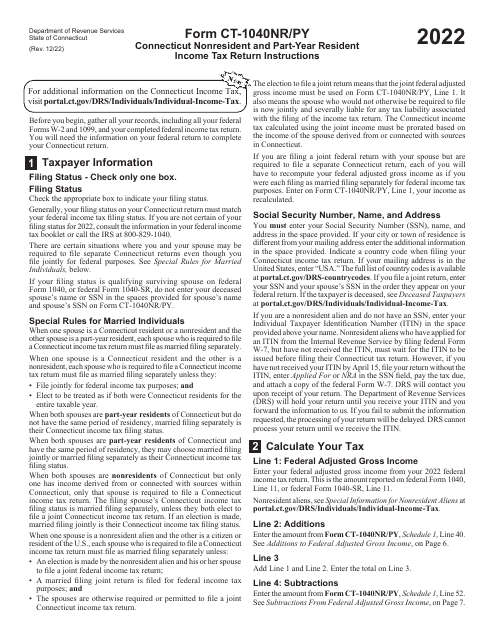

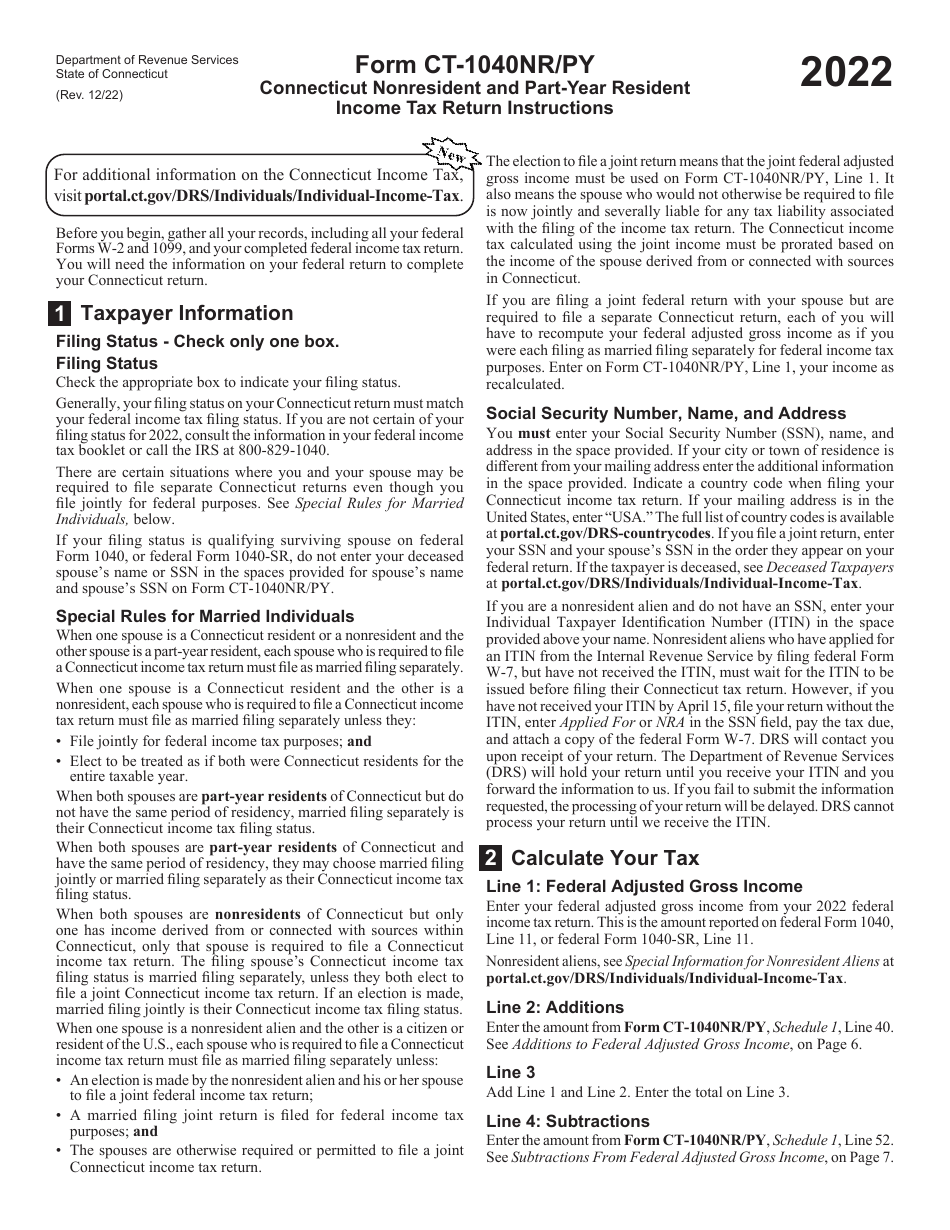

Instructions for Form CT-1040NR / PY Connecticut Nonresident and Part-Year Resident Income Tax Return - Connecticut

