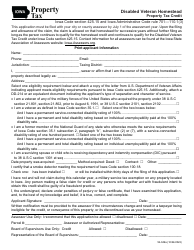

This version of the form is not currently in use and is provided for reference only. Download this version of

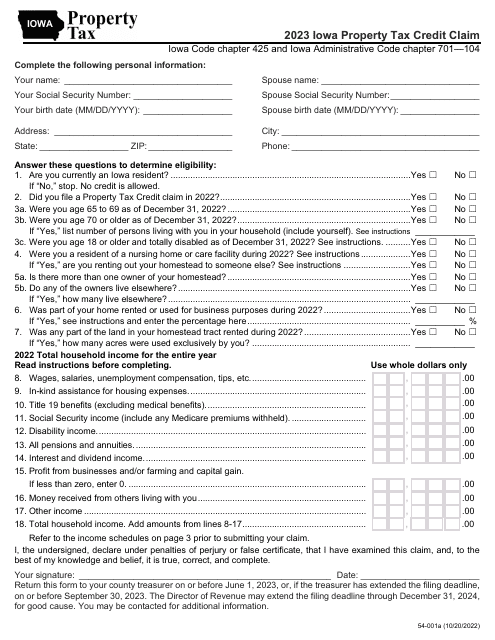

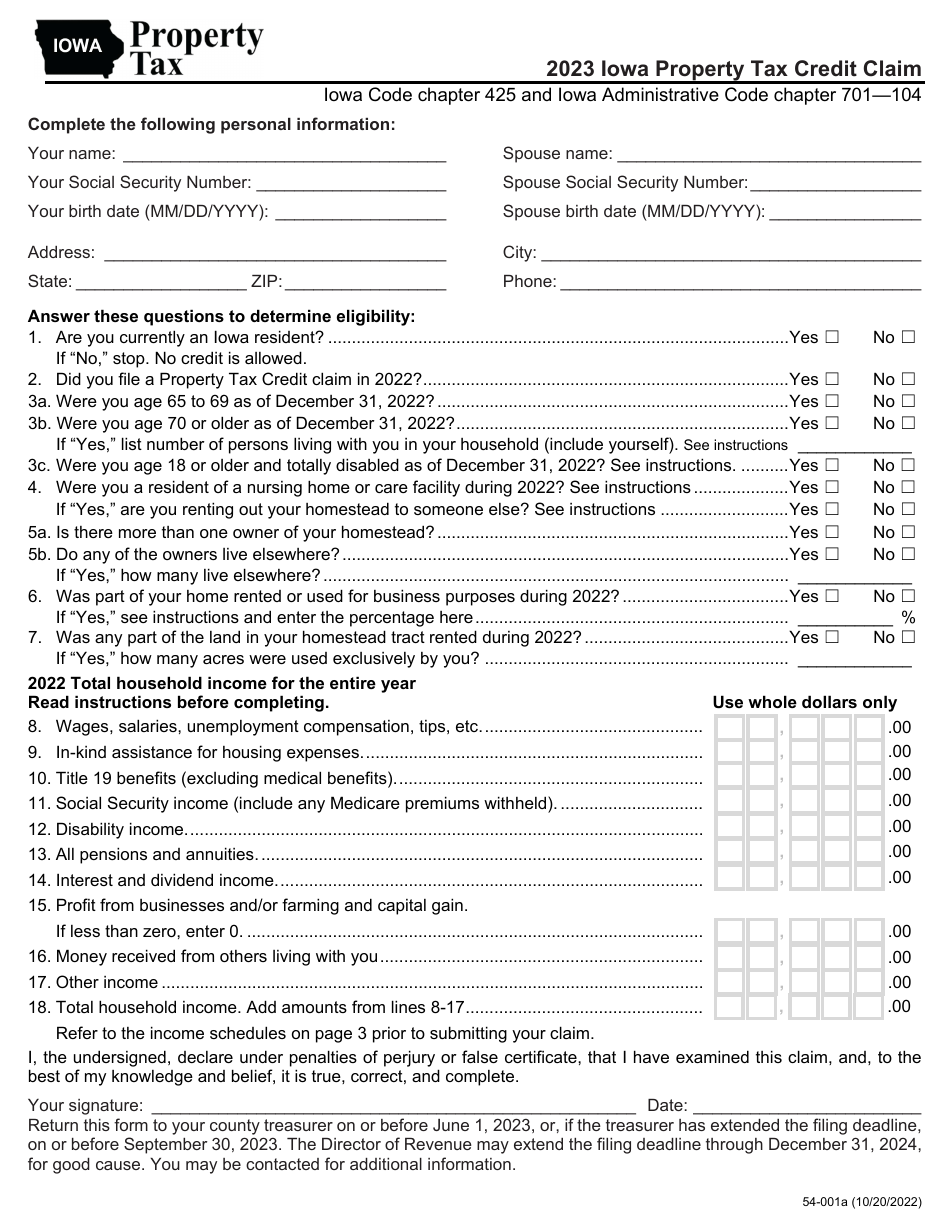

