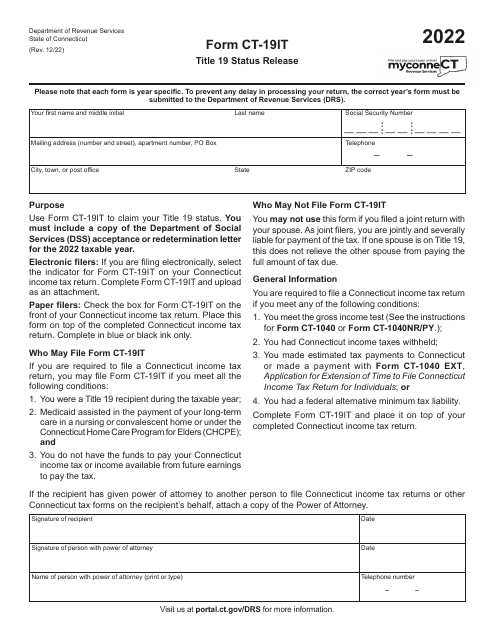

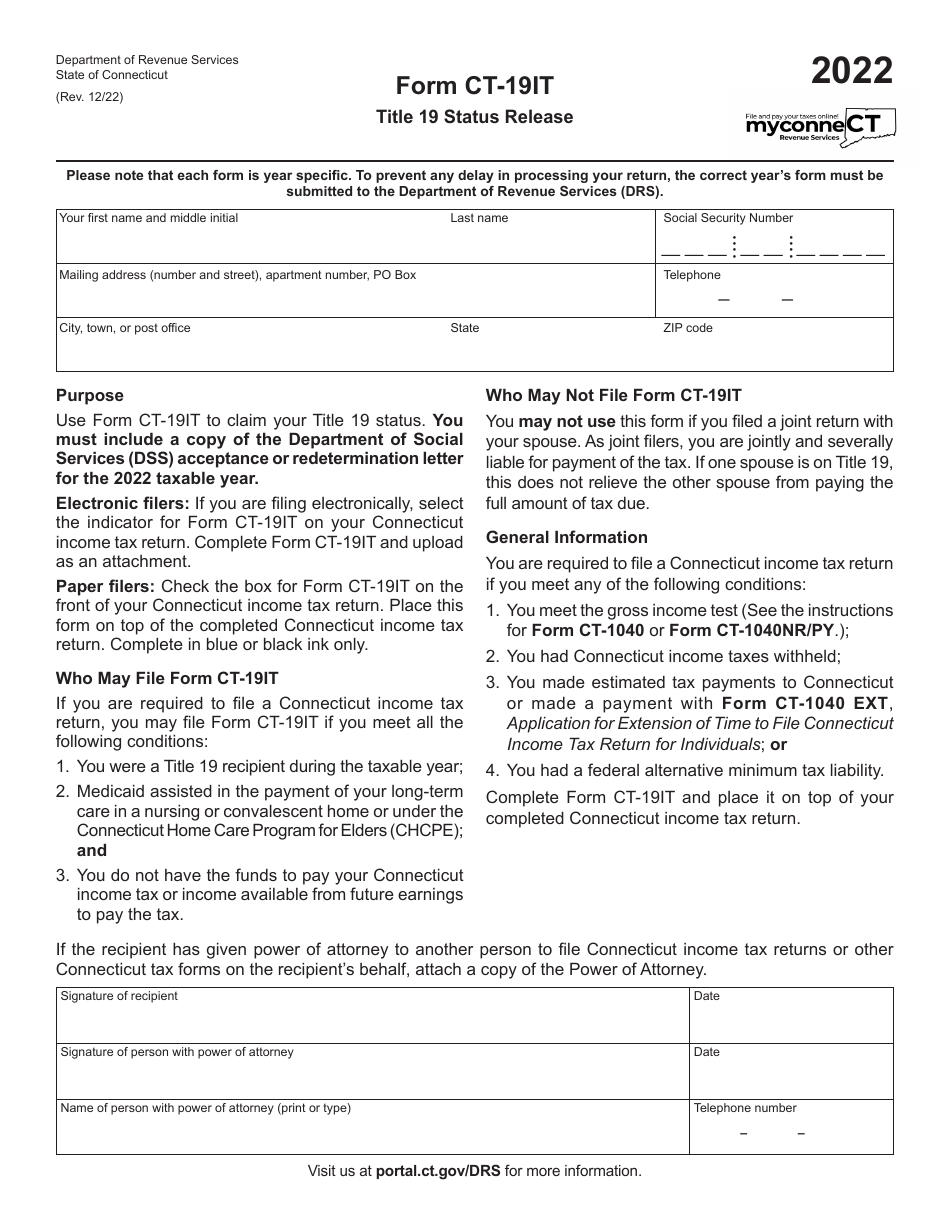

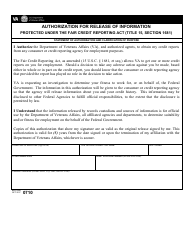

Form CT-19IT Title 19 Status Release - Connecticut

What Is Form CT-19IT?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

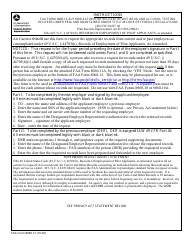

Q: What is Form CT-19IT?

A: Form CT-19IT is a tax form used in the state of Connecticut.

Q: What is the purpose of Form CT-19IT?

A: The purpose of Form CT-19IT is to request a Title 19 Status Release in Connecticut.

Q: What is Title 19 Status Release?

A: Title 19 Status Release refers to the eligibility for certain government benefits in Connecticut.

Q: Who needs to file Form CT-19IT?

A: Individuals who are seeking a Title 19 Status Release in Connecticut need to file Form CT-19IT.

Q: What information is required on Form CT-19IT?

A: Form CT-19IT requires information such as personal details, income information, and proof of eligibility for Title 19 benefits.

Q: Are there any fees associated with filing Form CT-19IT?

A: No, there are no fees associated with filing Form CT-19IT.

Q: What is the deadline for filing Form CT-19IT?

A: The deadline for filing Form CT-19IT varies and depends on individual circumstances. It is best to check with the Connecticut Department of Revenue Services for the specific deadline.

Q: What happens after I file Form CT-19IT?

A: After filing Form CT-19IT, the Connecticut Department of Revenue Services will review the information and determine eligibility for Title 19 benefits.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-19IT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.