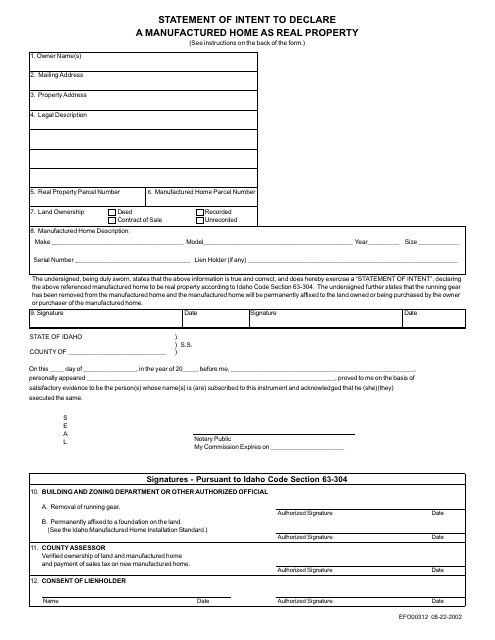

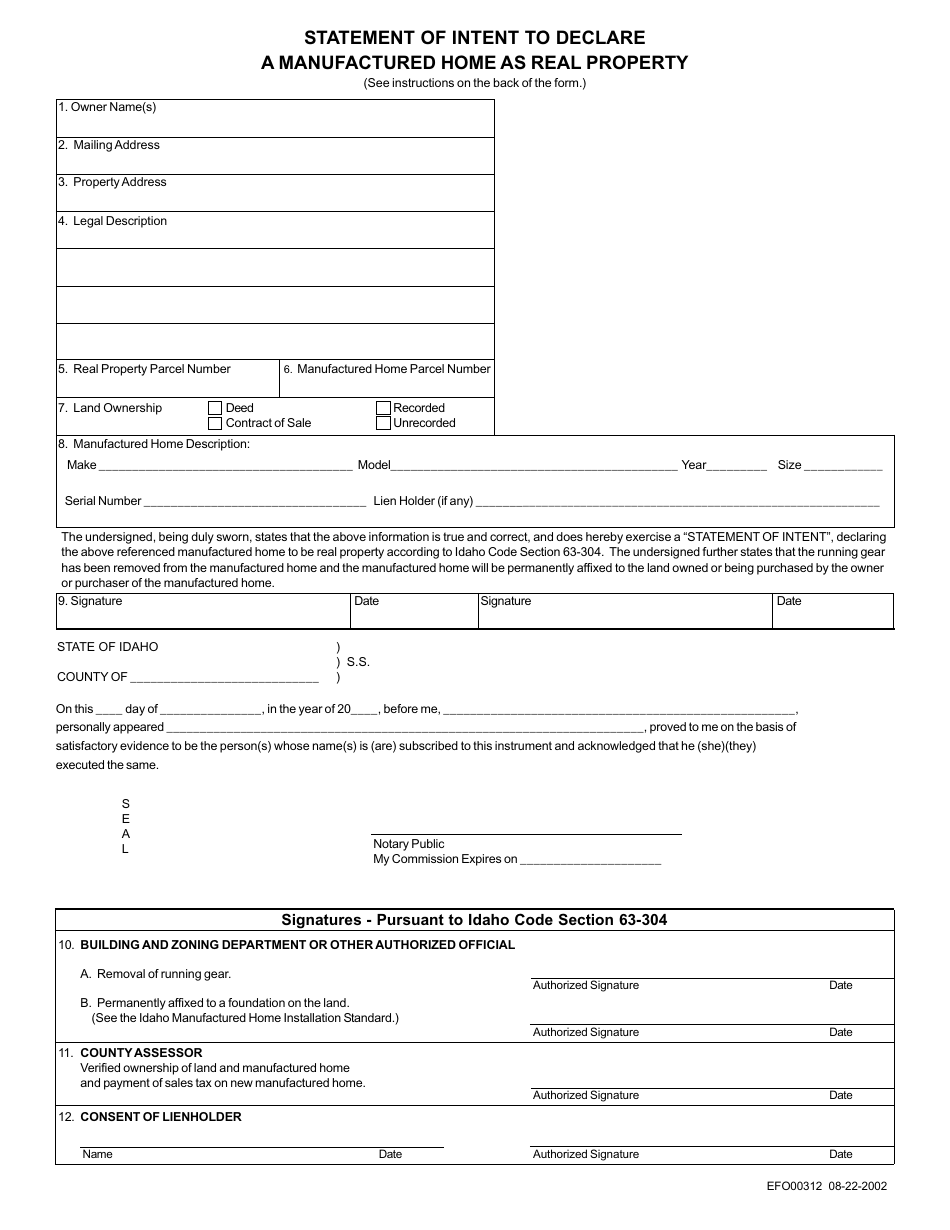

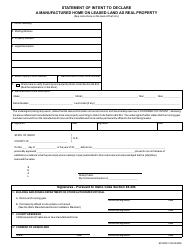

Form EFO00312 Statement of Intent to Declare a Manufactured Home as Real Property - Idaho

What Is Form EFO00312?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EFO00312?

A: Form EFO00312 is a Statement of Intent to Declare a Manufactured Home as Real Property in Idaho.

