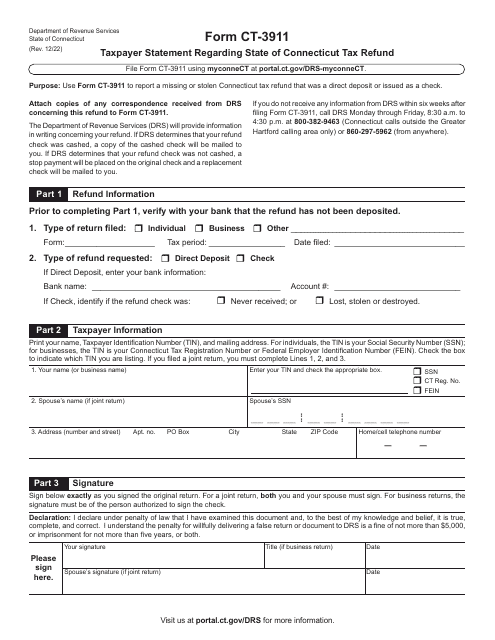

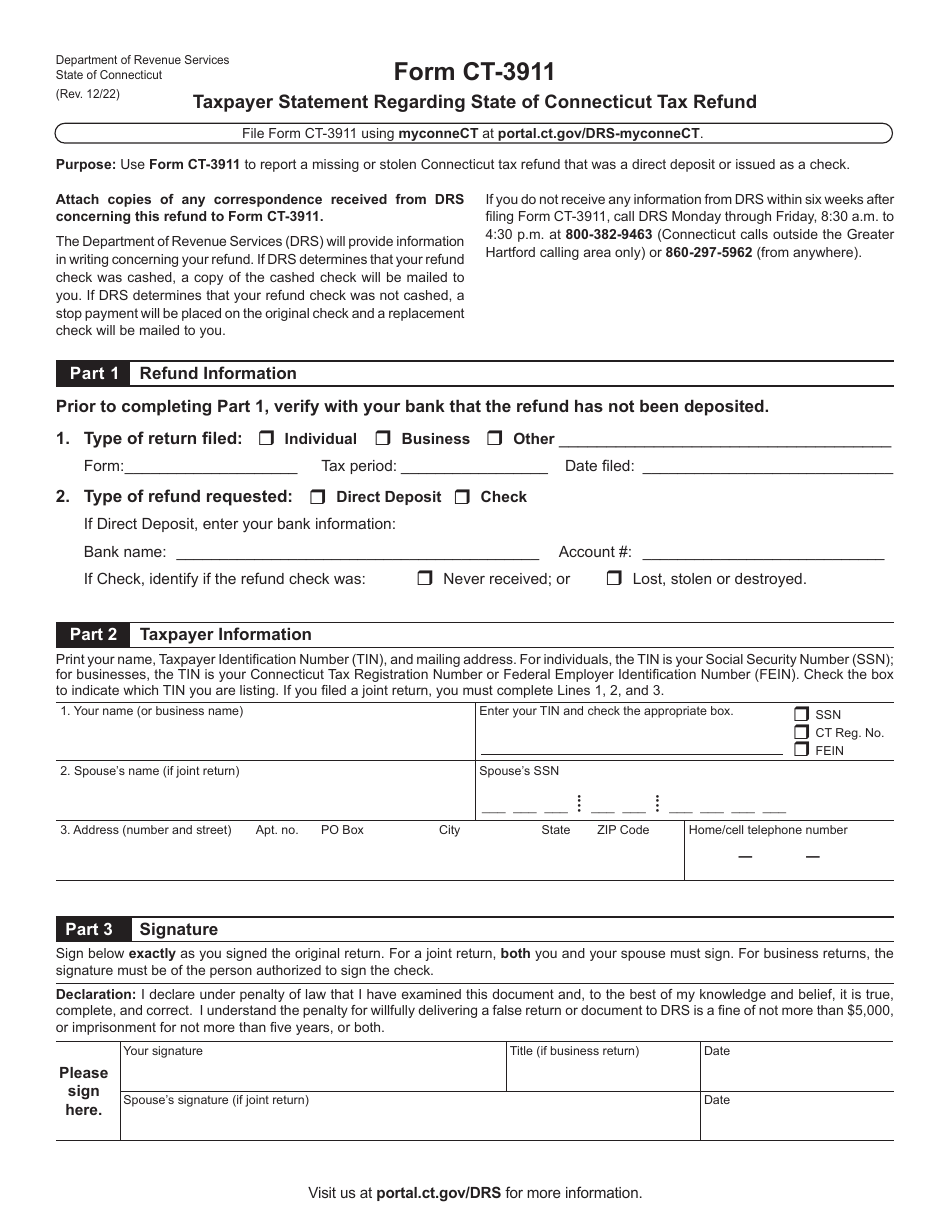

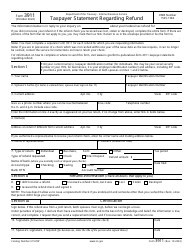

Form CT-3911 Taxpayer Statement Regarding State of Connecticut Tax Refund - Connecticut

What Is Form CT-3911?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-3911?

A: Form CT-3911 is a taxpayer statement regarding the State of Connecticut tax refund.

Q: What is the purpose of Form CT-3911?

A: The purpose of Form CT-3911 is to provide information regarding the taxpayer's state tax refund.

Q: What information is required on Form CT-3911?

A: Form CT-3911 requires the taxpayer to provide their name, Social Security number, address, and other details related to the tax refund.

Q: When should I submit Form CT-3911?

A: Form CT-3911 should be submitted as soon as possible after discovering an issue with your state tax refund.

Q: Can I submit Form CT-3911 electronically?

A: No, Form CT-3911 cannot be submitted electronically. It must be printed and mailed.

Q: Is there a deadline for submitting Form CT-3911?

A: There is no specific deadline mentioned for submitting Form CT-3911. However, it is recommended to submit it promptly to resolve any issues with your state tax refund.

Q: What should I do if I made a mistake on Form CT-3911?

A: If you made a mistake on Form CT-3911, you should submit a corrected form with the accurate information.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3911 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.