This version of the form is not currently in use and is provided for reference only. Download this version of

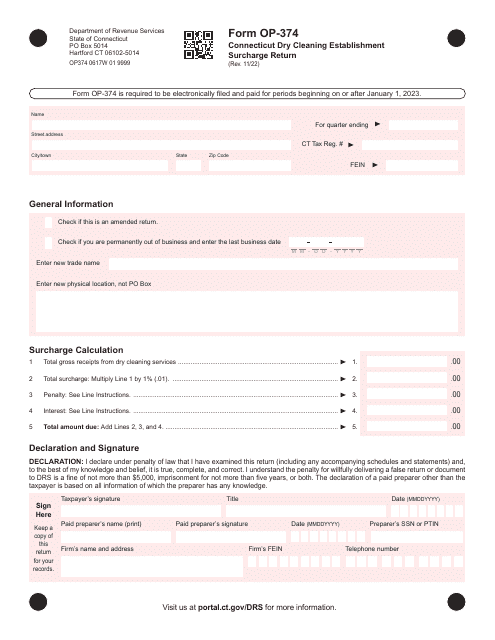

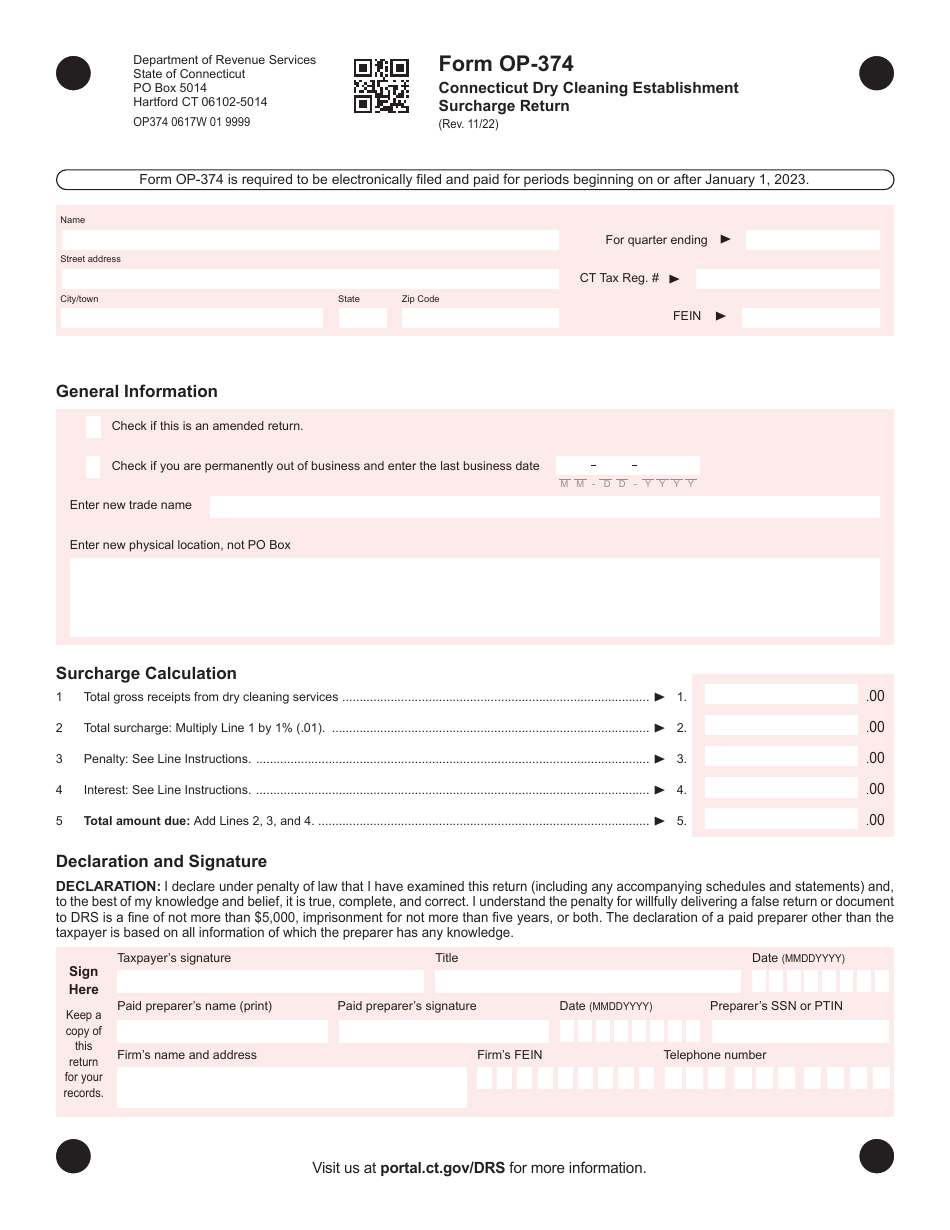

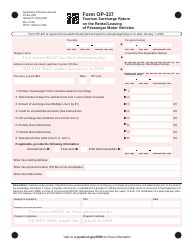

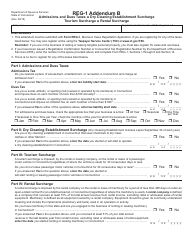

Form OP-374

for the current year.

