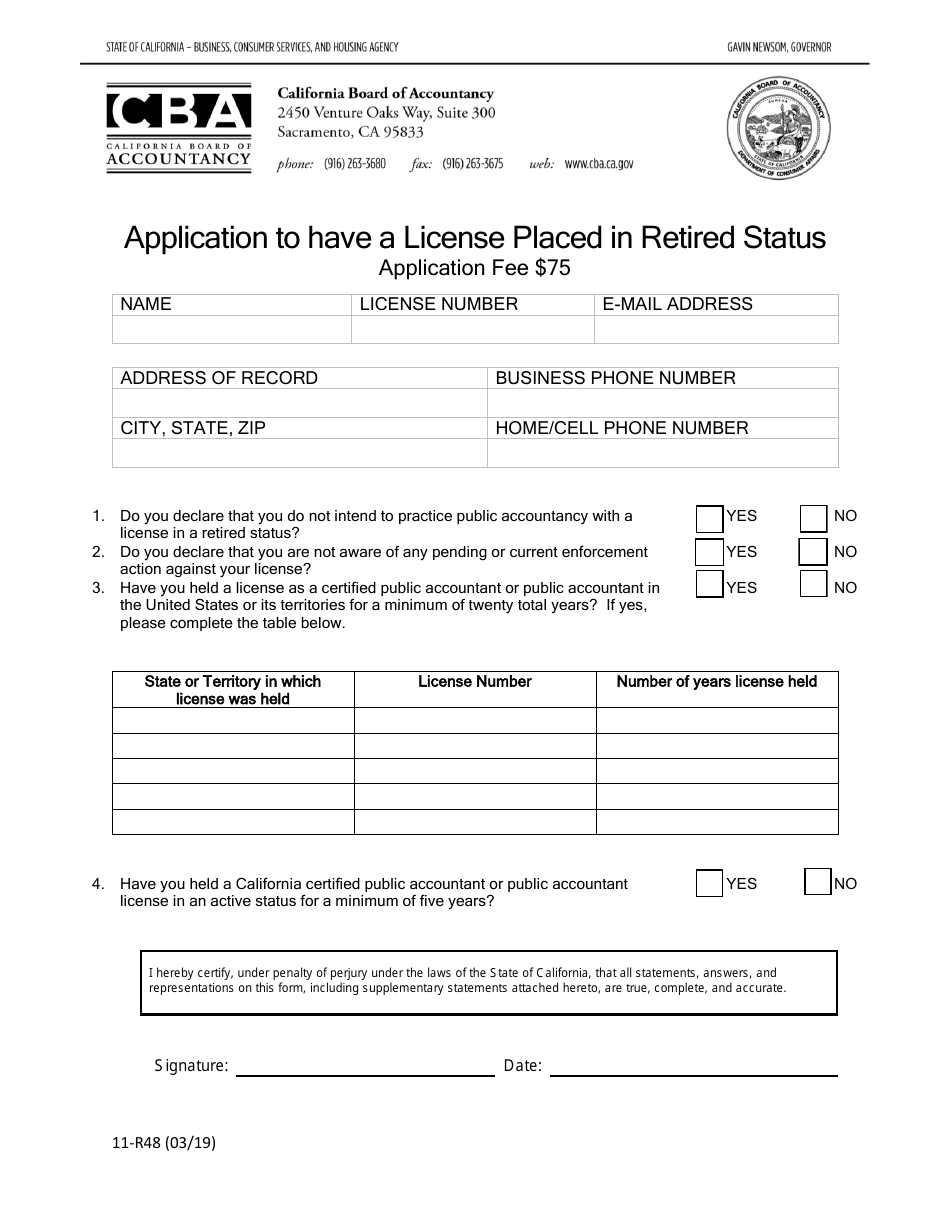

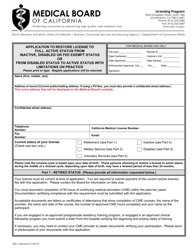

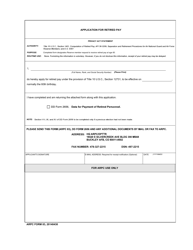

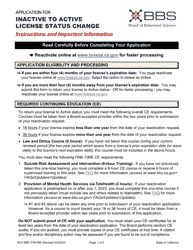

Form 11-R48 Application to Have a License Placed in Retired Status - California

What Is Form 11-R48?

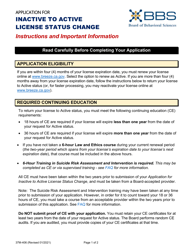

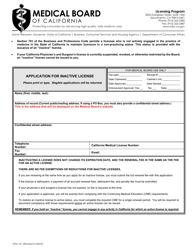

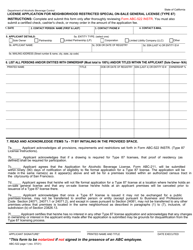

This is a legal form that was released by the California Department of Consumer Affairs - Board of Accountancy - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

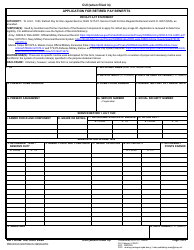

Q: What is Form 11-R48?

A: Form 11-R48 is an application to have a license placed in retired status in California.

Q: Who can use Form 11-R48?

A: This form can be used by individuals in California who want to place their license in retired status.

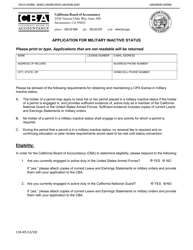

Q: What does it mean to have a license placed in retired status?

A: Having a license placed in retired status means that the individual will no longer be actively practicing their profession, but their license will remain valid.

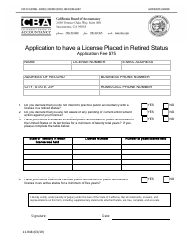

Q: Are there any fees associated with Form 11-R48?

A: There may be a fee associated with submitting Form 11-R48. Please check the instructions or contact the licensing authority in California for more information.

Q: What should I do after completing Form 11-R48?

A: After completing Form 11-R48, you should submit it to the licensing authority in California according to their instructions.

Q: Can I reactivate my license after it has been placed in retired status?

A: Yes, you may be able to reactivate your license after it has been placed in retired status. You should contact the licensing authority in California for more information on the reactivation process.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the California Department of Consumer Affairs - Board of Accountancy;

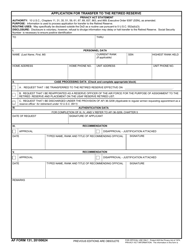

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 11-R48 by clicking the link below or browse more documents and templates provided by the California Department of Consumer Affairs - Board of Accountancy.