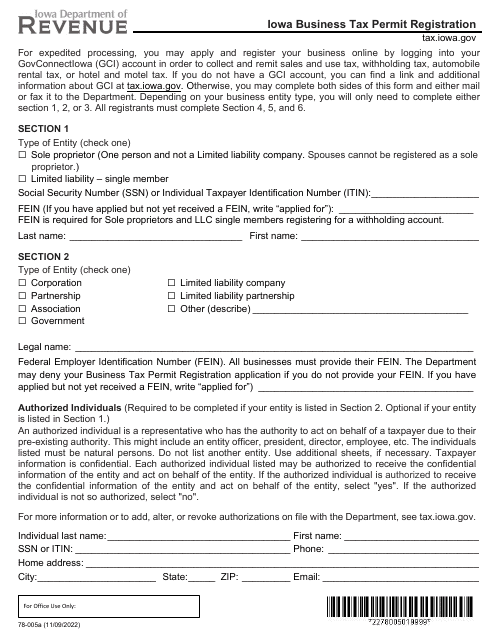

This version of the form is not currently in use and is provided for reference only. Download this version of

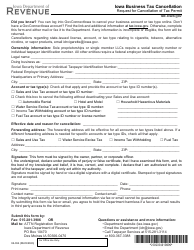

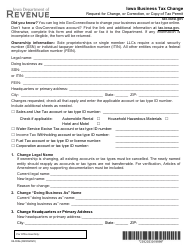

Form 78-005

for the current year.

