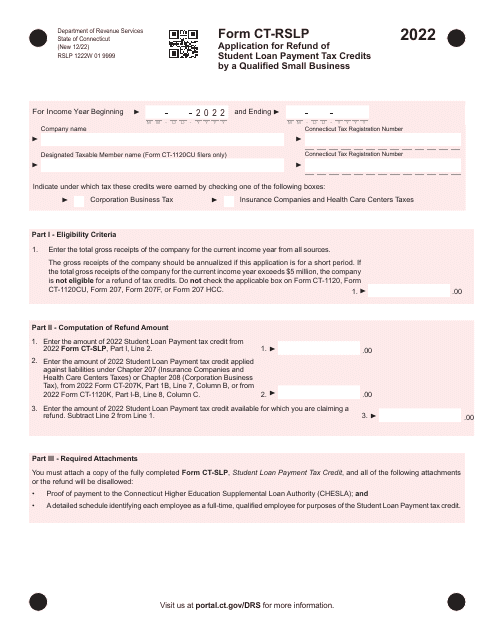

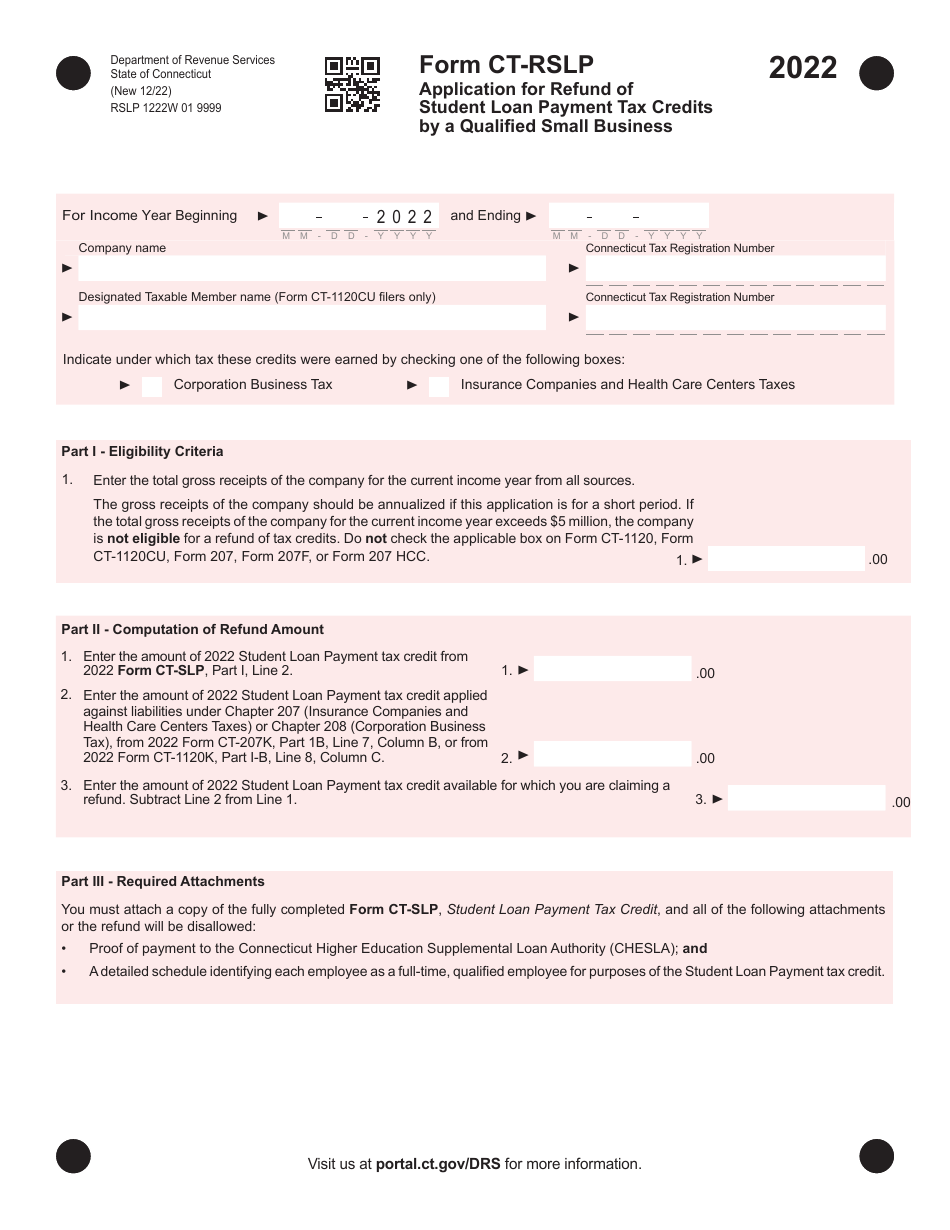

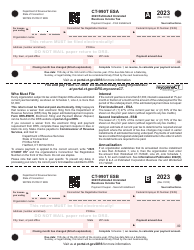

Form CT-RSLP Application for Refund of Student Loan Payment Tax Credits by a Qualified Small Business - Connecticut

What Is Form CT-RSLP?

