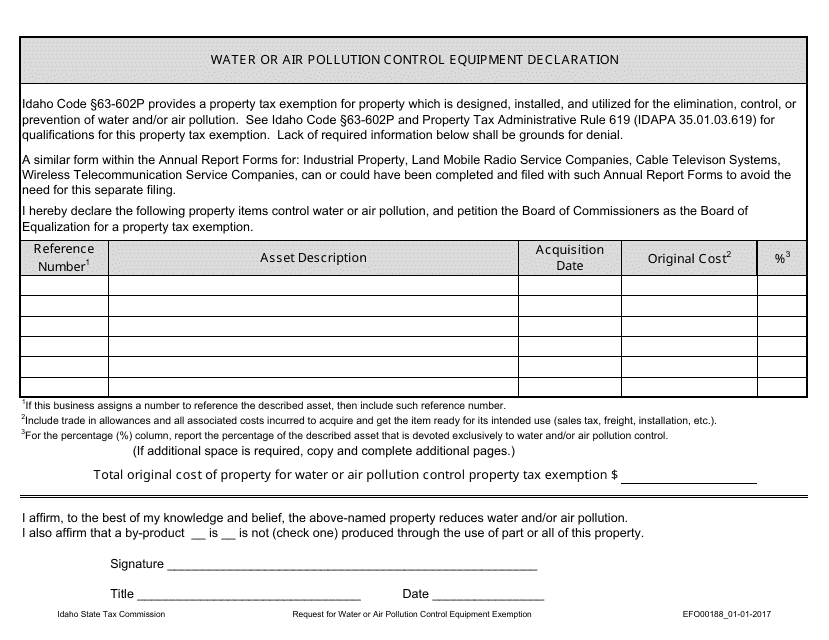

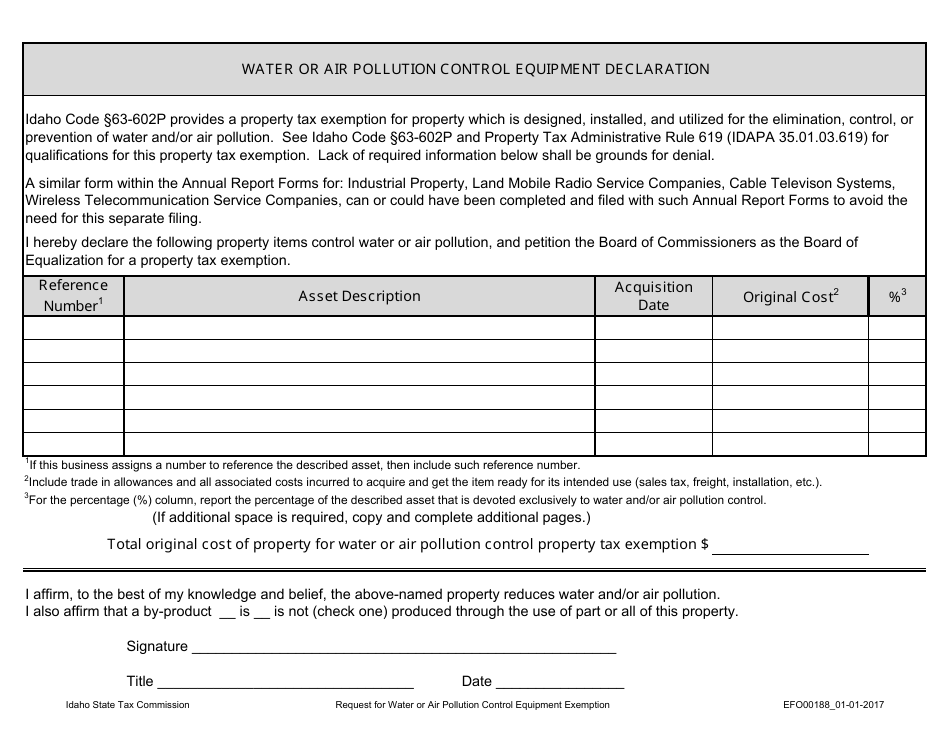

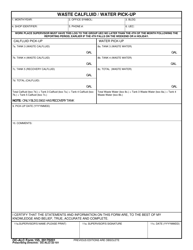

Form EFO00188 Water or Air Pollution Control Equipment Declaration - Idaho

What Is Form EFO00188?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EFO00188?

A: Form EFO00188 is a Water or Air Pollution Control Equipment Declaration.

Q: Who needs to file Form EFO00188?

A: Idaho taxpayers who purchase or lease pollution control equipment need to file this form.

Q: What is the purpose of Form EFO00188?

A: The purpose of this form is to claim a sales tax exemption for the purchase or lease of pollution control equipment.

Q: When is Form EFO00188 due?

A: Form EFO00188 is due on the 15th day of the month following the end of the reporting period in which the equipment was purchased or leased.

Q: What information do I need to provide on Form EFO00188?

A: You need to provide information such as your name, address, equipment description, purchase/lease date, cost, and other details.

Q: Are there any penalties for not filing Form EFO00188?

A: Yes, there may be penalties for not filing or filing incomplete or incorrect information on Form EFO00188.

Q: Can I claim the sales tax exemption for pollution control equipment retroactively?

A: No, you cannot claim the sales tax exemption retroactively. You must file Form EFO00188 within the specified timeframe.

Q: Is there a fee for filing Form EFO00188?

A: No, there is no fee for filing Form EFO00188.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form EFO00188 by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.