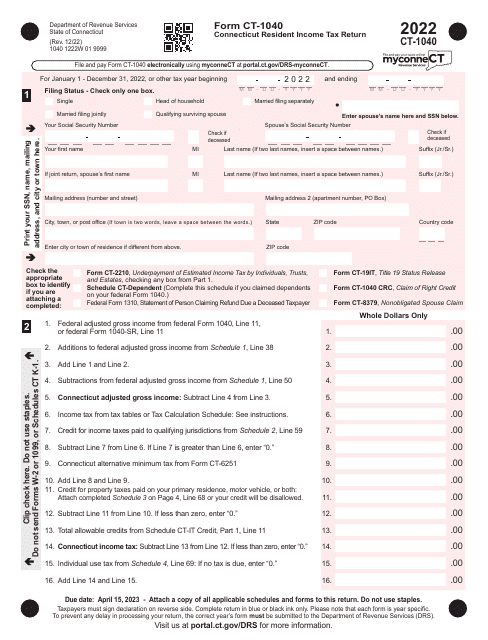

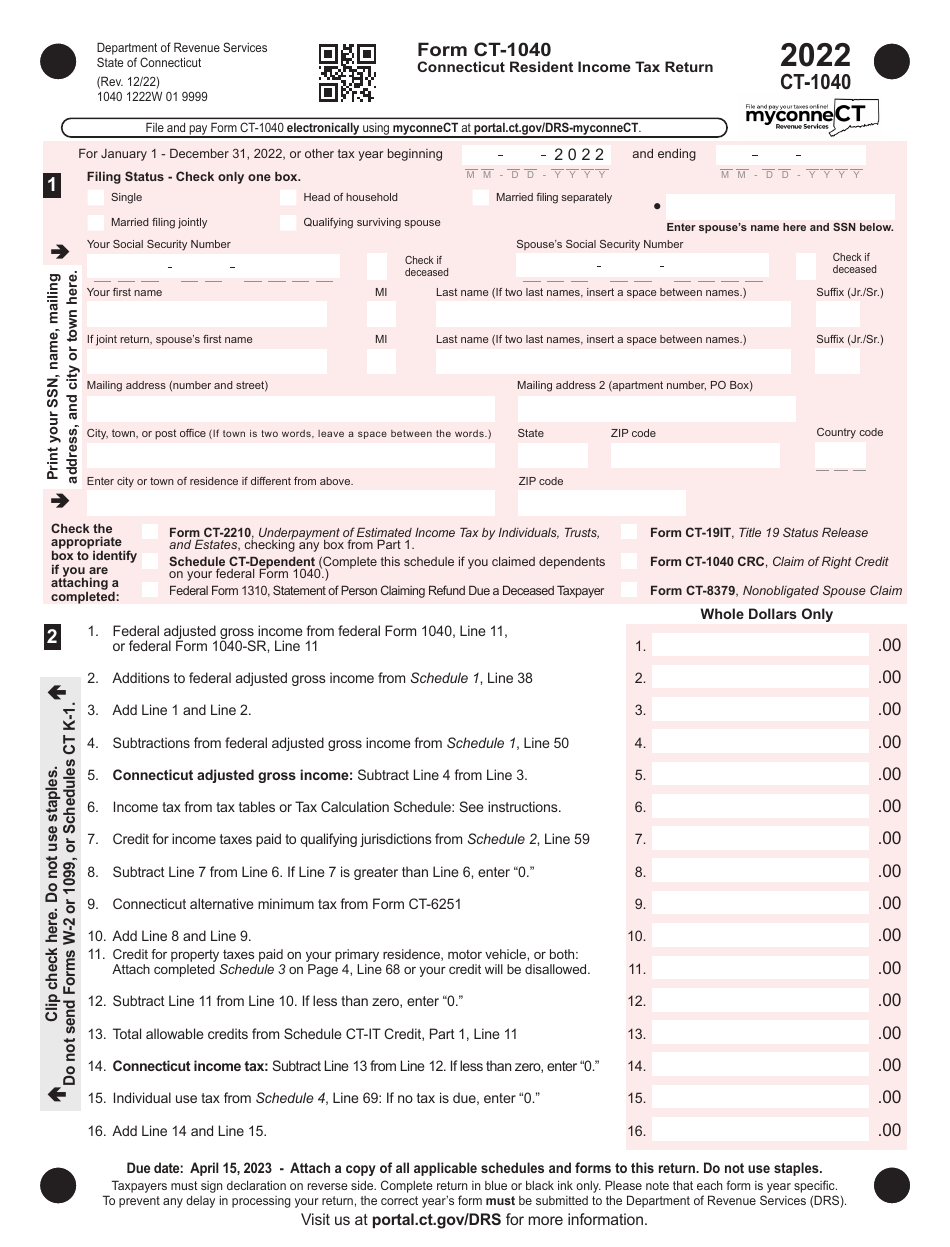

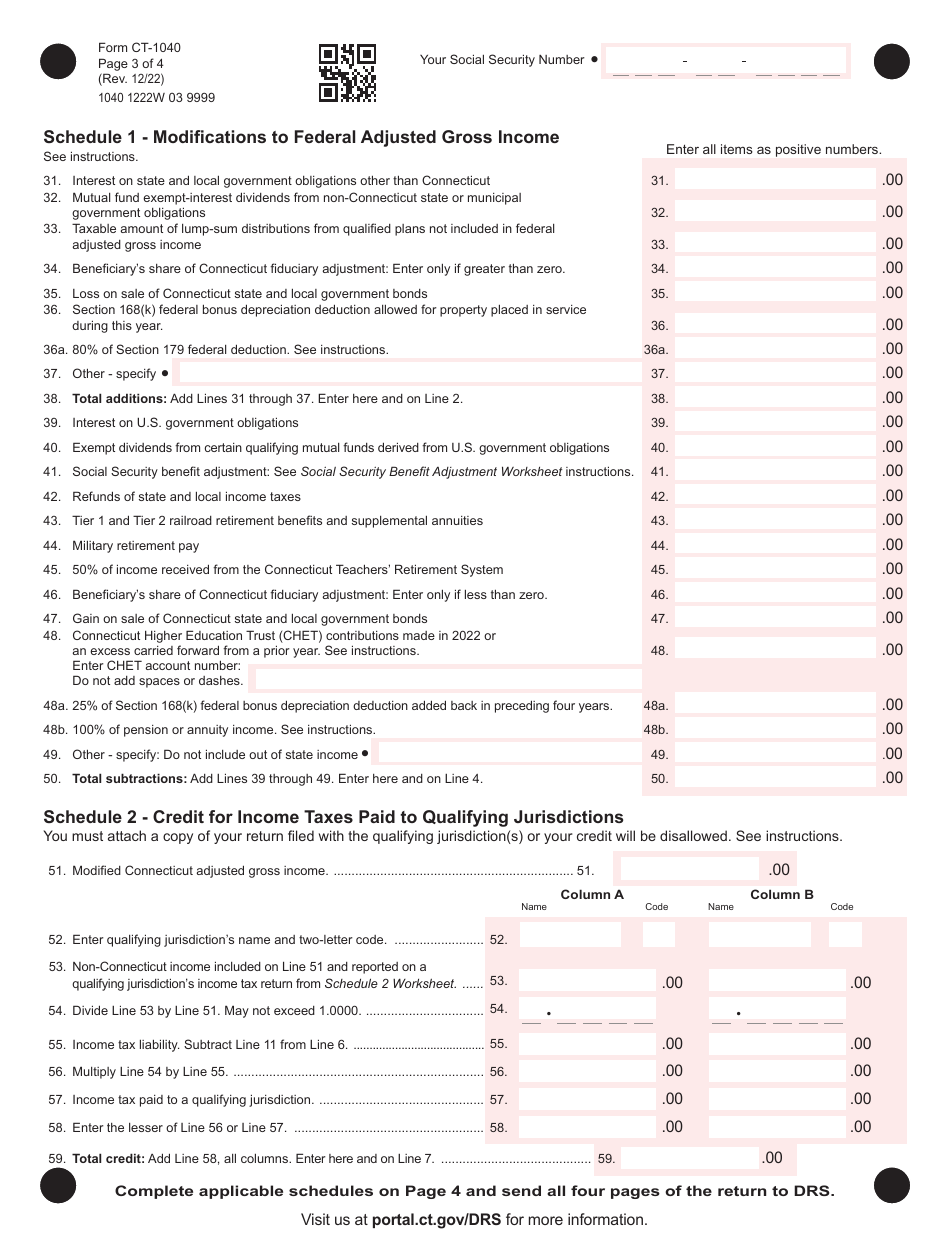

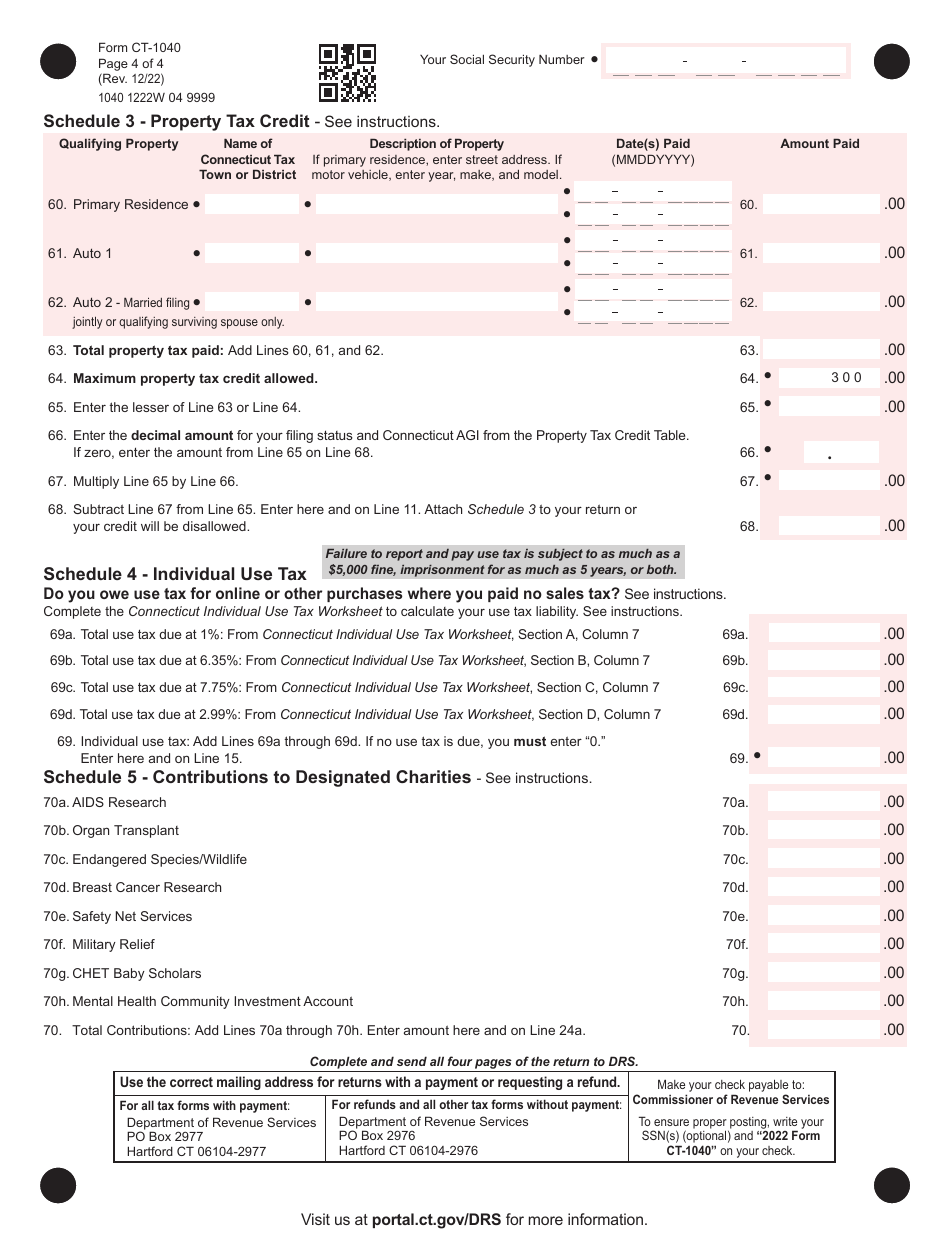

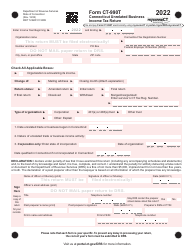

