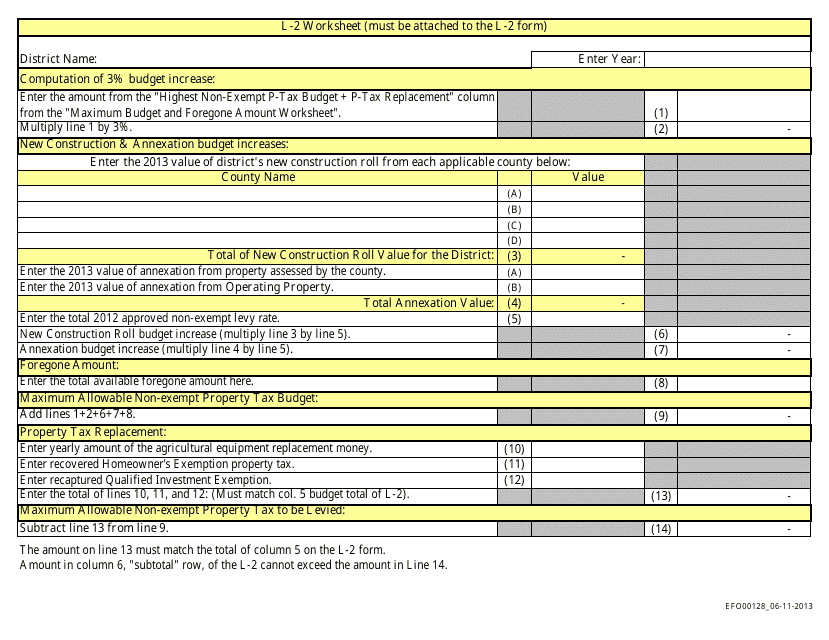

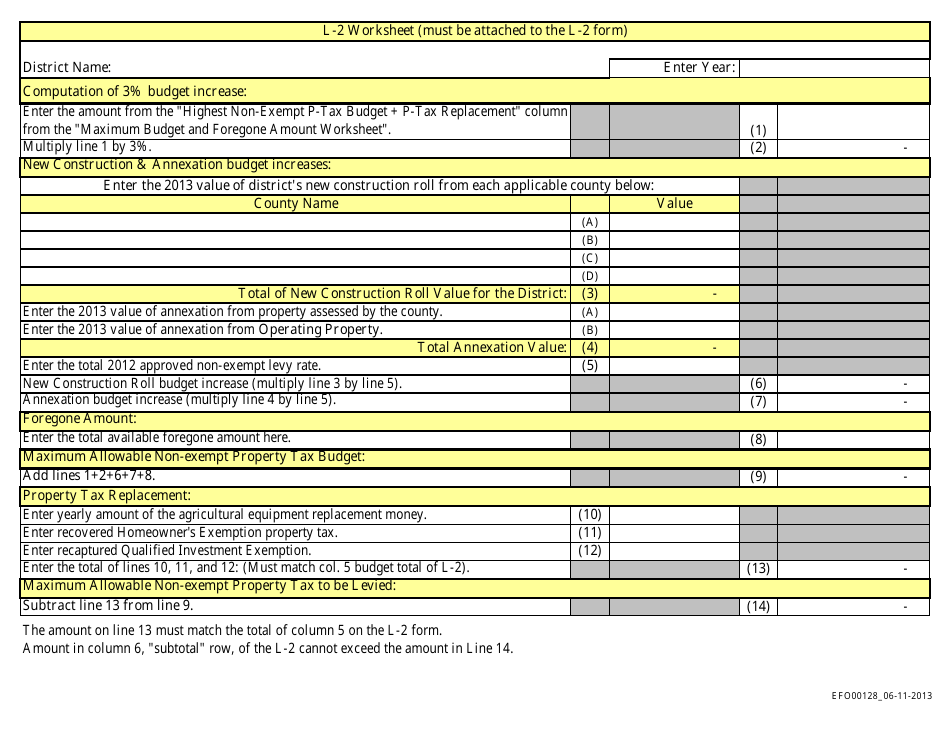

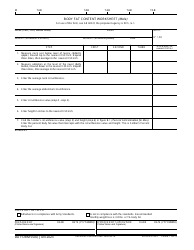

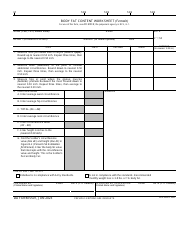

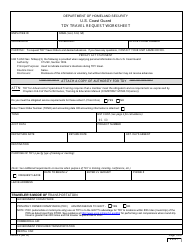

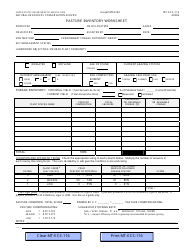

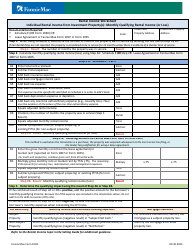

Form L-2 (EFO00128) Worksheet - Idaho

What Is Form L-2 (EFO00128)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-2?

A: Form L-2 is a worksheet used in Idaho.

Q: What is the purpose of Form L-2?

A: The purpose of Form L-2 is to provide a worksheet for calculating Idaho state income tax.

Q: Who uses Form L-2?

A: Form L-2 is used by individuals or households in Idaho who need to calculate their state income tax.

Q: What information is required on Form L-2?

A: Form L-2 requires information such as income, deductions, and credits to calculate Idaho state income tax.

Q: When is Form L-2 due?

A: Form L-2 is typically due on April 15th, the same as the federal income tax deadline.

Q: Are there any penalties for not filing Form L-2?

A: Yes, there can be penalties for not filing Form L-2 or filing it late. It's important to timely file the form to avoid any penalties.

Form Details:

- Released on June 11, 2013;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-2 (EFO00128) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.