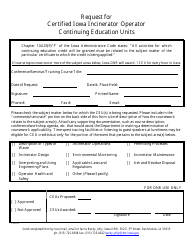

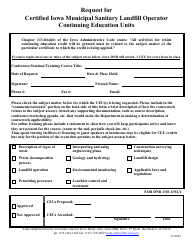

This version of the form is not currently in use and is provided for reference only. Download this version of

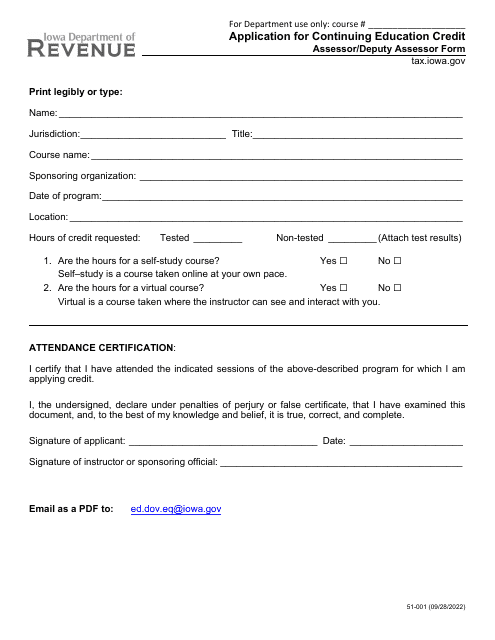

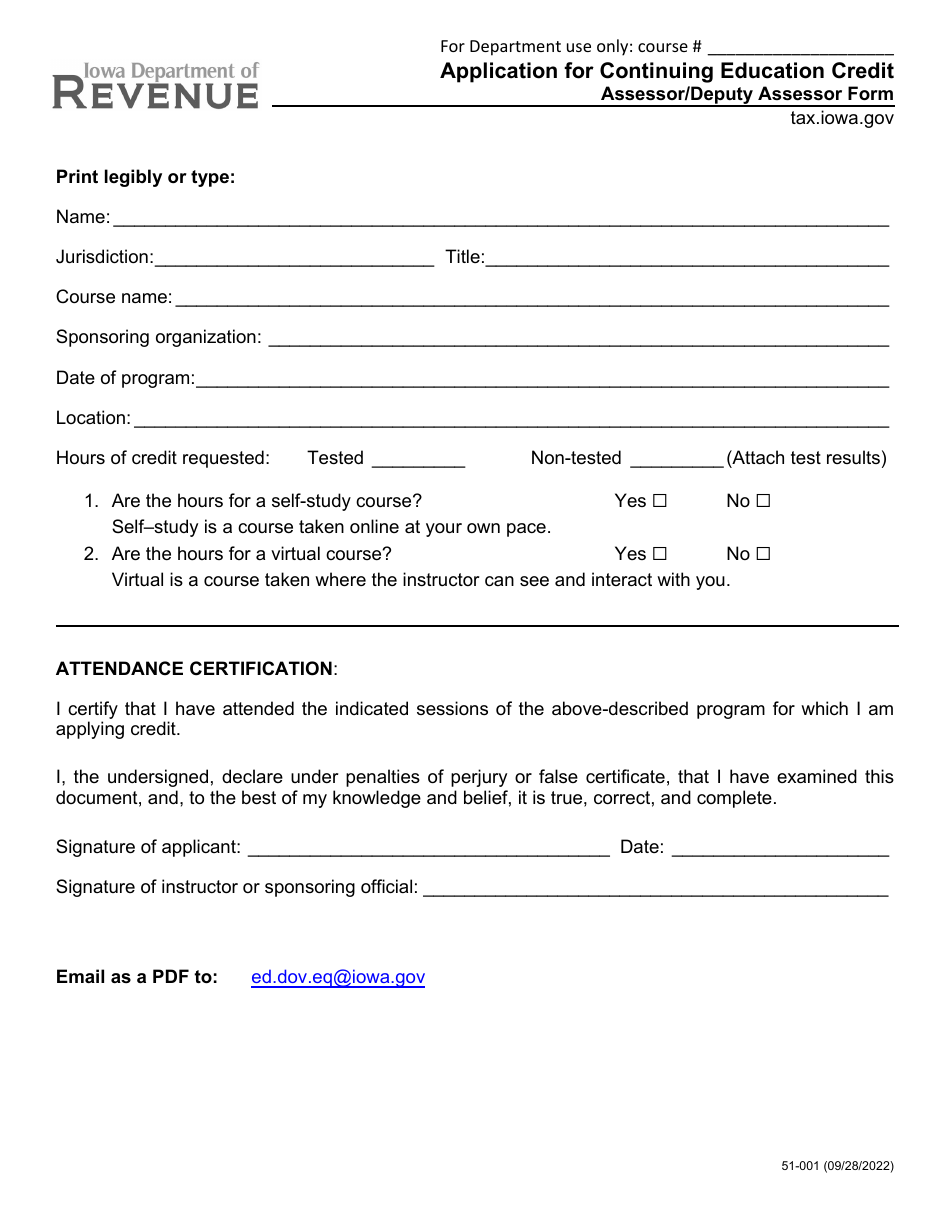

Form 51-001

for the current year.

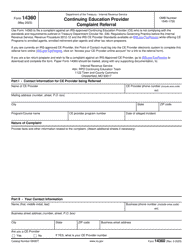

Form 51-001 Continuing Education Credit for Assessors and Deputy Assessors - Iowa

What Is Form 51-001?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51-001?

A: Form 51-001 is a document used for Continuing Education Credit for Assessors and Deputy Assessors in Iowa.

Q: Who is required to fill out Form 51-001?

A: Assessors and Deputy Assessors in Iowa are required to fill out Form 51-001.

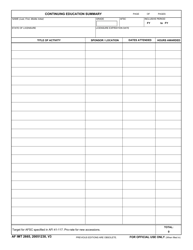

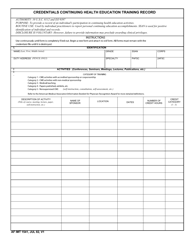

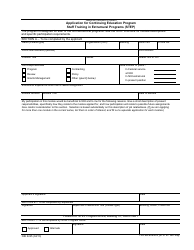

Q: What is the purpose of Form 51-001?

A: The purpose of Form 51-001 is to track and document continuing education credits for Assessors and Deputy Assessors in Iowa.

Q: Is Form 51-001 mandatory?

A: Yes, Form 51-001 is mandatory for Assessors and Deputy Assessors in Iowa to fulfill their continuing education requirements.

Form Details:

- Released on September 28, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 51-001 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.