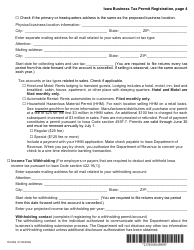

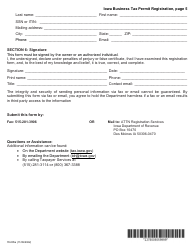

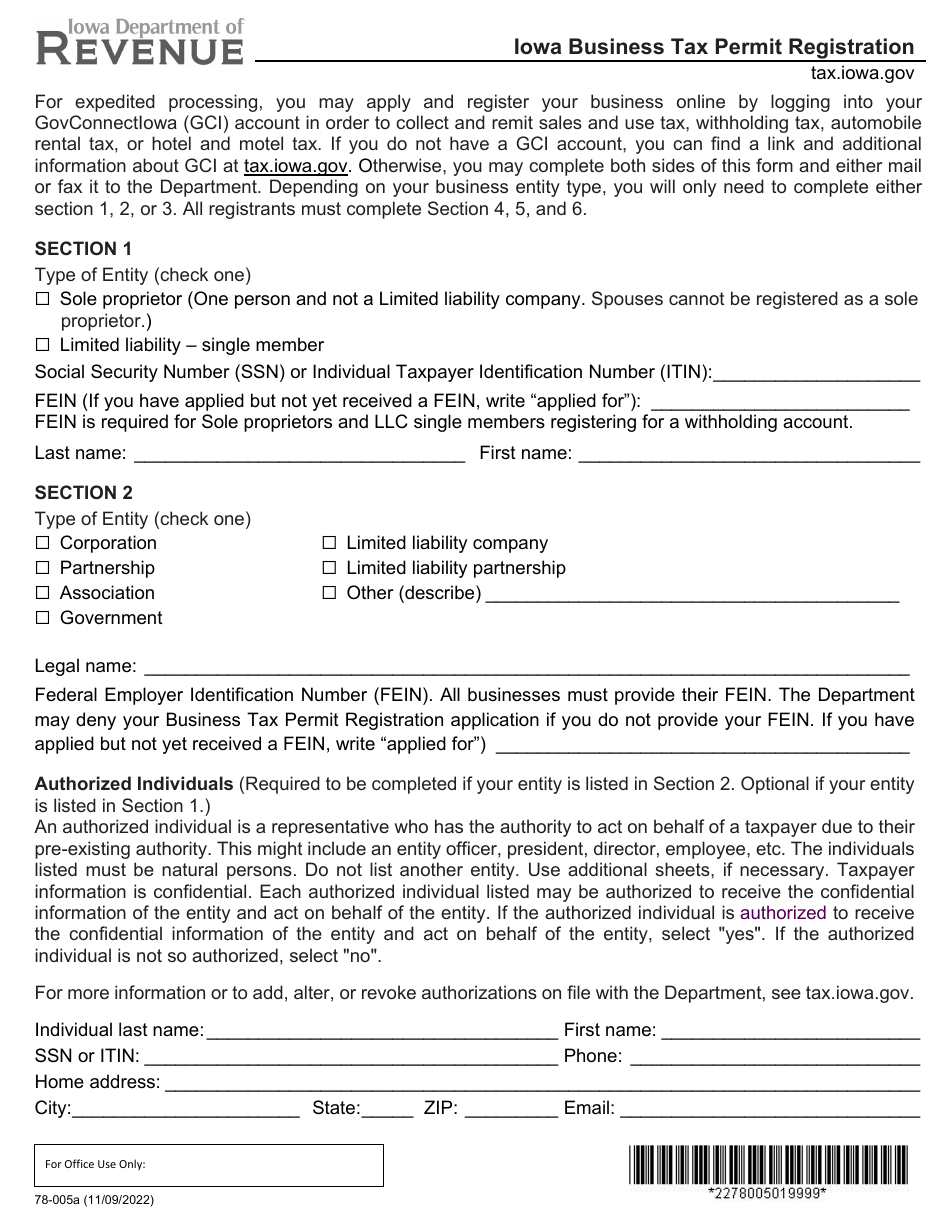

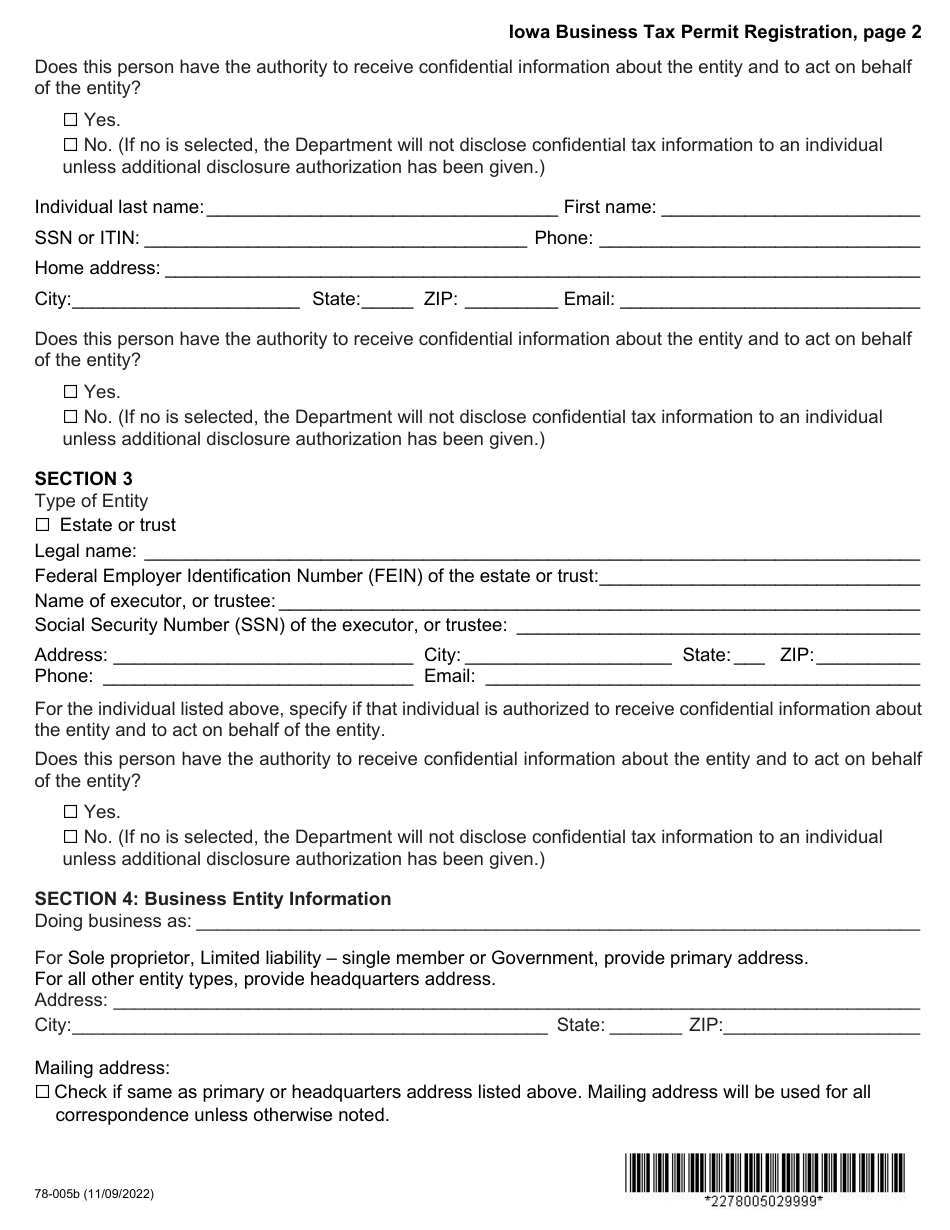

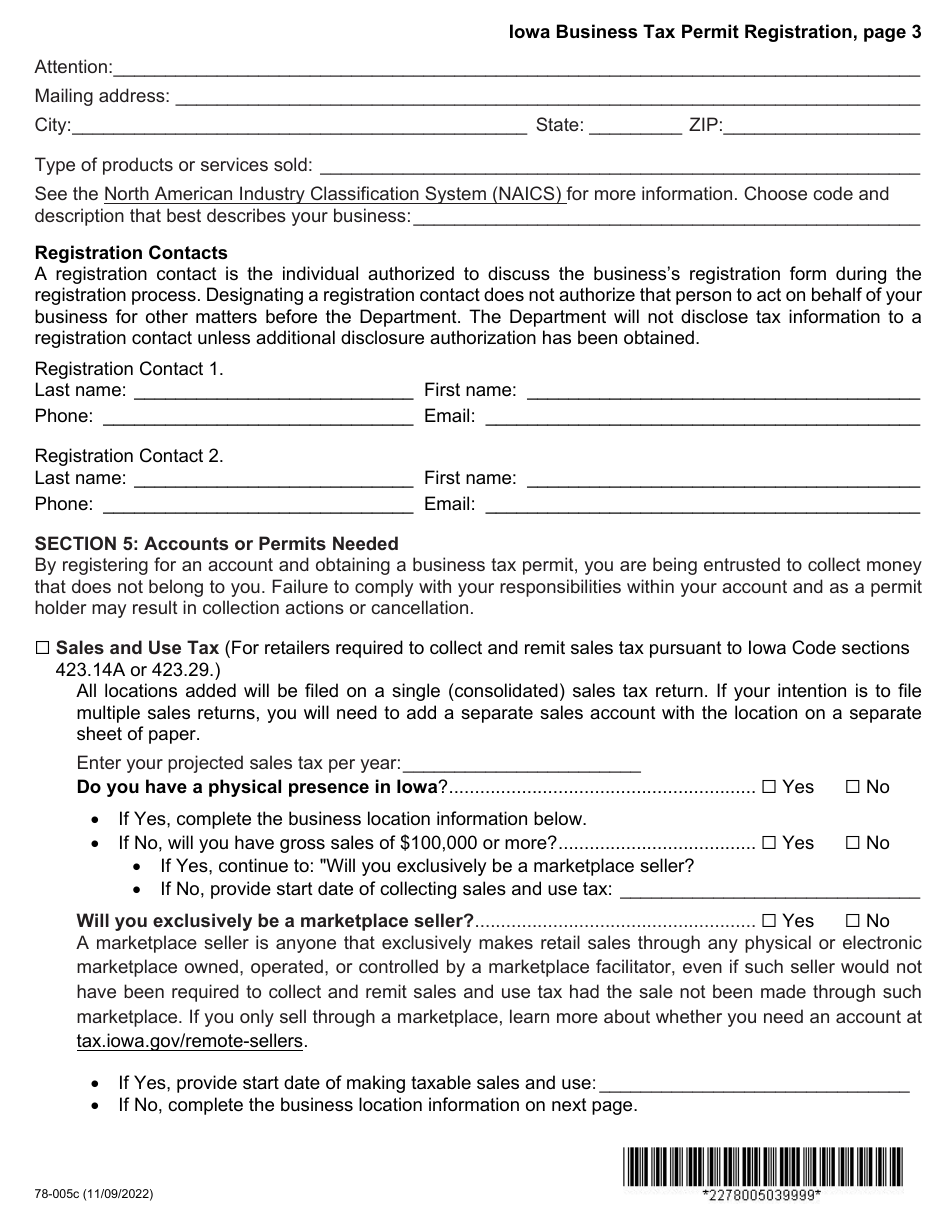

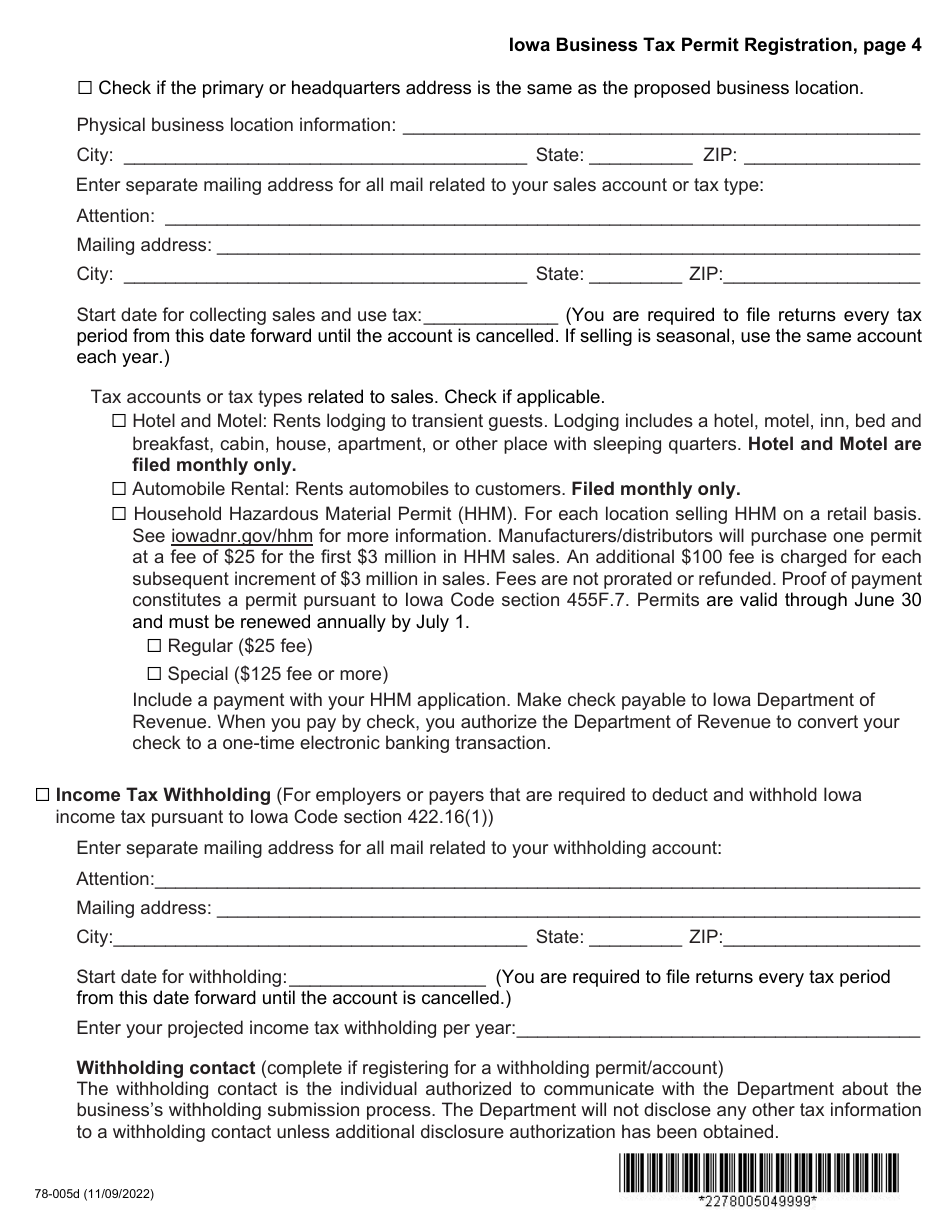

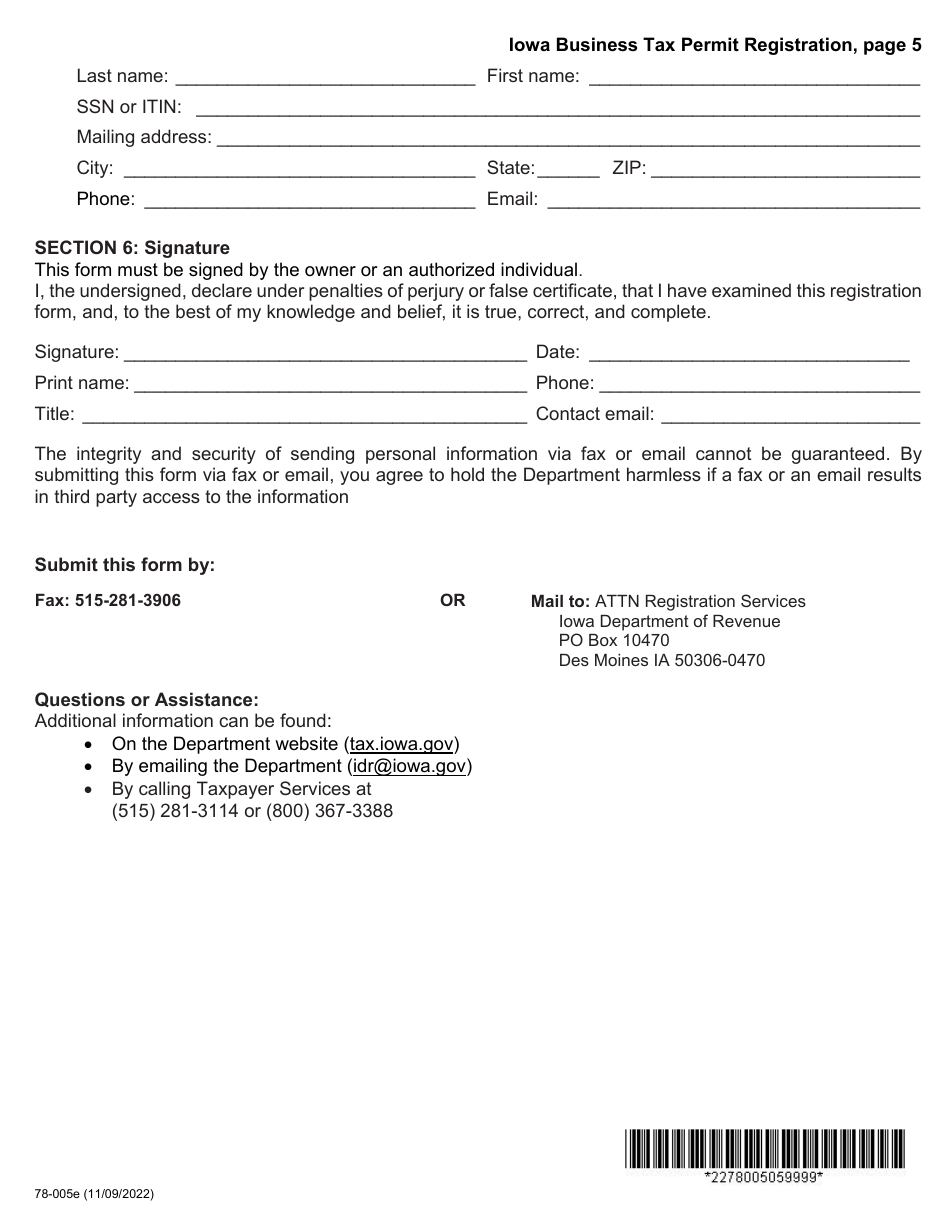

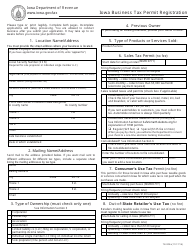

Form 78-005 Iowa Business Tax Permit Registration - Iowa

What Is Form 78-005?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 78-005?

A: Form 78-005 is the Iowa Business Tax Permit Registration form.

Q: What is the purpose of Form 78-005?

A: The purpose of Form 78-005 is to register for a business tax permit in Iowa.

Q: Who needs to complete Form 78-005?

A: Any business operating in Iowa that is required to collect sales tax or make retail sales needs to complete Form 78-005.

Q: What information is required on Form 78-005?

A: Form 78-005 requires information such as the business name, address, owner's name, federal employer identification number, and other related details.

Q: Is there a fee to submit Form 78-005?

A: No, there is no fee to submit Form 78-005.

Q: When should Form 78-005 be submitted?

A: Form 78-005 should be submitted before the start of business operations or within 20 days of starting to make sales in Iowa.

Q: What happens after submitting Form 78-005?

A: After submitting Form 78-005, you will receive a business tax permit from the Iowa Department of Revenue.

Q: Do I need to renew my business tax permit?

A: Yes, business tax permits in Iowa need to be renewed periodically.

Form Details:

- Released on November 9, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 78-005 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.