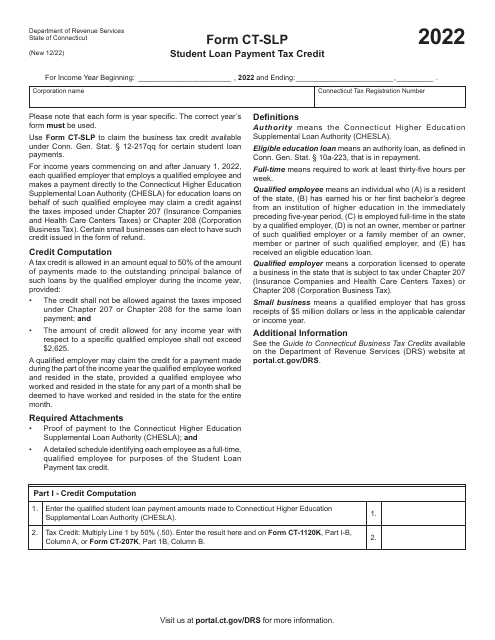

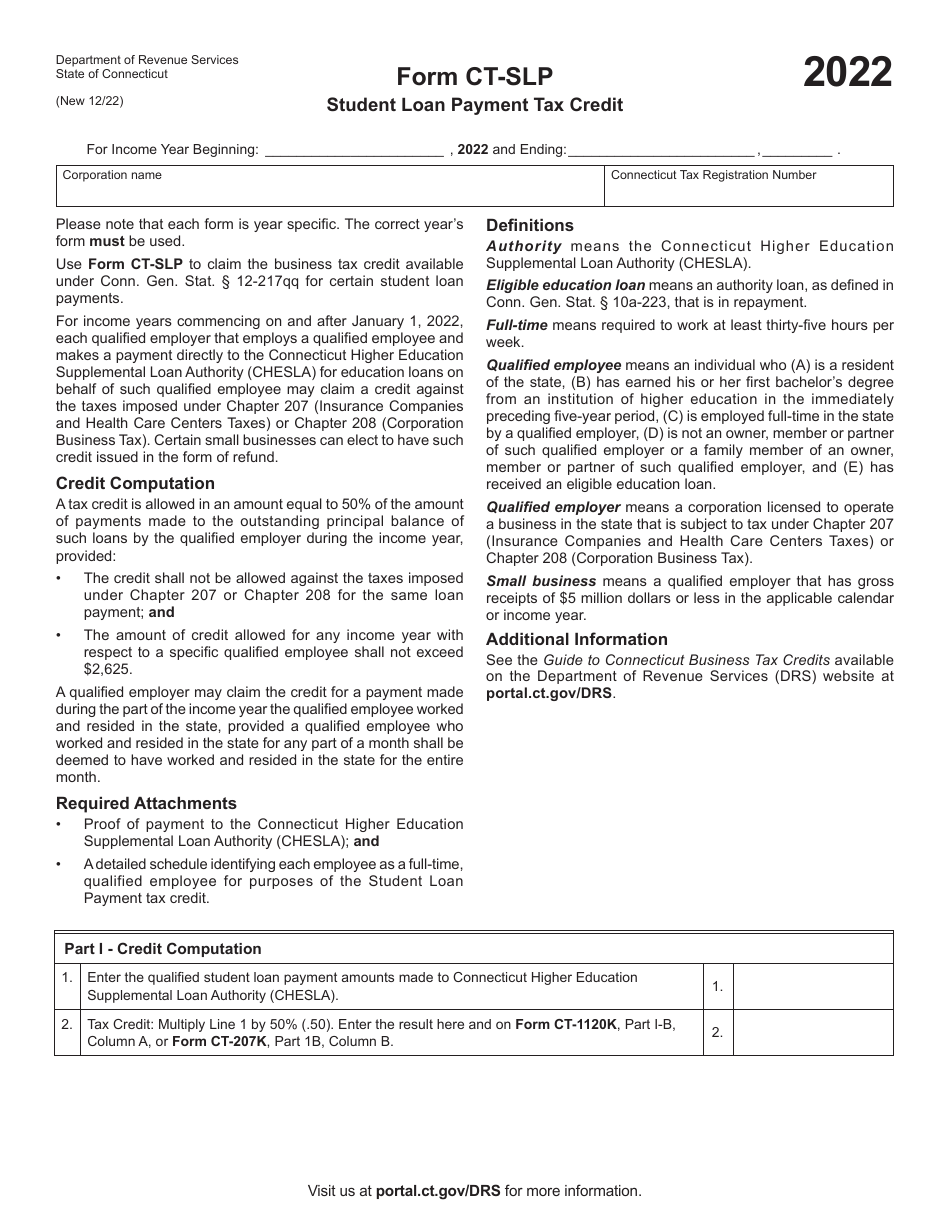

Form CT-SLP Student Loan Payment Tax Credit - Connecticut

What Is Form CT-SLP?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CT-SLP Student Loan Payment Tax Credit?

A: The CT-SLP Student Loan Payment Tax Credit is a tax credit offered by the state of Connecticut for individuals who make qualifying student loan payments.

Q: Who is eligible for the CT-SLP Student Loan Payment Tax Credit?

A: Connecticut residents who have made qualifying student loan payments and meet certain income and loan criteria are eligible for the tax credit.

