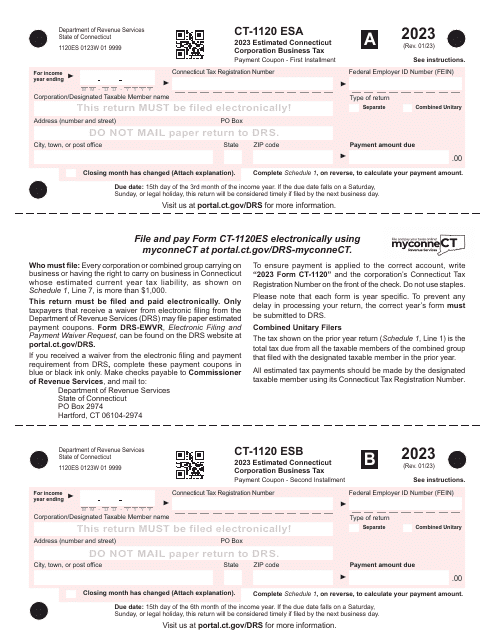

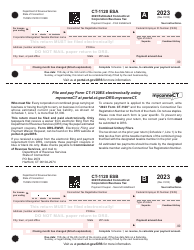

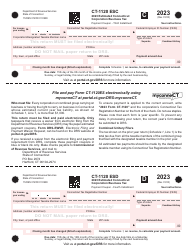

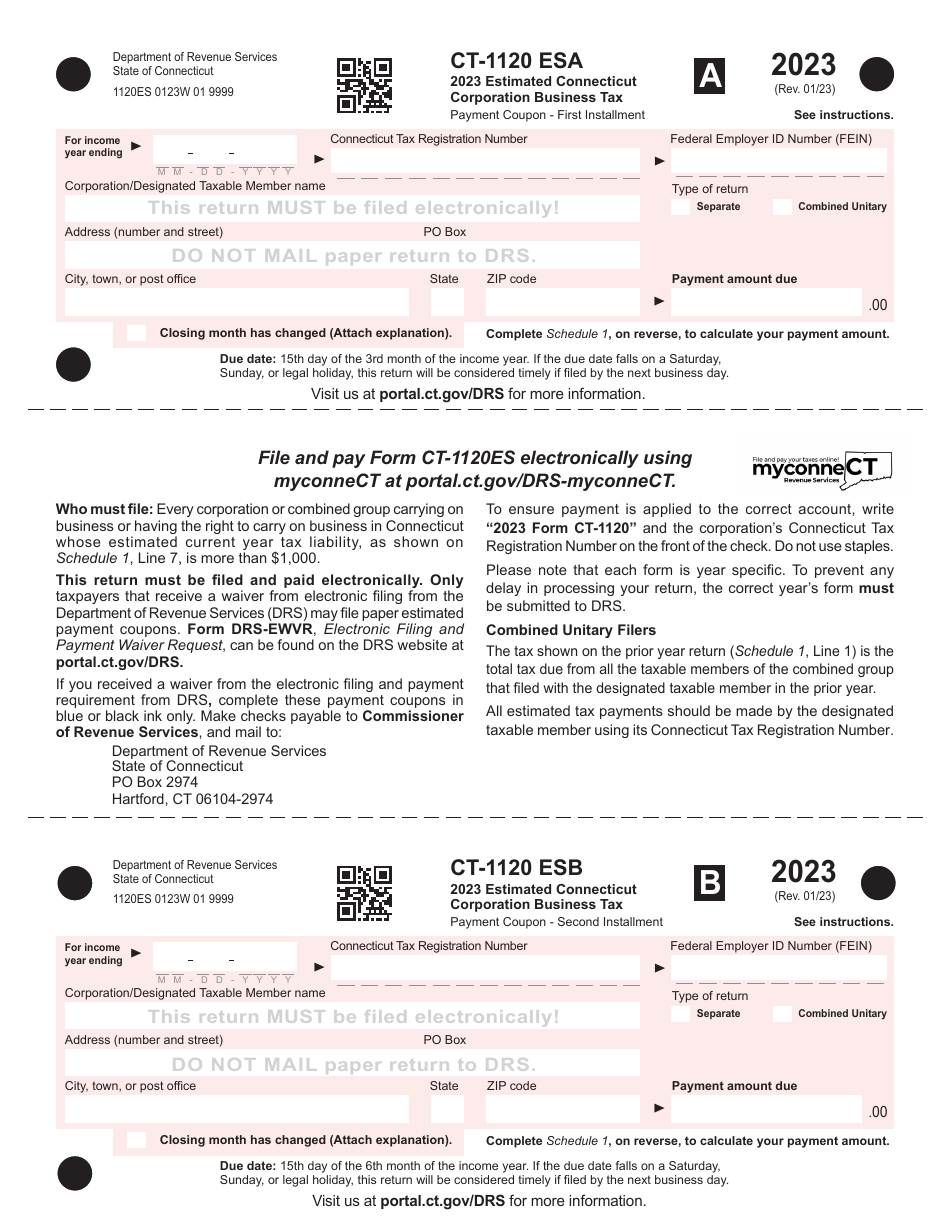

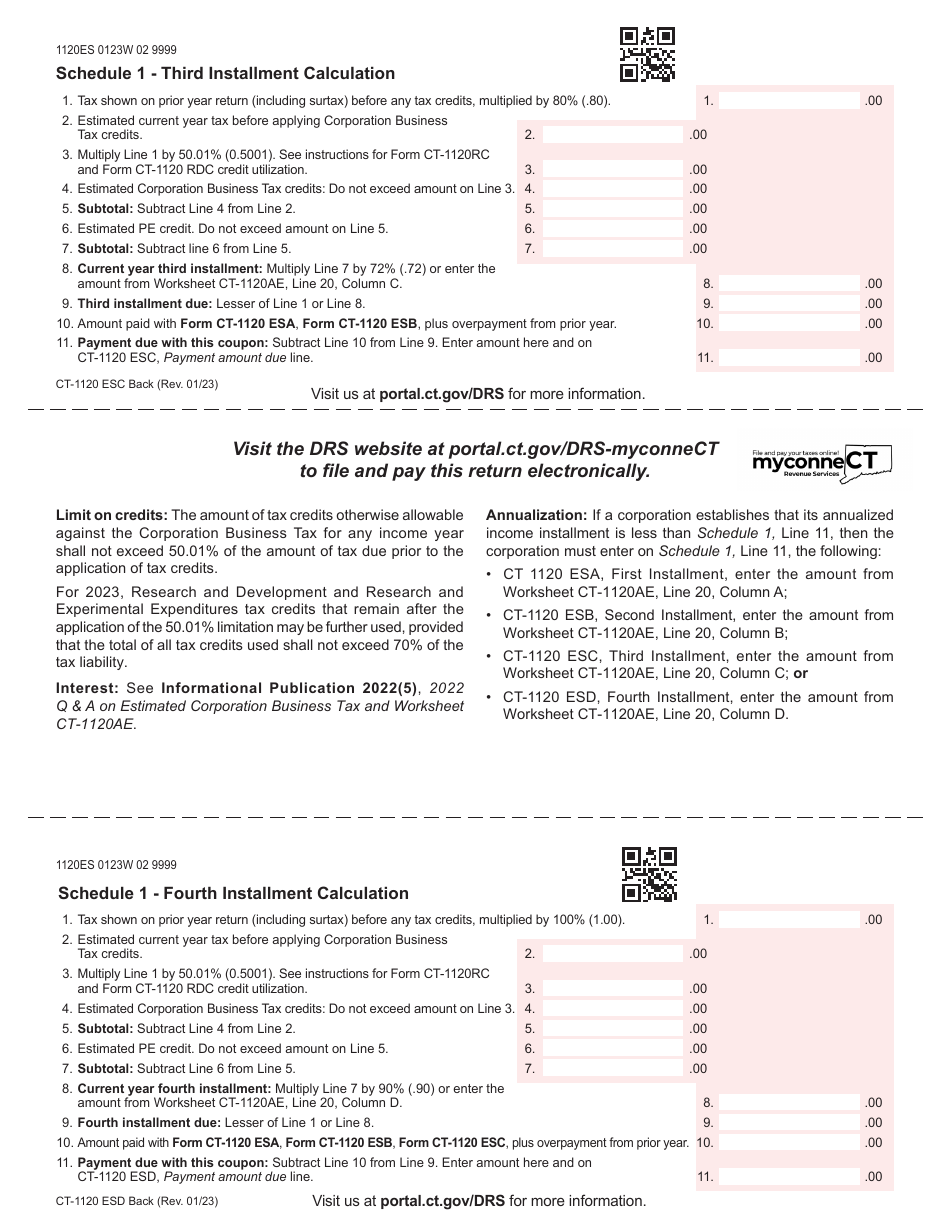

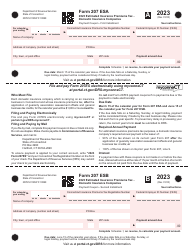

Form CT-1120 ES Estimated Corporation Business Tax Payment Coupons - Connecticut

What Is Form CT-1120 ES?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 ES?

A: Form CT-1120 ES is a form used to make estimated tax payments for corporation business tax in Connecticut.

Q: What is the purpose of Form CT-1120 ES?

A: The purpose of Form CT-1120 ES is to submit estimated tax payments to the Connecticut Department of Revenue Services for corporation business tax.

Q: Who needs to file Form CT-1120 ES?

A: Corporations in Connecticut that anticipate owing corporation business tax are required to file Form CT-1120 ES to make estimated tax payments.

Q: When is Form CT-1120 ES due?

A: Form CT-1120 ES is due on a quarterly basis. The due dates are April 15, June 15, September 15, and December 15.

Q: What information is needed to complete Form CT-1120 ES?

A: To complete Form CT-1120 ES, you will need to provide your corporation's name, address, federal employer identification number, estimated tax liability, and payment information.

Q: What happens if I don't file Form CT-1120 ES?

A: If you don't file Form CT-1120 ES or make the required estimated tax payments, you may be subject to penalties and interest on the underpaid amount.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 ES by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.