This version of the form is not currently in use and is provided for reference only. Download this version of

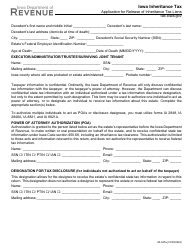

Form 32-041

for the current year.

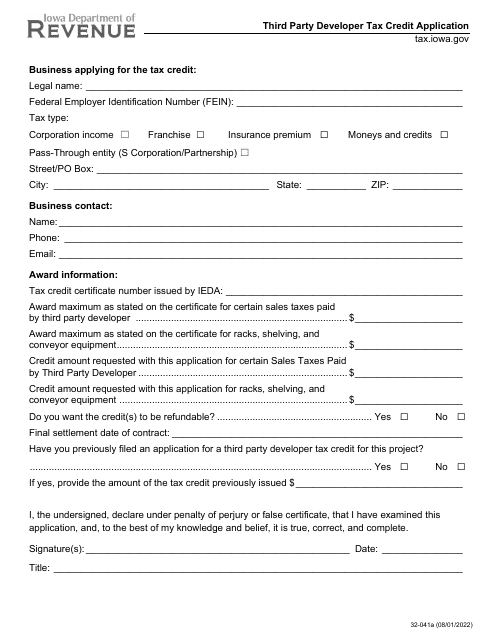

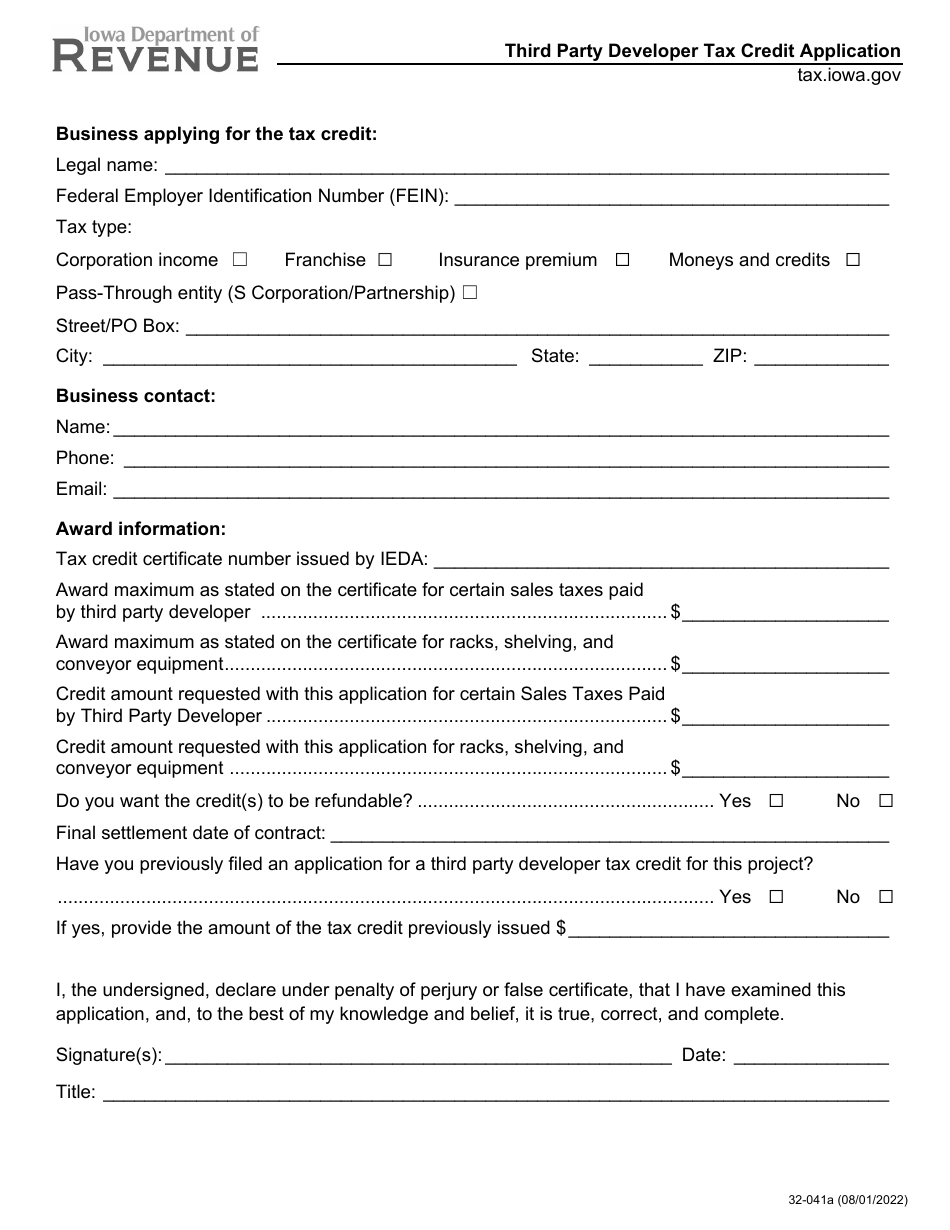

Form 32-041 Third Party Developer Tax Credit Application - Iowa

What Is Form 32-041?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 32-041?

A: Form 32-041 is the Third Party Developer Tax Credit Application in Iowa.

Q: Who can use Form 32-041?

A: Third-party developers in Iowa can use Form 32-041.

Q: What is the purpose of Form 32-041?

A: The purpose of Form 32-041 is to apply for the Third Party Developer Tax Credit in Iowa.

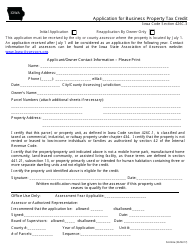

Q: What information is required on Form 32-041?

A: Form 32-041 requires information such as the developer's name, address, tax identification number, and details about the development project.

Q: What is the deadline for filing Form 32-041?

A: The deadline for filing Form 32-041 varies depending on the specific tax year. You should check the instructions for the most up-to-date deadline.

Q: Is there a fee to submit Form 32-041?

A: There is no fee to submit Form 32-041.

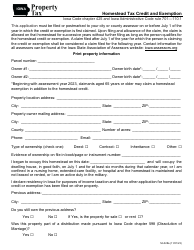

Q: Are there any supporting documents required with Form 32-041?

A: Yes, you may need to attach supporting documents such as a copy of the contract or agreement relating to the development project.

Q: How long does it take to process Form 32-041?

A: The processing time for Form 32-041 varies. You should contact the Iowa Department of Revenue for more information.

Q: Can I file Form 32-041 electronically?

A: Yes, you can file Form 32-041 electronically through the Iowa Department of Revenue's eFile & Pay system.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 32-041 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.