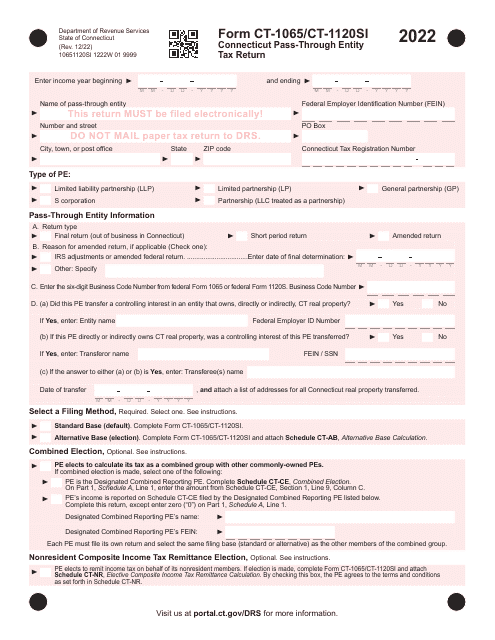

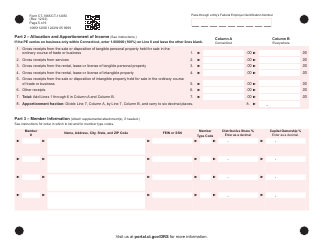

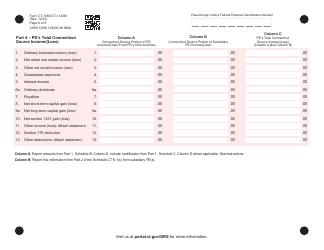

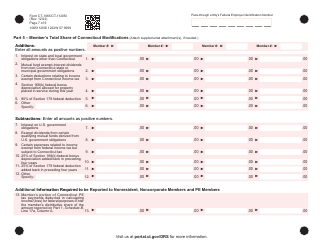

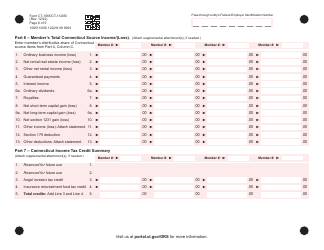

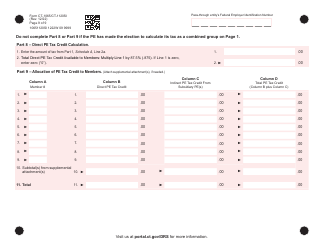

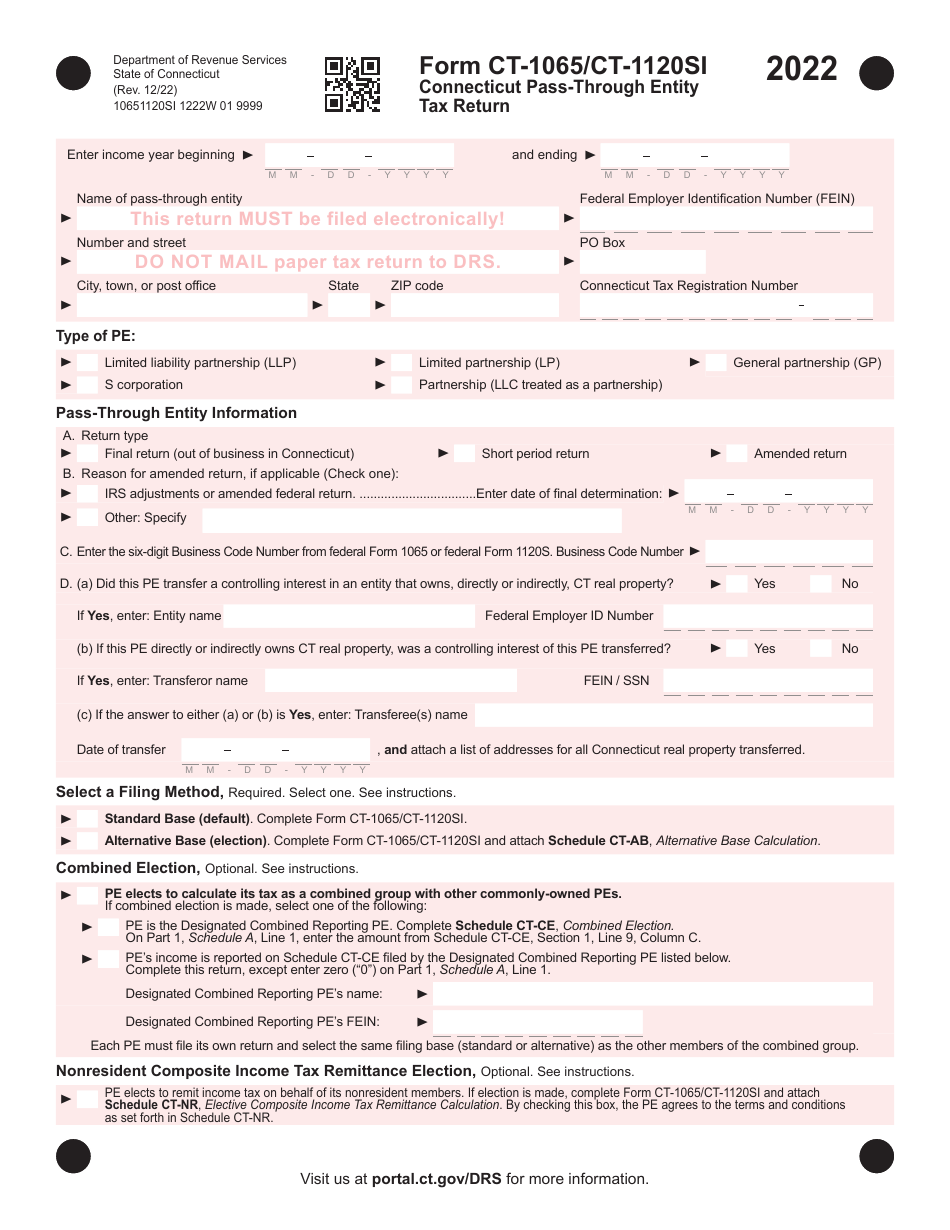

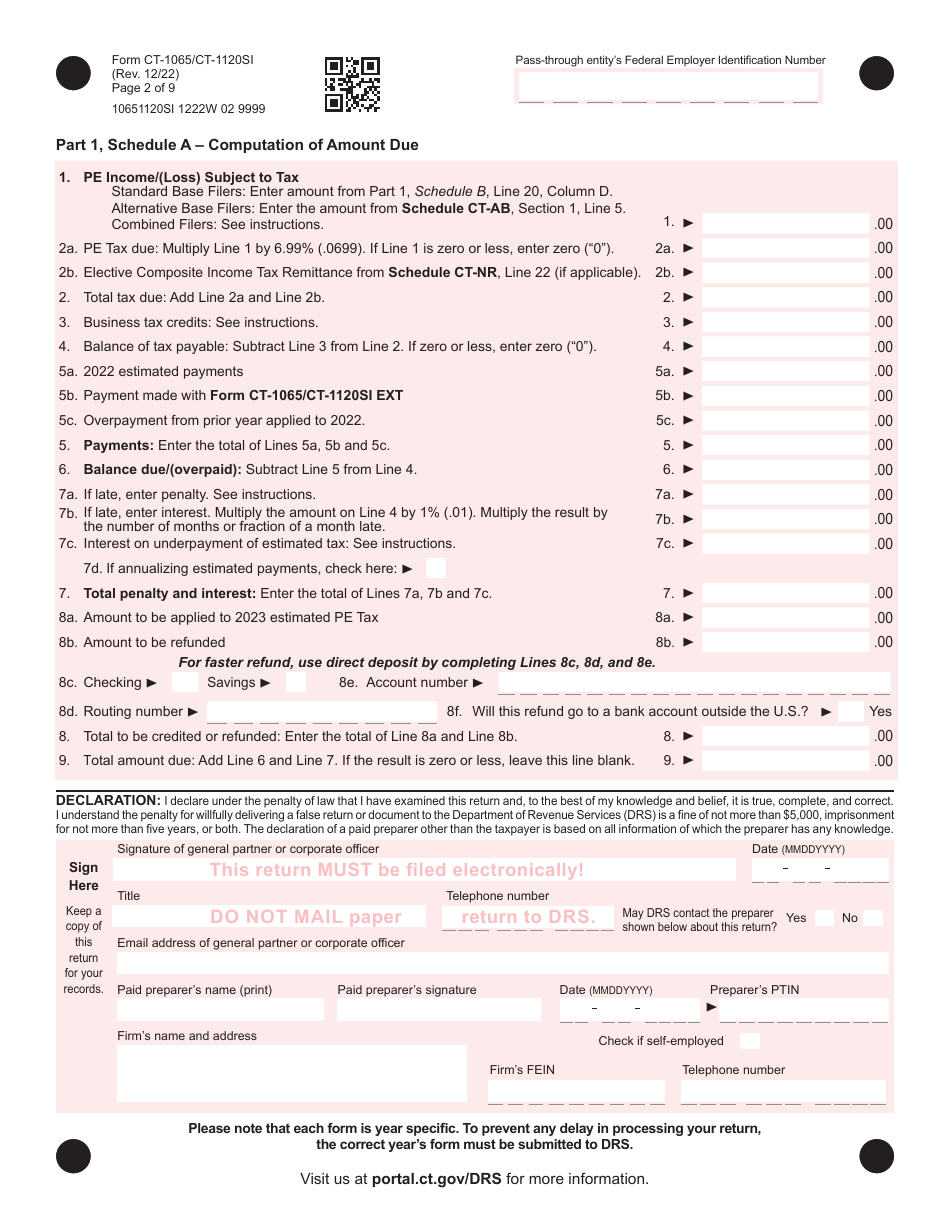

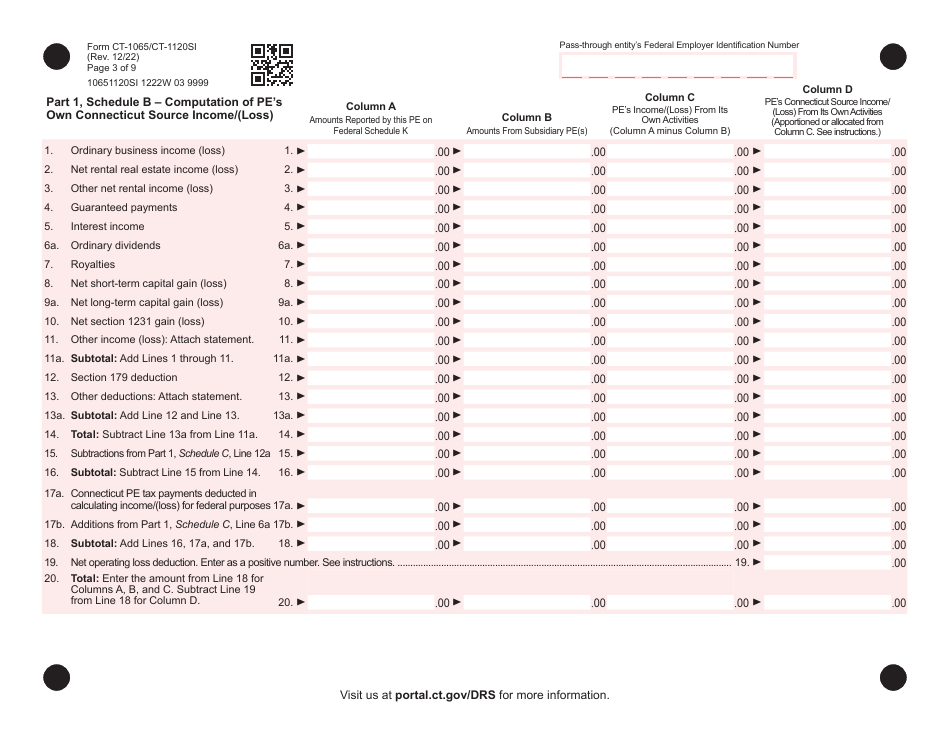

