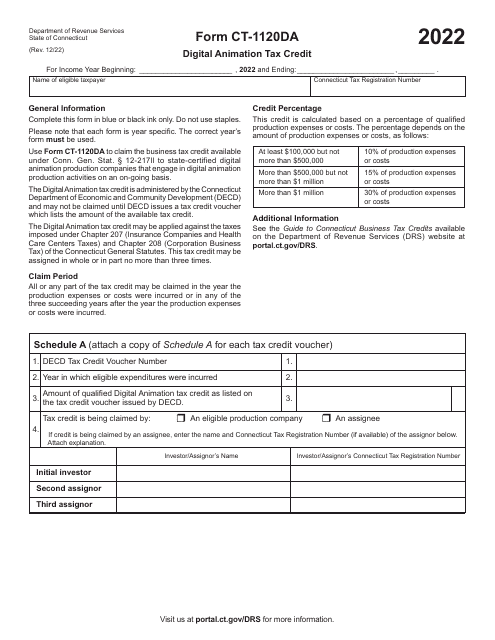

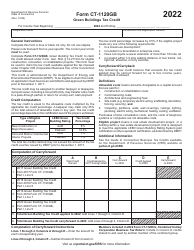

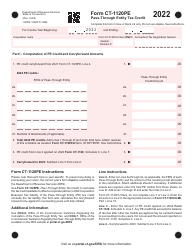

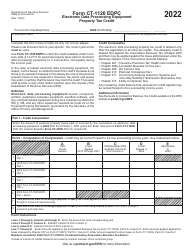

Form CT-1120DA Digital Animation Tax Credit - Connecticut

What Is Form CT-1120DA?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120DA?

A: Form CT-1120DA is a tax form used to claim the Digital Animation Production Tax Credit in Connecticut.

Q: Who can use Form CT-1120DA?

A: Any eligible taxpayer who is engaged in digital animation production in Connecticut can use Form CT-1120DA.

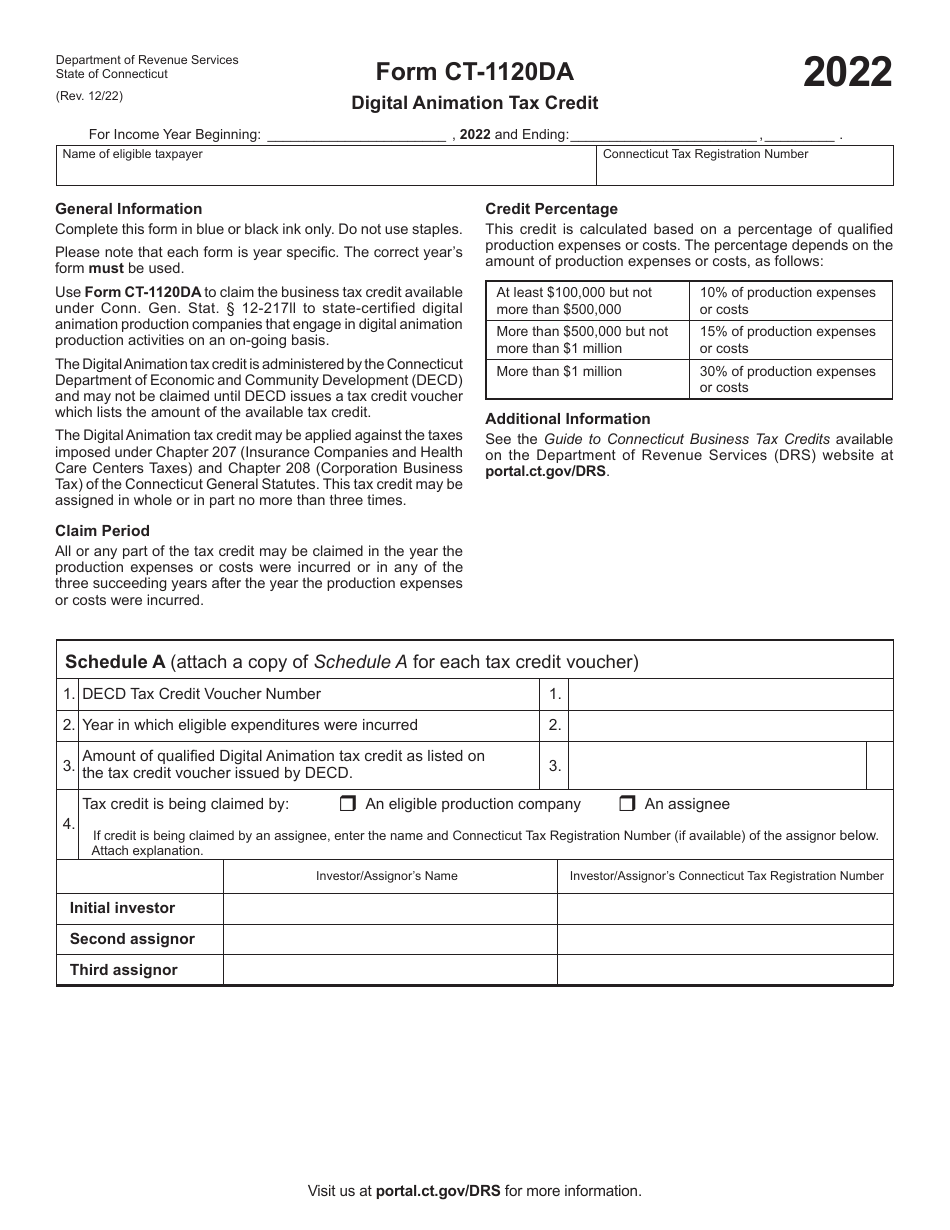

Q: What is the purpose of the Digital Animation Tax Credit?

