This version of the form is not currently in use and is provided for reference only. Download this version of

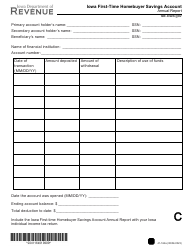

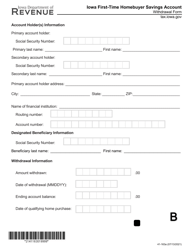

Form 41-162

for the current year.

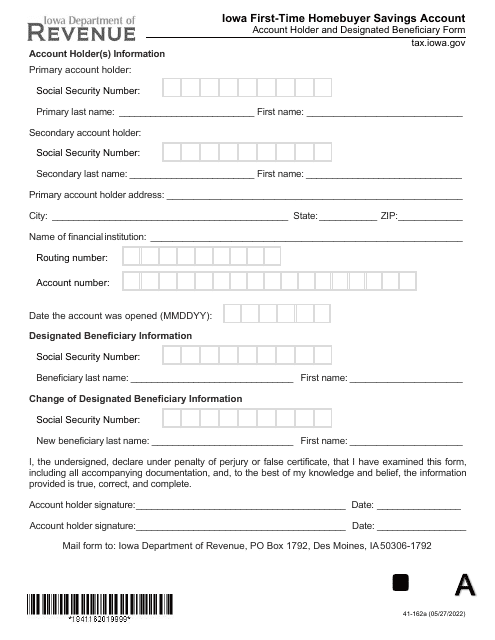

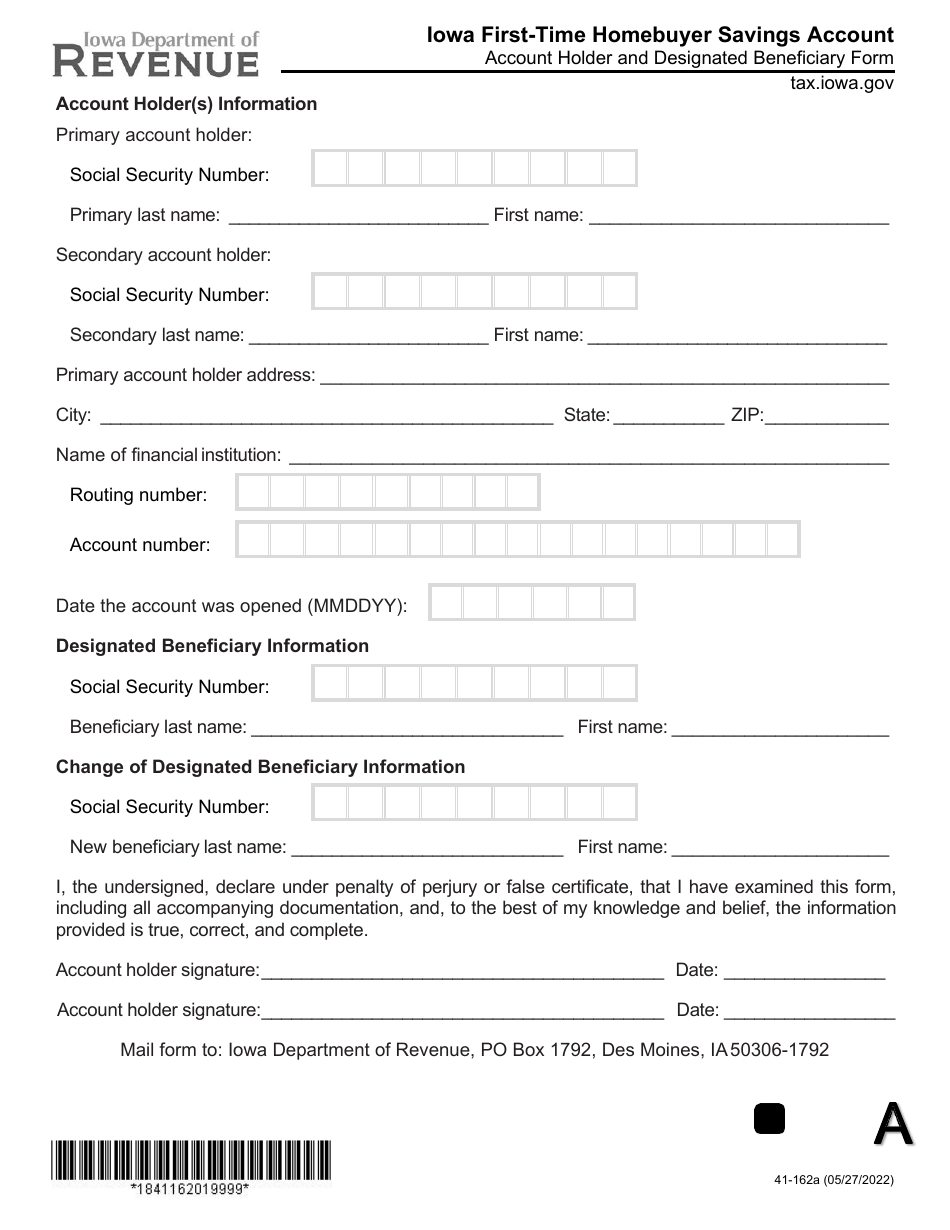

Form 41-162 First-Time Homebuyer Account Holder and Designated Beneficiary Form - Iowa

What Is Form 41-162?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41-162?