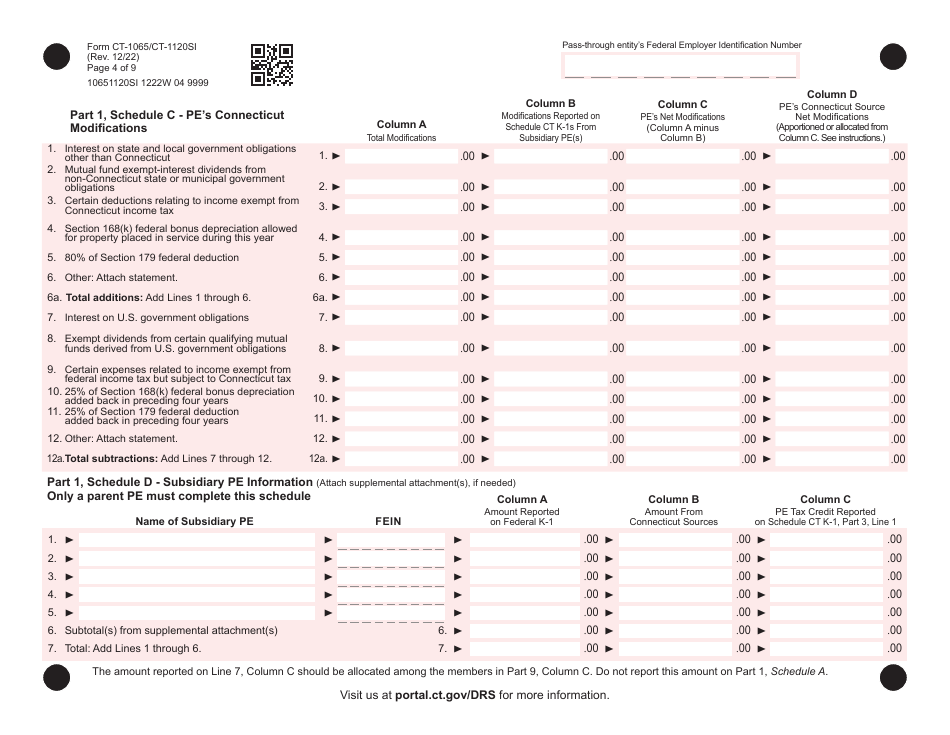

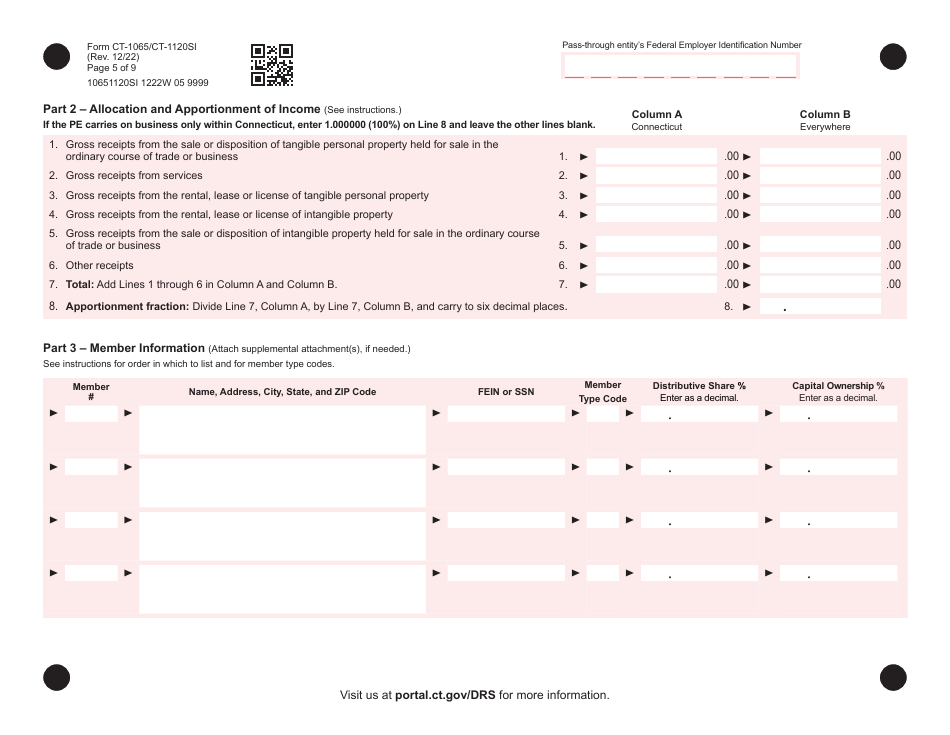

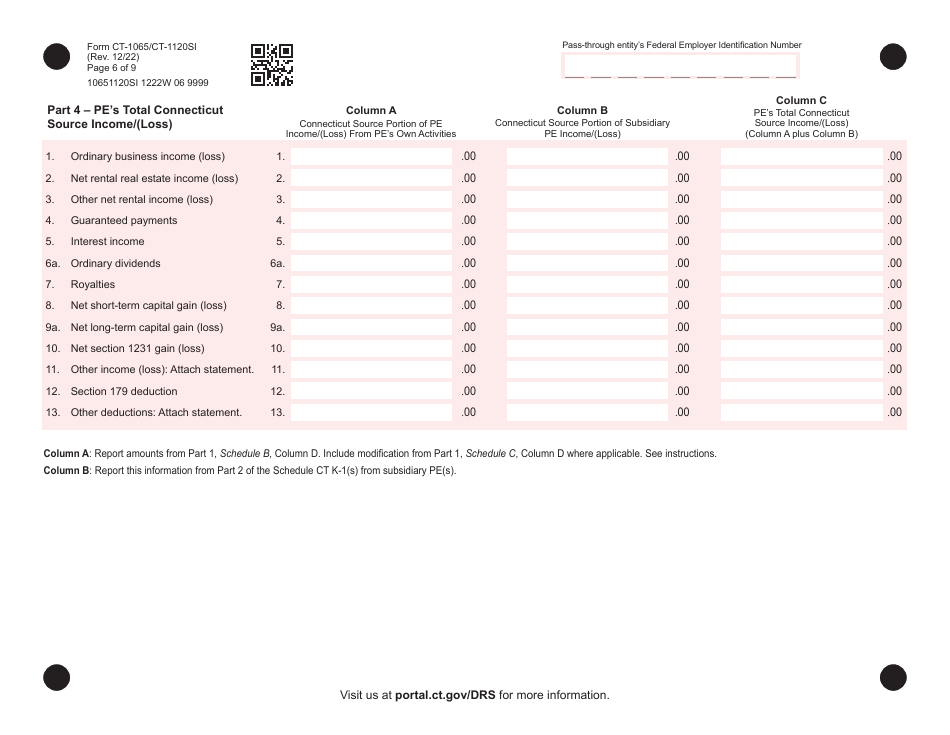

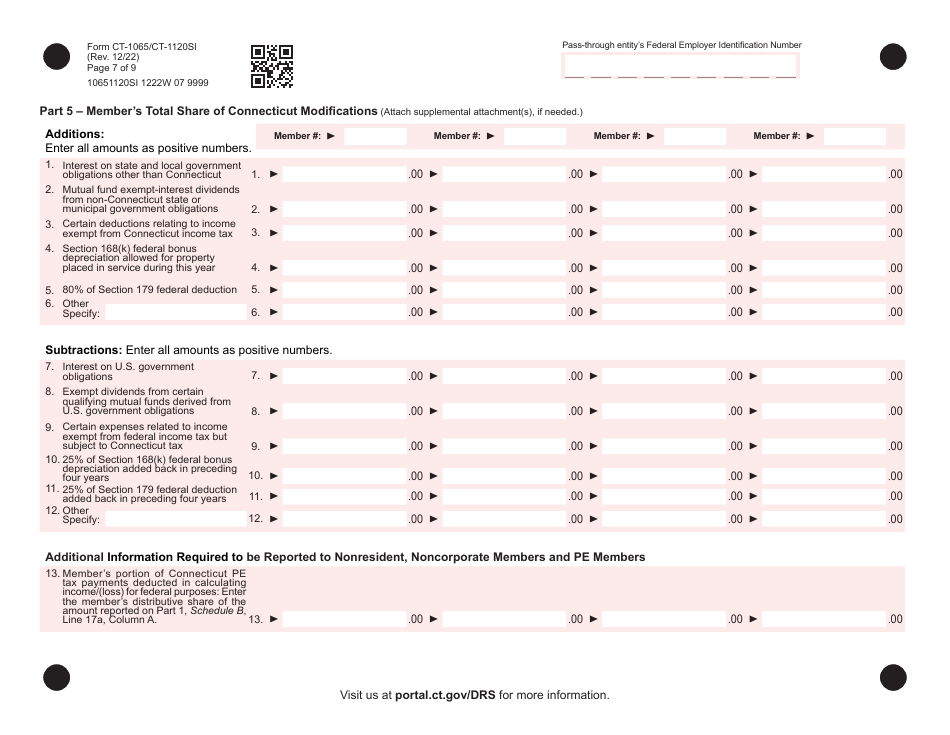

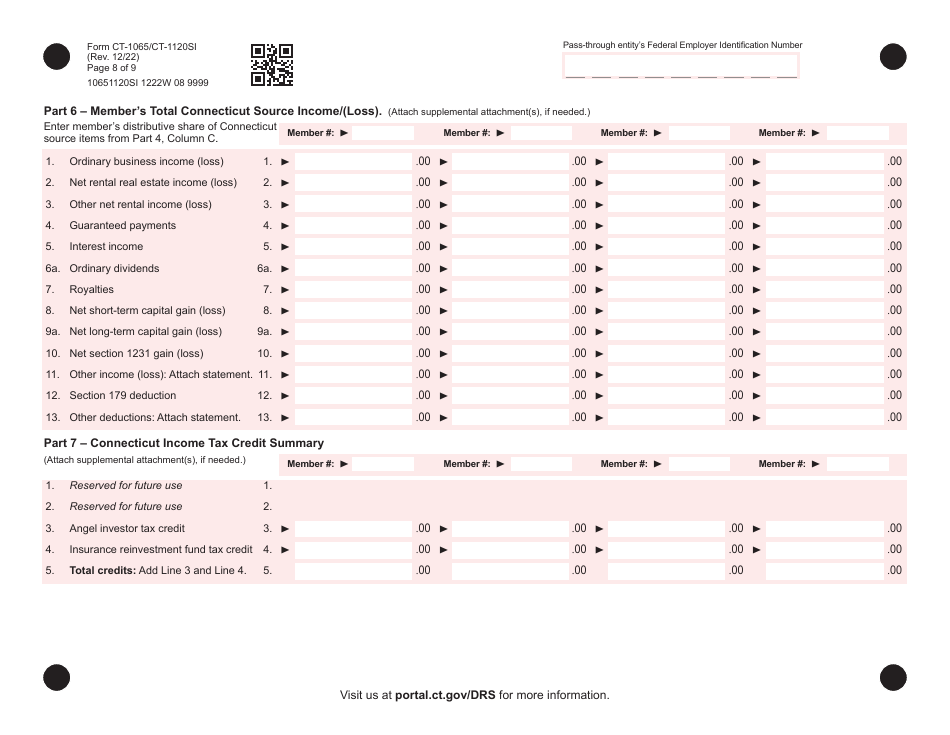

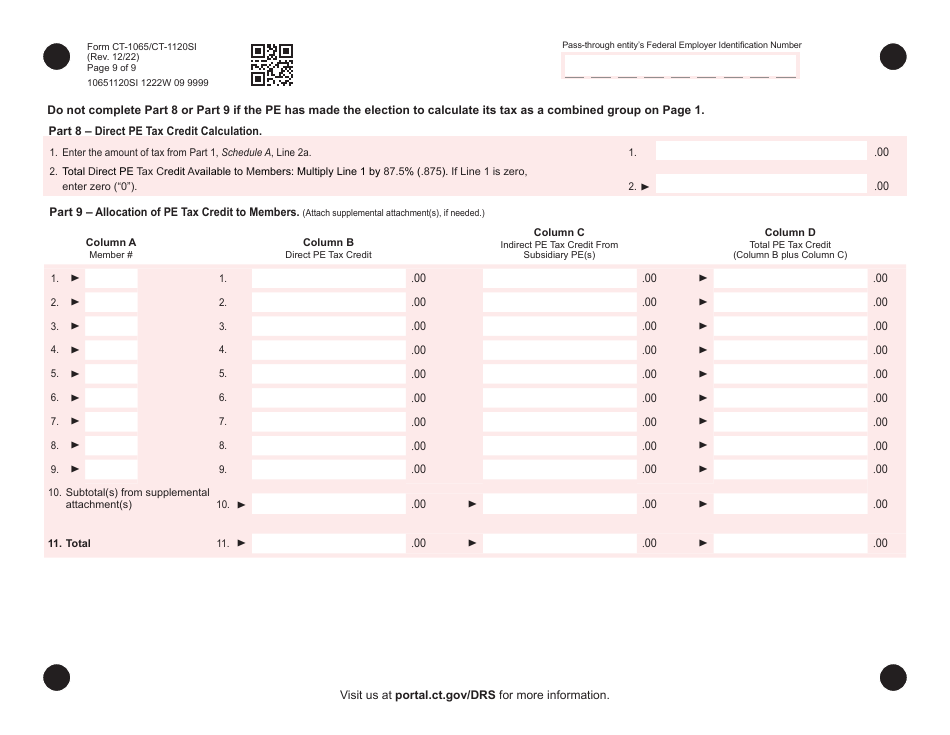

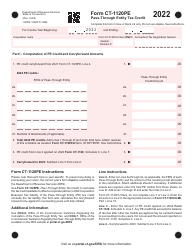

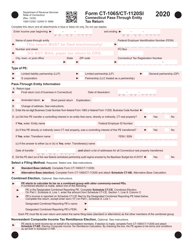

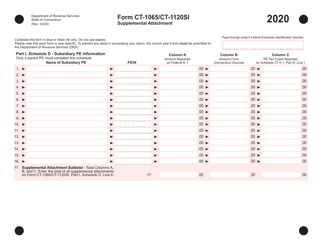

