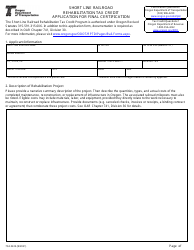

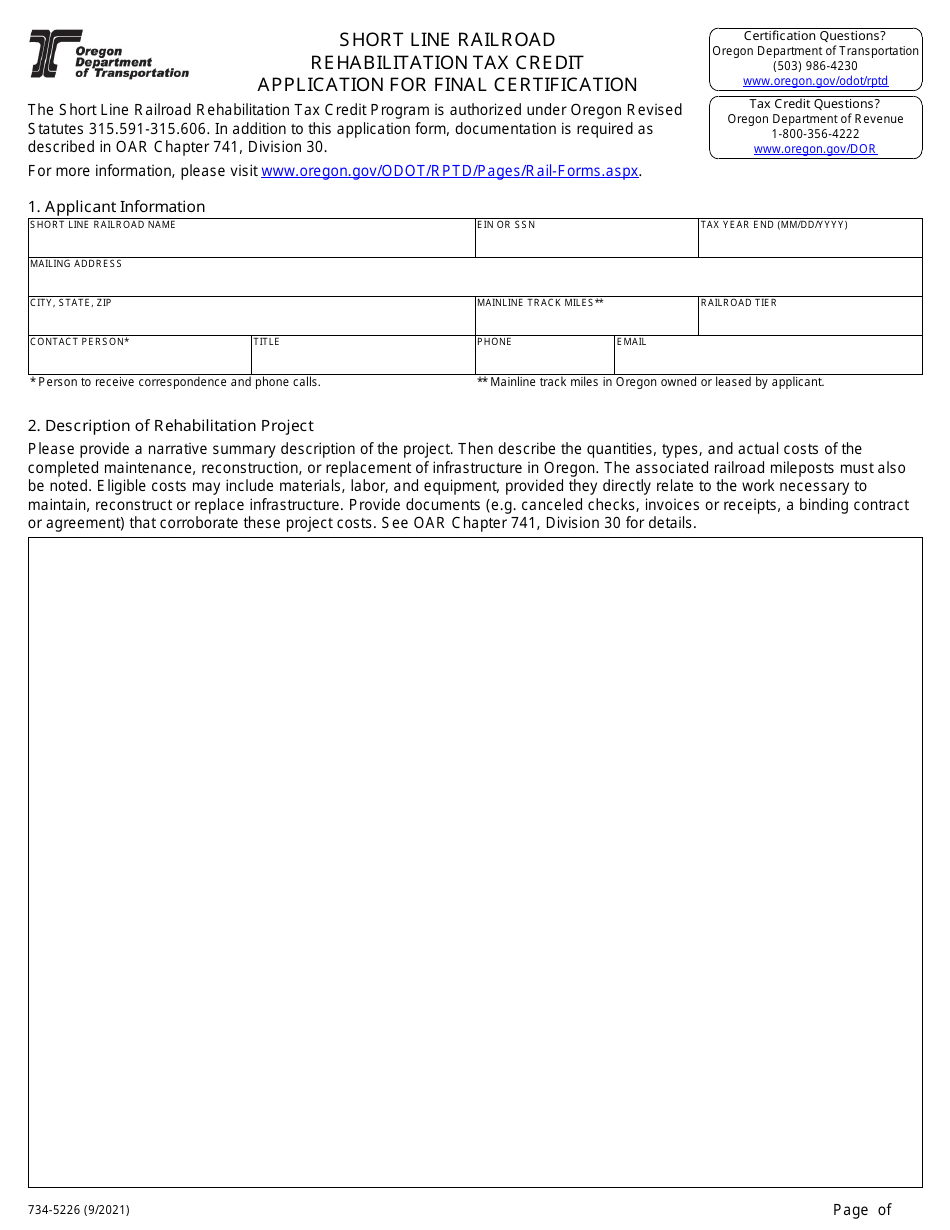

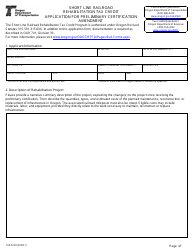

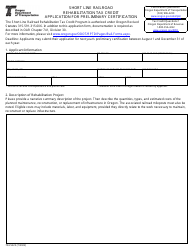

ODOT Form 734-5226 Short Line Railroad Rehabilitation Tax Credit Application for Final Certification - Oregon

What Is ODOT Form 734-5226?

This is a legal form that was released by the Oregon Department of Transportation - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the ODOT Form 734-5226?

A: ODOT Form 734-5226 is the Short Line Railroad Rehabilitation Tax Credit Application for Final Certification in Oregon.

Q: What is the purpose of ODOT Form 734-5226?

A: The purpose of ODOT Form 734-5226 is to apply for final certification for the Short Line Railroad Rehabilitation Tax Credit in Oregon.

Q: What is the Short Line Railroad Rehabilitation Tax Credit?

A: The Short Line Railroad Rehabilitation Tax Credit is a tax credit available in Oregon to promote the rehabilitation of short line railroads.

Q: Who is eligible for the Short Line Railroad Rehabilitation Tax Credit?

A: Short line railroads that meet certain criteria are eligible for the tax credit. You can refer to the ODOT Form 734-5226 for specific eligibility requirements.

Q: What is the process for applying for the tax credit?

A: The process for applying for the tax credit involves completing ODOT Form 734-5226 and submitting it to the Oregon Department of Transportation for review and certification.

Q: Are there any deadlines for submitting ODOT Form 734-5226?

A: Yes, there are specific deadlines for submitting ODOT Form 734-5226. It is important to refer to the form or contact the Oregon Department of Transportation for the current deadlines.

Q: What are the benefits of the Short Line Railroad Rehabilitation Tax Credit?

A: The tax credit provides financial incentives for the rehabilitation of short line railroads, which can help improve transportation infrastructure and promote economic development.

Q: Can the tax credit be claimed retroactively?

A: No, the tax credit can only be claimed for eligible expenses incurred after the certification of the short line railroad by the Oregon Department of Transportation.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Oregon Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of ODOT Form 734-5226 by clicking the link below or browse more documents and templates provided by the Oregon Department of Transportation.