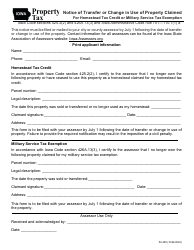

This version of the form is not currently in use and is provided for reference only. Download this version of

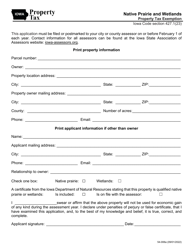

Form 54-146

for the current year.

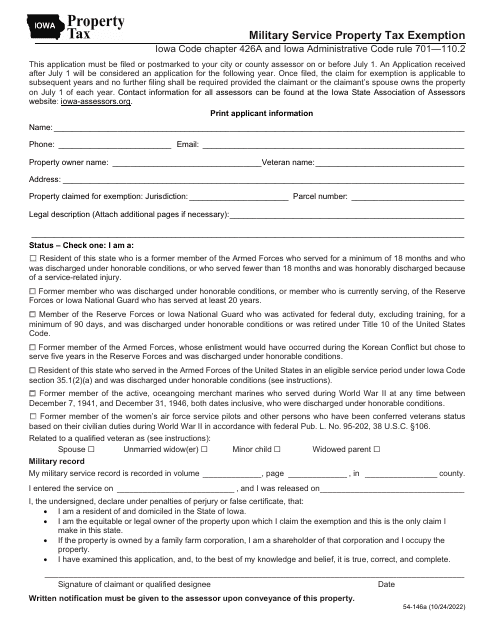