Q: How much is the CT-SLP Student Loan Payment Tax Credit?

A: The tax credit is equal to 10% of the eligible student loan payments made during the tax year, up to a maximum credit of $2,500.

Q: What are qualifying student loan payments?

A: Qualifying student loan payments include payments made on student loans that were taken out solely to pay for higher education expenses.

Q: What is the income limit for the CT-SLP Student Loan Payment Tax Credit?

A: The income limit for the tax credit varies depending on filing status, ranging from $35,000 to $60,000 for individuals and $70,000 to $120,000 for married couples filing jointly.

Q: How do I apply for the CT-SLP Student Loan Payment Tax Credit?

A: To apply for the tax credit, you must complete and file Form CT-SLP with your Connecticut state income tax return.

Q: Is the CT-SLP Student Loan Payment Tax Credit refundable?

A: No, the tax credit is non-refundable. It can only be used to offset your Connecticut state income tax liability.

Q: Can I claim the CT-SLP Student Loan Payment Tax Credit if I took out student loans for my child's education?

A: No, the tax credit can only be claimed by individuals who took out student loans for their own higher education expenses.

Q: Can I claim the CT-SLP Student Loan Payment Tax Credit if I have a co-signer on my student loans?

A: Yes, as long as you meet all the other eligibility criteria, you can claim the tax credit even if you have a co-signer on your student loans.

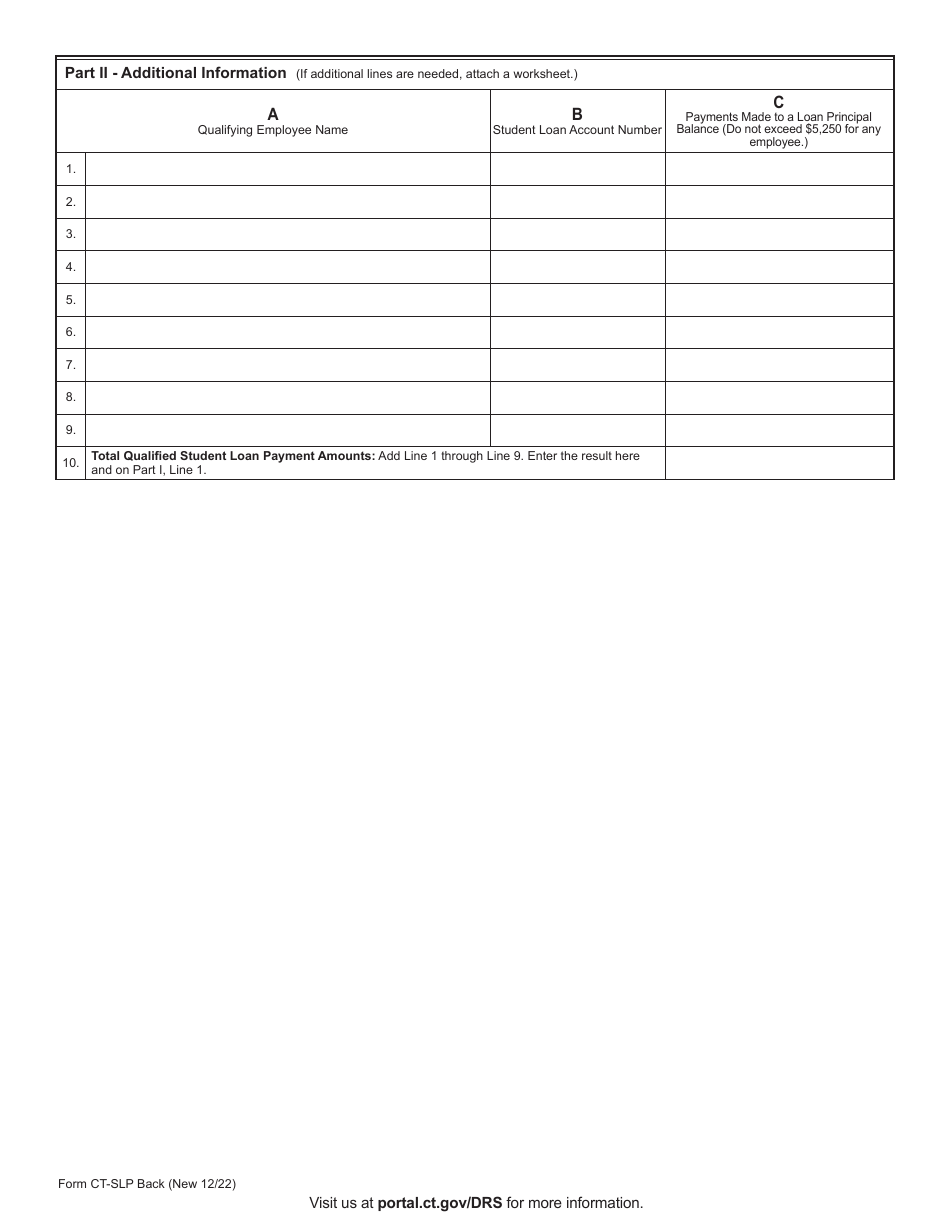

Q: What documents do I need to provide when applying for the CT-SLP Student Loan Payment Tax Credit?

A: You will need to provide proof of your qualifying student loan payments, such as loan statements or payment receipts, along with your completed Form CT-SLP.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-SLP by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.