This version of the form is not currently in use and is provided for reference only. Download this version of

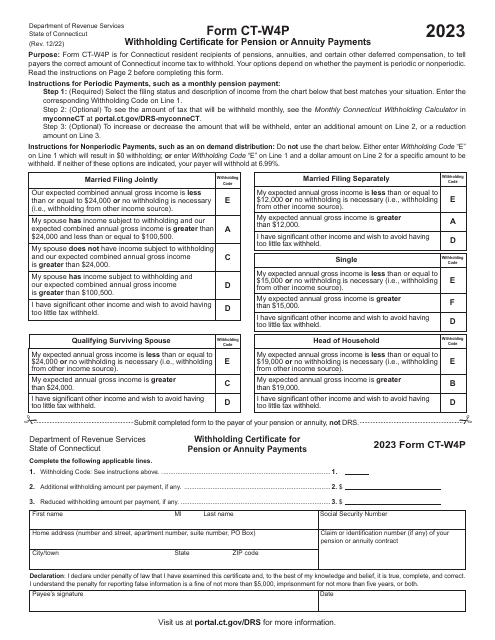

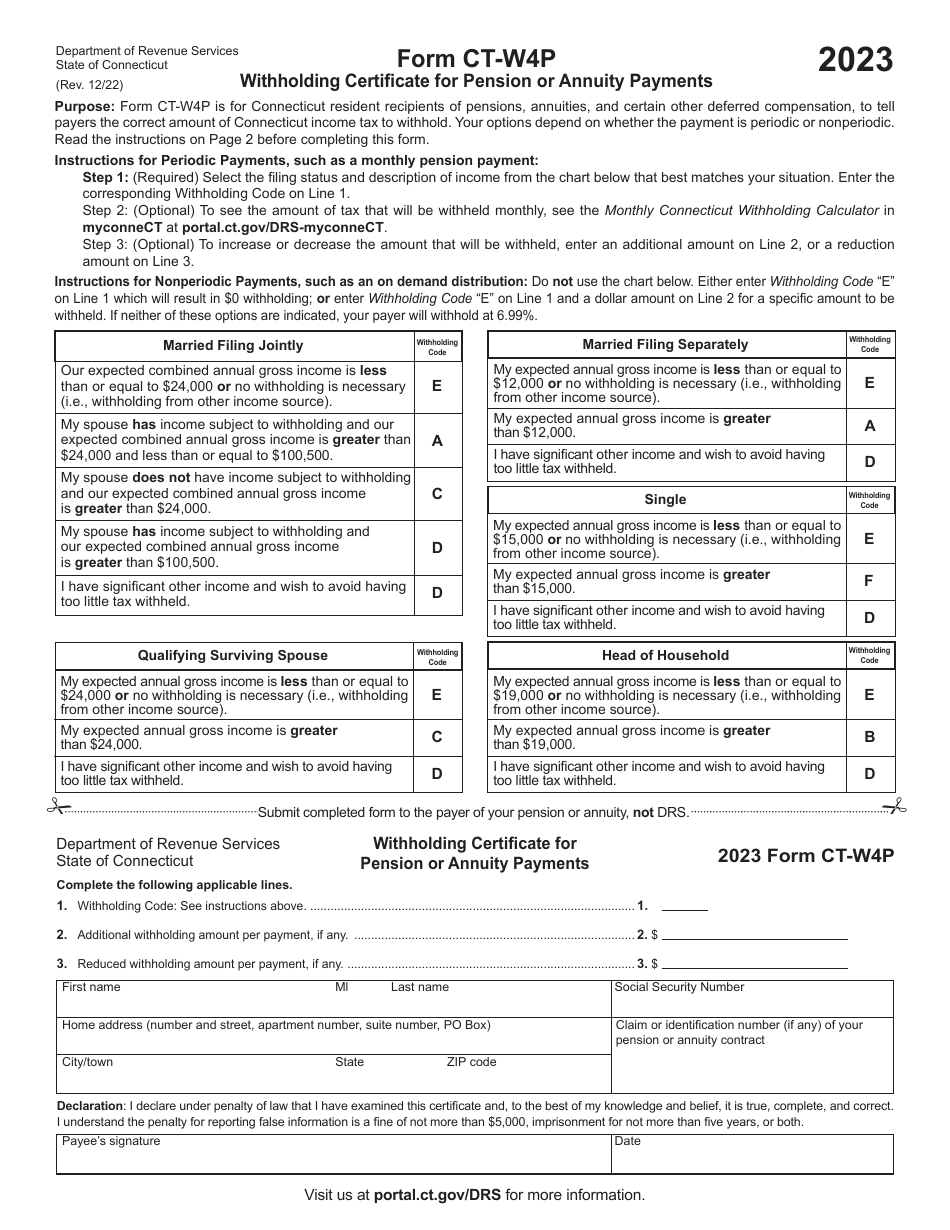

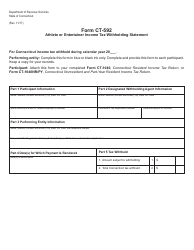

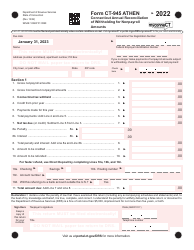

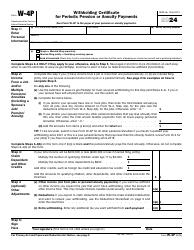

Form CT-W4P

for the current year.