This document contains official instructions for Form CT-1040NR/PY , Connecticut Nonresident and Part-Year Resident Income Tax Return - a form released and collected by the Connecticut Department of Revenue Services. An up-to-date fillable Form CT-1040NR/PY is available for download through this link.

FAQ

Q: Who needs to file Form CT-1040NR/PY?

A: Nonresidents and part-year residents of Connecticut.

Q: What is the purpose of Form CT-1040NR/PY?

A: To report income earned in Connecticut and calculate the correct amount of tax owed.

Q: How do I determine if I am a nonresident or part-year resident?

A: A nonresident is someone who does not live in Connecticut, while a part-year resident is someone who moved in or out of Connecticut during the tax year.

Q: What income should I report on Form CT-1040NR/PY?

A: You should report all income earned in Connecticut, including wages, self-employment income, rental income, and any other sources of income.

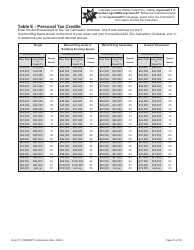

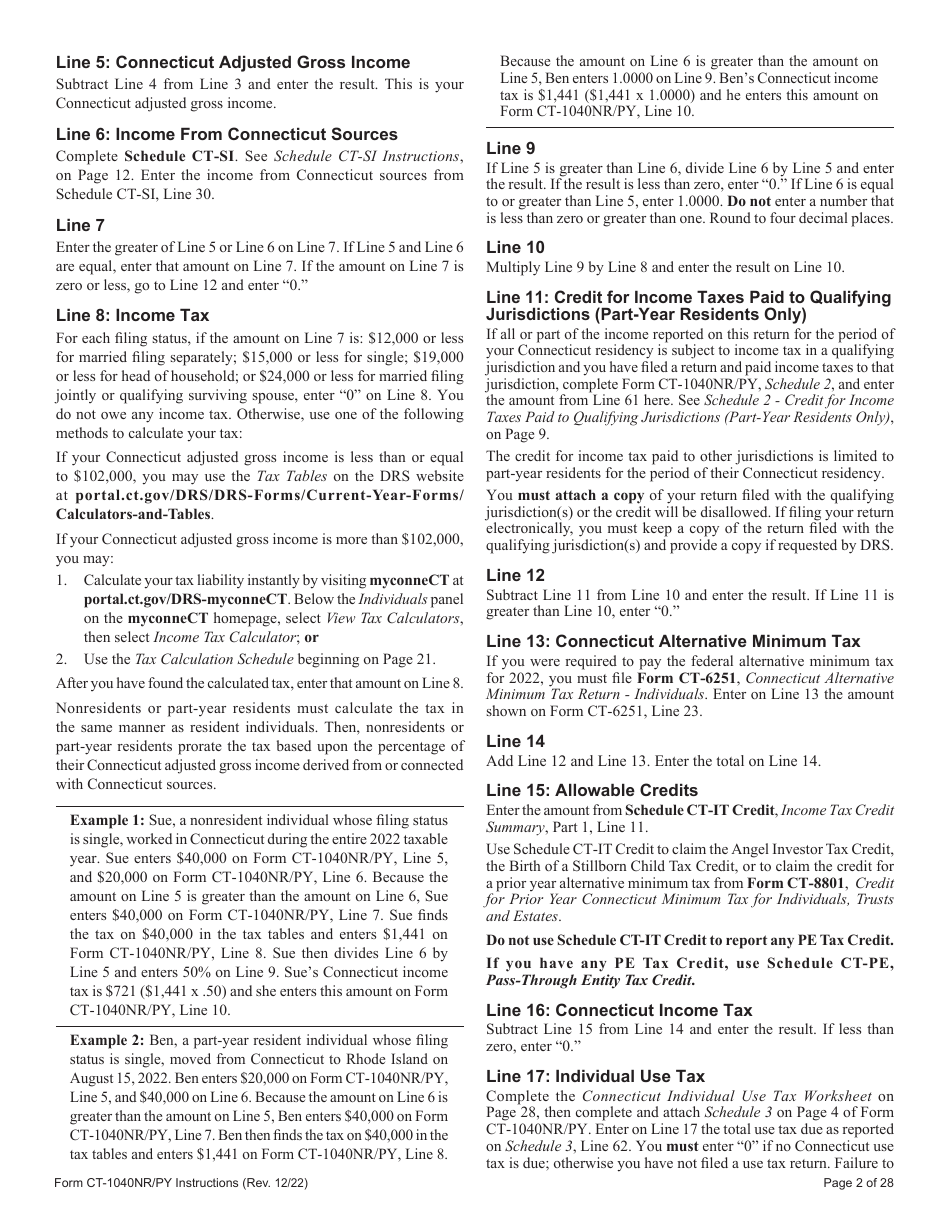

Q: Are there any deductions or credits available on Form CT-1040NR/PY?

A: Yes, Connecticut offers various deductions and credits, such as the standard deduction, dependent exemption, and education credits.

Q: When is the deadline to file Form CT-1040NR/PY?

A: The deadline is usually April 15th, but it may vary depending on the tax year.

Q: Can I file Form CT-1040NR/PY electronically?

A: Yes, Connecticut allows electronic filing for nonresidents and part-year residents.

Q: What if I need more time to file Form CT-1040NR/PY?

A: You can request an extension by filing Form CT-1040EXT before the original due date of the return.

Q: What happens if I don't file Form CT-1040NR/PY?

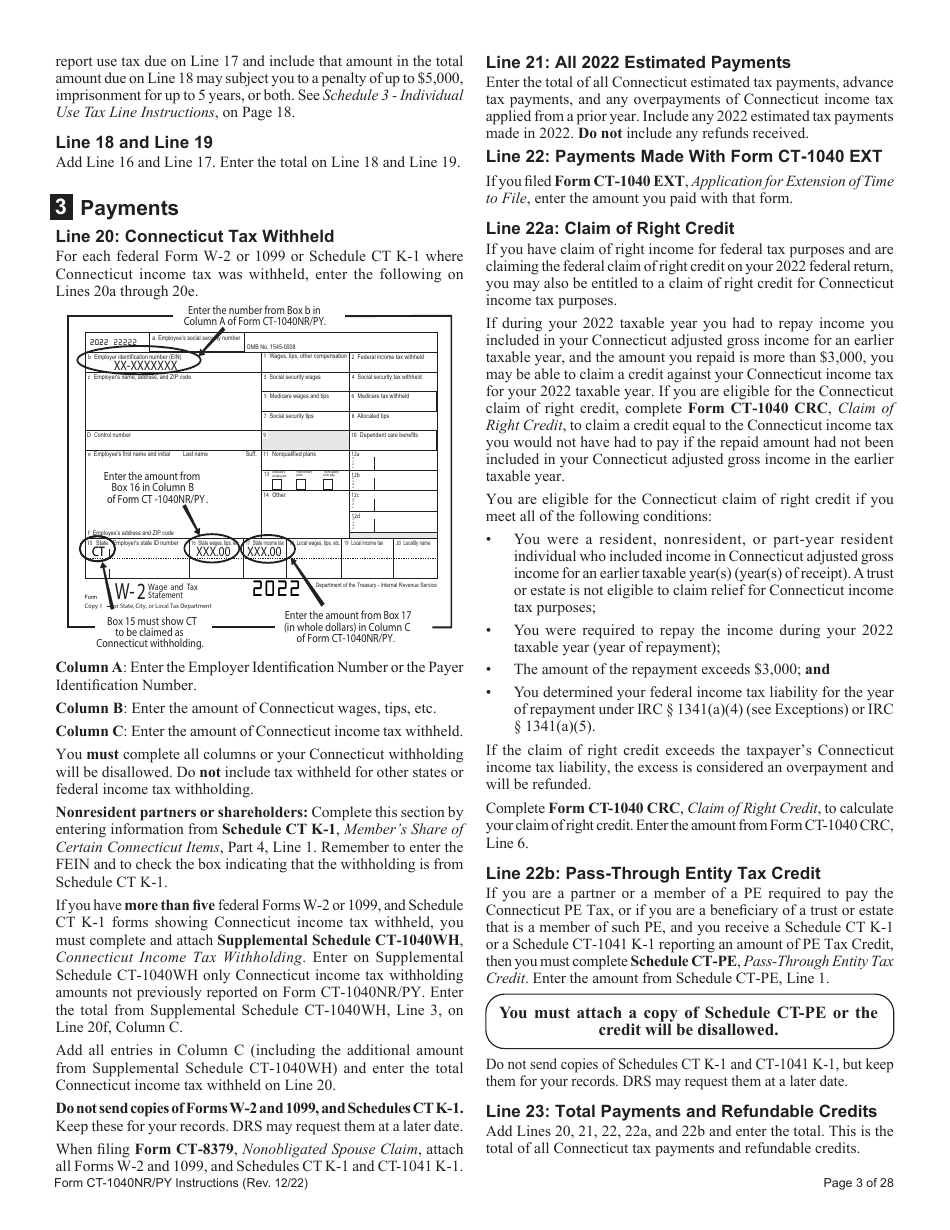

A: If you are required to file but fail to do so, you may face penalties and interest charges.