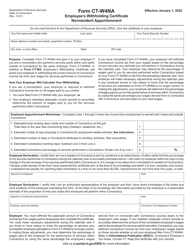

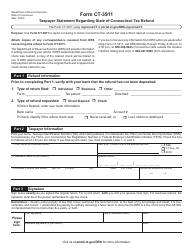

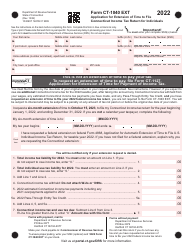

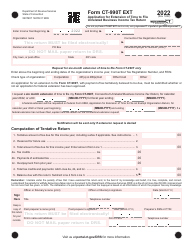

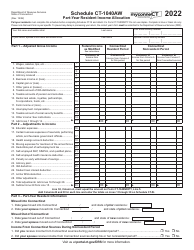

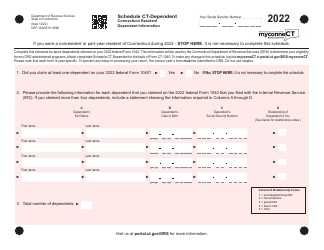

Form CT-1040 Connecticut Resident Income Tax Return - Connecticut

What Is Form CT-1040?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1040?

A: Form CT-1040 is the Connecticut Resident Income Tax Return.

Q: Who should file Form CT-1040?

A: Connecticut residents who need to report their income and pay state taxes should file Form CT-1040.

Q: What is the purpose of Form CT-1040?