A: Form 41-162 is the First-Time Homebuyer Account Holder and Designated Beneficiary Form in Iowa.

Q: Who can use Form 41-162?

A: Form 41-162 can be used by first-time homebuyers and designated beneficiaries in Iowa.

Q: What is the purpose of Form 41-162?

A: The purpose of Form 41-162 is to establish and manage a First-Time Homebuyer Account in Iowa.

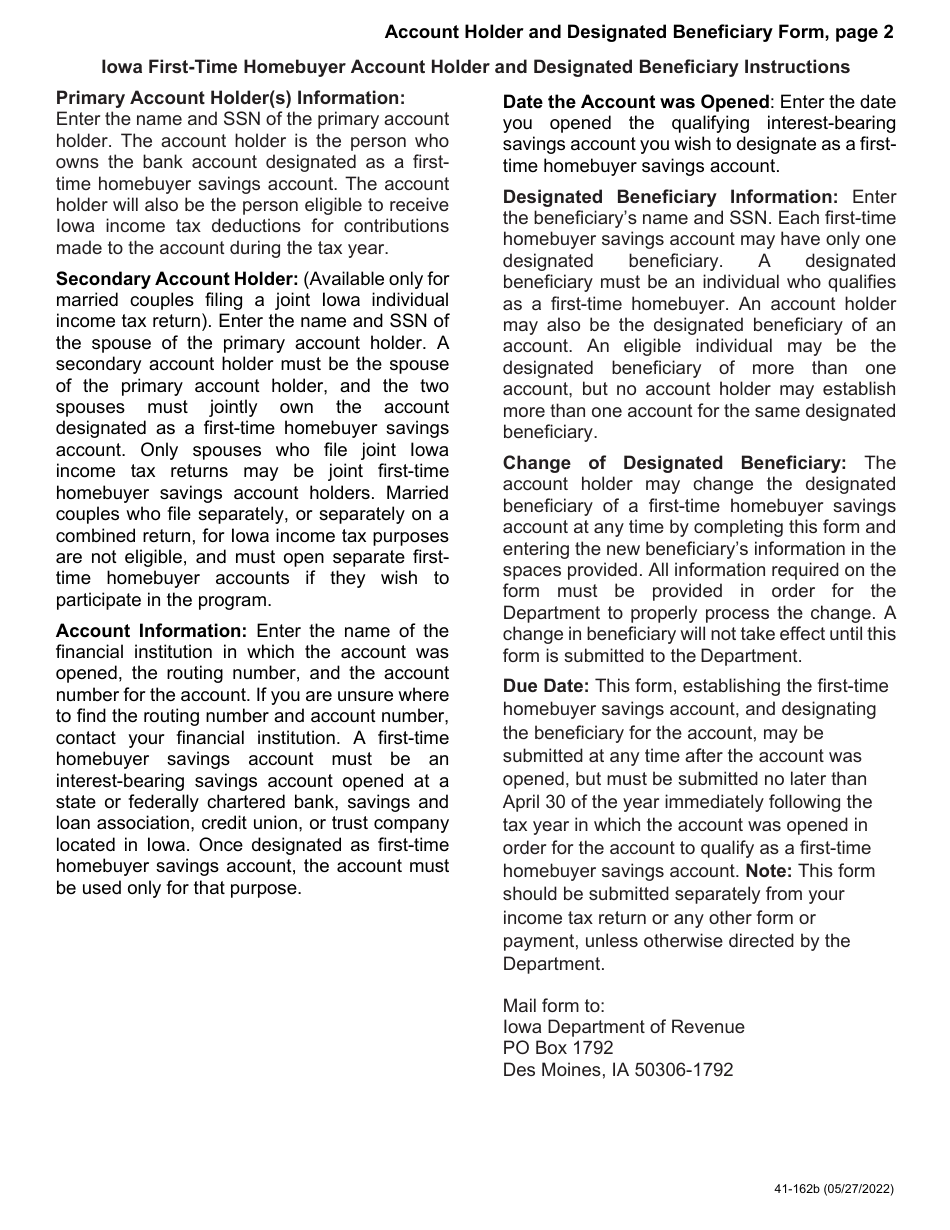

Q: What information is required on Form 41-162?

A: Form 41-162 requires information such as name, address, Social Security number, and account details.

Q: Is there a fee for filing Form 41-162?

A: There is no fee for filing Form 41-162.

Q: What are the consequences of providing false information on Form 41-162?

A: Providing false information on Form 41-162 may result in penalties and criminal charges.

Q: Can I make changes to my Form 41-162 once it is submitted?

A: Once submitted, changes to Form 41-162 may not be allowed. Contact the Iowa Department of Revenue for more information.

Q: Are there any tax benefits associated with the First-Time Homebuyer Account?

A: Yes, qualified withdrawals from the First-Time Homebuyer Account may be exempt from Iowa state income tax.

Q: How long does it take to process Form 41-162?

A: The processing time for Form 41-162 may vary. Contact the Iowa Department of Revenue for more information.

Form Details:

- Released on May 27, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41-162 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.