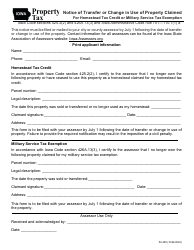

Form 54-001

for the current year.

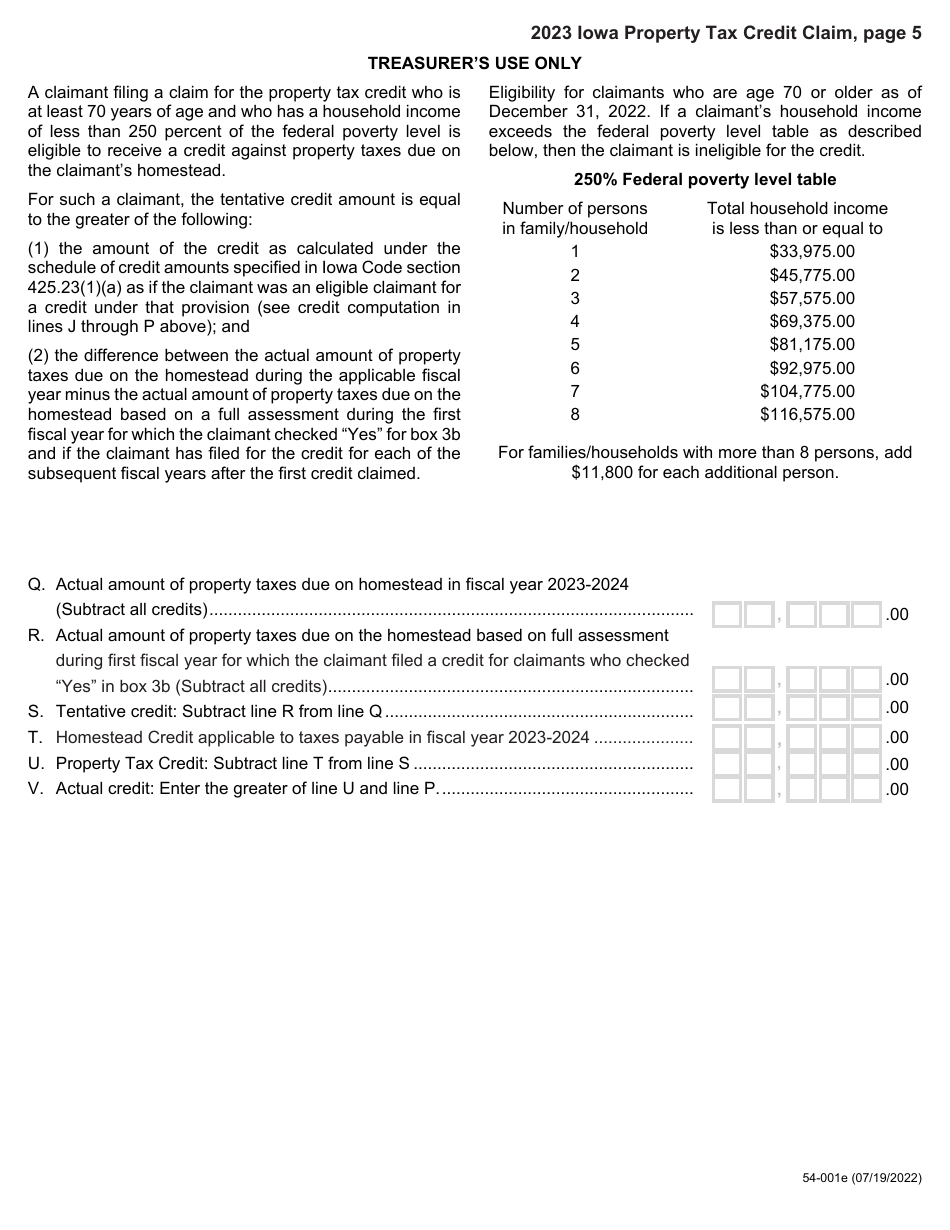

Form 54-001 Iowa Property Tax Credit Claim - Iowa

What Is Form 54-001?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54-001?