Form CT-W4P Withholding Certificate for Pension or Annuity Payments - Connecticut

What Is Form CT-W4P?

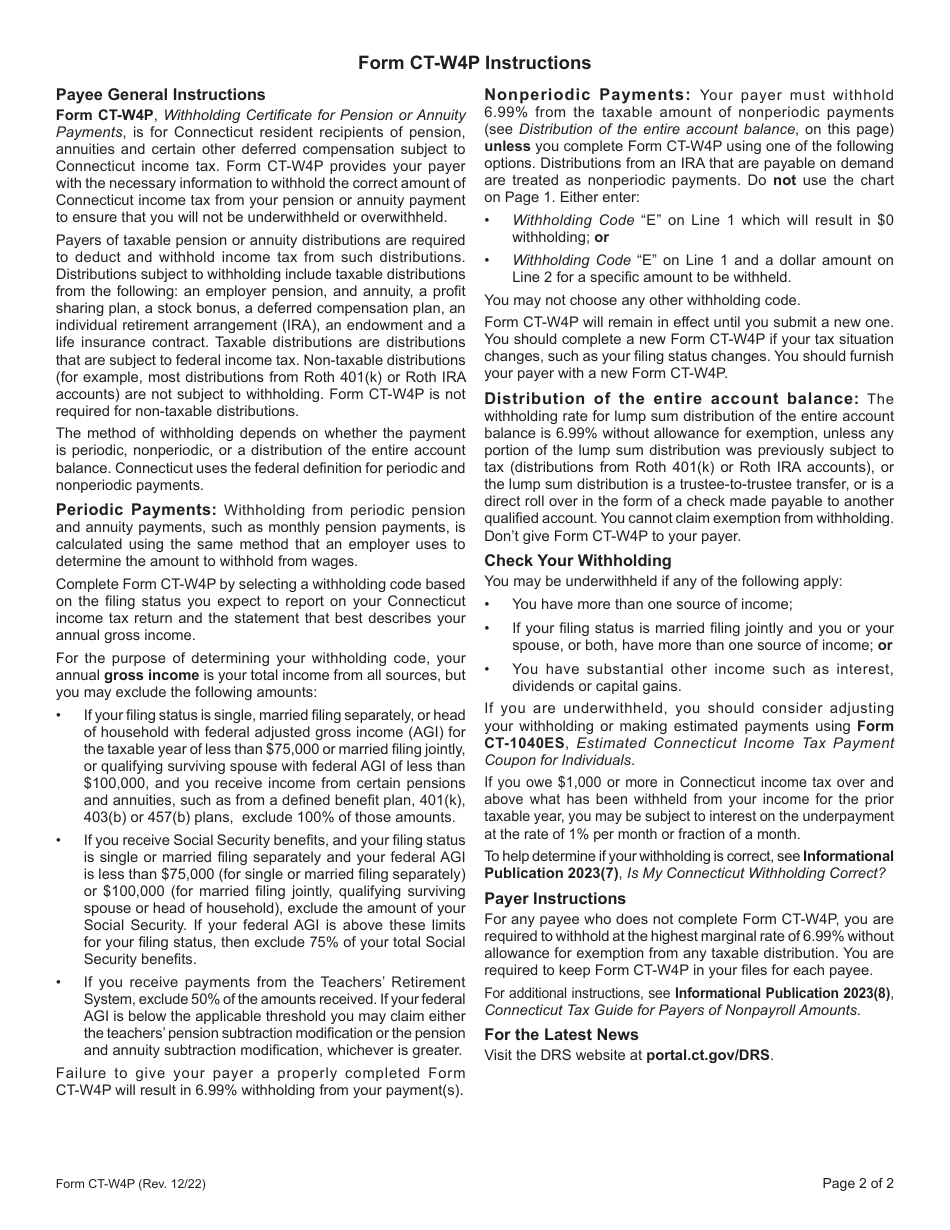

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who needs to file Form CT-W4P?

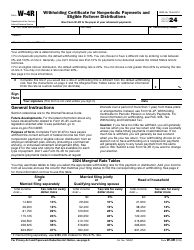

A: Individuals receiving pension or annuity payments in Connecticut.

Q: What is Form CT-W4P used for?

A: To determine the amount of Connecticut income tax to withhold from pension or annuity payments.

Q: Do I need to file Form CT-W4P every year?

A: No, you only need to file it when you have changes to your withholding preferences or if requested by the payer.

Q: Can I claim exemption from withholding on Form CT-W4P?

A: Yes, you can claim exemption if you meet certain criteria and the payer agrees to the exemption.

Q: Are pension or annuity payments taxable in Connecticut?

A: Yes, pension and annuity payments are generally subject to Connecticut income tax.

Q: What is the due date for filing Form CT-W4P?

A: The form should be given to the payer within 10 days of the payment.

Q: Can I change my withholding preferences later?

A: Yes, you can submit a new Form CT-W4P to the payer at any time to make changes to your withholding preferences.

Q: What if I need assistance with completing Form CT-W4P?

A: You can contact the Connecticut Department of Revenue Services or consult a tax professional for assistance.

Q: Do I need to include a copy of Form CT-W4P with my tax return?

A: No, you do not need to include a copy of Form CT-W4P with your tax return. Keep it for your records.

Form Details:

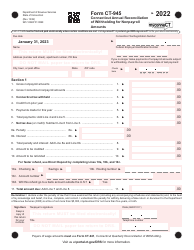

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-W4P by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.