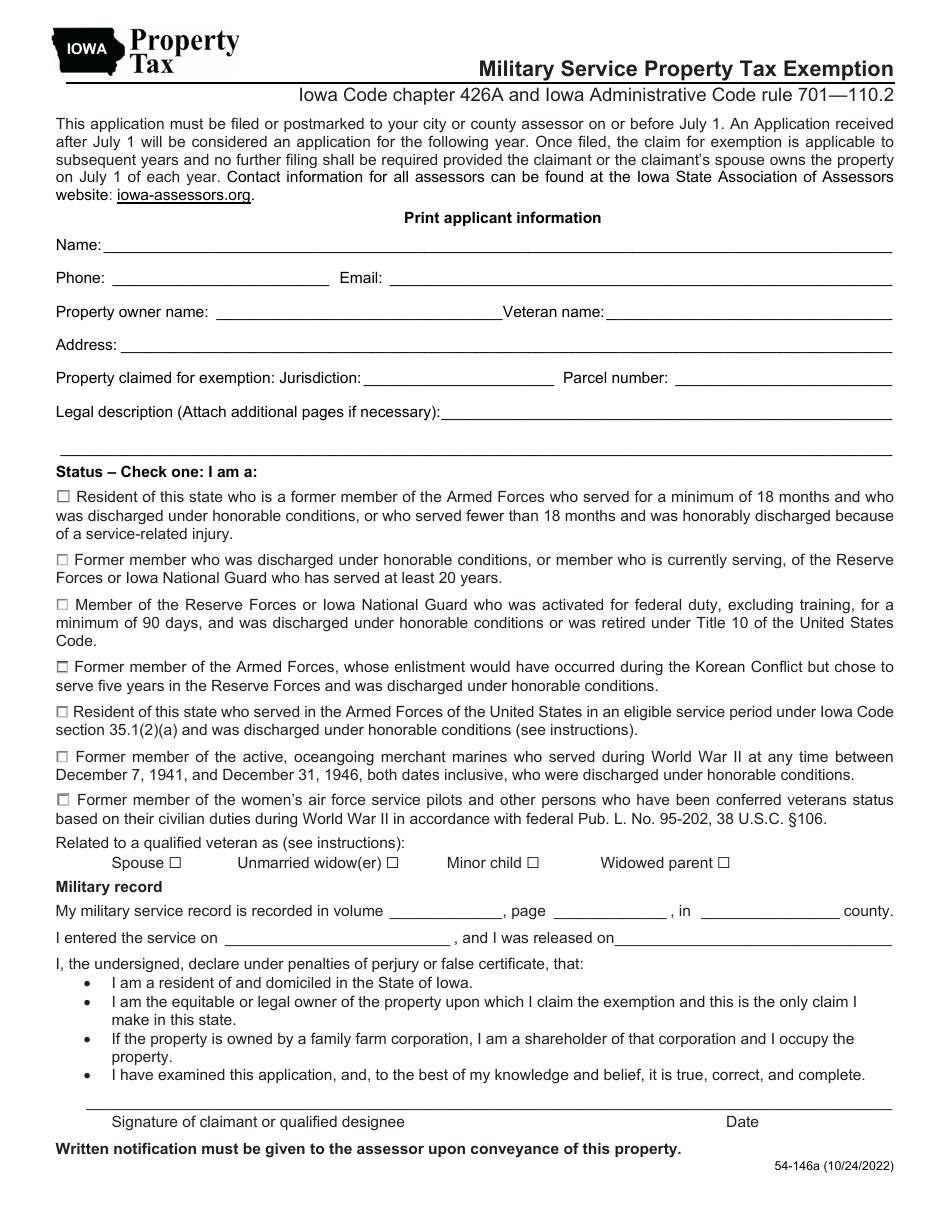

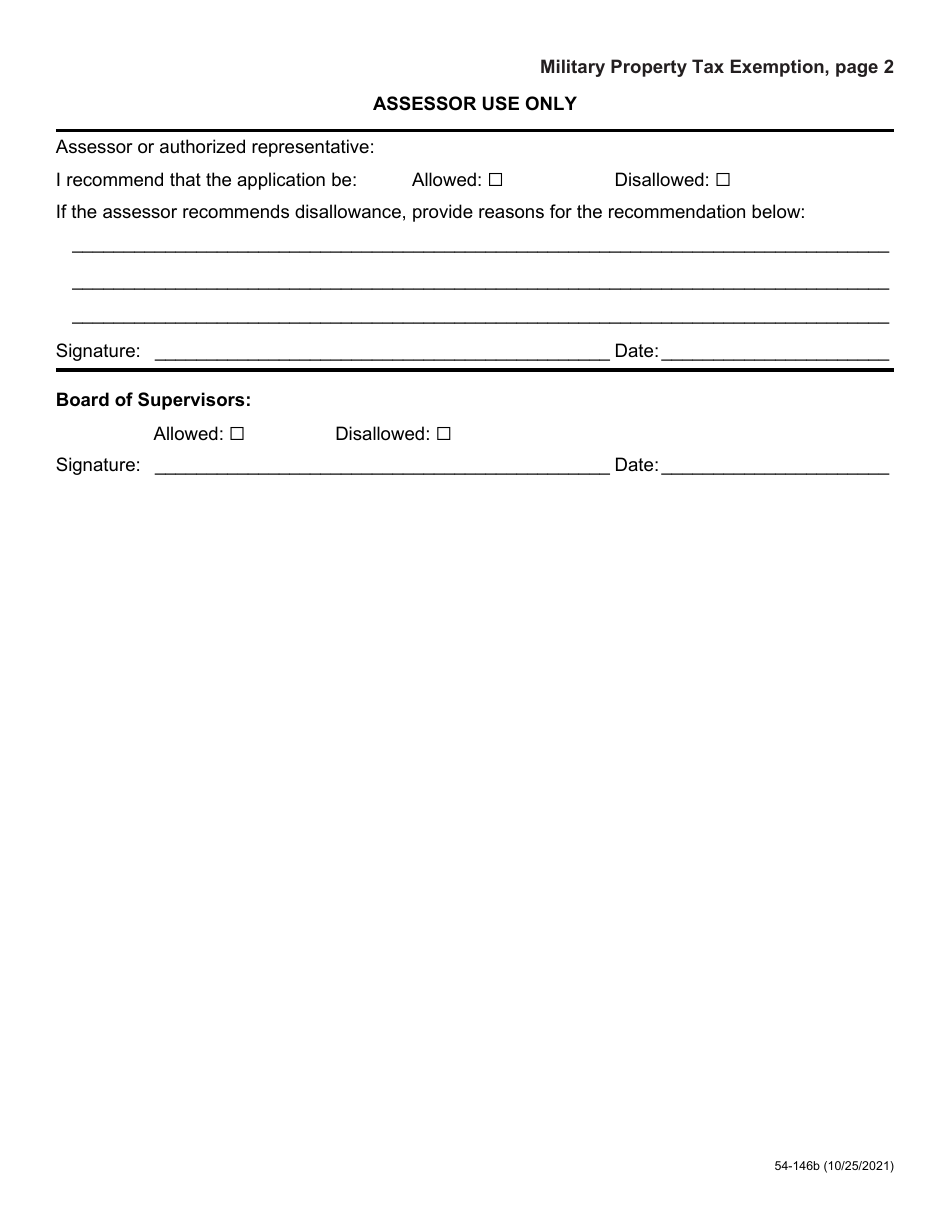

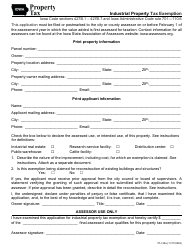

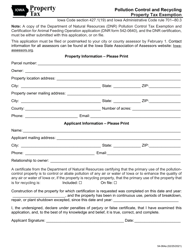

Form 54-146 Military Service Property Tax Exemption - Iowa

What Is Form 54-146?

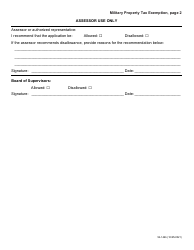

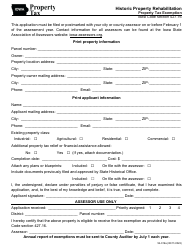

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54-146?

A: Form 54-146 is the Military Service Property Tax Exemption application form specifically for Iowa.

