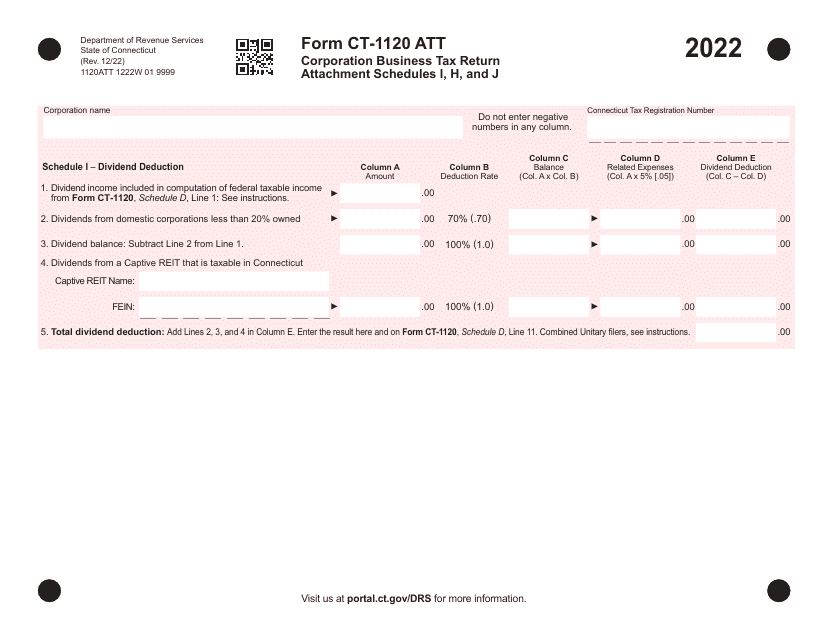

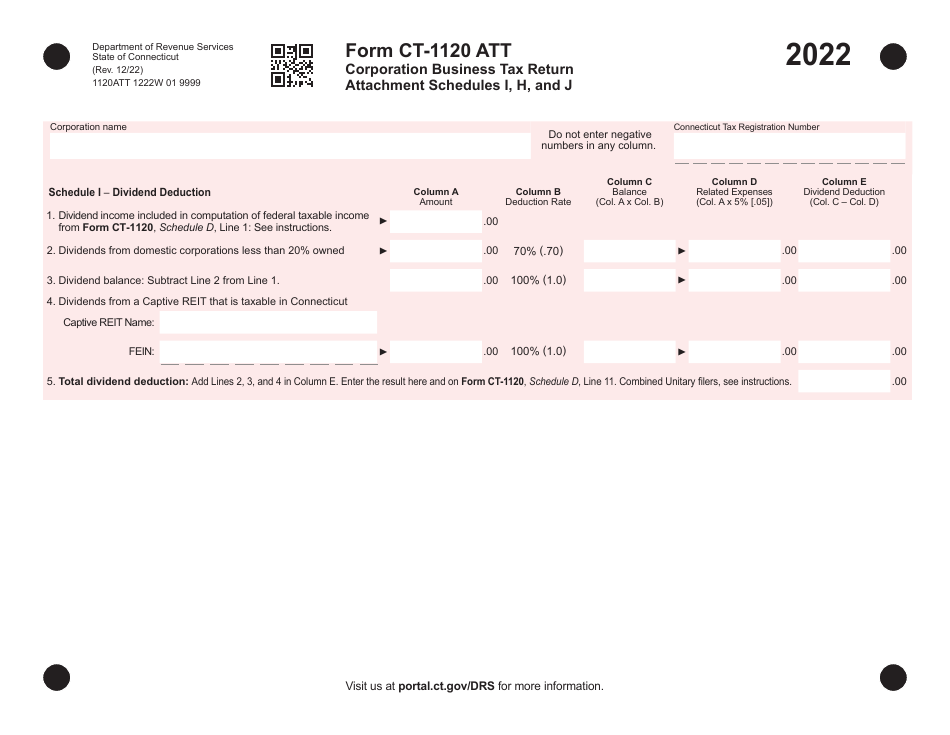

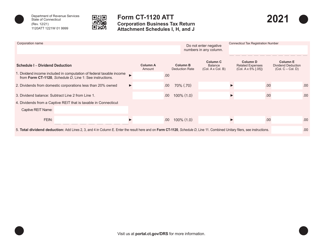

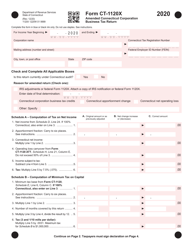

Form CT-1120 ATT Corporation Business Tax Return - Connecticut

What Is Form CT-1120 ATT?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 ATT?

A: Form CT-1120 ATT is the Corporation Business Tax Return for corporations in Connecticut.

Q: Who needs to file Form CT-1120 ATT?

A: Corporations doing business in Connecticut and subject to corporation business tax need to file Form CT-1120 ATT.

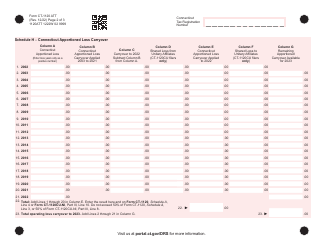

Q: What information is required on Form CT-1120 ATT?

A: Form CT-1120 ATT requires information about the corporation's income, deductions, credits, and tax liability.

Q: When is the deadline for filing Form CT-1120 ATT?

A: The deadline for filing Form CT-1120 ATT is the same as the federal tax return deadline, which is usually April 15th.

Q: Can Form CT-1120 ATT be filed electronically?

A: Yes, Form CT-1120 ATT can be filed electronically through the Connecticut Taxpayer Service Center.

Q: Are there any penalties for late filing of Form CT-1120 ATT?

A: Yes, there are penalties for late filing of Form CT-1120 ATT, so it is important to file on time.

Q: Is there a separate form for estimated tax payments?

A: Yes, corporations making estimated tax payments need to file Form CT-1120 ESA, which is the Estimated Corporation Business Tax Payment Coupon.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 ATT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.