Q: What is a manufactured home?

A: A manufactured home is a dwelling that is built off-site and then transported to its final location.

Q: What does it mean to declare a manufactured home as real property?

A: Declaring a manufactured home as real property means that it is permanently affixed to a piece of land and is considered part of the real estate.

Q: Why would someone declare a manufactured home as real property?

A: There are various reasons, such as obtaining financing, qualifying for certain tax benefits, or complying with local zoning regulations.

Q: Who needs to fill out Form EFO00312?

A: Any owner of a manufactured home in Idaho who wants to declare it as real property needs to fill out this form.

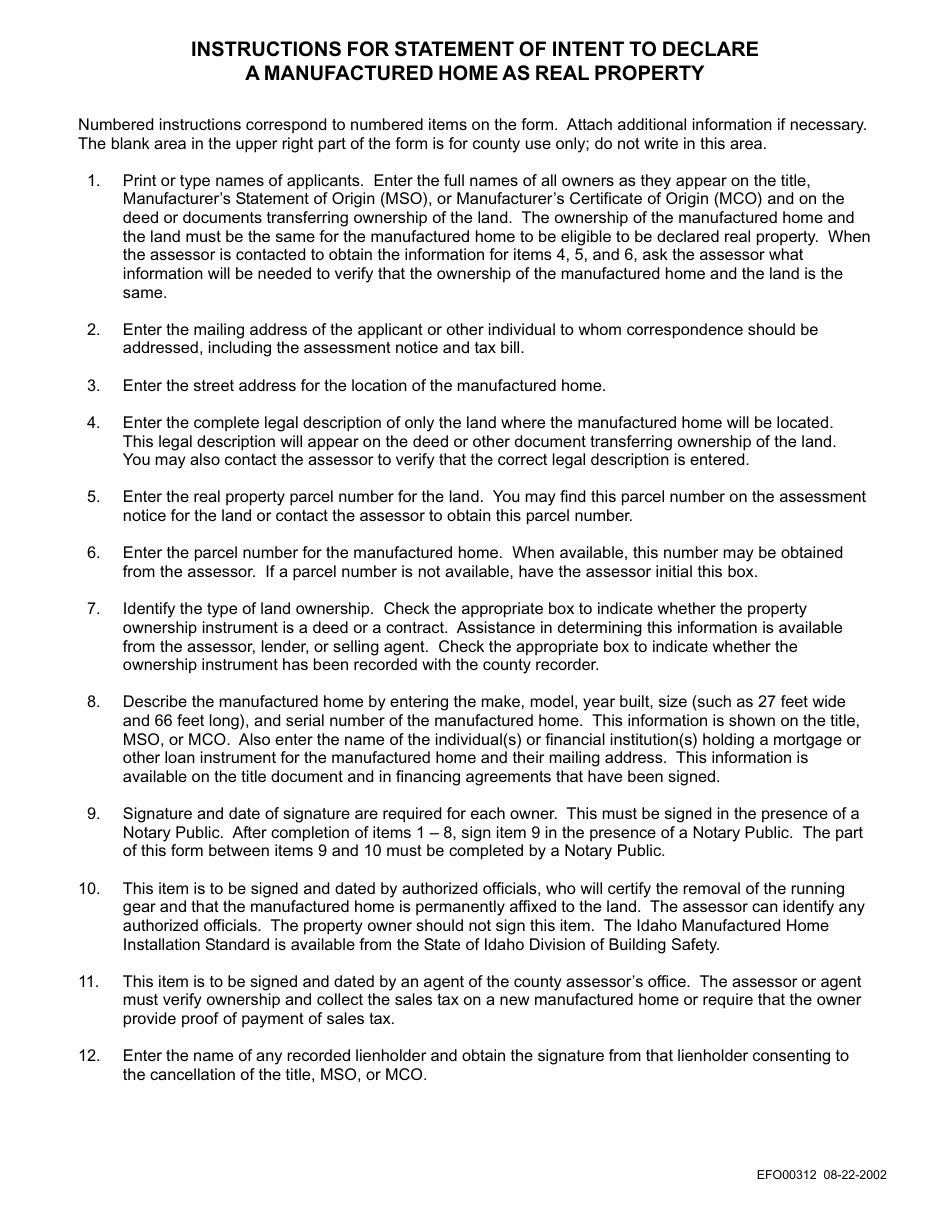

Q: What information is required on Form EFO00312?

A: The form requires information about the manufactured home, including its make, model, and serial number, as well as the property on which it is located.

Q: Are there any fees associated with filing this form?

A: There may be filing fees associated with submitting Form EFO00312. You should check with your local county assessor's office for more information.

Q: What should I do after filing Form EFO00312?

A: After filing the form, you should follow any instructions provided by the Idaho Division of Motor Vehicles or your local county assessor's office.

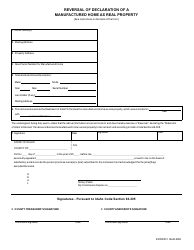

Q: Can I change my mind after declaring a manufactured home as real property?

A: Yes, you can change your mind, but you will need to take the necessary steps to have the declaration reversed.

Form Details:

- Released on August 22, 2022;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form EFO00312 by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.