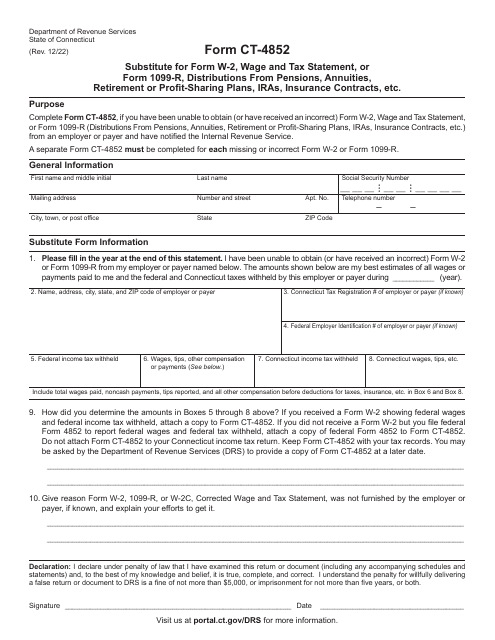

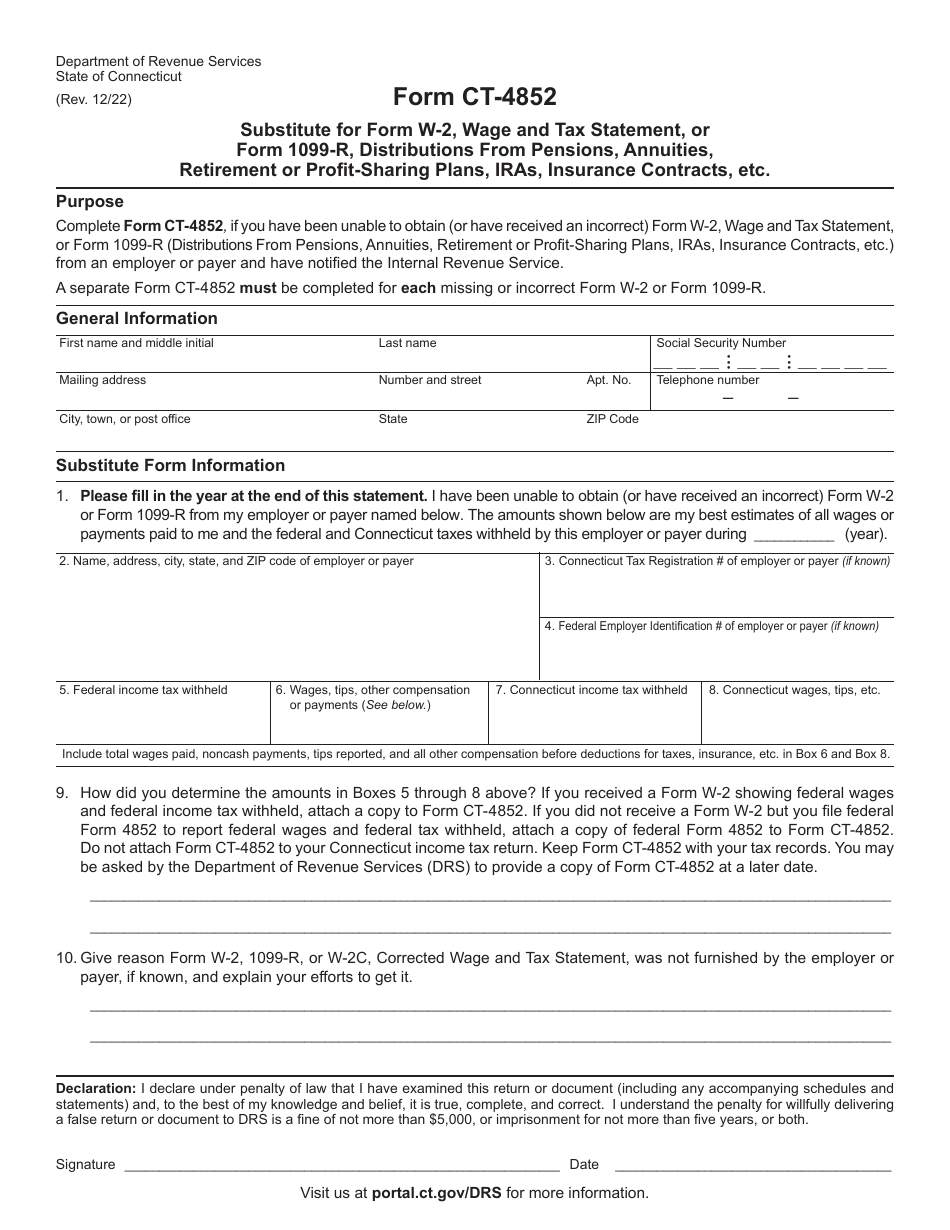

Form CT-4852 Substitute for Form W-2, Wage and Tax Statement, or Form 1099-r, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc. - Connecticut

What Is Form CT-4852?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-4852?

A: Form CT-4852 is a substitute for Form W-2 or Form 1099-R that you can use to report your wages, taxes withheld, and distribution from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc. in Connecticut.

Q: When should I use Form CT-4852?

A: You should use Form CT-4852 if you did not receive a Form W-2 or Form 1099-R from your employer or payer, or if the information on the form you received is incorrect or incomplete.

Q: Can I use Form CT-4852 for federal tax purposes?

A: No, Form CT-4852 is specific to Connecticut and cannot be used for federal tax purposes. You may need to use a similar substitute form for federal taxes, such as Form 4852.

Q: How do I complete Form CT-4852?

A: To complete Form CT-4852, you will need to provide your personal information, details about your income, taxes withheld, and any distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc. Attach any supporting documentation and mail the form to the Connecticut Department of Revenue Services.

Q: Can I e-file Form CT-4852?

A: Currently, e-filing is not available for Form CT-4852. You must submit the form by mail.

Q: Will I receive a refund if I file Form CT-4852?

A: Whether you will receive a refund or owe taxes depends on the specific details of your income, deductions, and credits. Filing Form CT-4852 accurately with the correct information will help determine your tax liability or refund amount.

Q: Can I use Form CT-4852 to report income from other states?

A: No, Form CT-4852 is specific to reporting income earned in Connecticut. If you have income from other states, you may need to use separate state-specific forms or consult with a tax professional.

Q: What should I do if I received a Form W-2 or Form 1099-R after filing Form CT-4852?

A: If you receive a Form W-2 or Form 1099-R after filing Form CT-4852, you should review the information on the new form and compare it with what you reported on Form CT-4852. If there are any discrepancies, you may need to file an amended return or take other appropriate actions.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-4852 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.