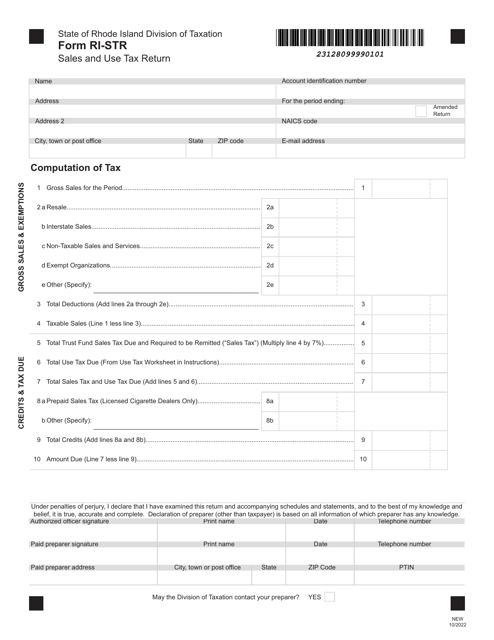

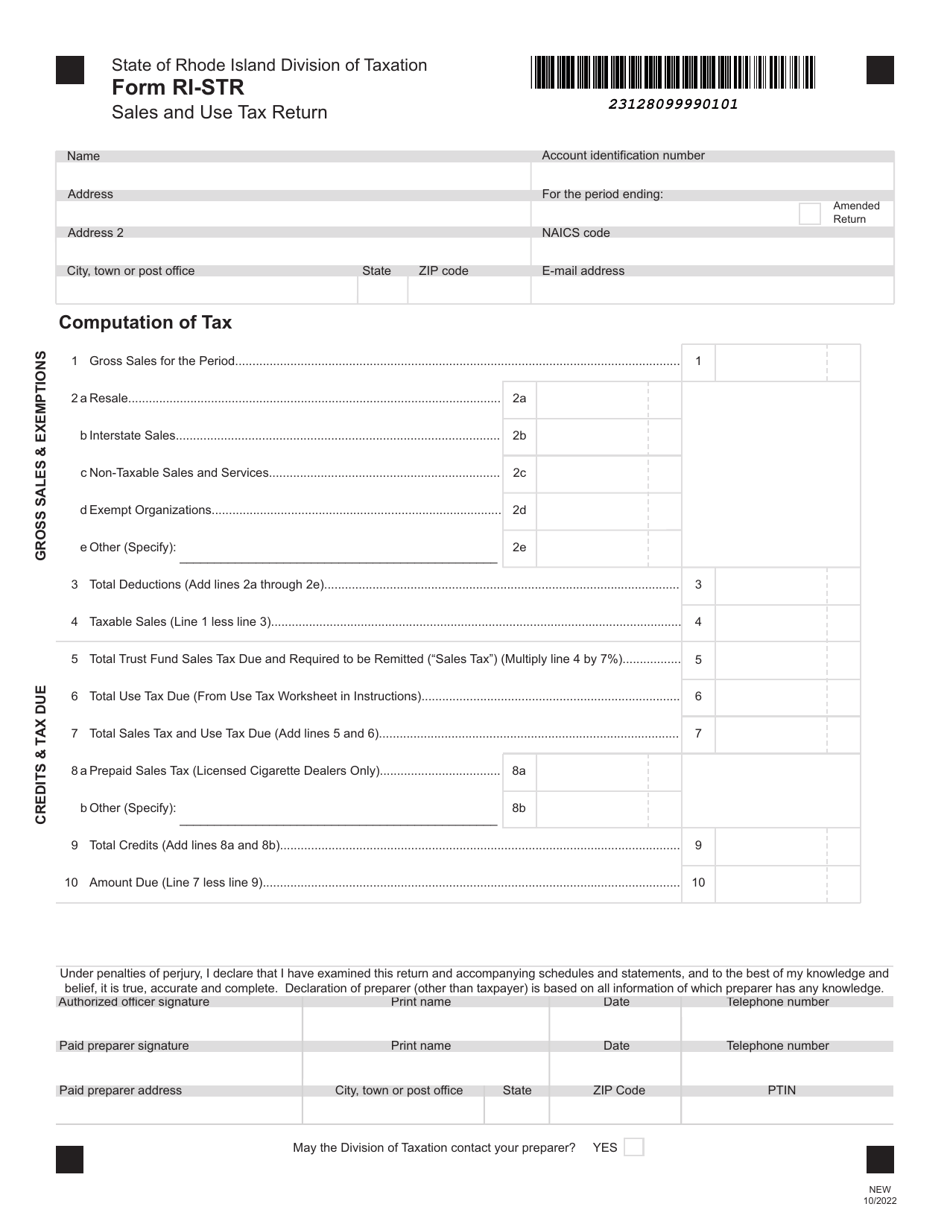

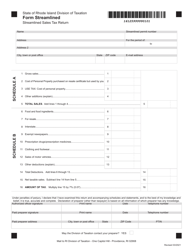

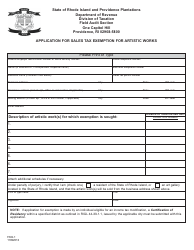

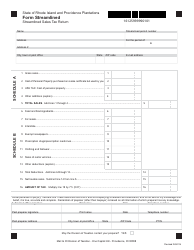

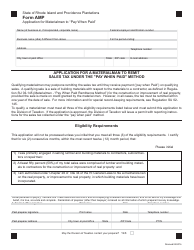

Form RI-STR Sales and Use Tax Return - Rhode Island

What Is Form RI-STR?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RI-STR?

A: Form RI-STR is the Sales and Use Tax Return in Rhode Island.

Q: Who needs to file Form RI-STR?

A: Businesses in Rhode Island that collect sales tax or use tax need to file Form RI-STR.

Q: What is sales tax?

A: Sales tax is a tax charged on the sale of goods and certain services.

Q: What is use tax?

A: Use tax is a tax on goods purchased for use in Rhode Island without paying sales tax.

Q: When is Form RI-STR due?

A: Form RI-STR is due on the 20th day of the month following the end of the reporting period.

Q: What information is required on Form RI-STR?

A: Form RI-STR requires information about sales, use tax, and any other applicable taxes.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing, including interest on any overdue tax.

Q: Can I request an extension for filing Form RI-STR?

A: Yes, you can request an extension by filling out Form RI-7004.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-STR by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.