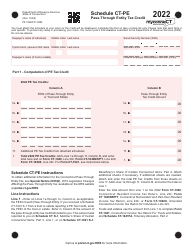

Form CT-1065 (CT-1120SI) Connecticut Pass-Through Entity Tax Return - Connecticut

What Is Form CT-1065 (CT-1120SI)?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1065 (CT-1120SI)?

A: Form CT-1065 (CT-1120SI) is the Connecticut Pass-Through Entity Tax Return.

Q: Who needs to file Form CT-1065 (CT-1120SI)?

A: Connecticut pass-through entities, such as partnerships and S corporations, need to file Form CT-1065 (CT-1120SI).

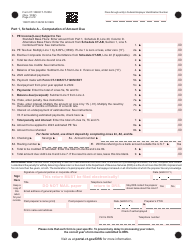

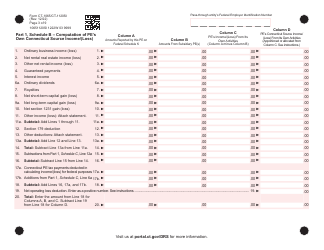

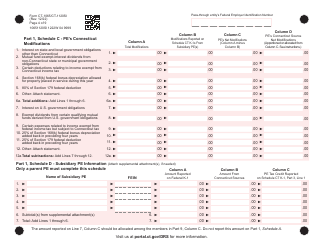

Q: What is the purpose of Form CT-1065 (CT-1120SI)?

A: The purpose of Form CT-1065 (CT-1120SI) is to report the income, deductions, and