This version of the form is not currently in use and is provided for reference only. Download this version of

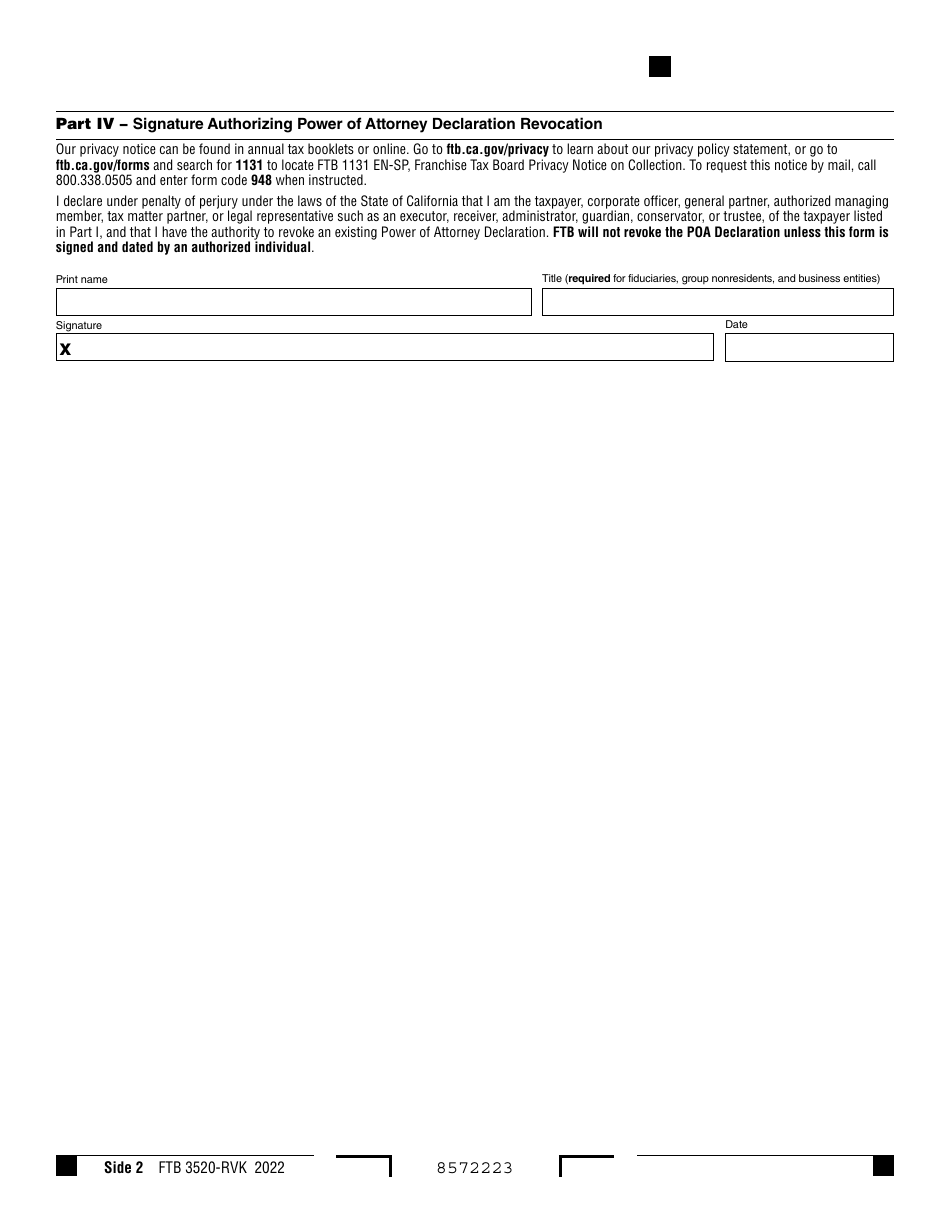

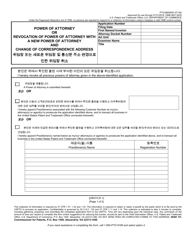

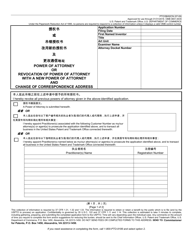

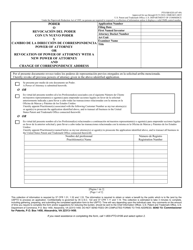

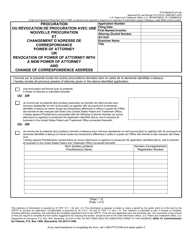

Form FTB3520-RVK

for the current year.

