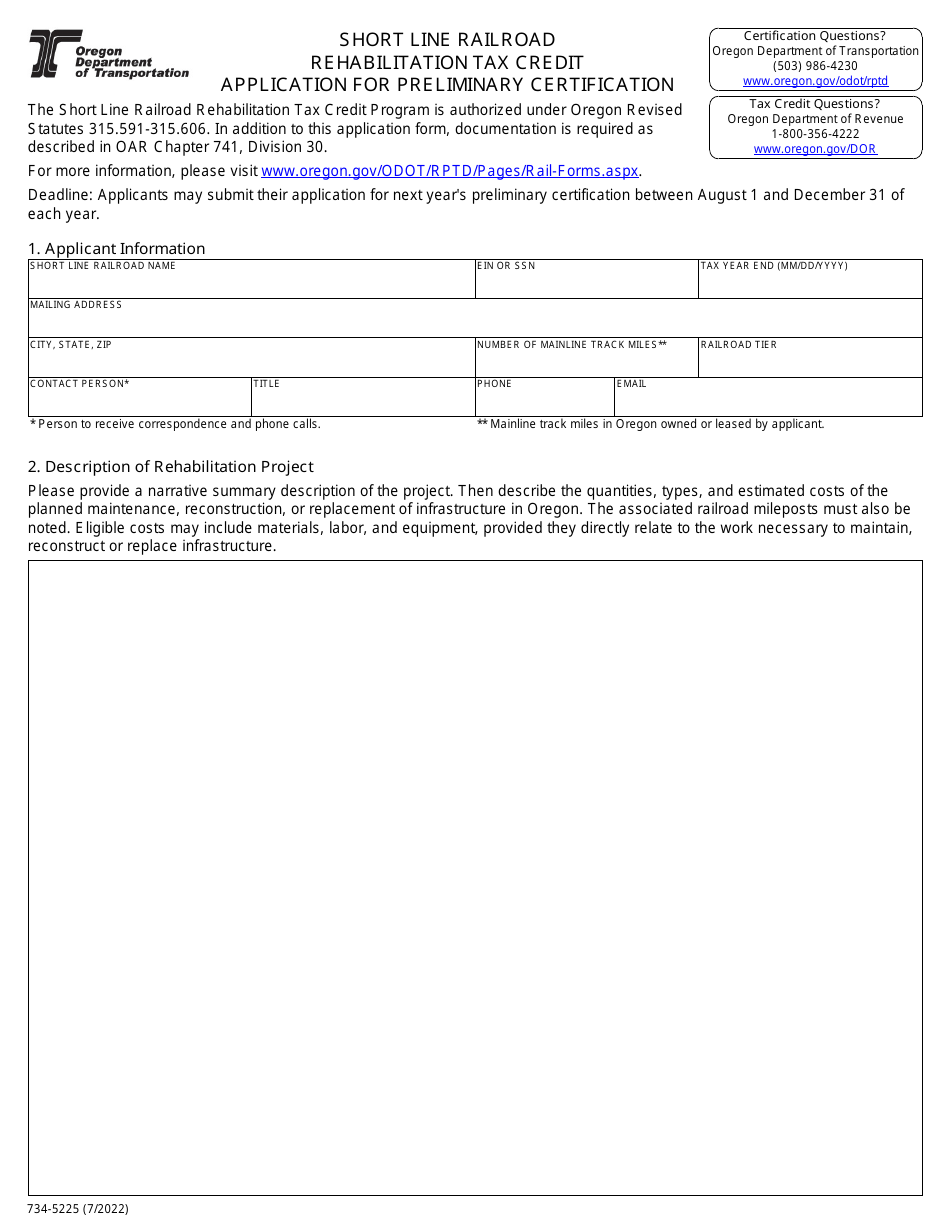

Q: What information is required on the form?

A: The form requires information about the applicant, the short line railroad being rehabilitated, and the expected rehabilitation costs.

Q: Is there a deadline to submit the form?

A: Yes, there is a deadline specified by the Oregon Department of Transportation for submitting the form.

Q: How long does it take to get preliminary certification?

A: The processing time for preliminary certification may vary. It is best to check with the Oregon Department of Transportation for specific timelines.

Q: What are the benefits of the tax credit?

A: The tax credit can help offset the costs of rehabilitating short line railroads and can contribute to improving freight transportation infrastructure in Oregon.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Oregon Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of ODOT Form 734-5225 by clicking the link below or browse more documents and templates provided by the Oregon Department of Transportation.