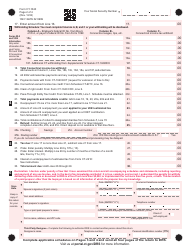

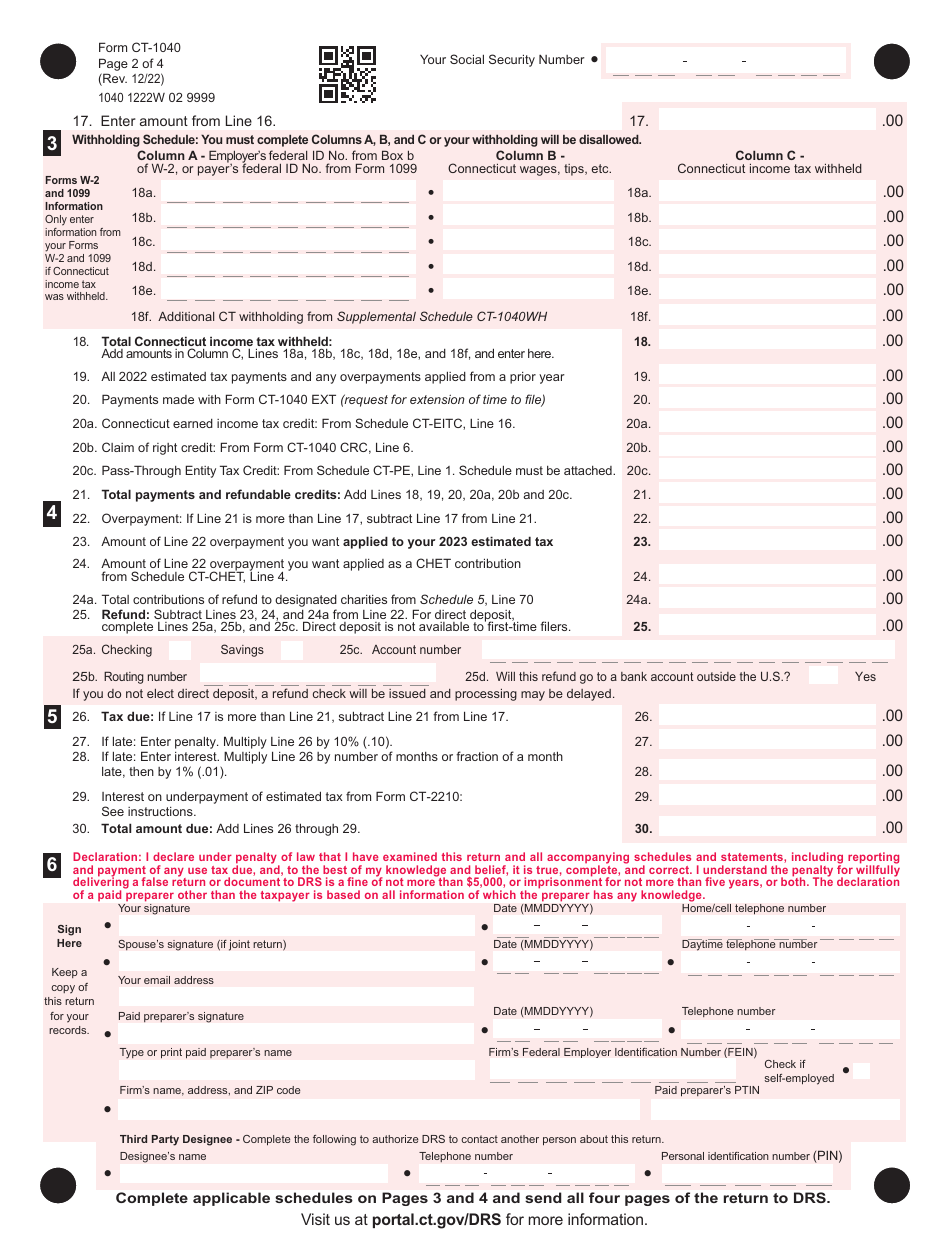

A: The purpose of Form CT-1040 is to report a resident individual's income, deductions, tax credits, and calculate the amount of tax owed or refund.

Q: What income should be reported on Form CT-1040?

A: All income earned by a Connecticut resident, including wages, self-employment income, rental income, and investment income, should be reported on Form CT-1040.

Q: Are there any tax credits or deductions available on Form CT-1040?

A: Yes, Form CT-1040 provides various tax credits and deductions for eligible Connecticut residents, such as the Earned Income Credit and resident credit for taxes paid to other states.

Q: When is the due date for filing Form CT-1040?

A: The due date for filing Form CT-1040 is typically April 15th, the same as the federal income tax return.

Q: What if I cannot file my Form CT-1040 by the due date?

A: If you cannot file your Form CT-1040 by the due date, you may request a six-month extension to file, but you must still pay any taxes owed by the original due date.

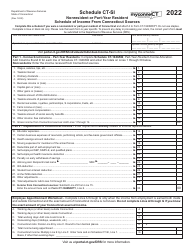

Q: Is there a separate state tax form for nonresidents of Connecticut?

A: Yes, nonresidents of Connecticut should file Form CT-1040NR, the Nonresident/Part-Year Resident Tax Return, to report income earned or received from Connecticut sources.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1040 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.