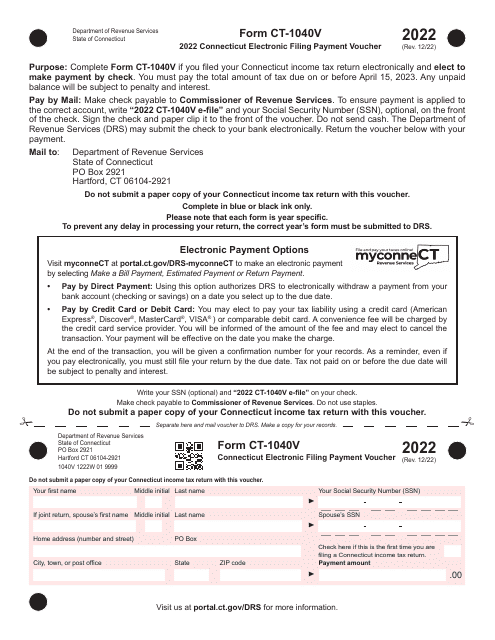

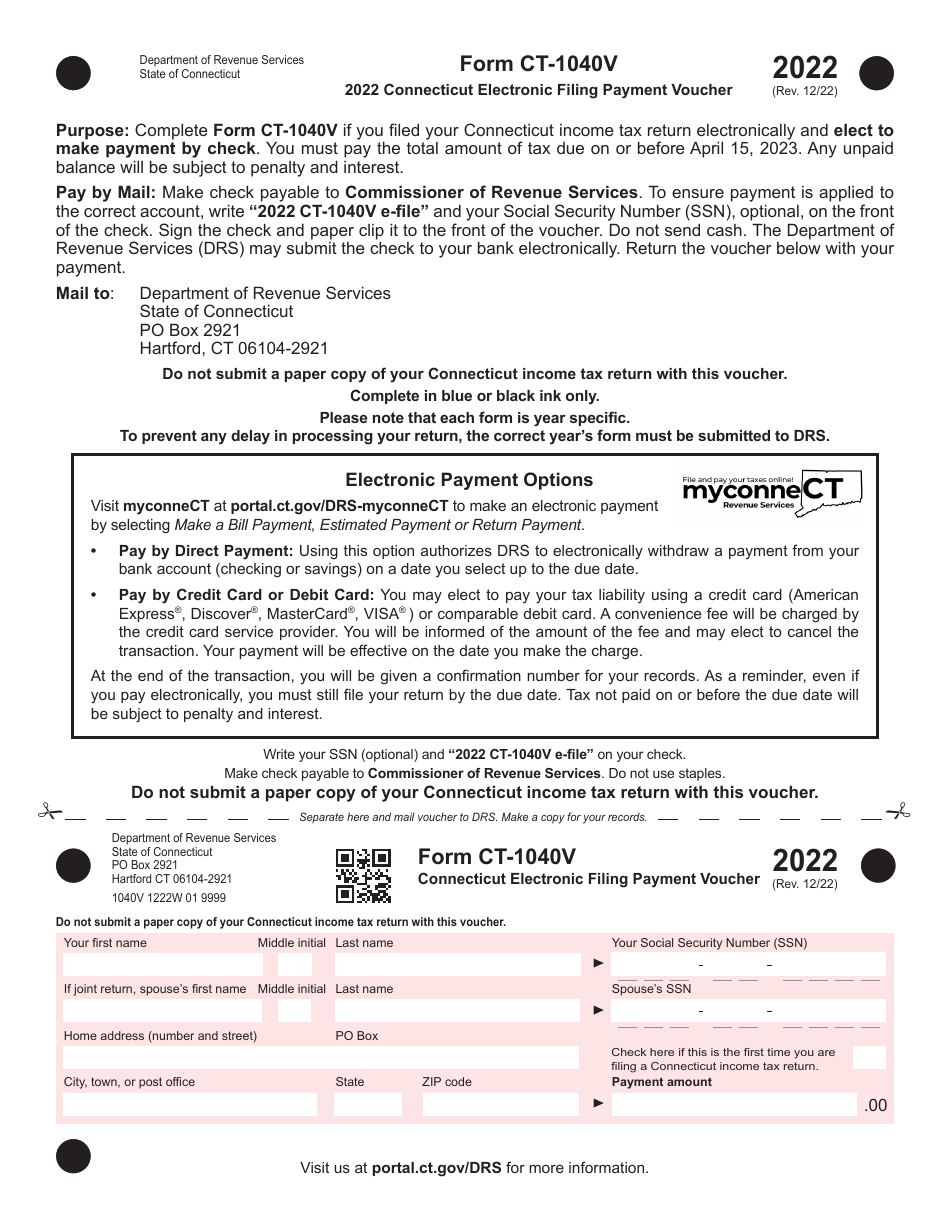

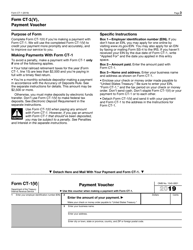

Form CT-1040V Connecticut Electronic Filing Payment Voucher - Connecticut

What Is Form CT-1040V?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1040V?

A: Form CT-1040V is a payment voucher used for electronic filing of taxes in Connecticut.

Q: What is the purpose of Form CT-1040V?

A: The purpose of Form CT-1040V is to provide a payment voucher for taxpayers who are filing their taxes electronically in Connecticut.

Q: Who needs to use Form CT-1040V?

A: Taxpayers who are filing their taxes electronically in Connecticut need to use Form CT-1040V to submit their payment.

Q: What information is required on Form CT-1040V?

A: Form CT-1040V requires the taxpayer's name, address, Social Security number, tax year, and the amount of the payment being made.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1040V by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.