This version of the form is not currently in use and is provided for reference only. Download this version of

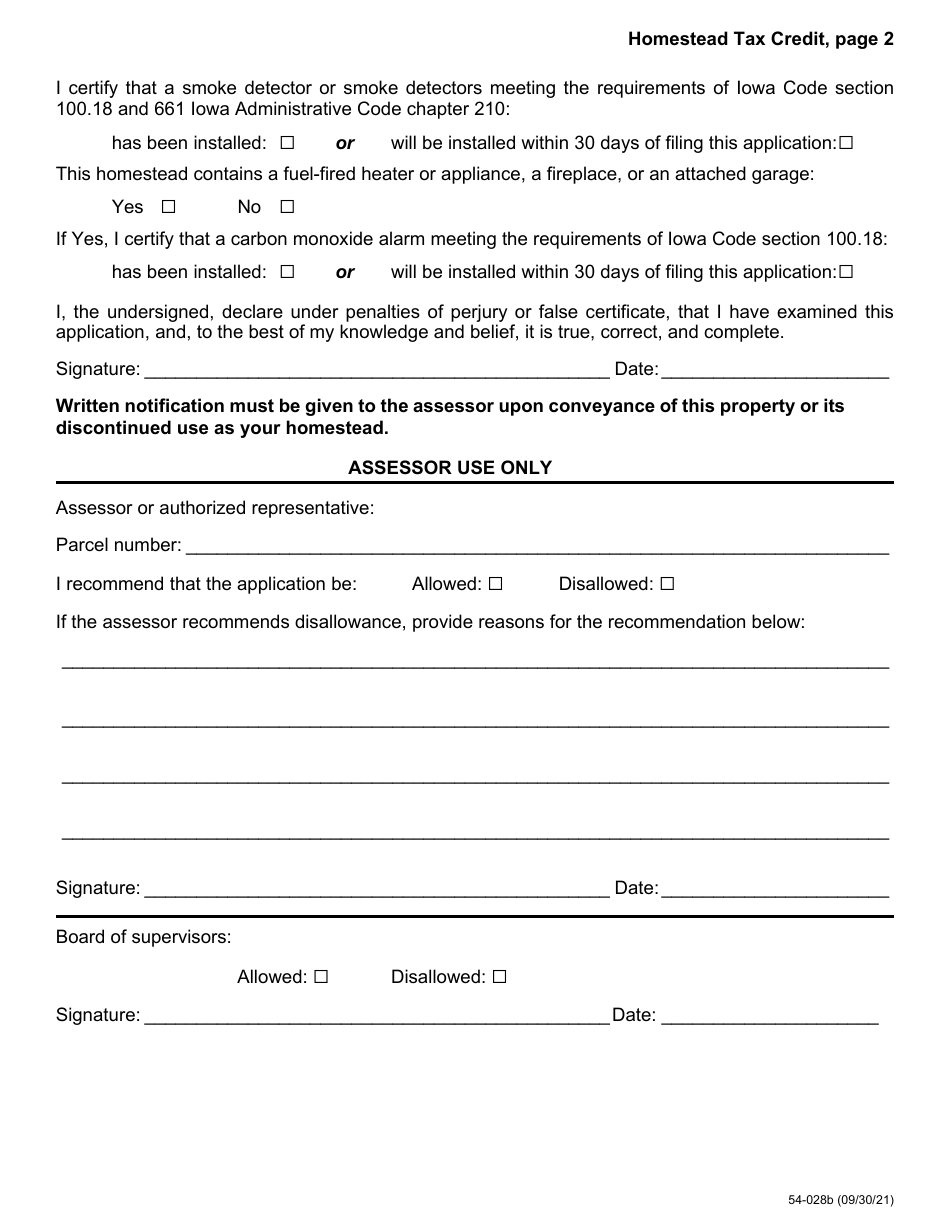

Form 54-028

for the current year.

