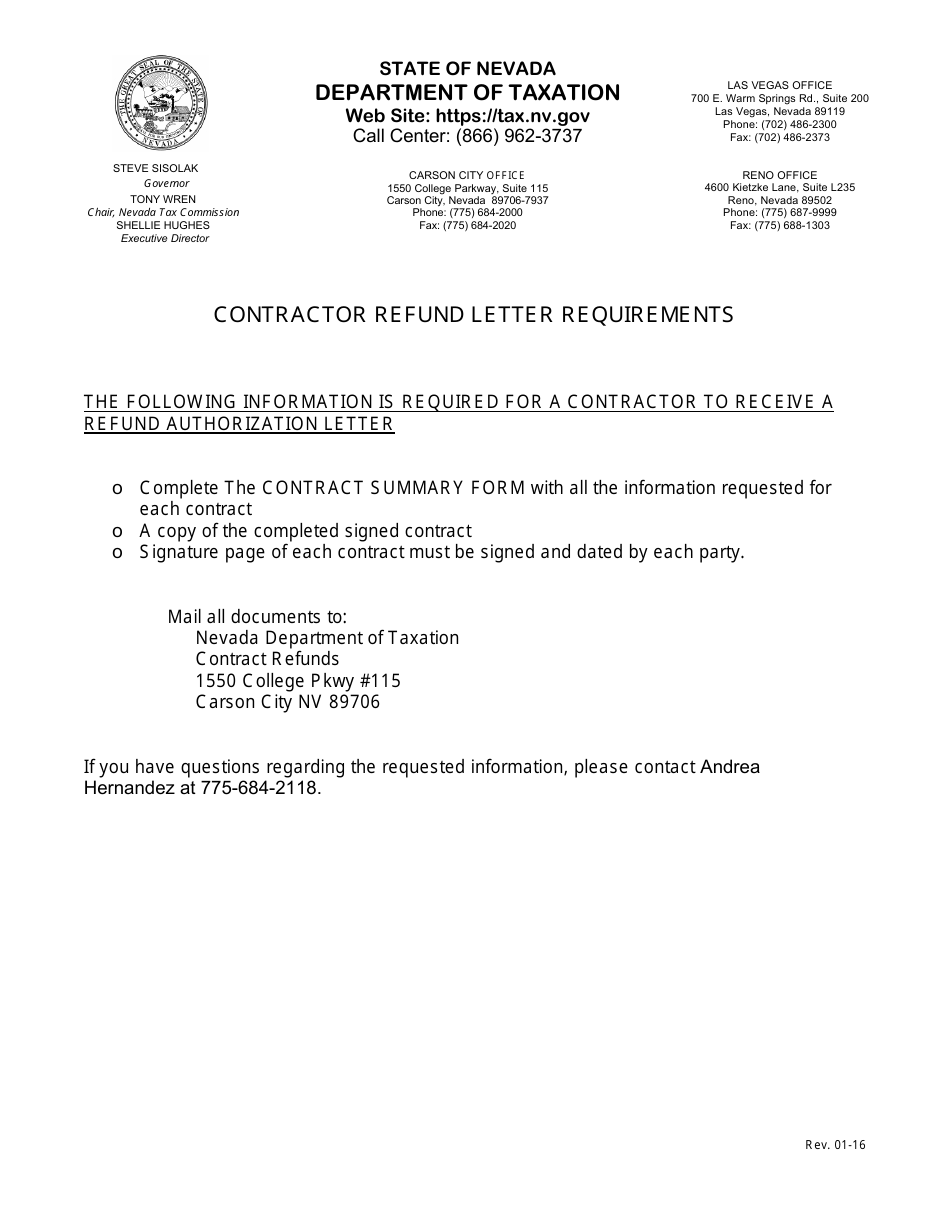

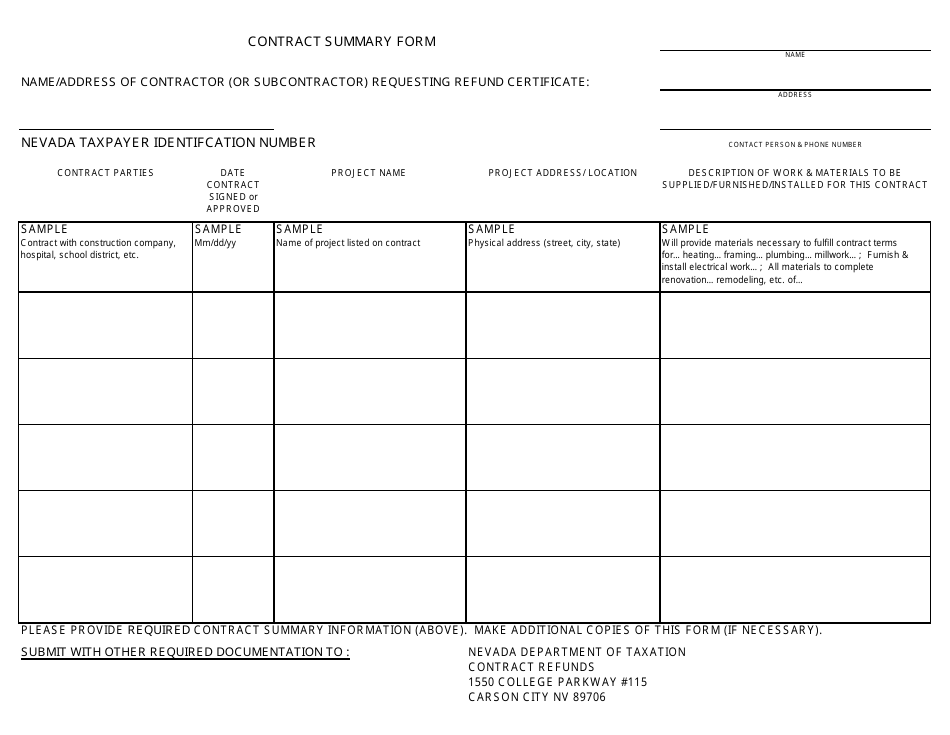

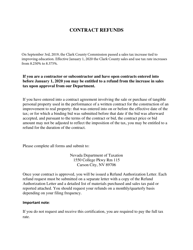

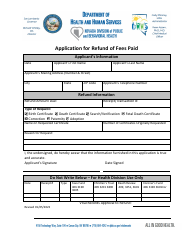

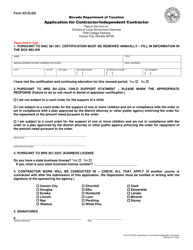

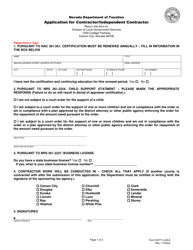

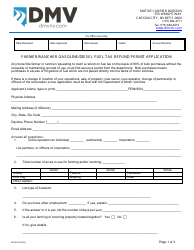

Application for a Contractor Refund (Before January 1, 2016) - Nevada

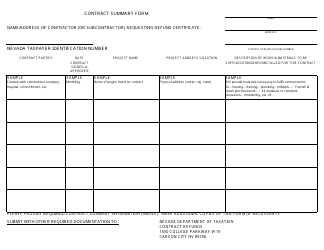

Application for a Contractor Refund (Before January 1, 2016) is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

Q: What is the application for a Contractor Refund?

A: It is a form to request a refund for contractors.

Q: Who can apply for a Contractor Refund?

A: Contractors in Nevada who meet certain criteria.

Q: When should the application be filed?

A: Before January 1, 2016.

Q: What is the purpose of the refund?

A: To receive a refund for overpaid fees or taxes.

Q: What are the eligibility criteria?

A: The contractor must have overpaid fees or taxes and meet certain conditions.

Q: Are there any fees for applying?

A: There may be a fee for filing the application, depending on the circumstances.

Q: How long does it take to process the application?

A: Processing times may vary, but it typically takes several weeks.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be submitted before January 1, 2016.

Q: What if the contractor misses the deadline?

A: They may not be eligible for the refund if they miss the deadline.

Form Details:

- Released on January 1, 2016;

- The latest edition currently provided by the Nevada Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.