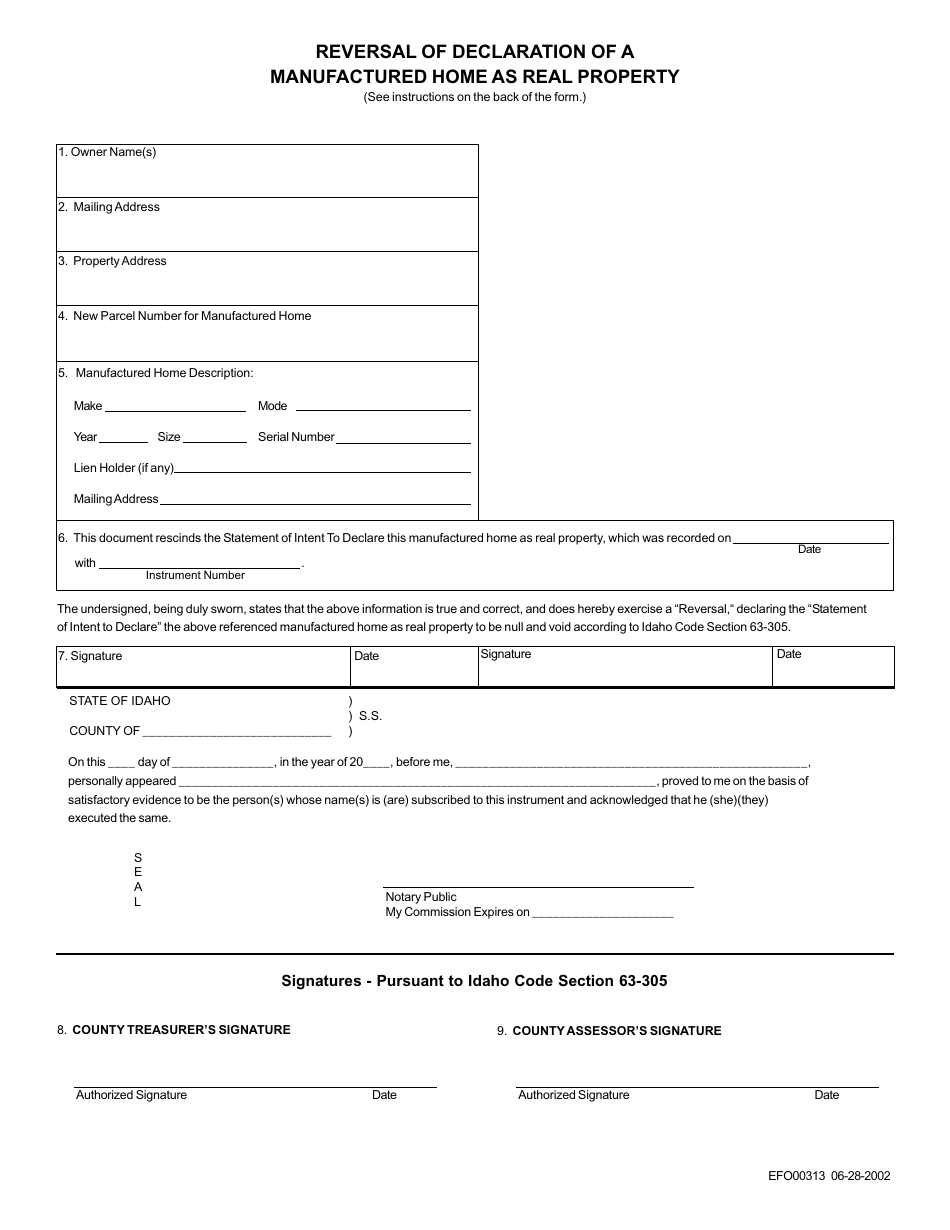

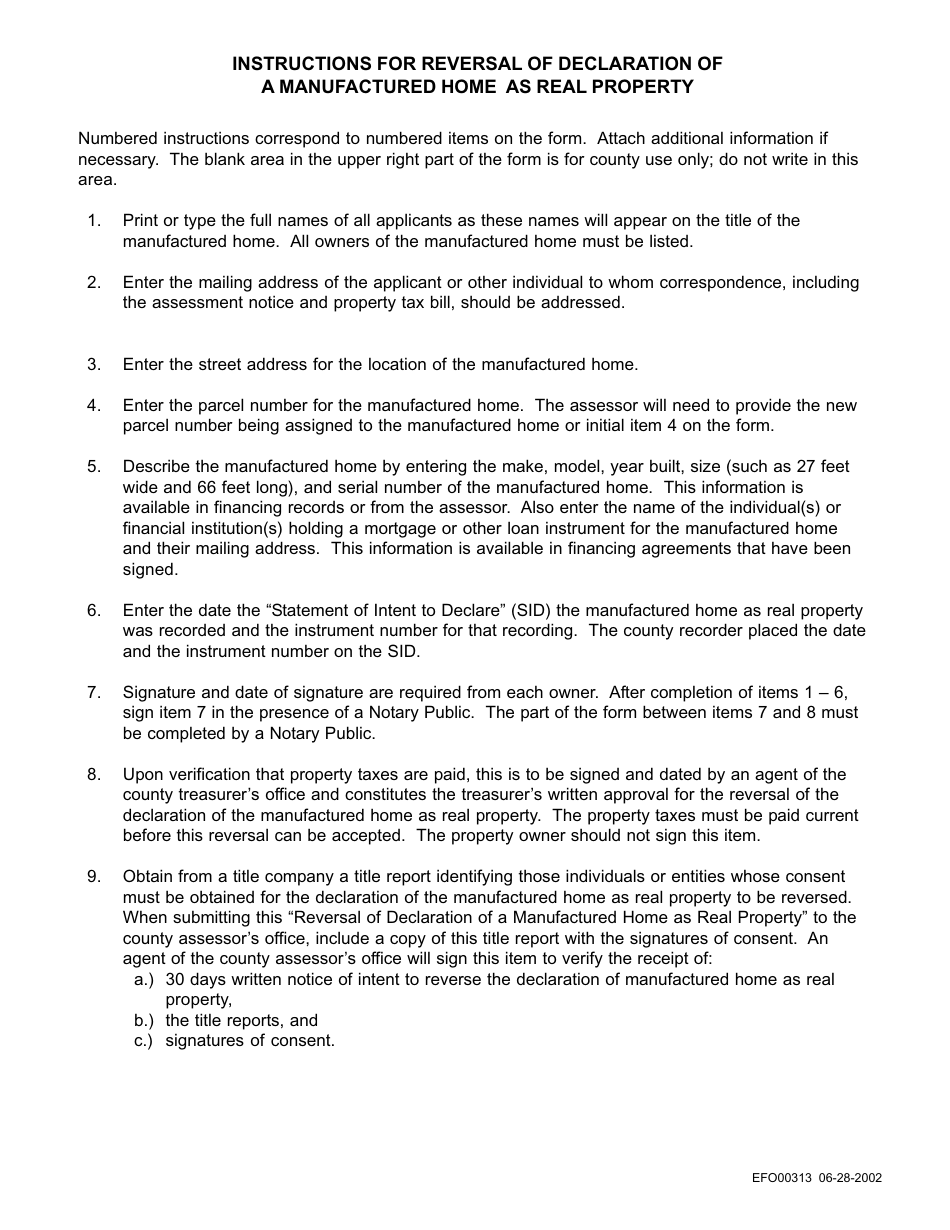

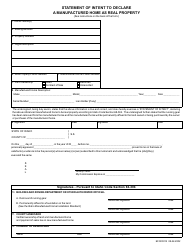

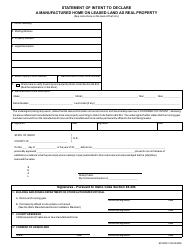

Form EFO00313 Reversal of Declaration of a Manufactured Home as Real Property - Idaho

What Is Form EFO00313?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EFO00313?

A: Form EFO00313 is the document used for the reversal of declaration of a manufactured home as real property in Idaho.

Q: What does the reversal of declaration of a manufactured home as real property mean?

A: It means changing the status of a manufactured home from real property to personal property.

Q: Why would someone want to reverse the declaration of a manufactured home as real property?

A: There could be multiple reasons, such as selling the manufactured home separately from the land it sits on.

Q: Who needs to fill out Form EFO00313?

A: The owner of the manufactured home and the land it sits on may need to fill out this form.

Q: Are there any fees associated with filing Form EFO00313?

A: There may be a fee involved, but it varies by county. You should contact your county assessor's office for details.

Q: Do I need to include any supporting documents with Form EFO00313?

A: Yes, you may need to include a copy of the original declaration of a manufactured home as real property.

Q: What happens after submitting Form EFO00313?

A: Once the form is processed, the manufactured home will be reassessed as personal property instead of real property.

Q: Is there a deadline for submitting Form EFO00313?

A: There may be a deadline, so it's best to check with your county assessor's office for any specific timeframes.

Form Details:

- Released on June 28, 2002;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form EFO00313 by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.