Instruction Details:

- This 28-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

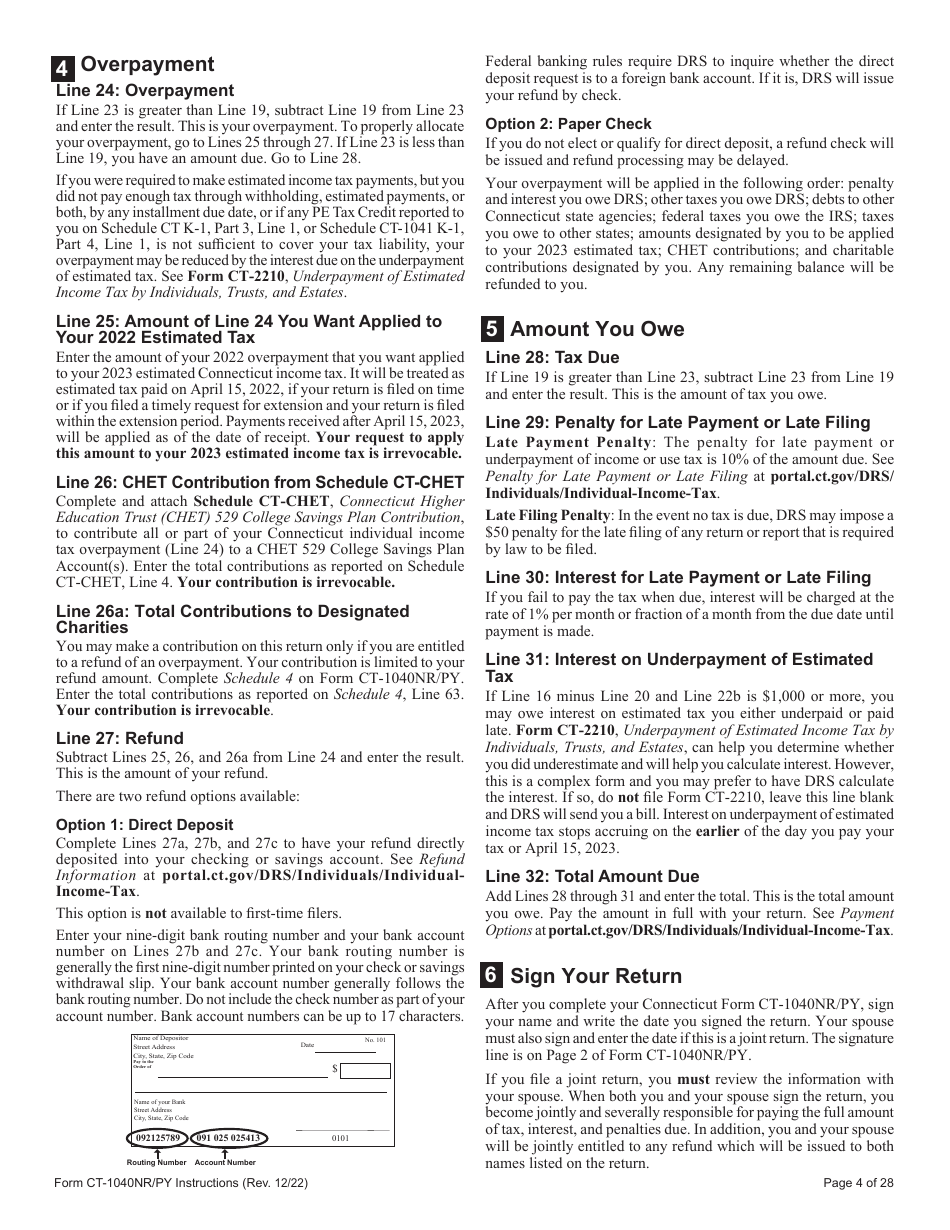

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Connecticut Department of Revenue Services.