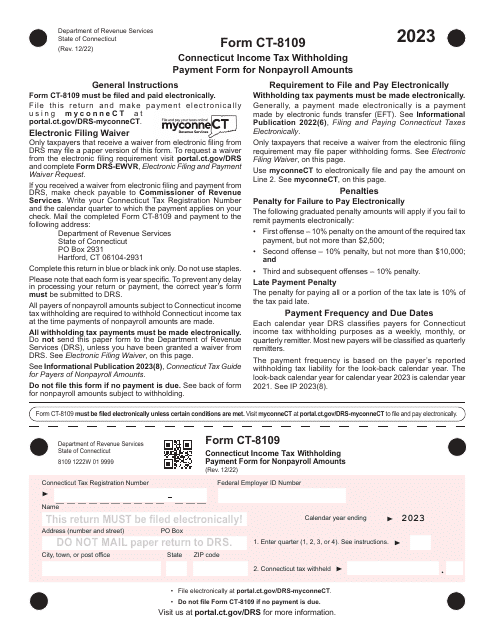

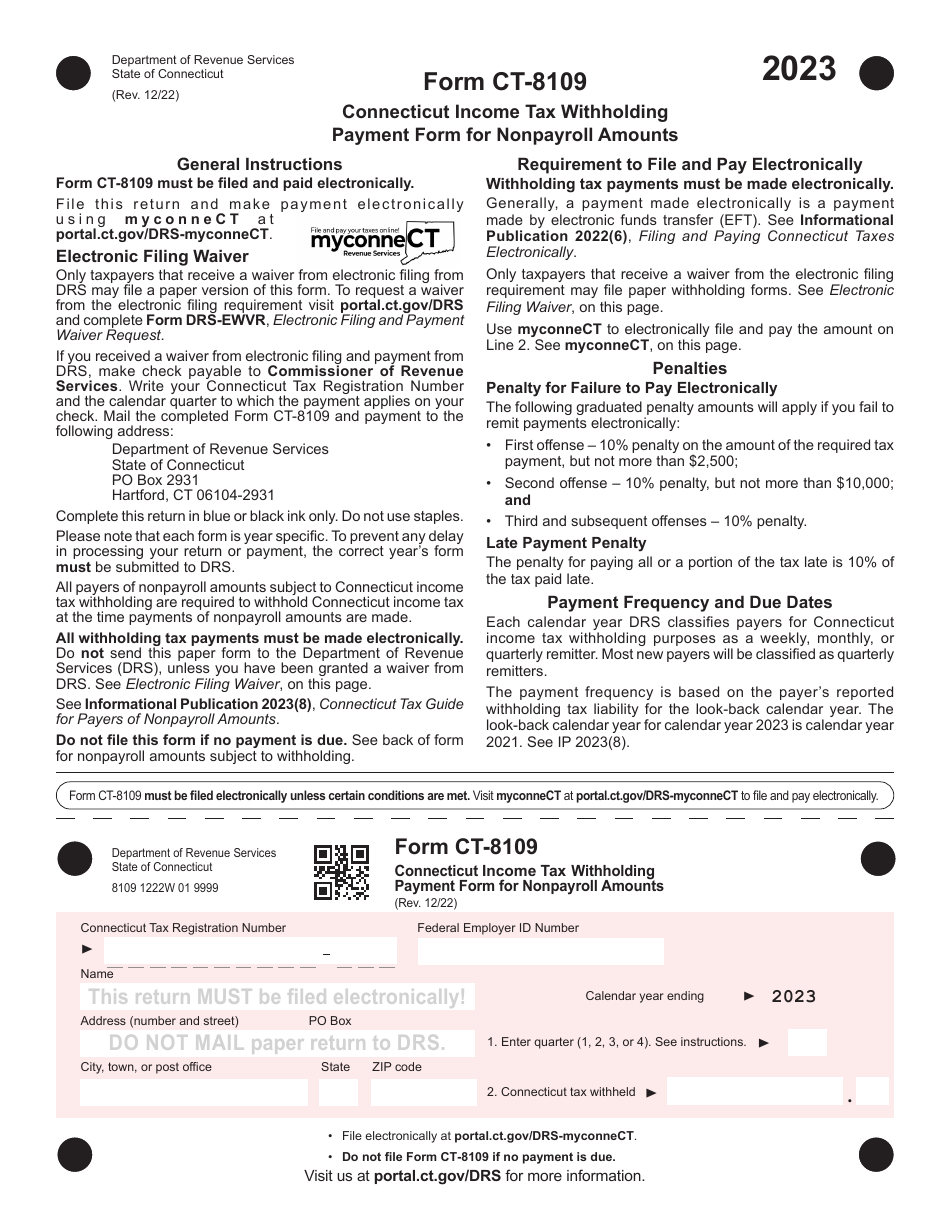

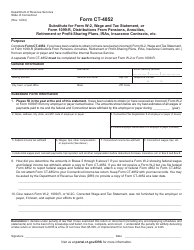

Form CT-8109 Connecticut Income Tax Withholding Payment Form for Nonpayroll Amounts - Connecticut

What Is Form CT-8109?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-8109?

A: Form CT-8109 is the Connecticut Income Tax Withholding Payment Form for Nonpayroll Amounts.

Q: Who should use Form CT-8109?

A: Form CT-8109 should be used by individuals or entities making Connecticut income tax withholding payments for nonpayroll amounts.

Q: What are nonpayroll amounts?

A: Nonpayroll amounts refer to income subject to Connecticut income tax withholding that is not part of a regular payroll, such as distributions from pensions, annuities, or gambling winnings.

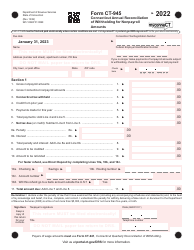

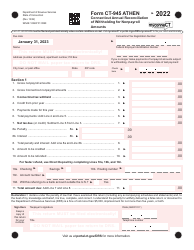

Q: How do I fill out Form CT-8109?

A: You will need to provide your name, address, Connecticut Tax Registration Number, and the payment details, including the amount of tax withheld and the payee information.

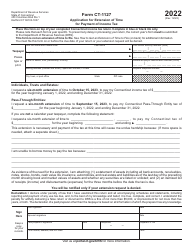

Q: When is the deadline to file Form CT-8109?

A: Form CT-8109 must be filed and the payment must be submitted within the same time period as the related nonpayroll amount payment or distribution, or with the annual reconciliation return.

Q: Are there any penalties for not filing Form CT-8109?

A: Yes, failure to file Form CT-8109 or to pay the withheld taxes in a timely manner may result in penalties and interest charges.

Q: Can I make the withholding payment electronically?

A: Yes, the Connecticut Department of Revenue Services encourages taxpayers to make withholding payments electronically through the Taxpayer Service Center (TSC) or the Electronic Funds Transfer (EFT) system.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-8109 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.