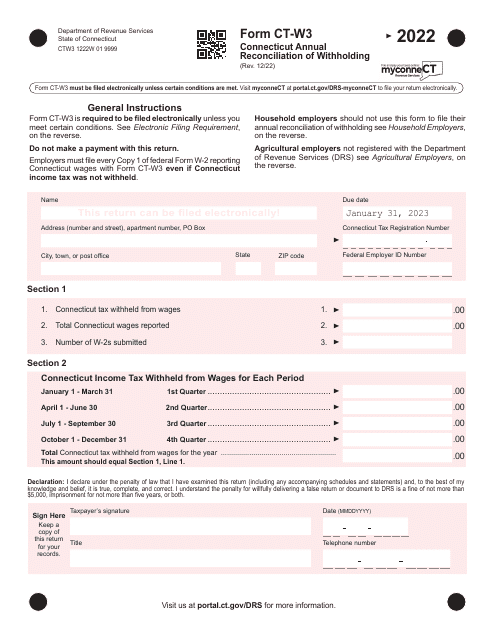

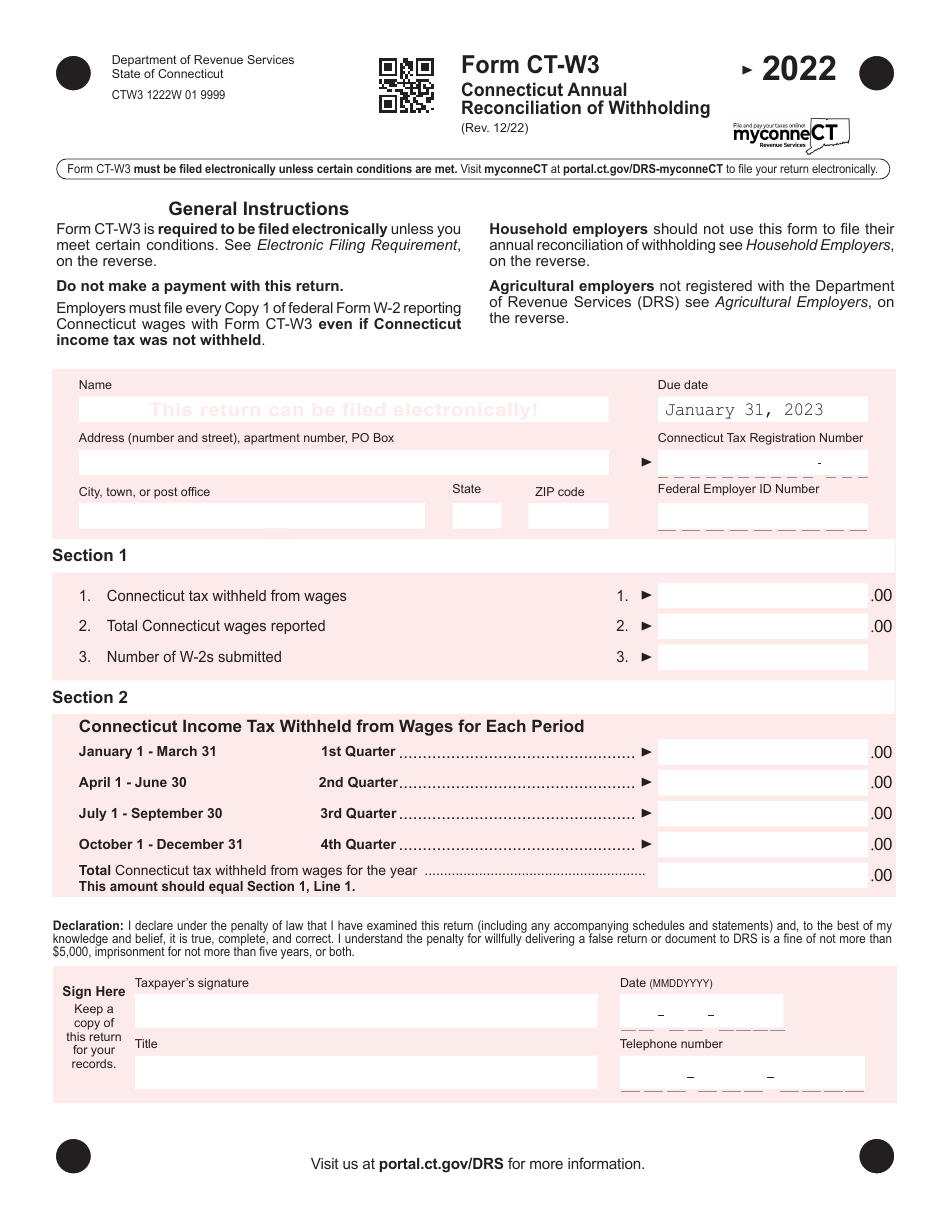

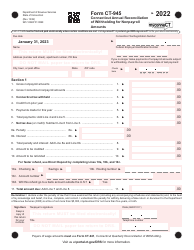

Form CT-W3 Connecticut Annual Reconciliation of Withholding - Connecticut

What Is Form CT-W3?

