This version of the form is not currently in use and is provided for reference only. Download this version of

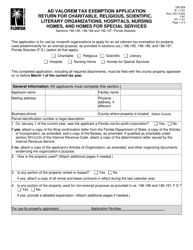

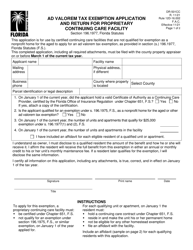

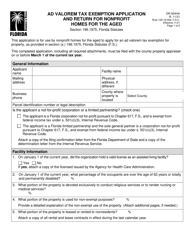

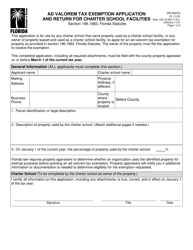

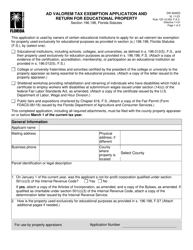

Form DR-501

for the current year.

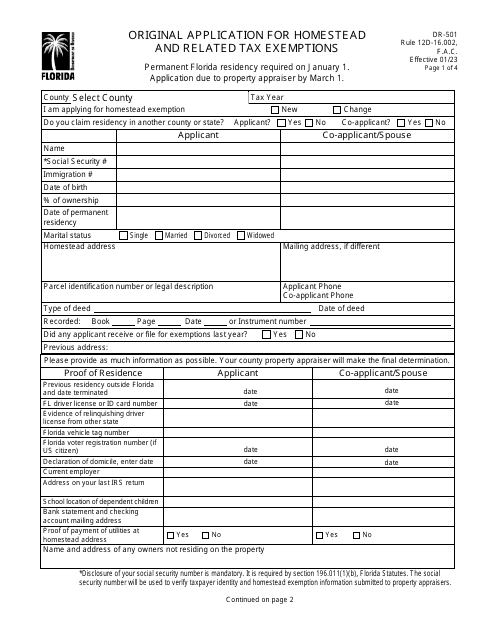

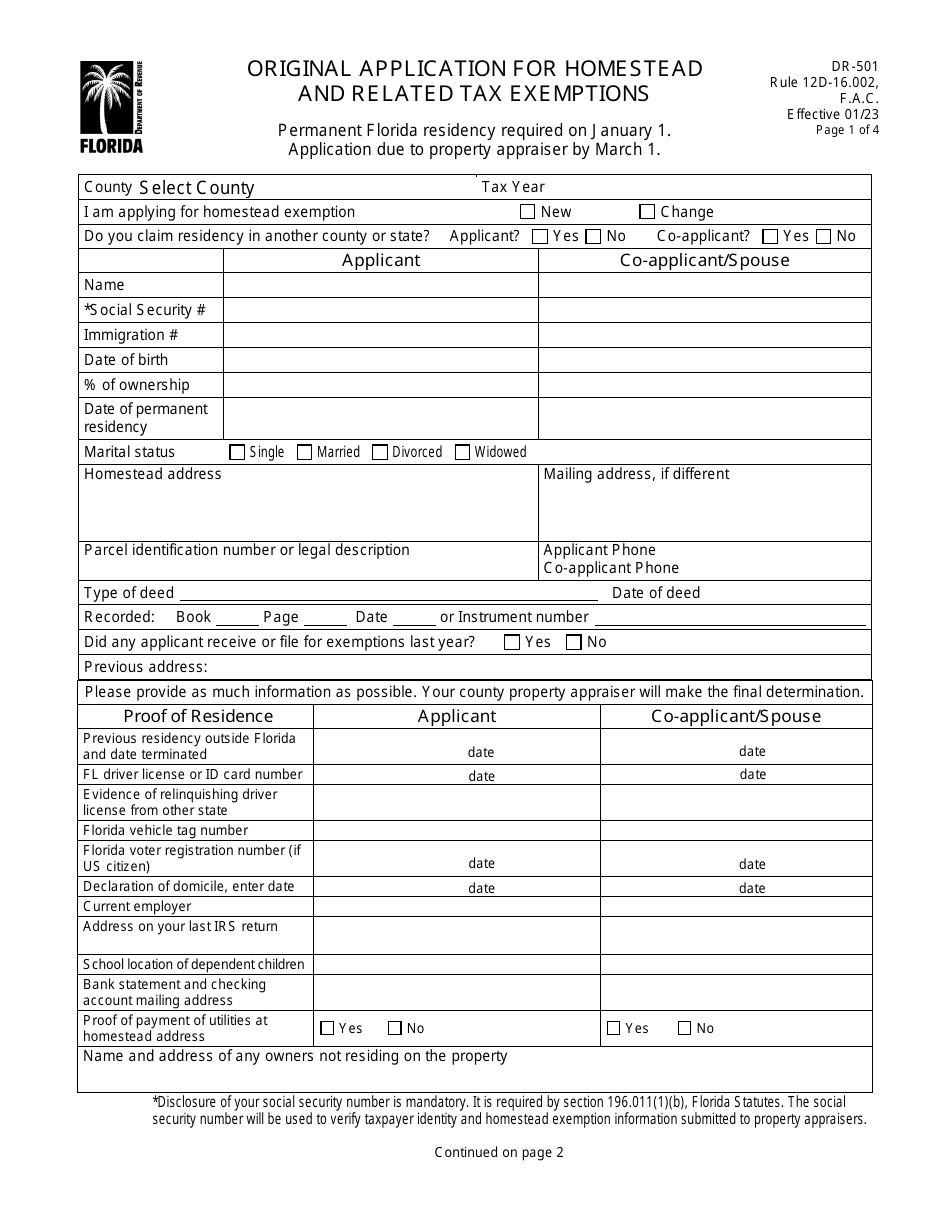

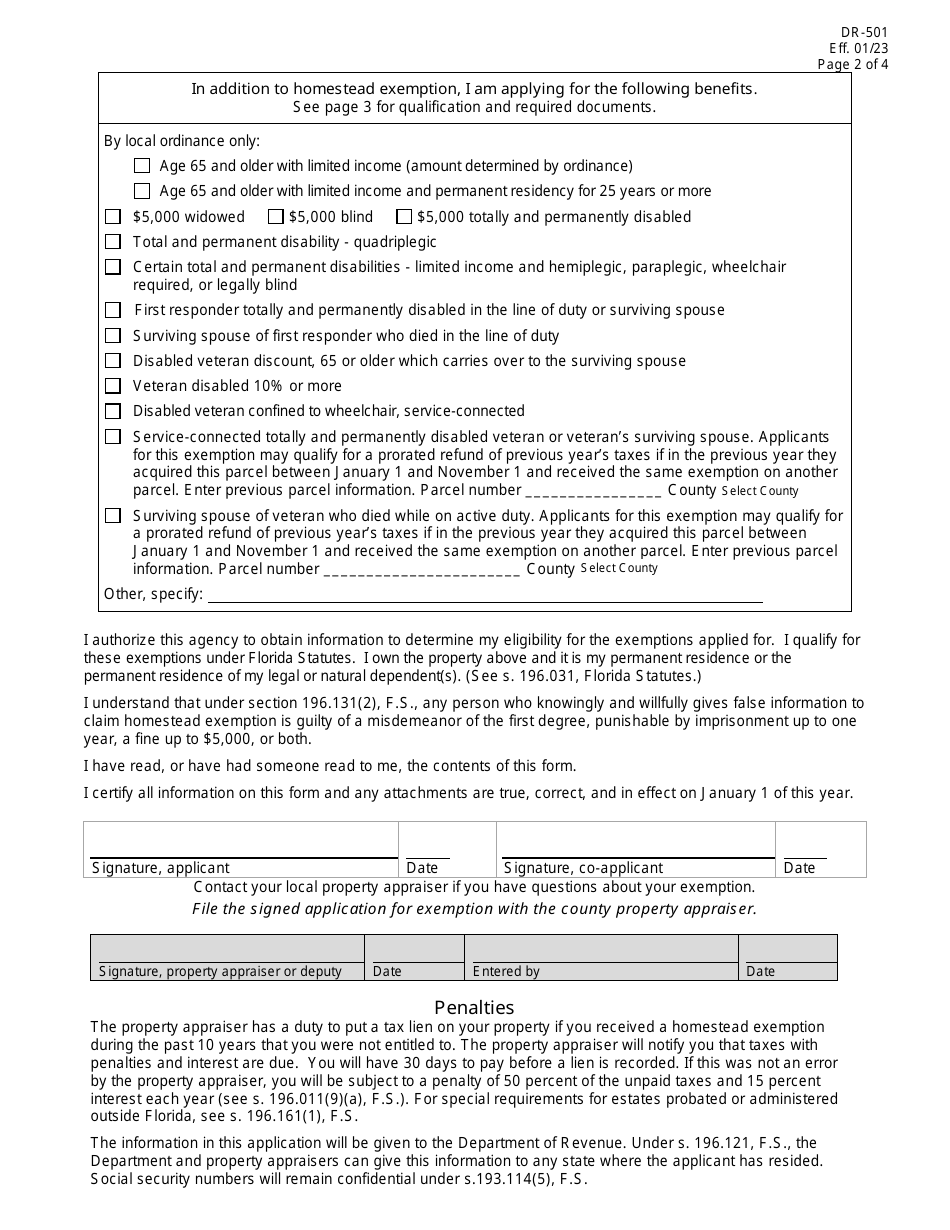

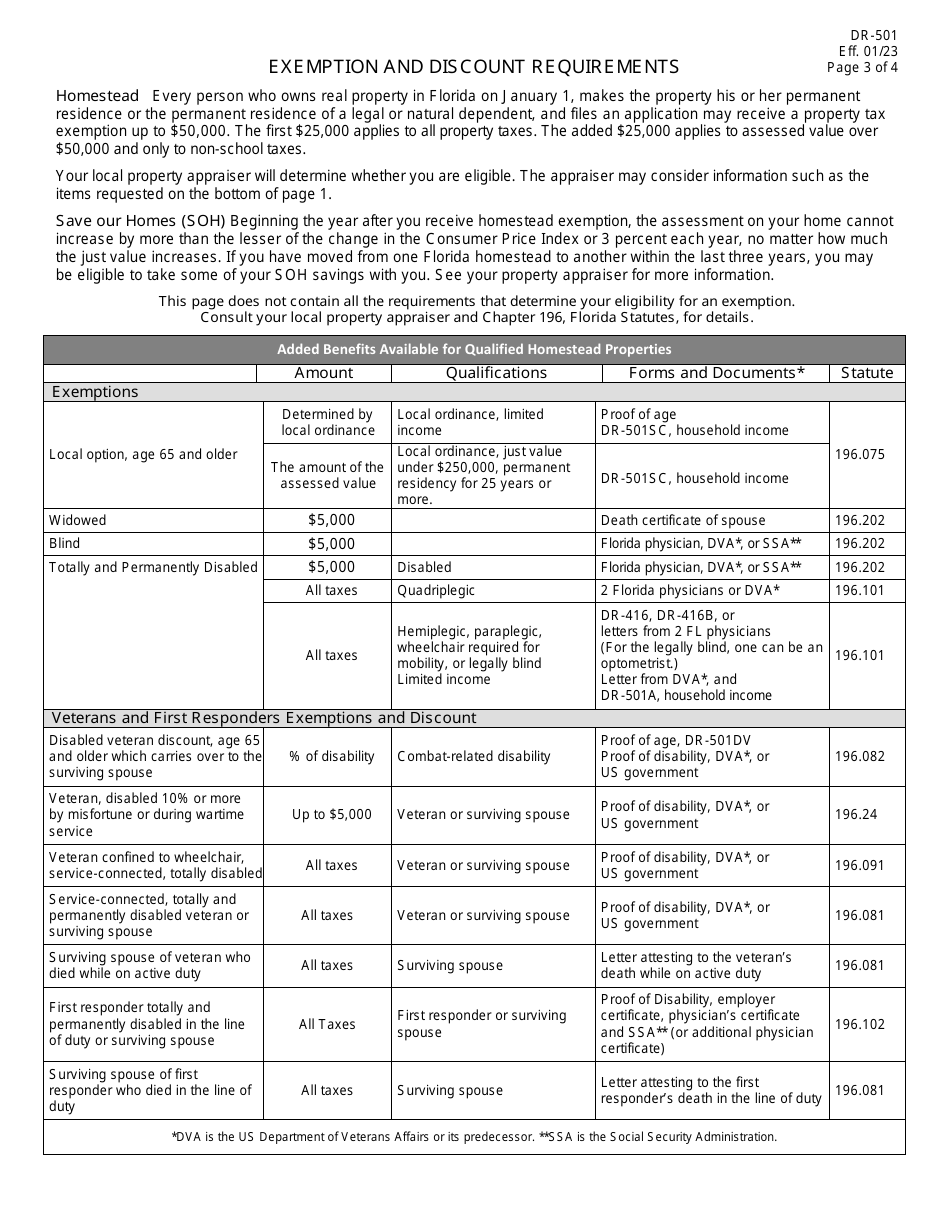

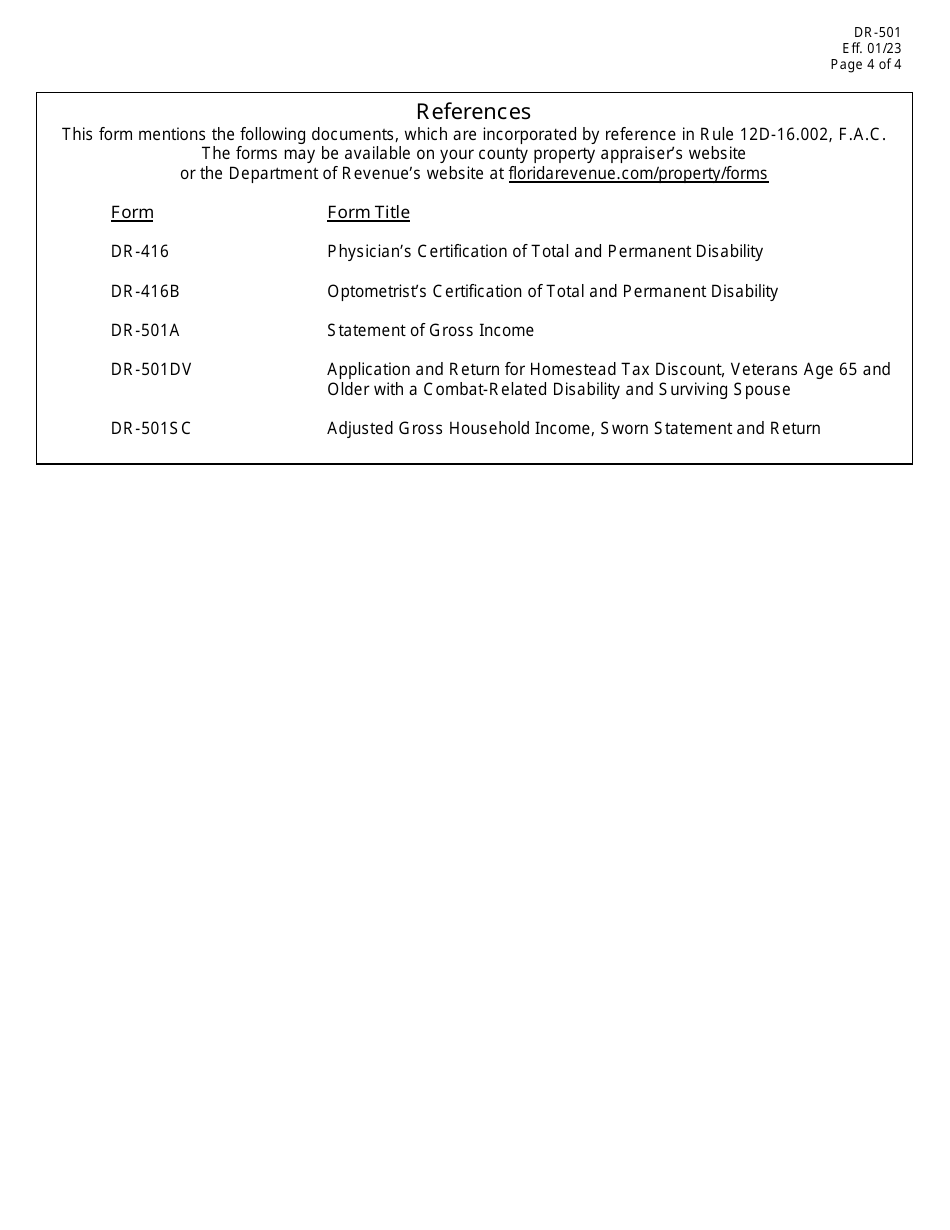