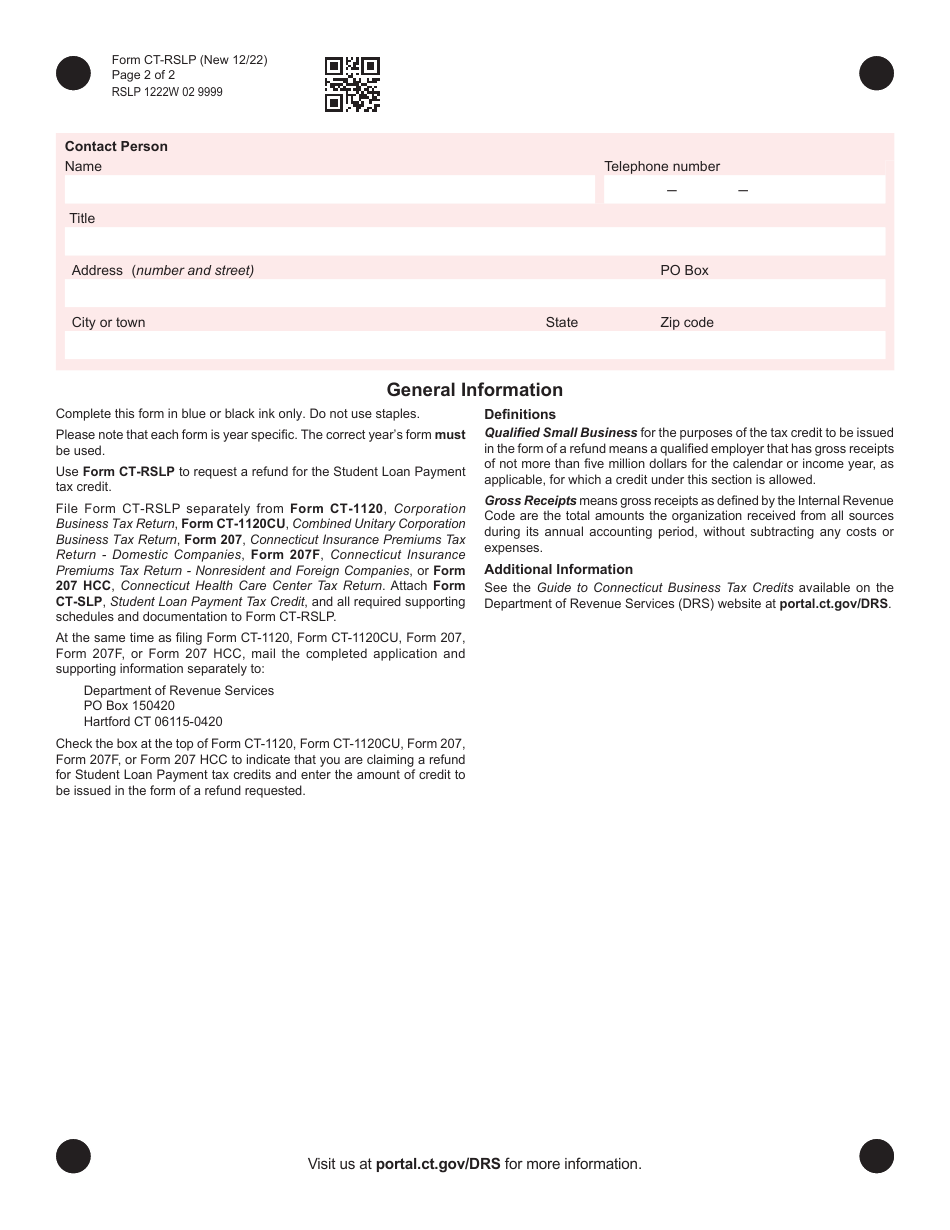

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

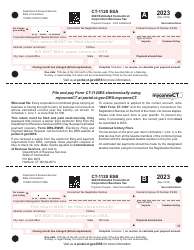

Q: What is the CT-RSLP Application?

A: The CT-RSLP Application is a form used to apply for a refund of student loan payment tax credits by a qualified small business in Connecticut.

Q: What is the purpose of the CT-RSLP Application?

A: The purpose of the CT-RSLP Application is to allow qualified small businesses in Connecticut to claim a refund for eligible student loan payment tax credits.

Q: Who is eligible to use the CT-RSLP Application?

A: Qualified small businesses in Connecticut are eligible to use the CT-RSLP Application to claim a refund of student loan payment tax credits.

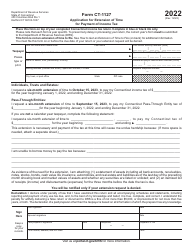

Q: What types of student loan payment tax credits can be claimed through the CT-RSLP Application?

A: The CT-RSLP Application can be used to claim tax credits for eligible student loan payments made by a qualified small business in Connecticut.

Q: Are there any deadlines for submitting the CT-RSLP Application?

A: Yes, the CT-RSLP Application must be filed by the due date of the corresponding tax return or within three years of the date the tax was paid, whichever is later.

Q: Is there any documentation that needs to be included with the CT-RSLP Application?

A: Yes, supporting documentation such as proof of payment for eligible student loan payments should be included with the CT-RSLP Application.

Q: How long does it take to process the CT-RSLP Application?

A: The processing time for the CT-RSLP Application may vary, but the Connecticut Department of Revenue Services aims to process applications within a reasonable timeframe.

Q: Can I check the status of my CT-RSLP Application?

A: Yes, you can check the status of your CT-RSLP Application by contacting the Connecticut Department of Revenue Services directly.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-RSLP by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.