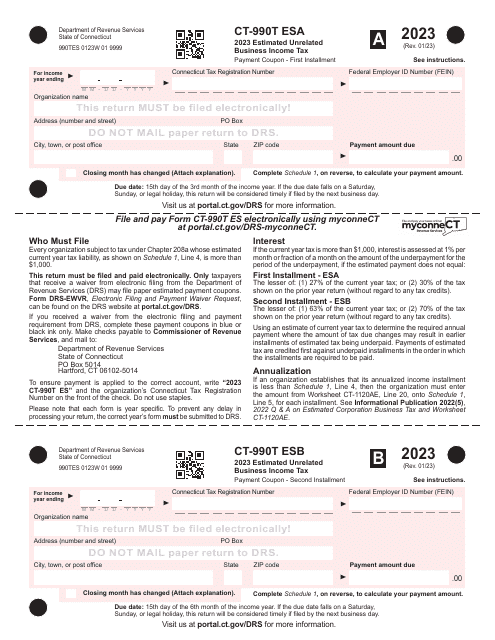

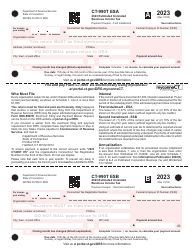

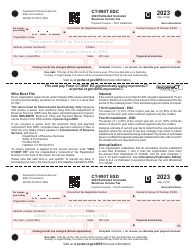

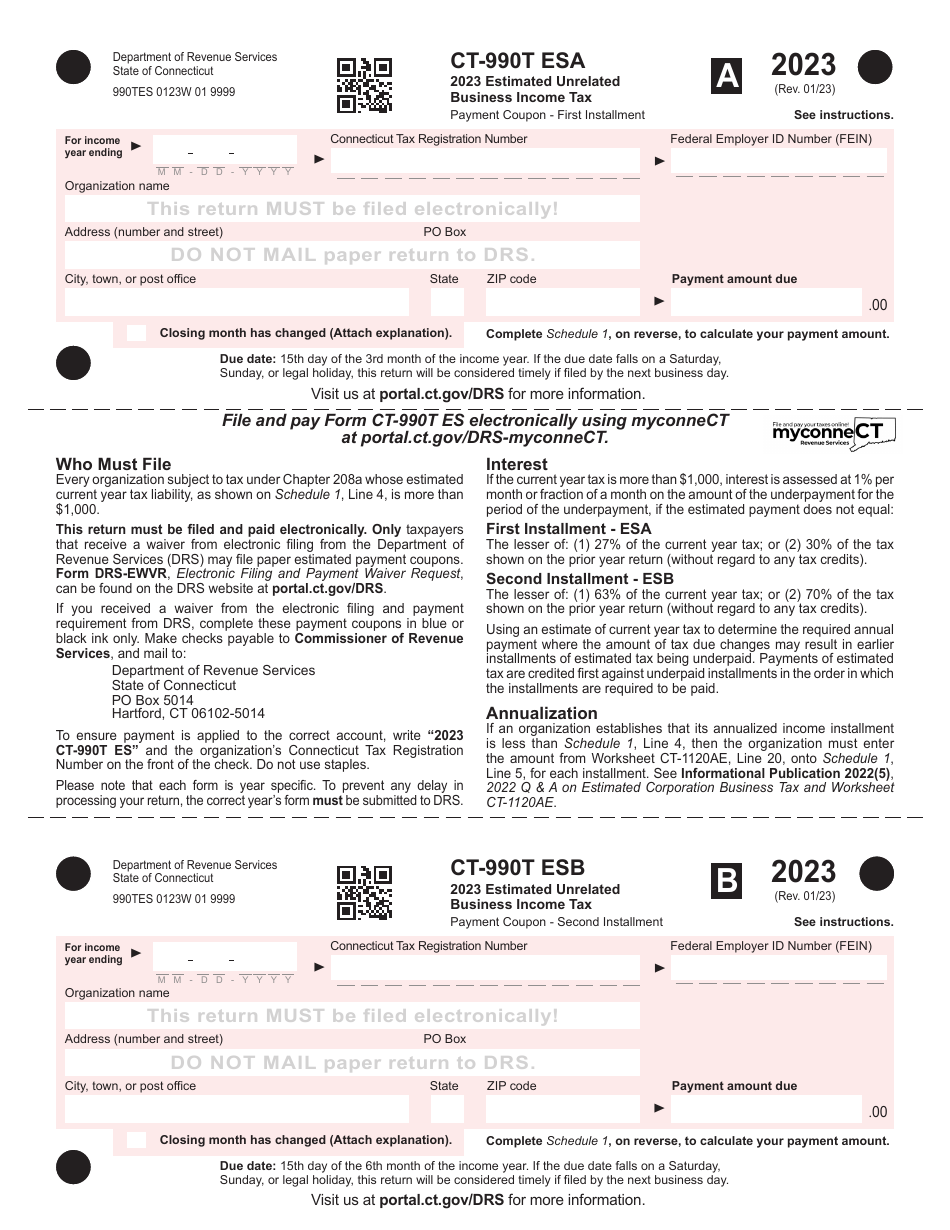

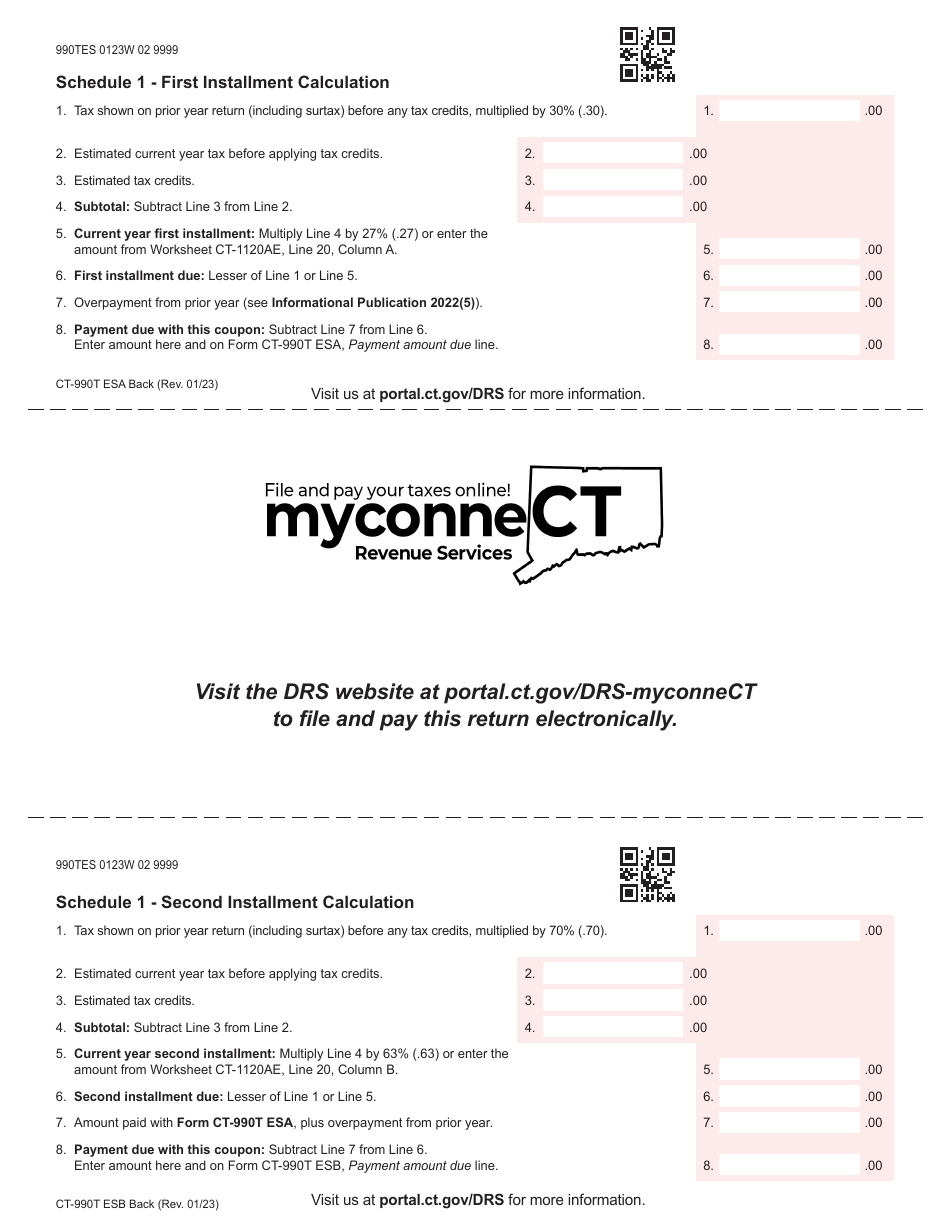

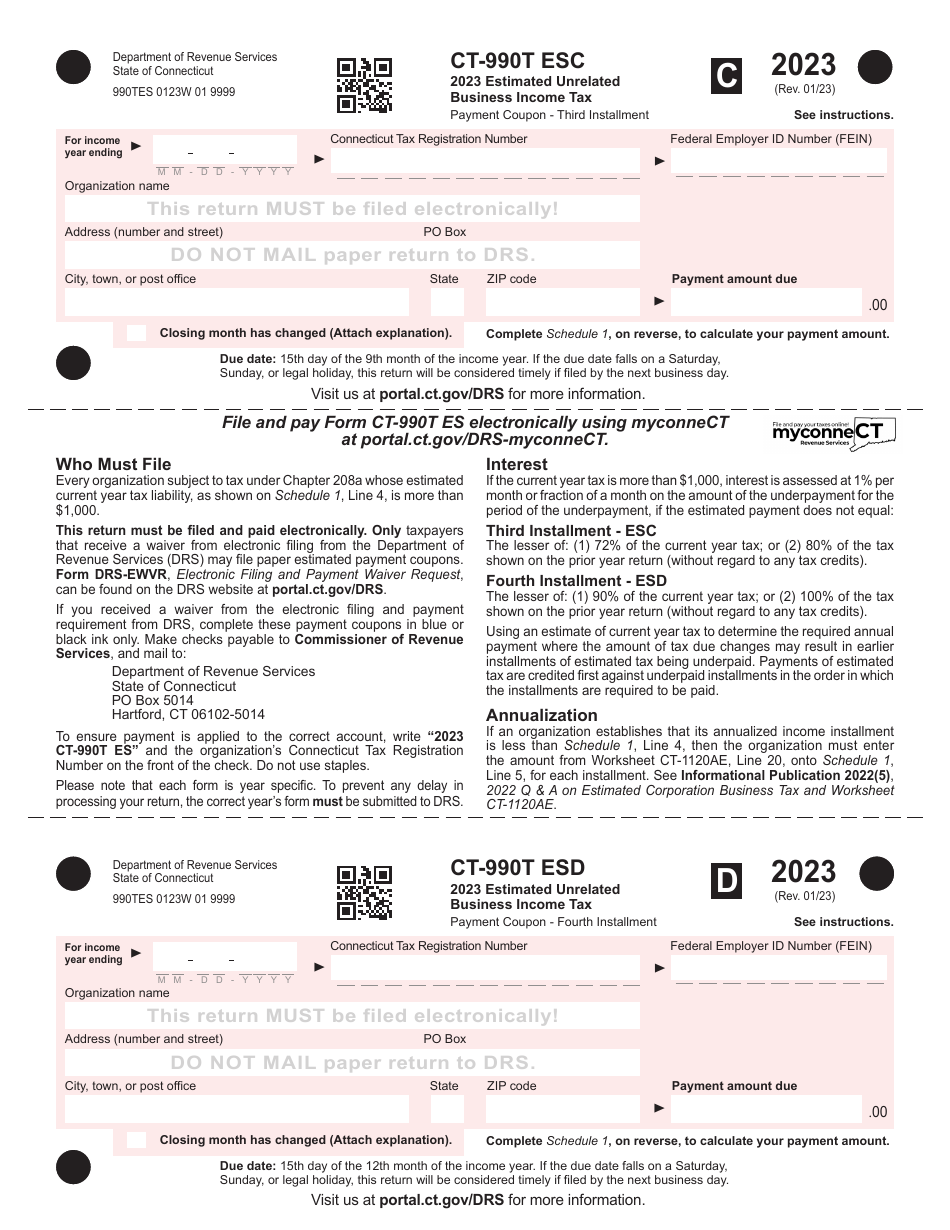

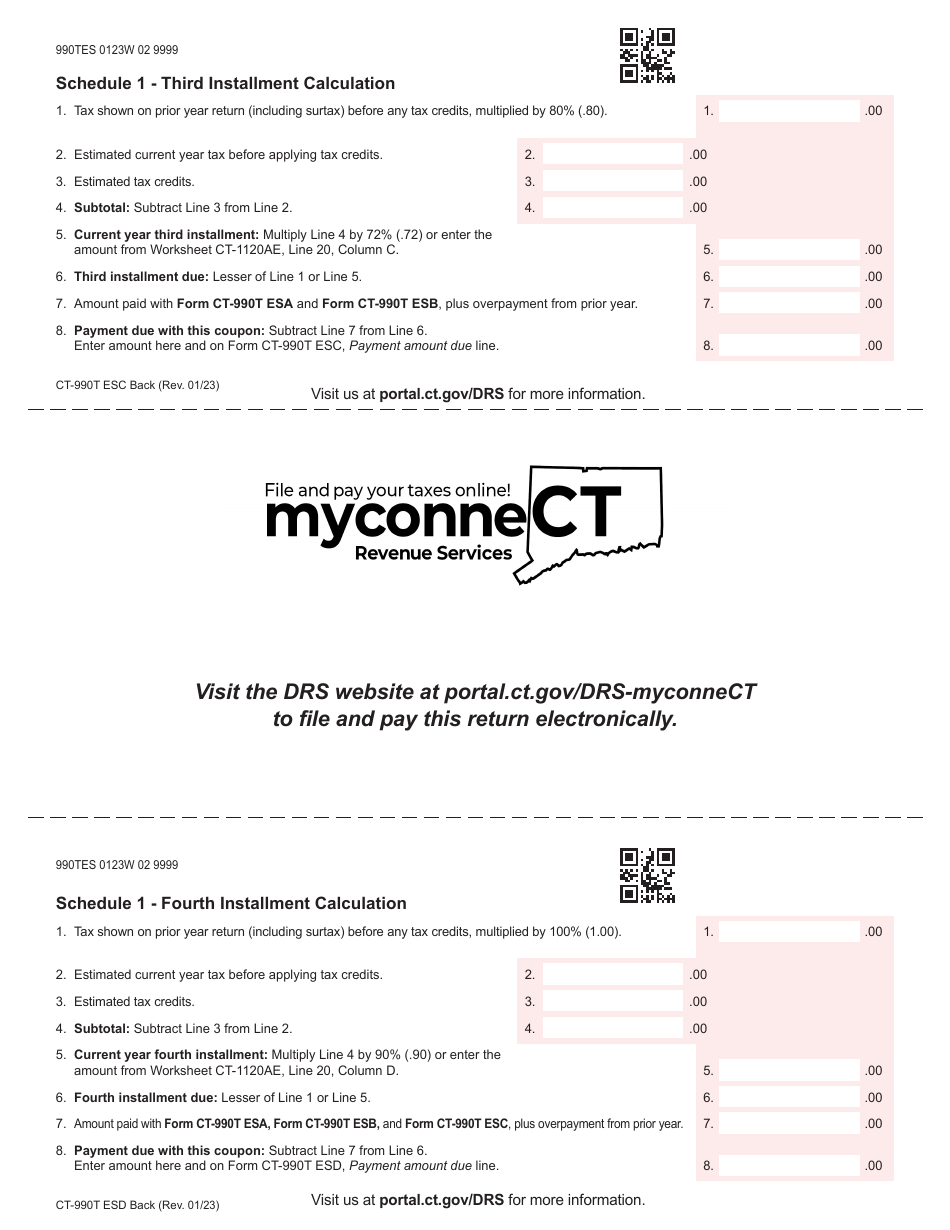

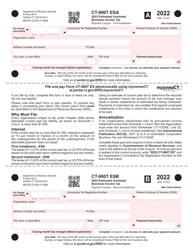

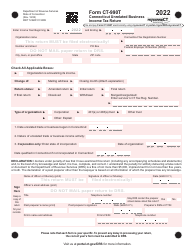

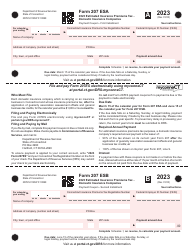

Form CT-990T ES Estimated Unrelated Business Income Tax Payment Coupon - Connecticut

What Is Form CT-990T ES?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-990T ES?

A: Form CT-990T ES is a payment coupon for estimated unrelated business income tax in Connecticut.

Q: What is unrelated business income tax?

A: Unrelated business income tax is a tax on income generated from activities that are not related to the tax-exempt purpose of an organization.

Q: Who needs to use Form CT-990T ES?

A: Nonprofit organizations in Connecticut that have unrelated business income and expect to owe $500 or more in tax for the year must use Form CT-990T ES to make estimated tax payments.

Q: What is the purpose of Form CT-990T ES?

A: The purpose of Form CT-990T ES is to allow nonprofits to make estimated tax payments on their unrelated business income throughout the year.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-990T ES by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.