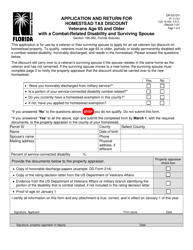

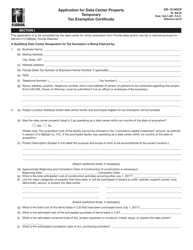

Form DR-501 Original Application for Homestead and Related Tax Exemptions - Florida

What Is Form DR-501?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

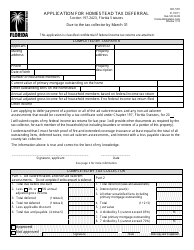

Q: What is Form DR-501?

A: Form DR-501 is the Original Application for Homestead and Related Tax Exemptions in Florida.

Q: What is the purpose of Form DR-501?

A: The purpose of Form DR-501 is to apply for homestead and related tax exemptions in Florida.

Q: Who is eligible to use Form DR-501?

A: Any individual who owns and resides in a permanent residence in Florida may use Form DR-501 to apply for homestead and related tax exemptions.

Q: What are homestead and related tax exemptions?

A: Homestead and related tax exemptions are benefits provided to eligible homeowners in Florida, which can reduce the amount of property taxes they owe.

Q: What documents are required to be submitted with Form DR-501?

A: The specific documents required may vary depending on your circumstances, but generally you will need proof of ownership, proof of residency, and other supporting documentation. It is recommended to check the instructions provided with Form DR-501 for the complete list of required documents.

Q: When is the deadline to submit Form DR-501?

A: The deadline to submit Form DR-501 is March 1st of each year. Late applications may be accepted with a satisfactory explanation.

Q: What happens after I submit Form DR-501?

A: After you submit Form DR-501, the property appraiser's office will review your application and determine your eligibility for the homestead and related tax exemptions.

Q: Can I claim homestead and related tax exemptions on multiple properties?

A: No, you can only claim homestead and related tax exemptions on your primary permanent residence in Florida.

Q: Are there any income restrictions to qualify for homestead and related tax exemptions?

A: No, there are no income restrictions to qualify for homestead and related tax exemptions in Florida.

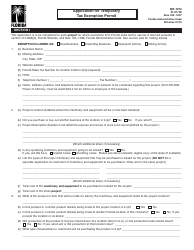

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-501 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.