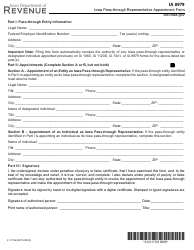

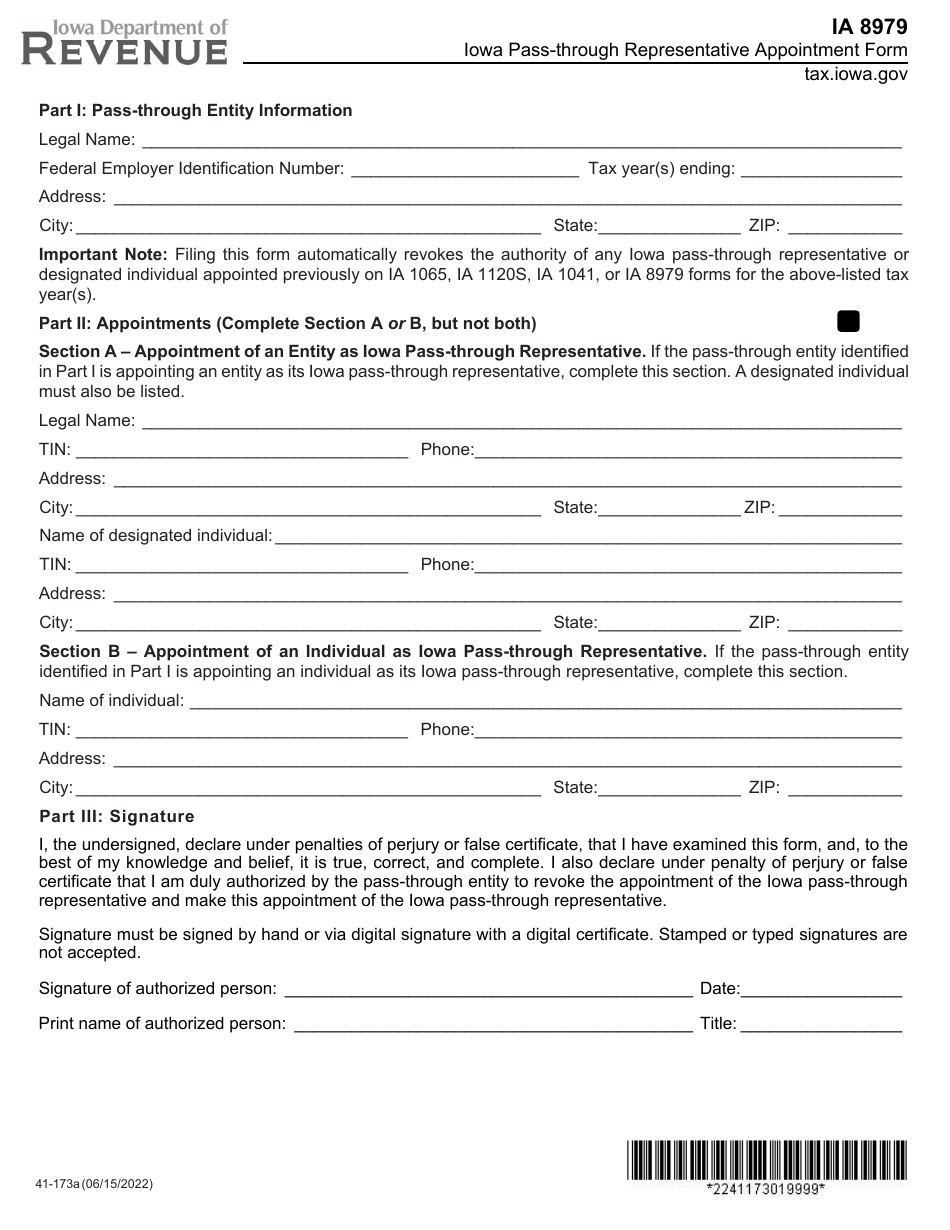

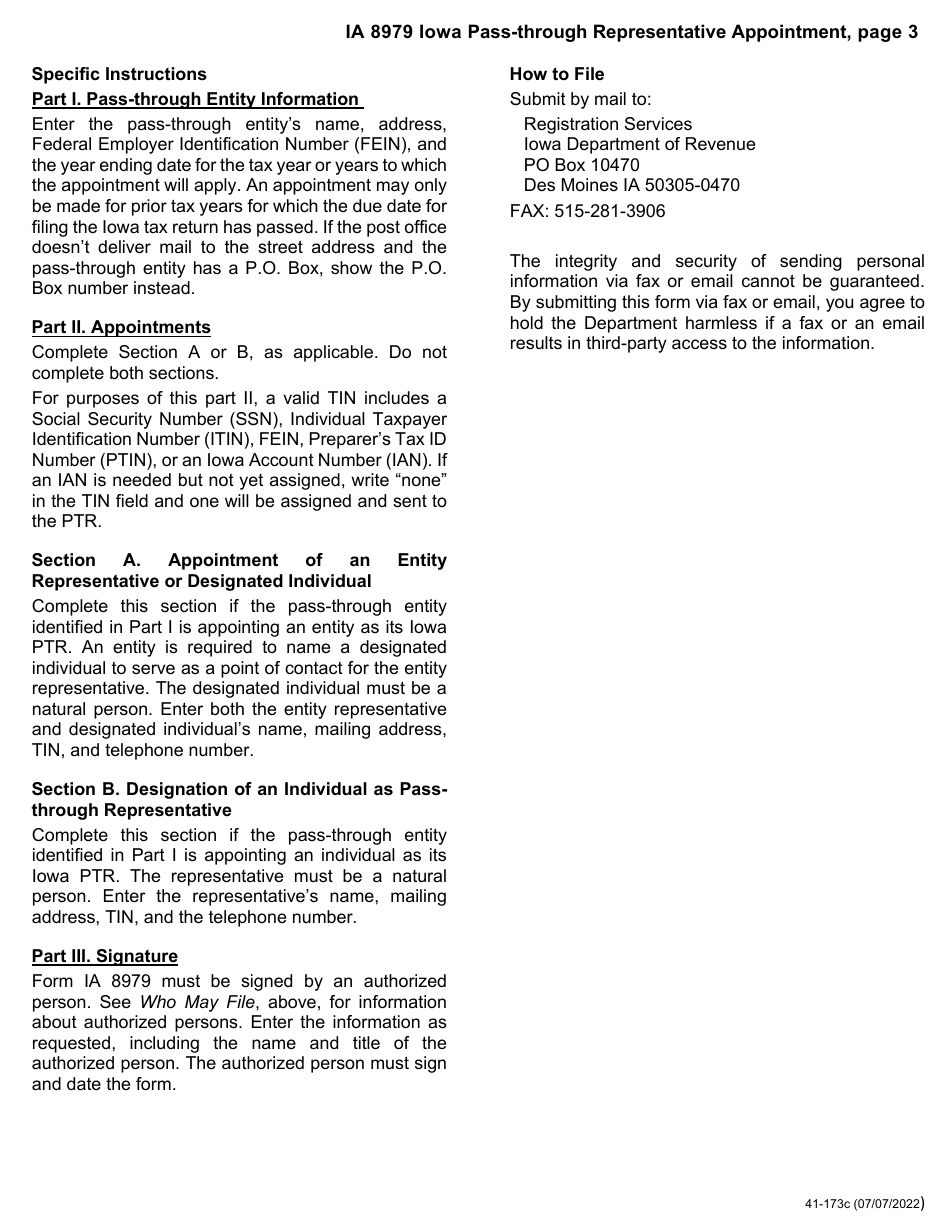

Form IA8979 (41-173) Iowa Pass-Through Representative Appointment Form - Iowa

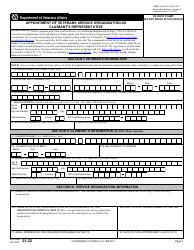

What Is Form IA8979 (41-173)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