A: Form 54-001 is the Iowa Property Tax Credit Claim.

Q: Who can use Form 54-001?

A: Iowa residents who meet certain criteria can use Form 54-001.

Q: What is the purpose of Form 54-001?

A: The purpose of Form 54-001 is to claim the Iowa Property Tax Credit.

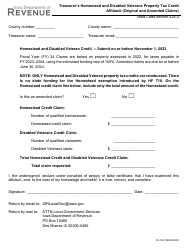

Q: What is the Iowa Property Tax Credit?

A: The Iowa Property Tax Credit is a tax credit available to eligible Iowa residents to help offset the cost of property taxes.

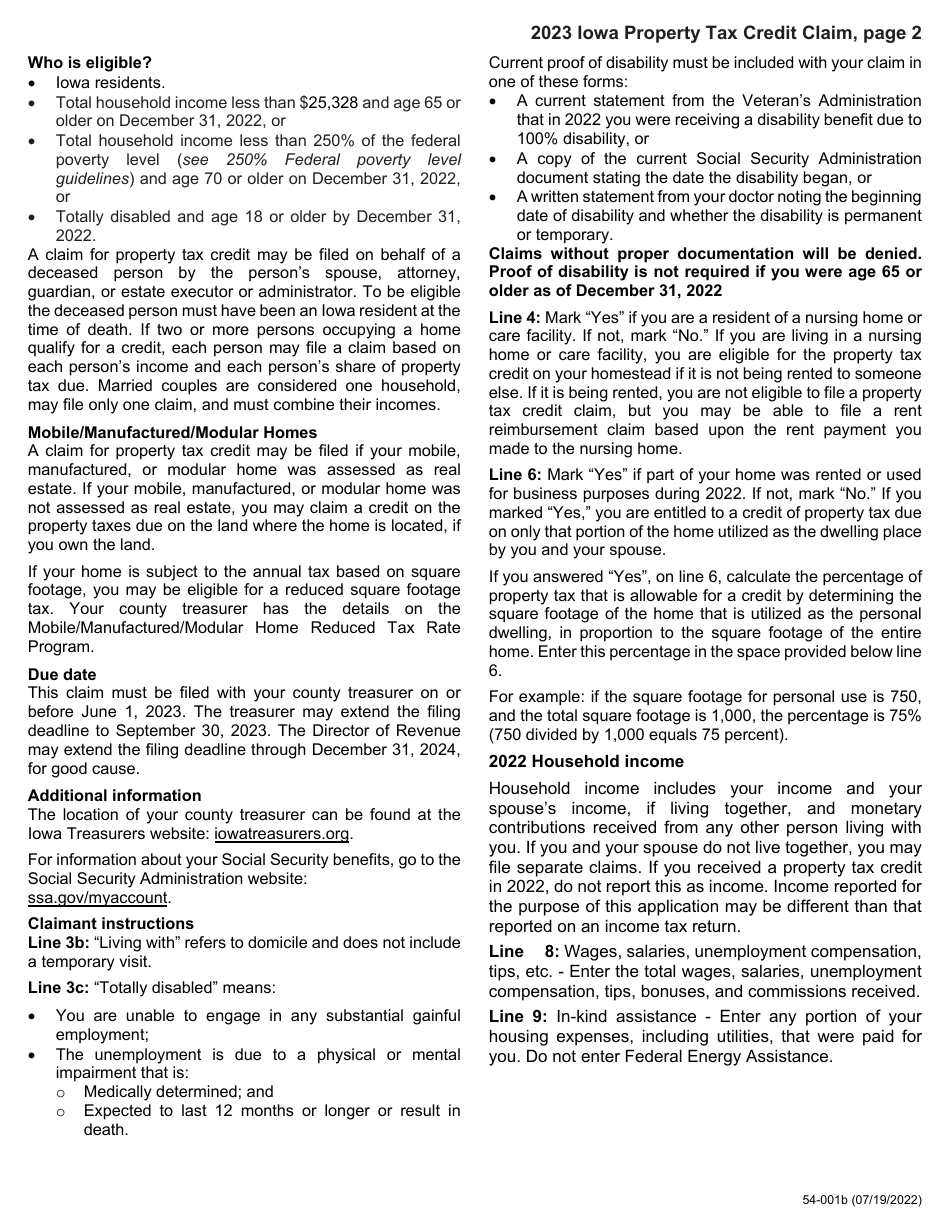

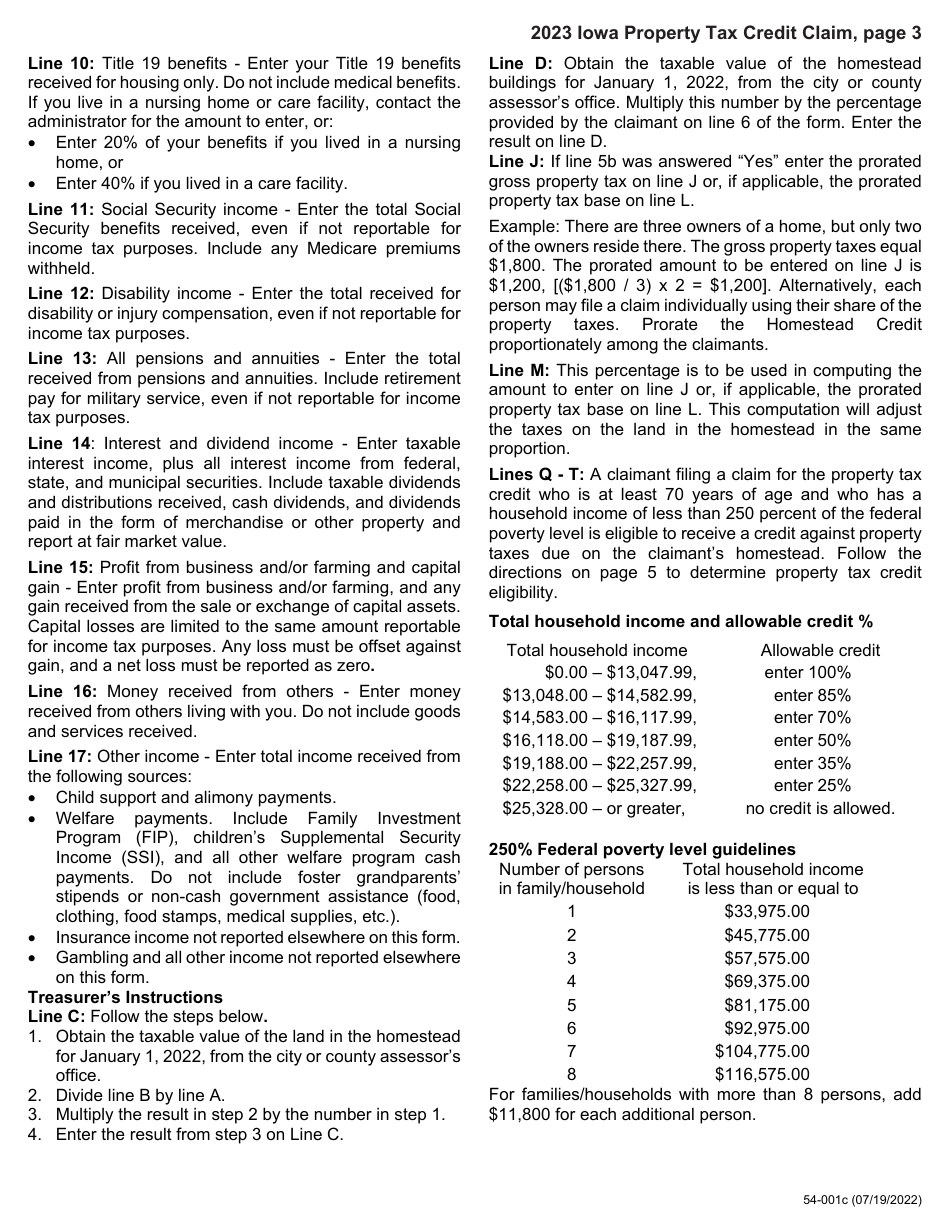

Q: What are the eligibility requirements for the Iowa Property Tax Credit?

A: To be eligible for the Iowa Property Tax Credit, you must meet certain income and residency requirements.

Q: How do I file Form 54-001?

A: Form 54-001 can be filed electronically or by mail. Instructions for filing are included with the form.

Q: When is the deadline for filing Form 54-001?

A: The deadline for filing Form 54-001 is generally July 1st of the assessment year.

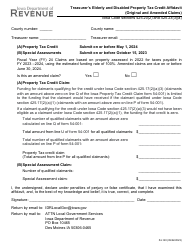

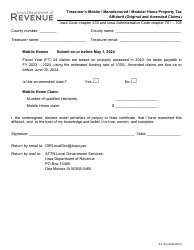

Form Details:

- Released on October 20, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 54-001 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.