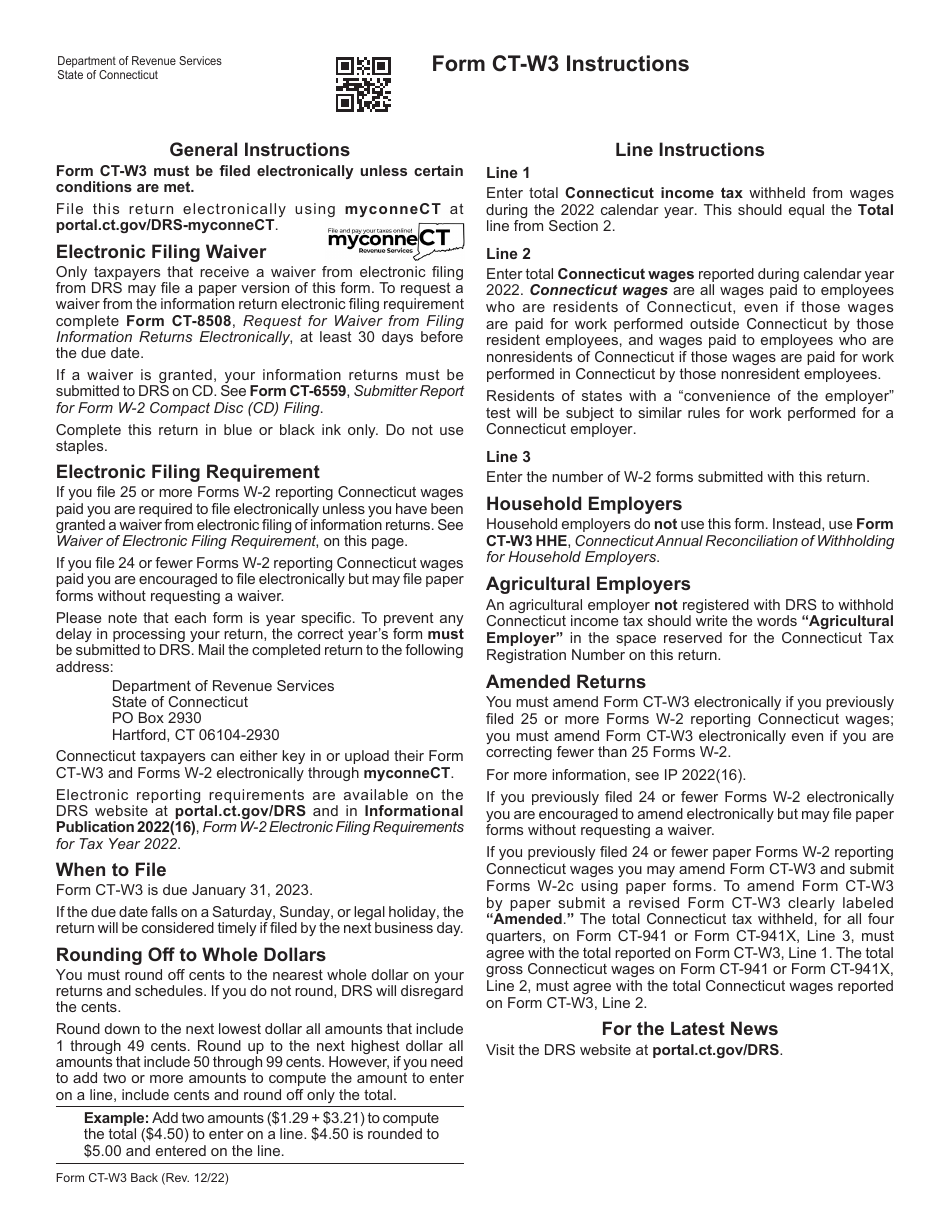

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-W3?

A: Form CT-W3 is the Connecticut Annual Reconciliation of Withholding.

Q: What is the purpose of Form CT-W3?

A: The purpose of Form CT-W3 is to reconcile the withholding taxes that have been withheld from employees' wages throughout the year.

Q: Who needs to file Form CT-W3?

A: Employers in Connecticut who have withheld income tax from their employees' wages need to file Form CT-W3.

Q: When is Form CT-W3 due?

A: Form CT-W3 is due on January 31st of the following year.

Q: What information do I need to complete Form CT-W3?

A: You will need to gather information about the withholding taxes you have withheld from employees' wages, including their names, social security numbers, and the amount of taxes withheld.

Q: Is there a penalty for filing Form CT-W3 late?

A: Yes, there may be penalties for filing Form CT-W3 late. It is important to file the form by the due date to avoid any penalties.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-W3 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.