A: The purpose of the Digital Animation Tax Credit is to incentivize digital animation production in Connecticut by providing a tax credit to eligible taxpayers.

Q: What expenses are eligible for the Digital Animation Tax Credit?

A: Expenses related to digital animation production, including payroll, production costs, and post-production costs, may be eligible for the tax credit.

Q: How much is the Digital Animation Tax Credit?

A: The tax credit can be up to 10% of eligible expenses, with a maximum credit of $15 million per taxpayer per year.

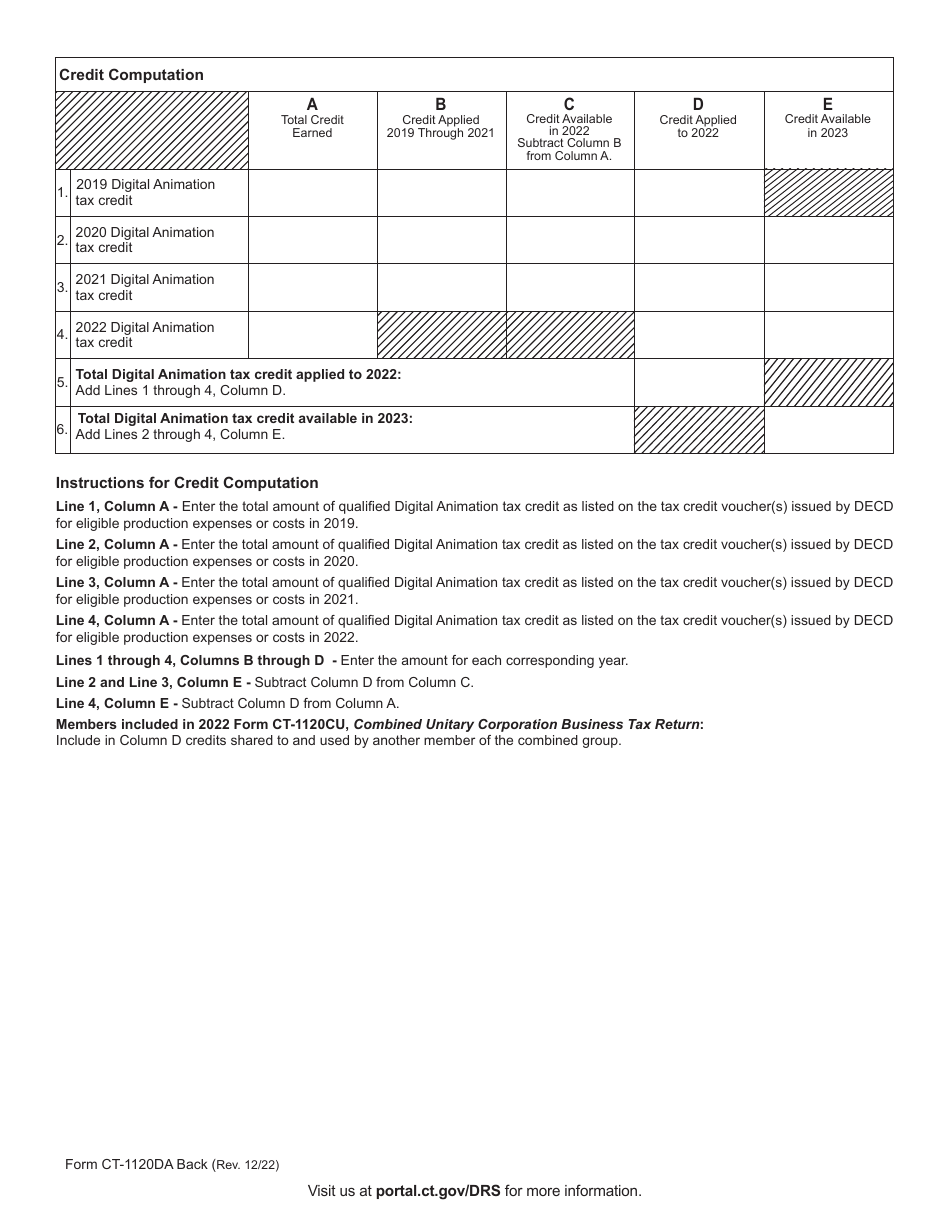

Q: What is the process for claiming the Digital Animation Tax Credit?

A: Taxpayers must complete and file Form CT-1120DA with the Connecticut Department of Revenue Services to claim the tax credit.

Q: Are there any deadlines for claiming the Digital Animation Tax Credit?

A: Yes, Form CT-1120DA must be filed on or before the due date of the taxpayer's Connecticut corporation business tax return for the year in which the credit is being claimed.

Q: Are there any additional requirements for claiming the Digital Animation Tax Credit?

A: Yes, taxpayers must meet certain requirements, including obtaining certification from the Connecticut Office of Film, Television and Digital Media.

Q: What happens if the tax credit exceeds the taxpayer's liability?

A: If the tax credit exceeds the taxpayer's liability, the excess credit may be carried forward for up to five years.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120DA by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.