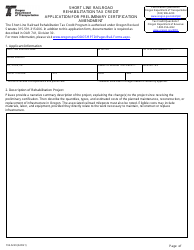

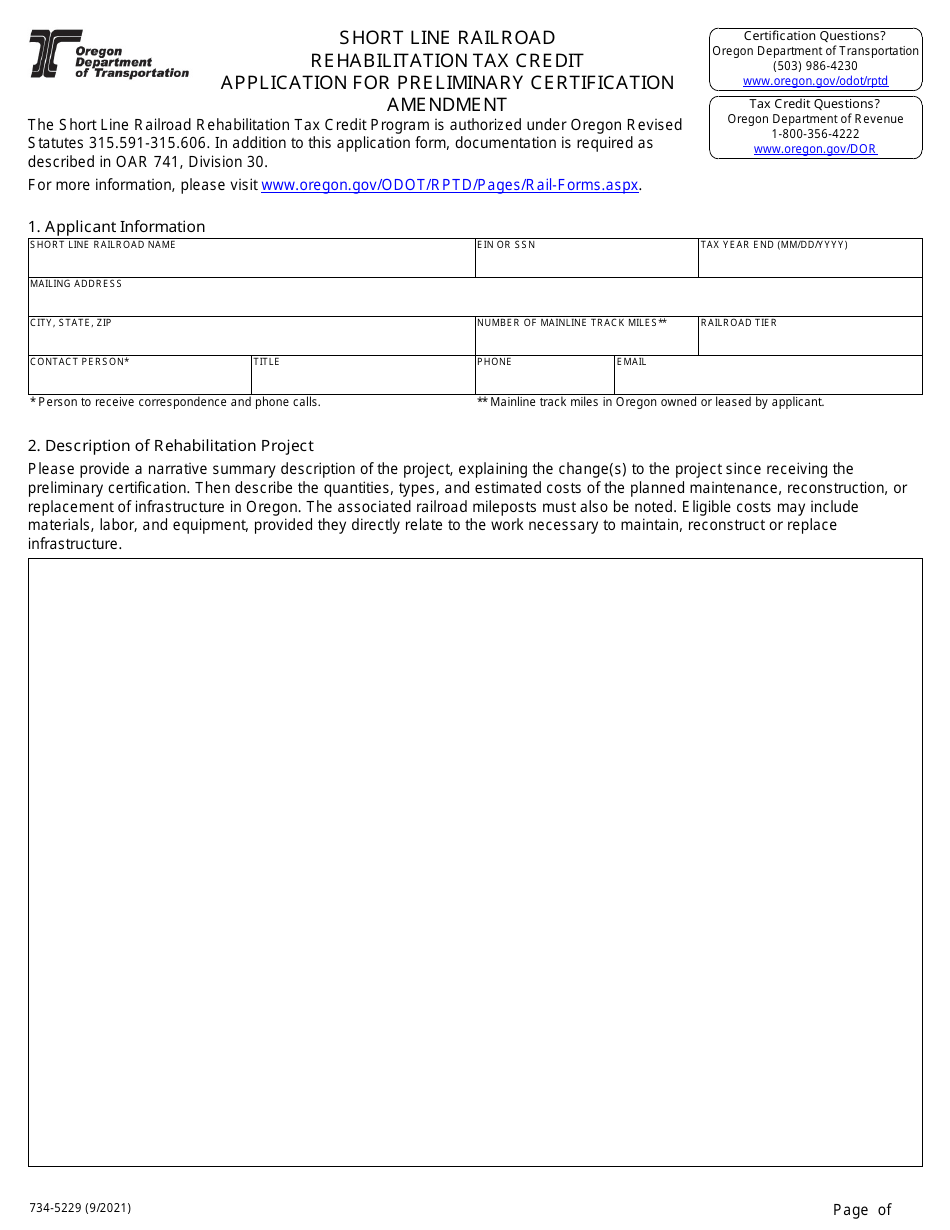

ODOT Form 734-5229 Short Line Railroad Rehabilitation Tax Credit Application for Preliminary Certification Amendment - Oregon

What Is ODOT Form 734-5229?

This is a legal form that was released by the Oregon Department of Transportation - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ODOT Form 734-5229?

A: ODOT Form 734-5229 is the Short Line Railroad Rehabilitation Tax Credit Application for Preliminary Certification Amendment form in Oregon.

Q: What is the purpose of ODOT Form 734-5229?

A: The purpose of ODOT Form 734-5229 is to amend the preliminary certification for the Short Line Railroad Rehabilitation Tax Credit.

Q: What is the Short Line Railroad Rehabilitation Tax Credit?

A: The Short Line Railroad Rehabilitation Tax Credit is a tax credit in Oregon that provides incentives for investment in rail infrastructure on short line railroads.

Q: Who should use ODOT Form 734-5229?

A: Short line railroads in Oregon who have already applied for preliminary certification for the tax credit should use ODOT Form 734-5229 to amend their certification.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Oregon Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of ODOT Form 734-5229 by clicking the link below or browse more documents and templates provided by the Oregon Department of Transportation.