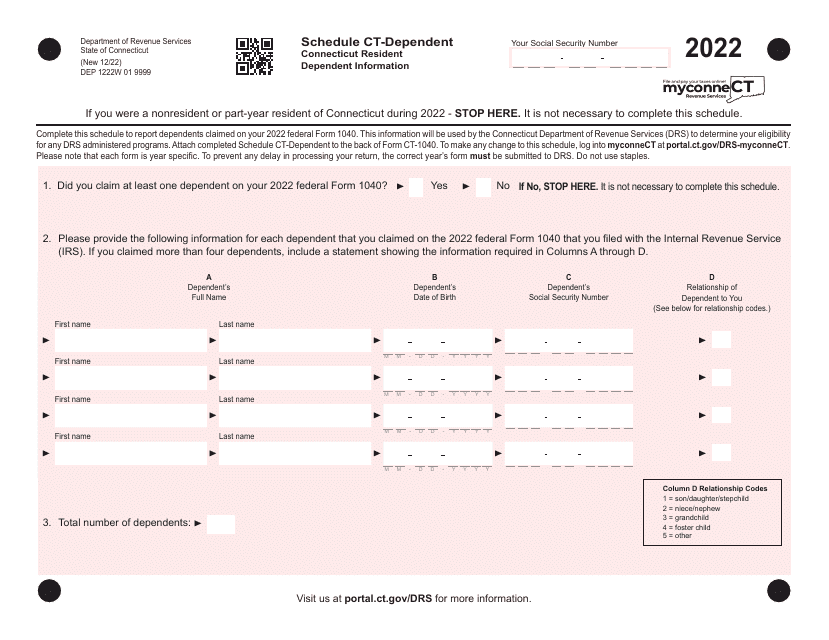

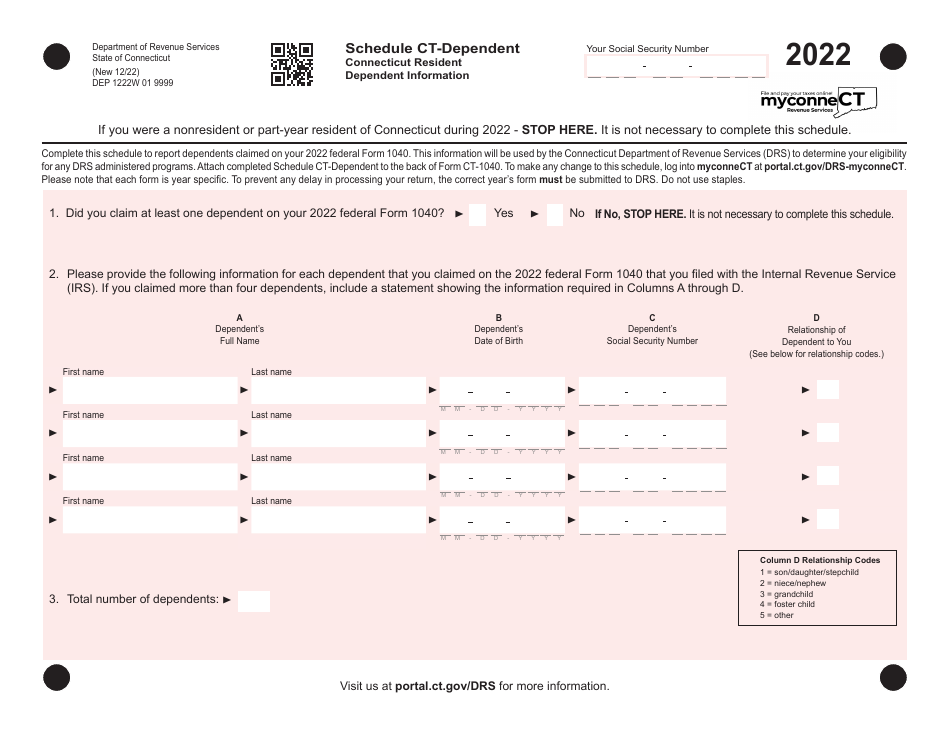

Schedule CT-DEPENDENT Connecticut Resident Dependent Information - Connecticut

What Is Schedule CT-DEPENDENT?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CT-DEPENDENT form?

A: The CT-DEPENDENT form is the Schedule CT-DEPENDENT Connecticut Resident Dependent Information form in Connecticut.

Q: Who needs to file the CT-DEPENDENT form?

A: Connecticut residents who have dependents need to file the CT-DEPENDENT form.

Q: What information does the CT-DEPENDENT form require?

A: The CT-DEPENDENT form requires information about the dependent's name, Social Security number, relationship to the taxpayer, and whether they meet the criteria for a qualifying child or relative.

Q: When is the deadline to file the CT-DEPENDENT form?

A: The deadline to file the CT-DEPENDENT form is the same as the deadline for filing your Connecticut state tax return.

Q: Is there a fee to file the CT-DEPENDENT form?

A: No, there is no fee to file the CT-DEPENDENT form.

Q: What happens if I don't file the CT-DEPENDENT form?

A: If you have dependents and don't file the CT-DEPENDENT form, you may miss out on potential tax credits or deductions.

Q: Can I claim a non-resident dependent on the CT-DEPENDENT form?

A: No, the CT-DEPENDENT form is specifically for Connecticut residents and their dependents.

Q: Do I need to attach any documents to the CT-DEPENDENT form?

A: You may need to attach supporting documentation, such as birth certificates or Social Security cards, for each dependent listed on the CT-DEPENDENT form.

Q: Can I e-file the CT-DEPENDENT form?

A: Yes, you can e-file the CT-DEPENDENT form along with your Connecticut state tax return.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule CT-DEPENDENT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.