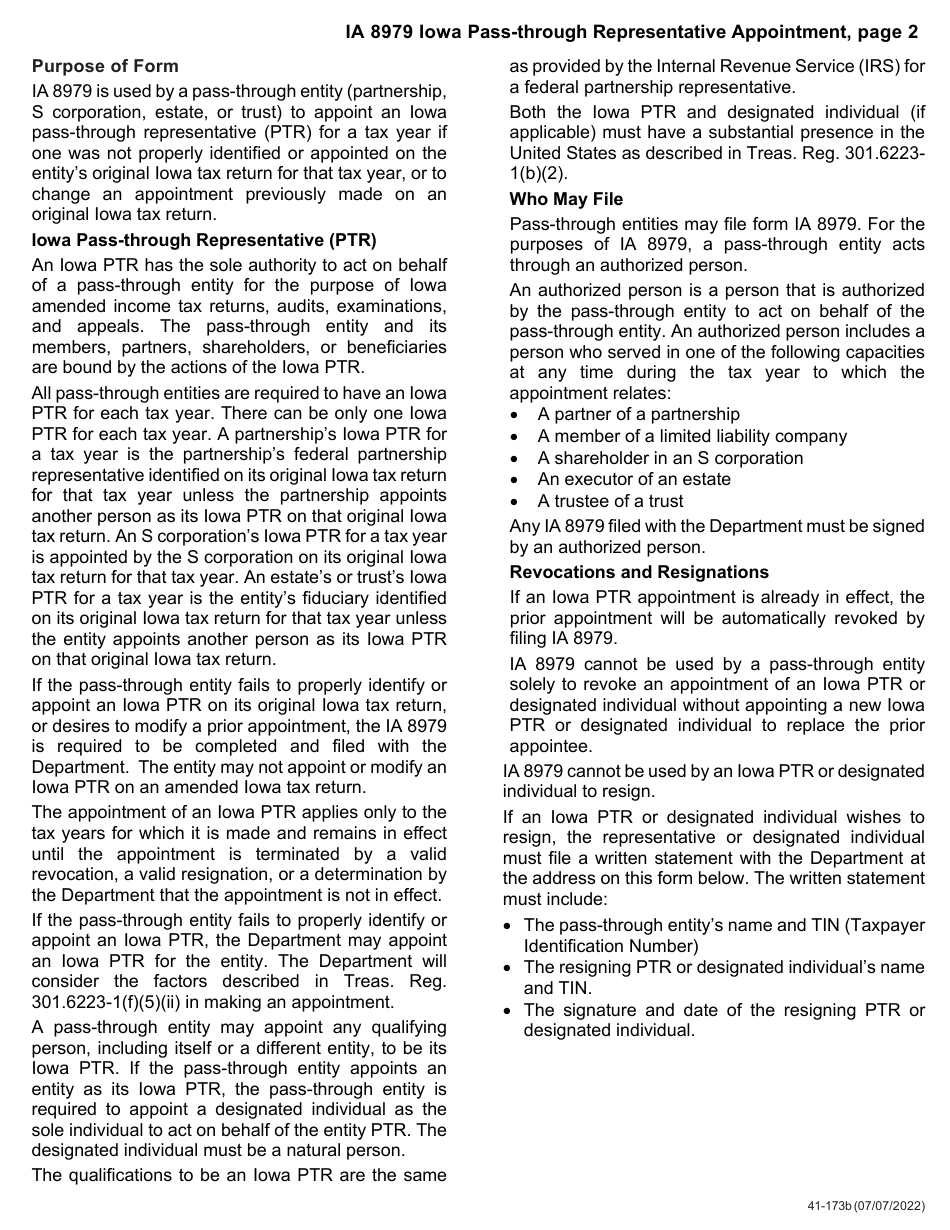

Q: What is Form IA8979 (41-173) Iowa Pass-Through Representative Appointment Form?

A: Form IA8979 is a document used in Iowa to appoint a pass-through representative for tax purposes.

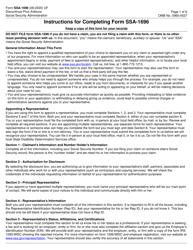

Q: When is Form IA8979 used?

A: Form IA8979 is used when a pass-through entity wants to designate a representative to handle tax matters on its behalf in Iowa.

Q: Do all pass-through entities need to file Form IA8979?

A: No, Form IA8979 is only required for pass-through entities that want to appoint a representative. It is not mandatory for all pass-through entities.

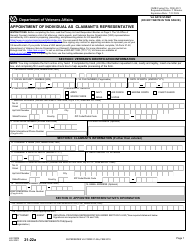

Q: What information is required on Form IA8979?

A: Form IA8979 requires information such as the name and contact details of the pass-through entity, as well as the details of the appointed representative.

Q: Is there a deadline for filing Form IA8979?

A: Yes, the deadline for filing Form IA8979 is the same as the pass-through entity's tax return filing deadline.

Q: What should I do if there are changes to the appointed representative?

A: If there are changes to the appointed representative, you need to file an amended Form IA8979 with the updated information.

Q: Can I appoint more than one representative on Form IA8979?

A: Yes, you can appoint multiple representatives by attaching additional pages with their information to the main form.

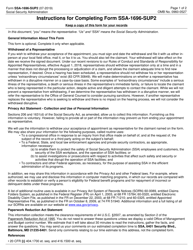

Form Details:

- Released on June 15, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA8979 (41-173) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.