credits of a Connecticut pass-through entity.

Q: When is Form CT-1065 (CT-1120SI) due?

A: Form CT-1065 (CT-1120SI) is due on the 15th day of the 4th month following the close of the tax year.

Q: Are there any filing fees for Form CT-1065 (CT-1120SI)?

A: No, there are no filing fees for Form CT-1065 (CT-1120SI).

Q: Can Form CT-1065 (CT-1120SI) be e-filed?

A: Yes, Form CT-1065 (CT-1120SI) can be e-filed using approved software or through a tax professional.

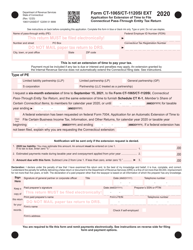

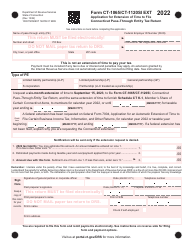

Q: What should I do if I need an extension to file Form CT-1065 (CT-1120SI)?

A: You can request an extension by filing Form CT-1120EXT, Application for Extension of Time to File Connecticut Corporation Tax Return.

Q: Do I need to include any supporting documents with Form CT-1065 (CT-1120SI)?

A: No, you do not need to attach any supporting documents with Form CT-1065 (CT-1120SI), but you should keep them for your records.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1065 (CT-1120SI) by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.