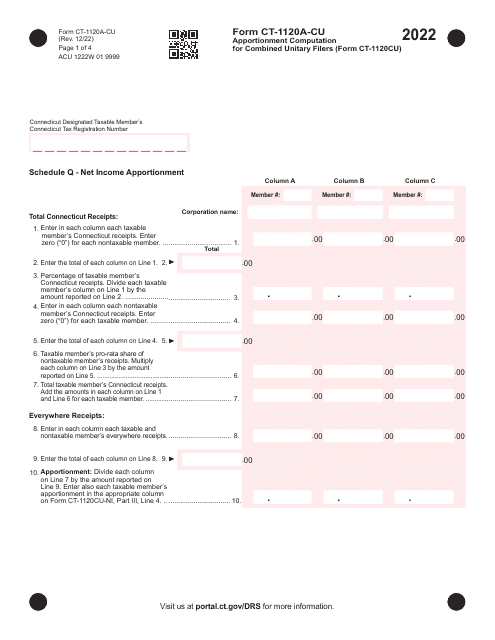

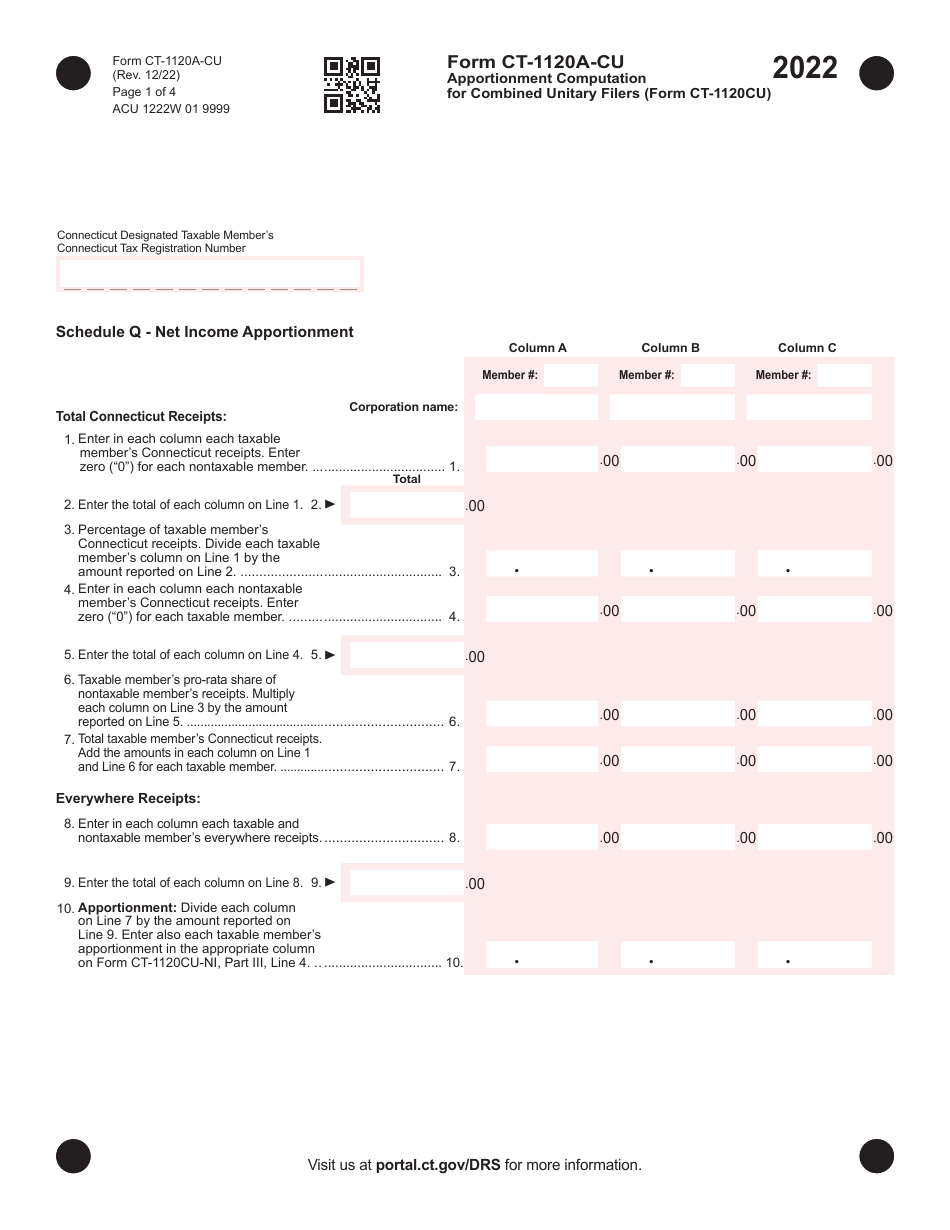

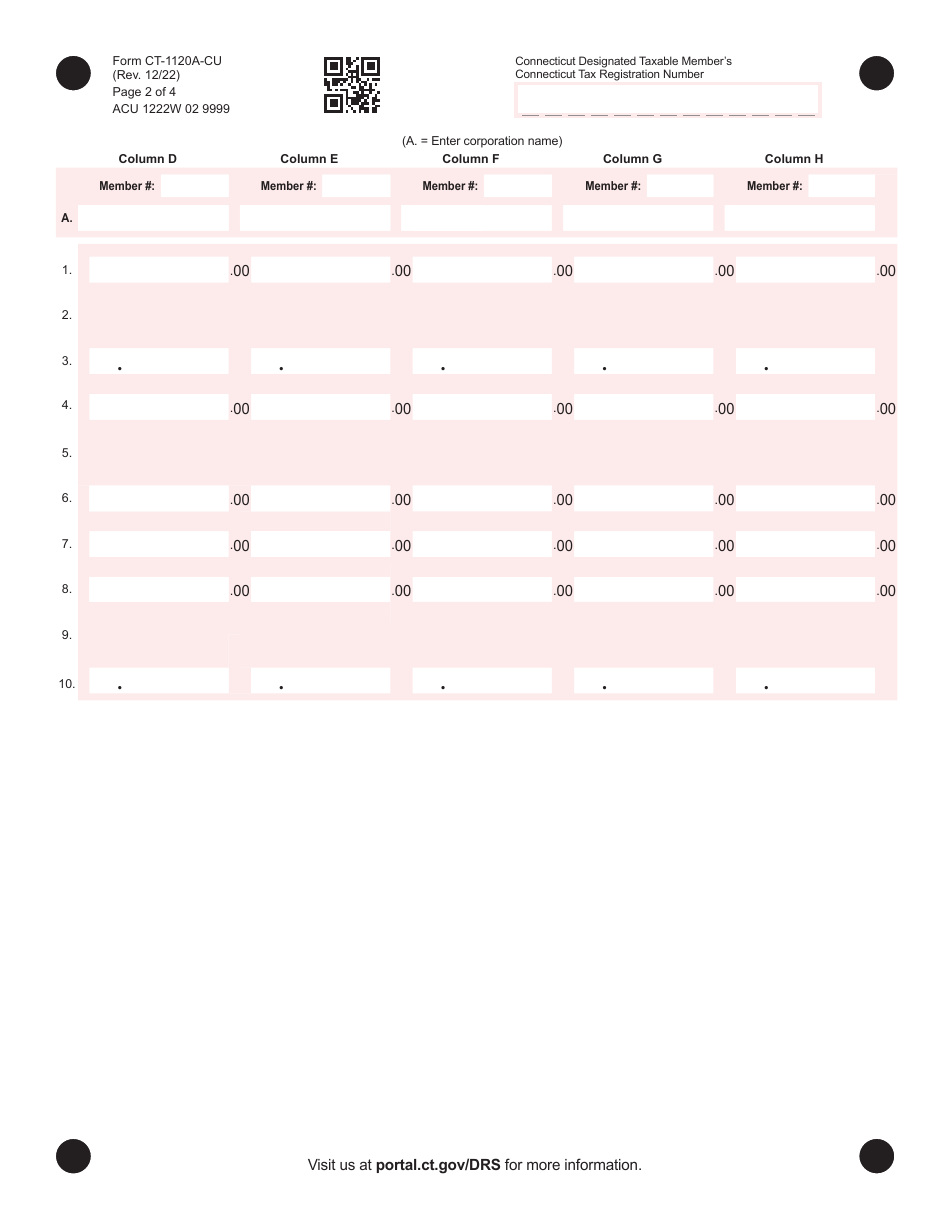

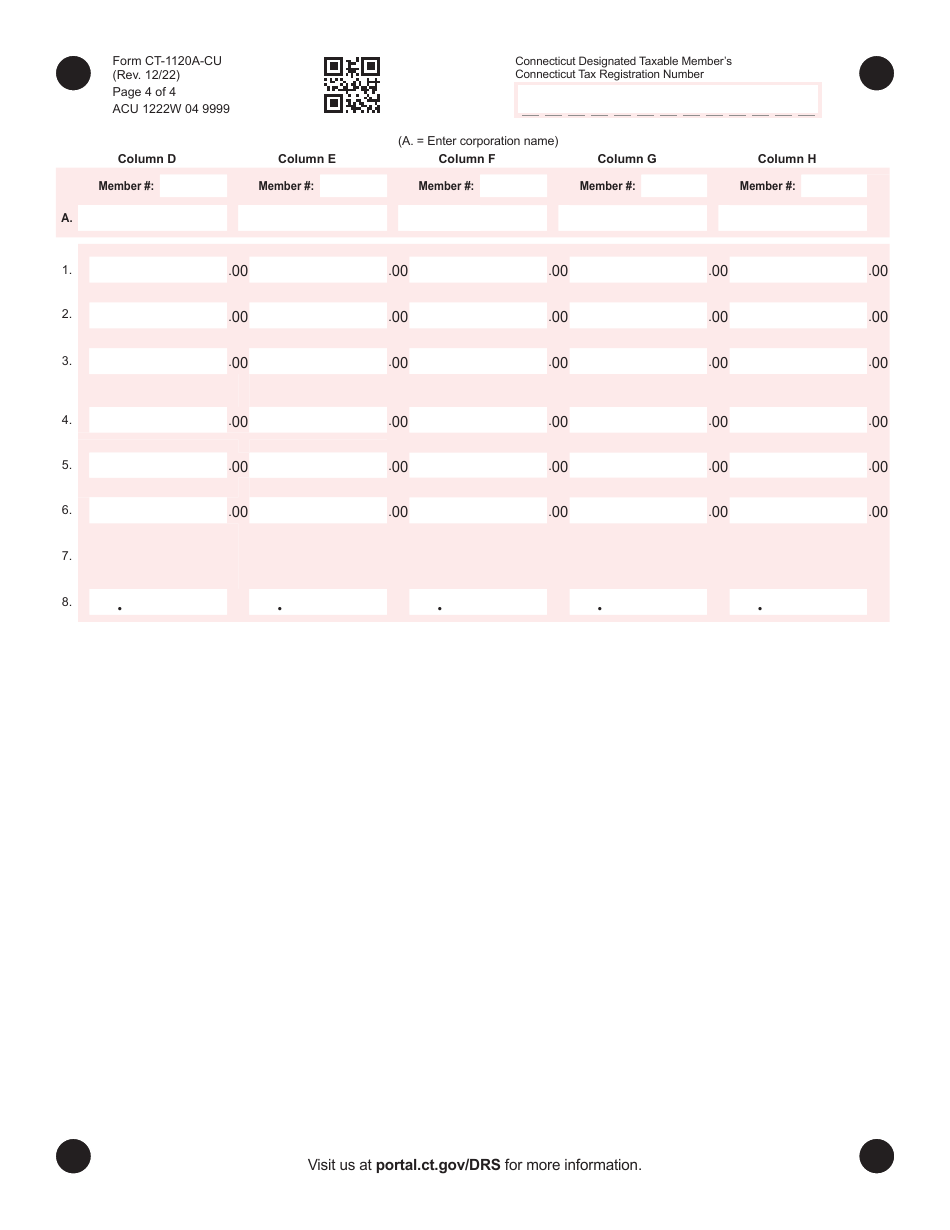

Form CT-1120A-CU Apportionment Computation for Combined Unitary Filers - Connecticut

What Is Form CT-1120A-CU?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120A-CU?

A: Form CT-1120A-CU is a tax form used by combined unitary filers in Connecticut to calculate apportionment.

Q: Who needs to file Form CT-1120A-CU?

A: Combined unitary filers in Connecticut need to file Form CT-1120A-CU.

Q: What is apportionment?

A: Apportionment is the process of allocating income between different states to determine the portion of income subject to state taxes.

Q: What information is required on Form CT-1120A-CU?

A: Form CT-1120A-CU requires information on state and worldwide sales, property, and payroll.

Q: Are there any instructions for completing Form CT-1120A-CU?

A: Yes, the Connecticut Department of Revenue Services provides instructions for completing Form CT-1120A-CU.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120A-CU by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.