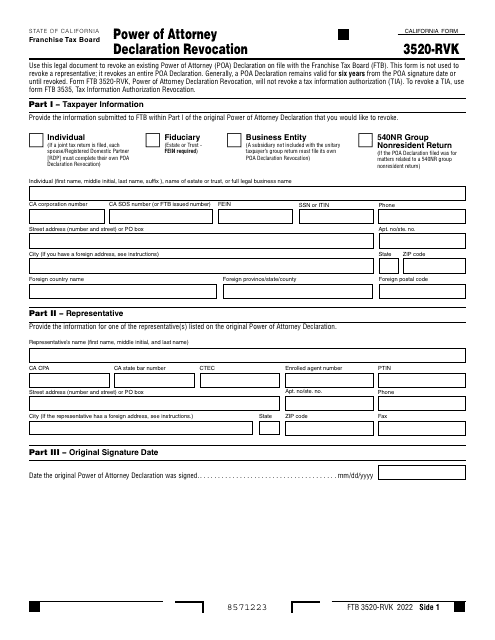

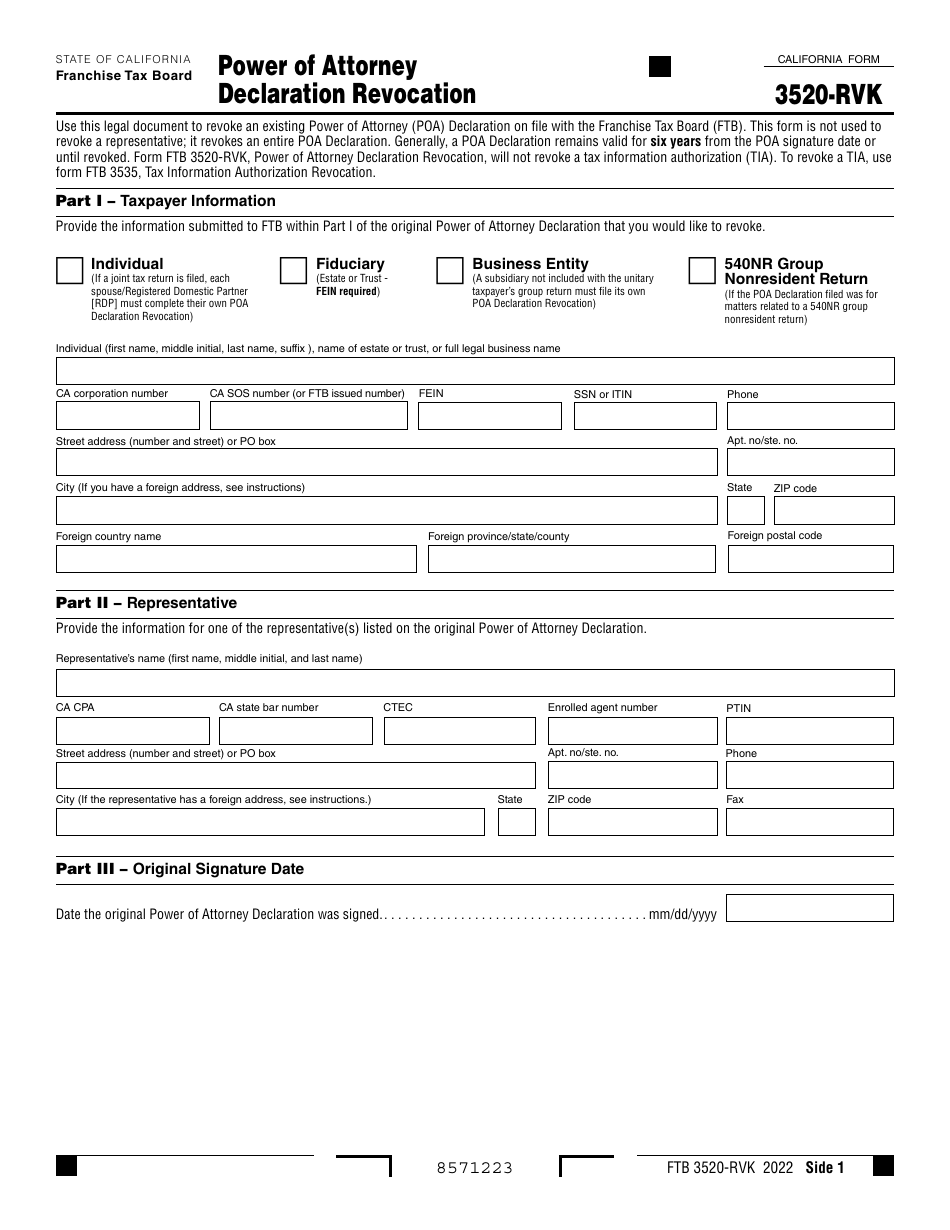

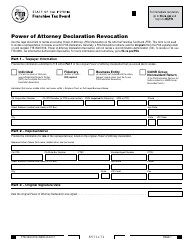

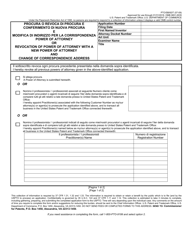

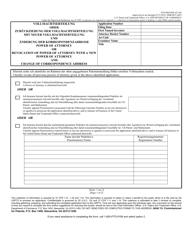

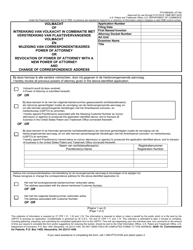

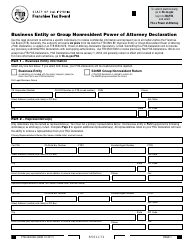

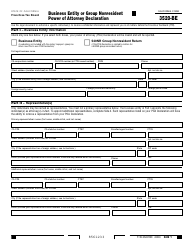

Form FTB3520-RVK Power of Attorney Declaration Revocation - California

What Is Form FTB3520-RVK?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3520-RVK?

A: Form FTB3520-RVK is a Power of Attorney Declaration Revocation form specifically used in the state of California.

Q: What is the purpose of Form FTB3520-RVK?

A: The purpose of Form FTB3520-RVK is to revoke a previously filed Power of Attorney Declaration with the California Franchise Tax Board.

Q: Who needs to file Form FTB3520-RVK?

A: Anyone who wants to revoke a Power of Attorney Declaration filed with the California Franchise Tax Board needs to file Form FTB3520-RVK.

Q: Is there a fee for filing Form FTB3520-RVK?

A: No, there is no fee for filing Form FTB3520-RVK.

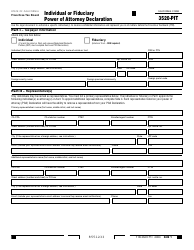

Q: What information do I need to provide on Form FTB3520-RVK?

A: On Form FTB3520-RVK, you will need to provide your personal information, the name and address of the previously designated attorney, and the date of the revocation.

Q: Can I revoke a Power of Attorney at any time?

A: Yes, you have the right to revoke a Power of Attorney at any time by completing and filing Form FTB3520-RVK.

Q: What happens after I file Form FTB3520-RVK?

A: Once you file Form FTB3520-RVK, the California Franchise Tax Board will update their records to reflect the revocation of the Power of Attorney Declaration.

Q: Do I need to notify the previous attorney of the revocation?

A: It is recommended to notify the previous attorney of the revocation, but it is not required by law.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3520-RVK by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.