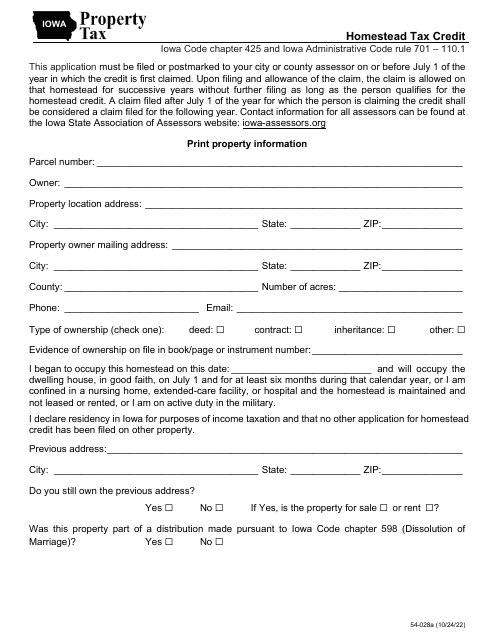

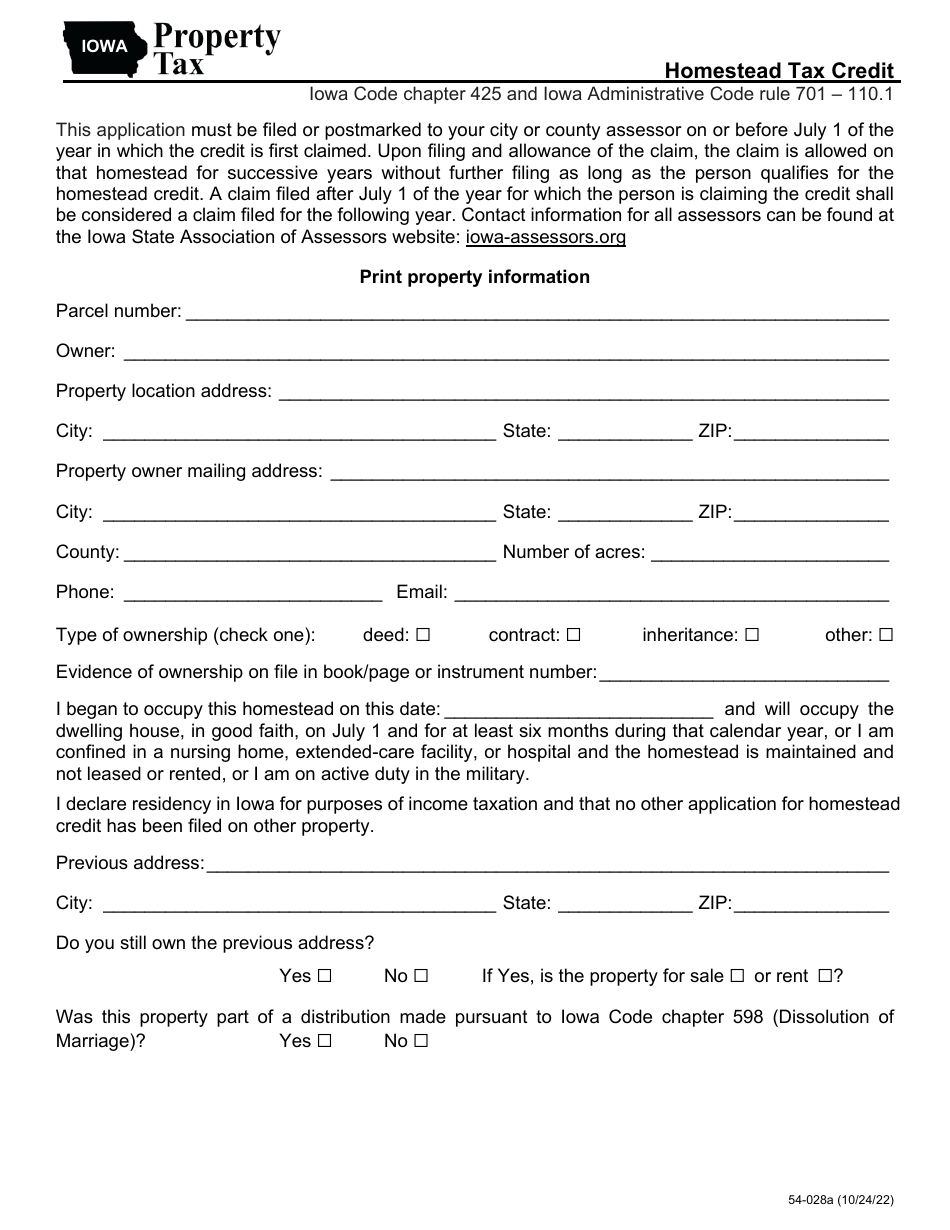

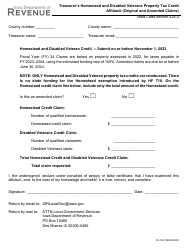

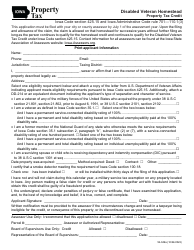

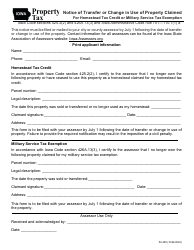

Form 54-028 Homestead Tax Credit - Iowa

What Is Form 54-028?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54-028 Homestead Tax Credit?

A: Form 54-028 Homestead Tax Credit is a form used in Iowa for applying for property tax relief.

Q: Who is eligible for the Homestead Tax Credit in Iowa?

A: In Iowa, homeowners who own and occupy their home as their primary residence are eligible for the Homestead Tax Credit.

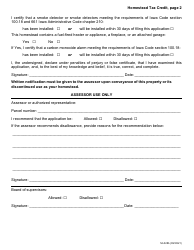

Q: How do I apply for the Homestead Tax Credit in Iowa?

A: To apply for the Homestead Tax Credit in Iowa, you need to complete and submit Form 54-028 to your local assessor's office.

Q: What is the purpose of the Homestead Tax Credit?

A: The purpose of the Homestead Tax Credit is to provide property tax relief to eligible homeowners in Iowa.

Q: Is there an income limit for the Homestead Tax Credit in Iowa?

A: No, there is no income limit for the Homestead Tax Credit in Iowa.

Form Details:

- Released on October 24, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 54-028 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.