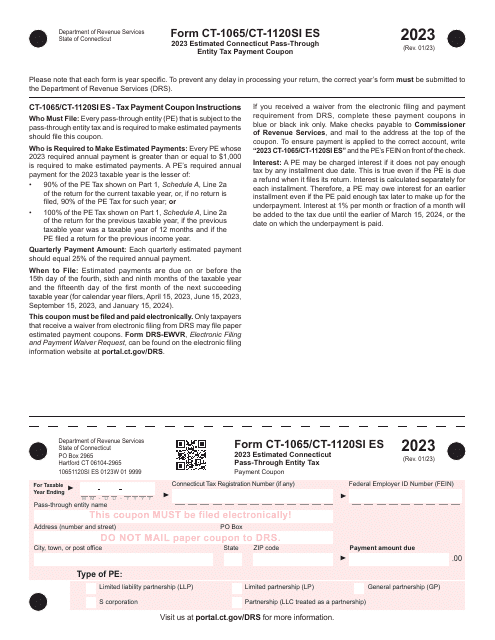

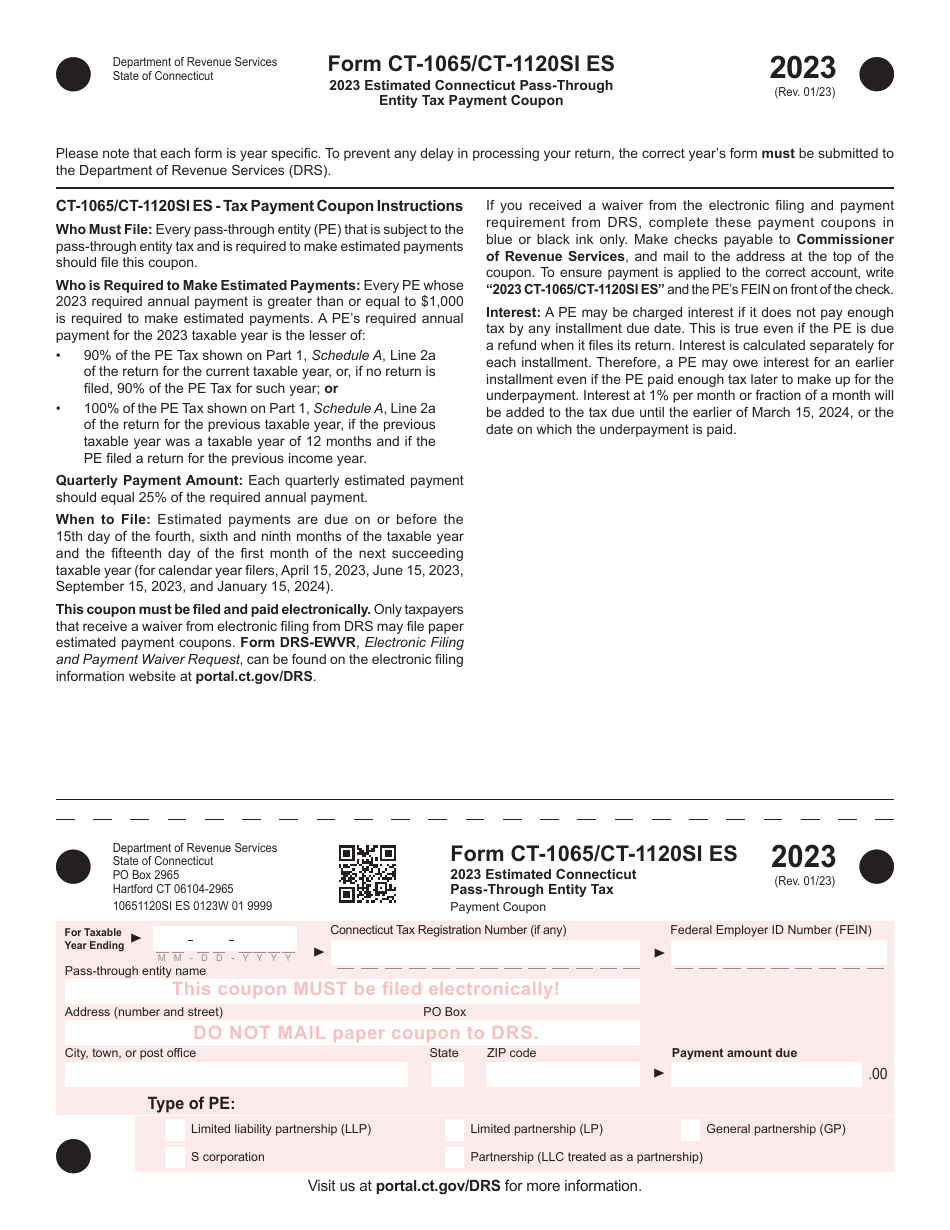

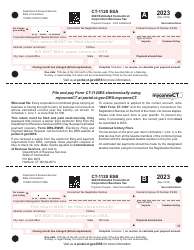

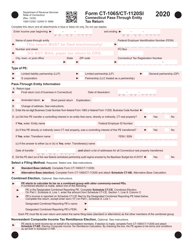

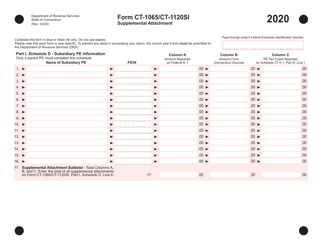

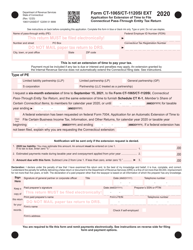

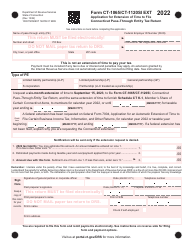

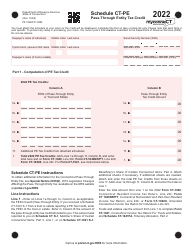

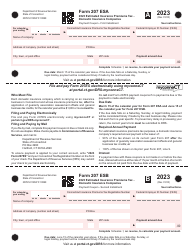

Form CT-1065 (CT-1120SI ES) Estimated Connecticut Pass-Through Entity Tax Payment Coupon - Connecticut

What Is Form CT-1065 (CT-1120SI ES)?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1065 (CT-1120SI ES)?

A: Form CT-1065 (CT-1120SI ES) is an estimated Connecticut pass-through entity tax payment coupon.

Q: What is the purpose of Form CT-1065 (CT-1120SI ES)?

A: The purpose of Form CT-1065 (CT-1120SI ES) is to make estimated tax payments for a Connecticut pass-through entity.

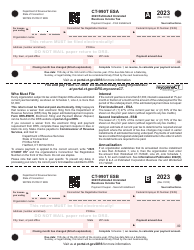

Q: Who needs to file Form CT-1065 (CT-1120SI ES)?

A: Connecticut pass-through entities that are required to make estimated tax payments need to file Form CT-1065 (CT-1120SI ES).

Q: How often do I need to file Form CT-1065 (CT-1120SI ES)?

A: Form CT-1065 (CT-1120SI ES) needs to be filed on a quarterly basis.

Q: Is there a deadline for filing Form CT-1065 (CT-1120SI ES)?

A: Yes, there are specific deadlines for each quarterly filing. Refer to the instructions provided with the form for exact deadlines.

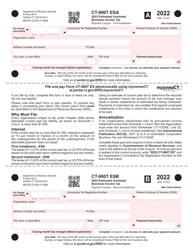

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1065 (CT-1120SI ES) by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.