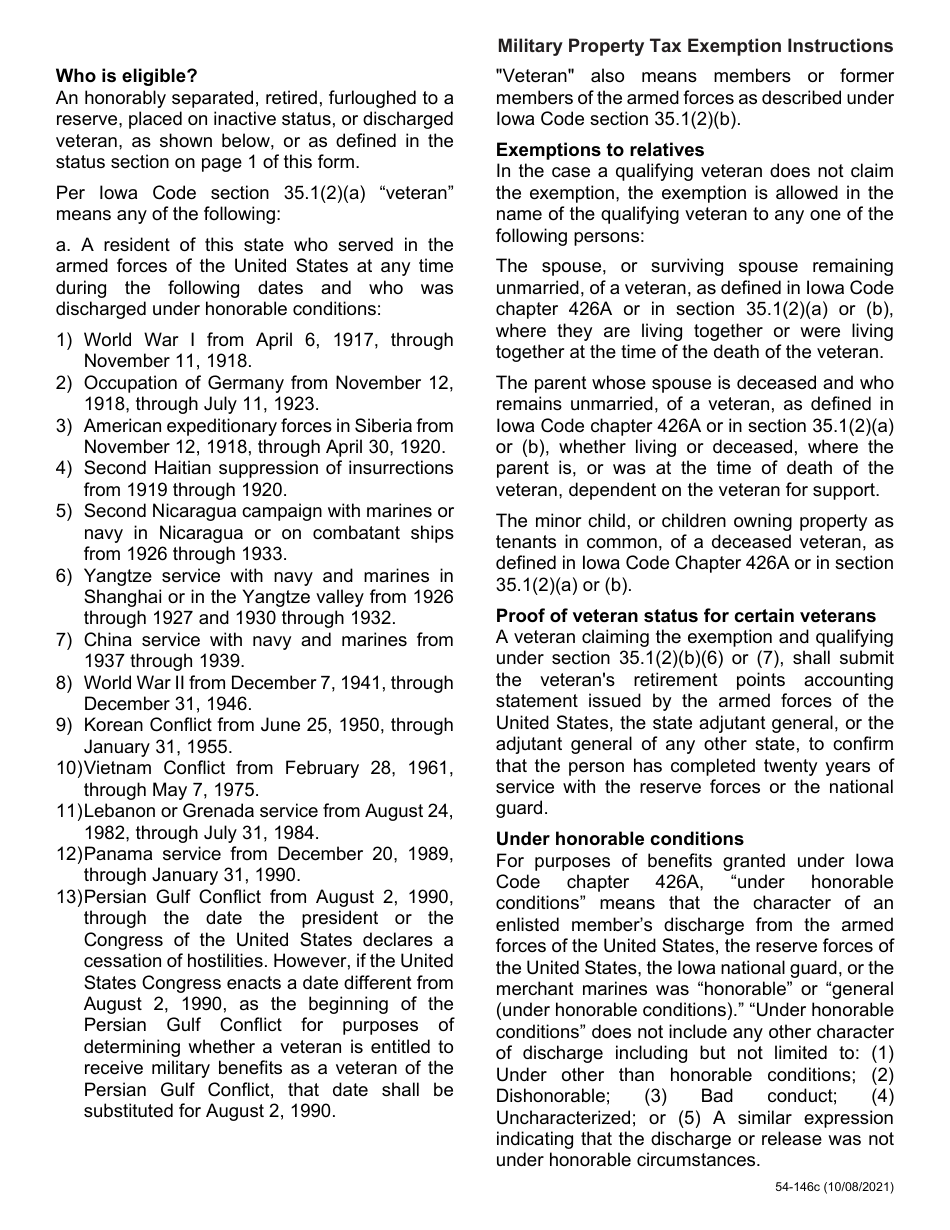

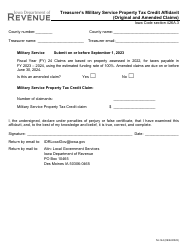

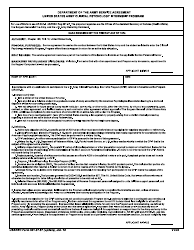

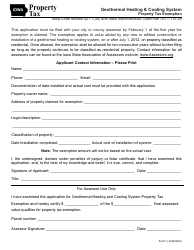

Q: Who is eligible for the Military Service Property Tax Exemption in Iowa?

A: Eligibility for the Military Service Property Tax Exemption in Iowa is based on certain criteria, including being a current or former member of the armed forces who served on active duty during specified periods of conflict.

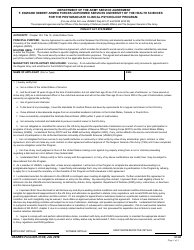

Q: What is the purpose of the Military Service Property Tax Exemption in Iowa?

A: The purpose of the Military Service Property Tax Exemption in Iowa is to provide eligible veterans with a property tax exemption for their primary residence.

Q: What documents do I need to submit with Form 54-146?

A: The specific documents required to be submitted with Form 54-146 may vary, but generally, you will need to provide proof of your military service and residency, such as a copy of your DD-214 and a driver's license or utility bill.

Q: Are there any deadlines for submitting Form 54-146?

A: Yes, there are deadlines for submitting Form 54-146 in Iowa. The application must be filed with the local county assessor's office by July 1st of the assessment year for which the exemption is sought.

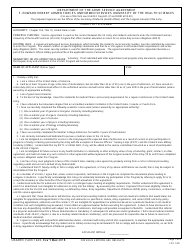

Form Details:

- Released on October 24, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

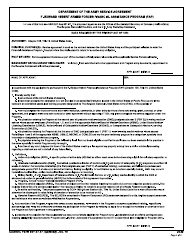

Download a fillable version of Form 54-146 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.