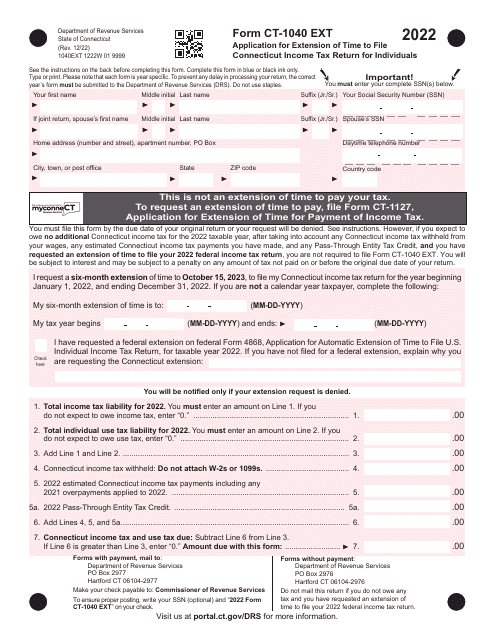

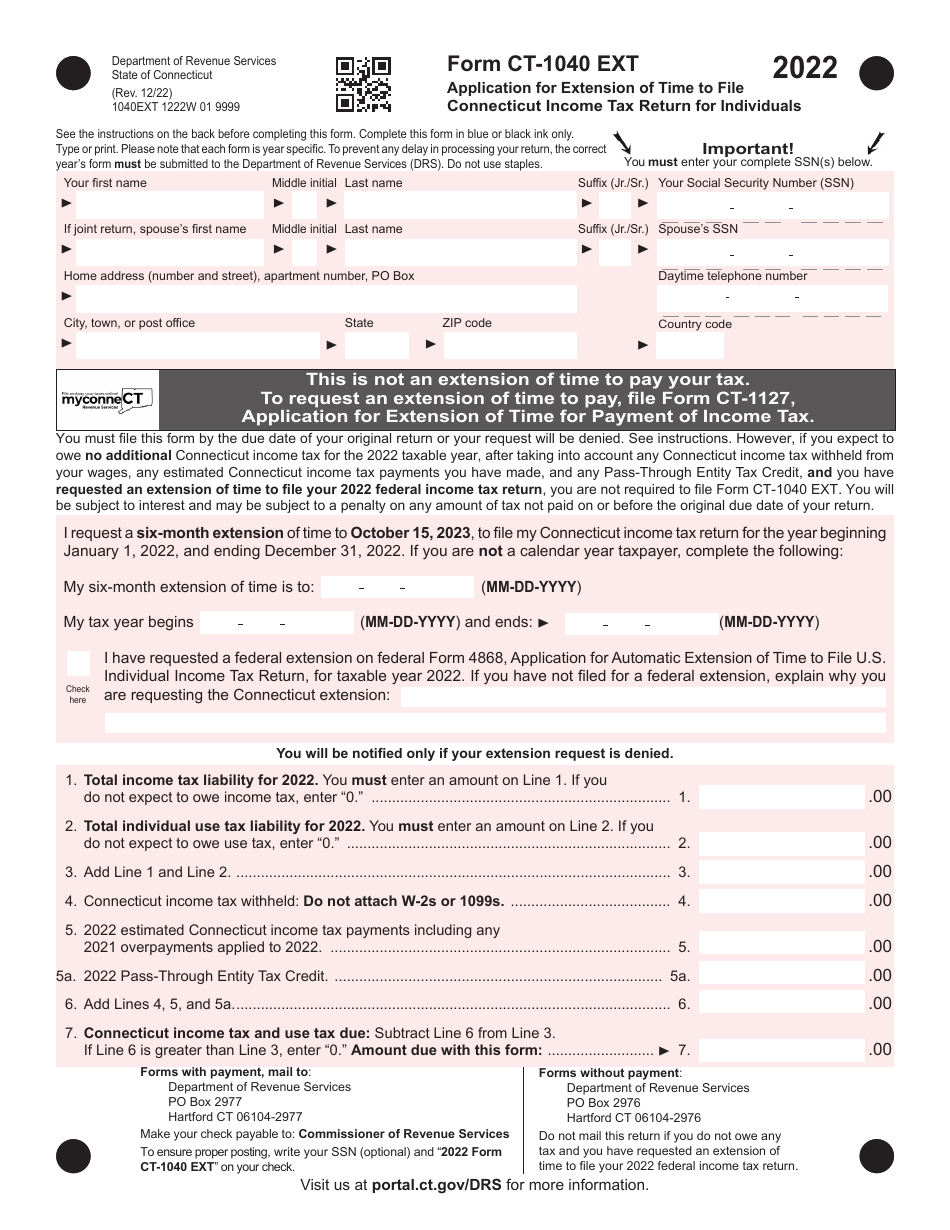

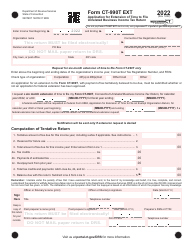

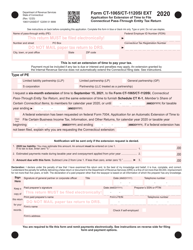

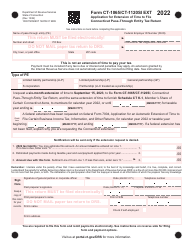

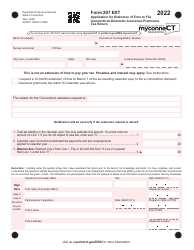

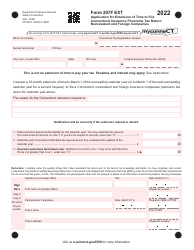

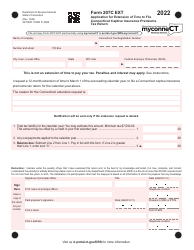

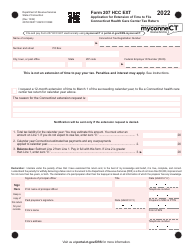

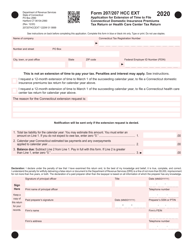

Form CT-1040 EXT Application for Extension of Time to File Connecticut Income Tax Return for Individuals - Connecticut

What Is Form CT-1040 EXT?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1040 EXT?