Form OP-374 Dry Cleaning Establishment Surcharge Return - Connecticut

What Is Form OP-374?

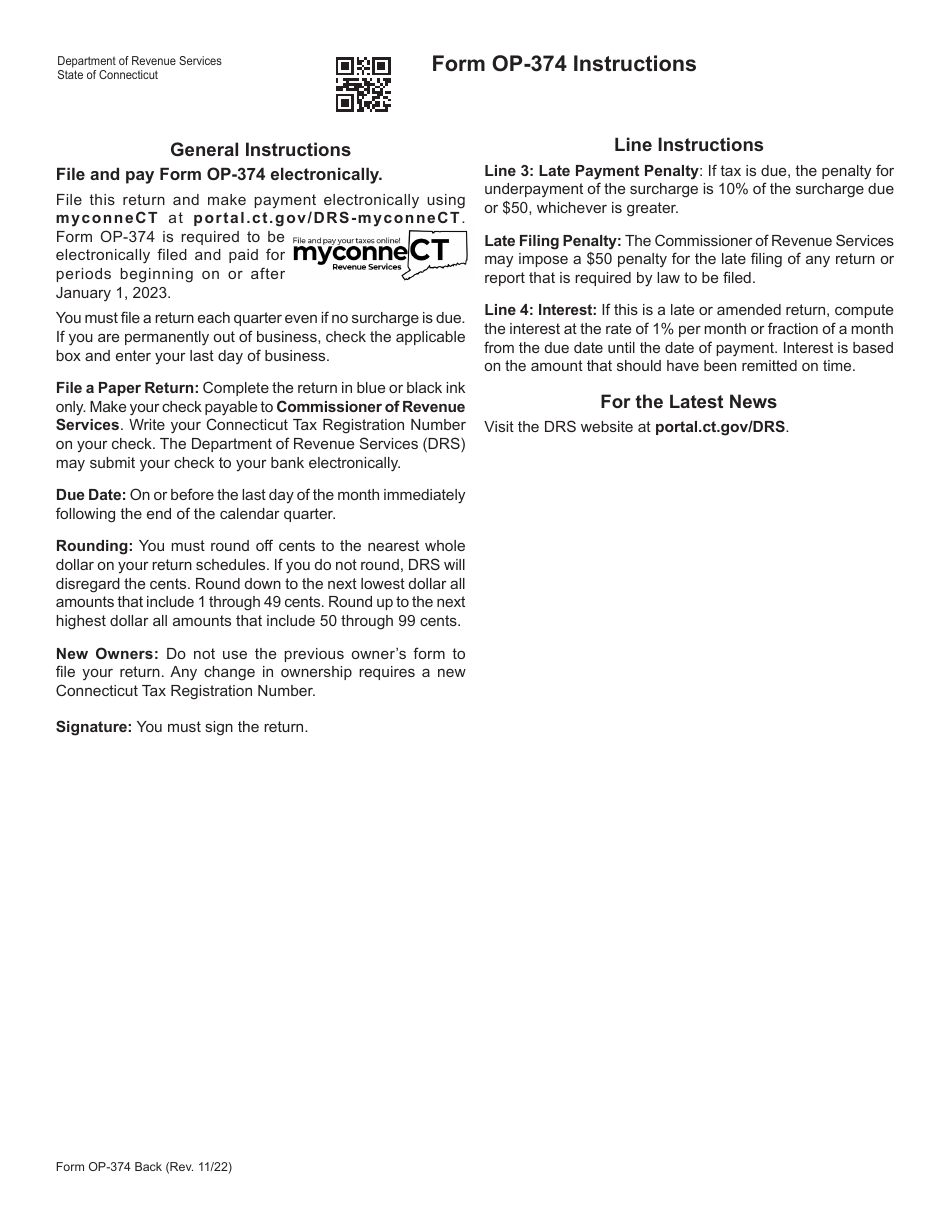

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OP-374?

A: Form OP-374 is the Dry Cleaning Establishment Surcharge Return used in Connecticut.

Q: Who needs to file Form OP-374?

A: Dry cleaning establishments in Connecticut need to file Form OP-374.

Q: What is the purpose of Form OP-374?

A: The purpose of Form OP-374 is to report and remit the dry cleaning establishment surcharge.

Q: How often should Form OP-374 be filed?

A: Form OP-374 should be filed monthly.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OP-374 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.