A: Form CT-1040 EXT is an application for an extension of time to file Connecticut Income Tax Return for individuals.

Q: Who can use Form CT-1040 EXT?

A: Individuals who need additional time to file their Connecticut Income Tax Return can use Form CT-1040 EXT.

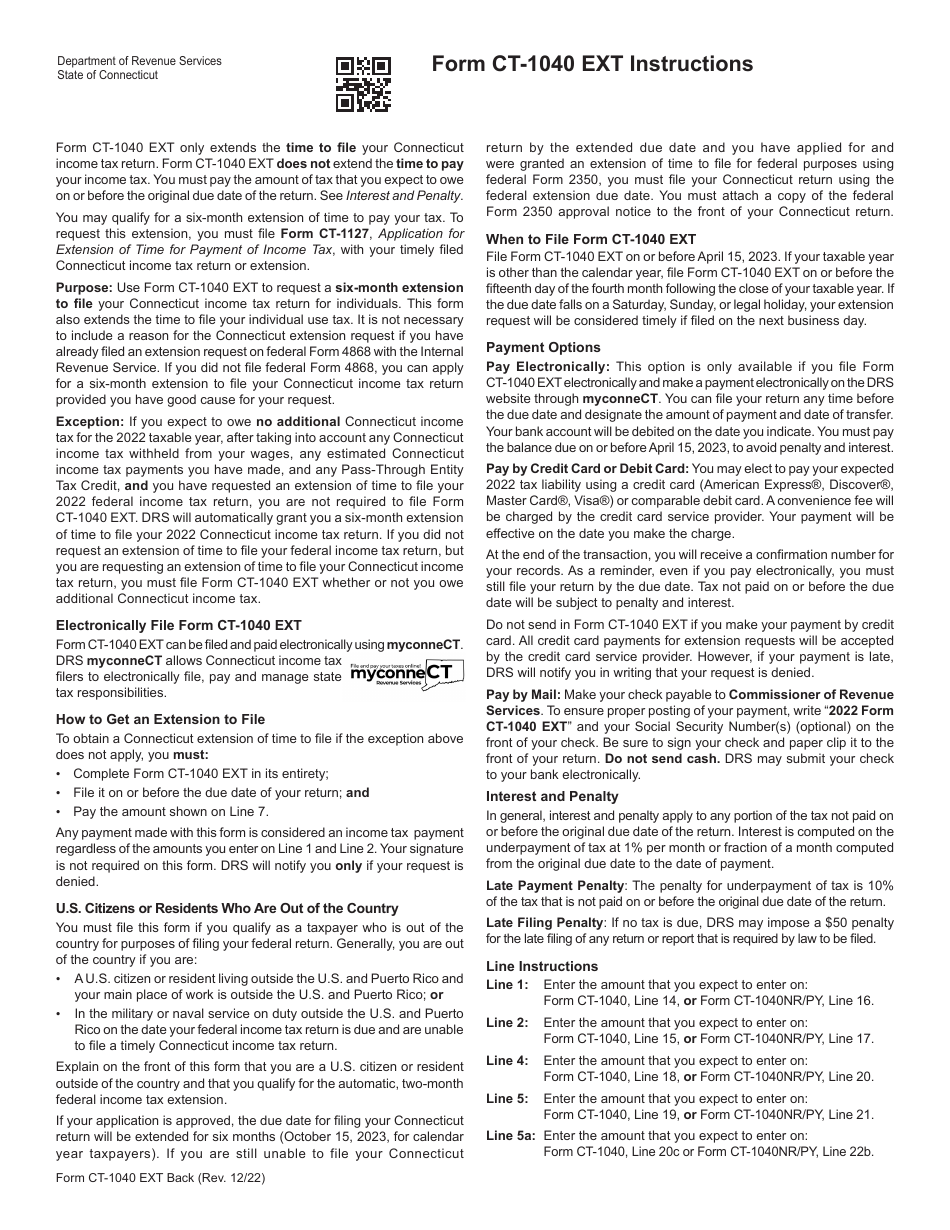

Q: How do I file Form CT-1040 EXT?

A: Form CT-1040 EXT can be filed electronically or by mail. The instructions on the form provide detailed information on how to file.

Q: What is the deadline for filing Form CT-1040 EXT?

A: Form CT-1040 EXT must be filed by the original due date of the Connecticut Income Tax Return, which is usually April 15th.

Q: How long is the extension granted by Form CT-1040 EXT?

A: Form CT-1040 EXT grants a 6-month extension, making the new deadline October 15th.

Q: Do I need to attach any documents to Form CT-1040 EXT?

A: No, you do not need to attach any documents to Form CT-1040 EXT. However, any tax payments due must be submitted with the form.

Q: What happens if I do not file Form CT-1040 EXT?

A: If you do not file Form CT-1040 EXT and fail to file your Connecticut Income Tax Return by the original due date, you may be subject to penalties and interest.

Q: Can I file Form CT-1040 EXT if I owe taxes?

A: Yes, you can still file Form CT-1040 EXT even if you owe taxes. However, any taxes owed must be paid with the form to avoid penalties and interest.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1040 EXT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.