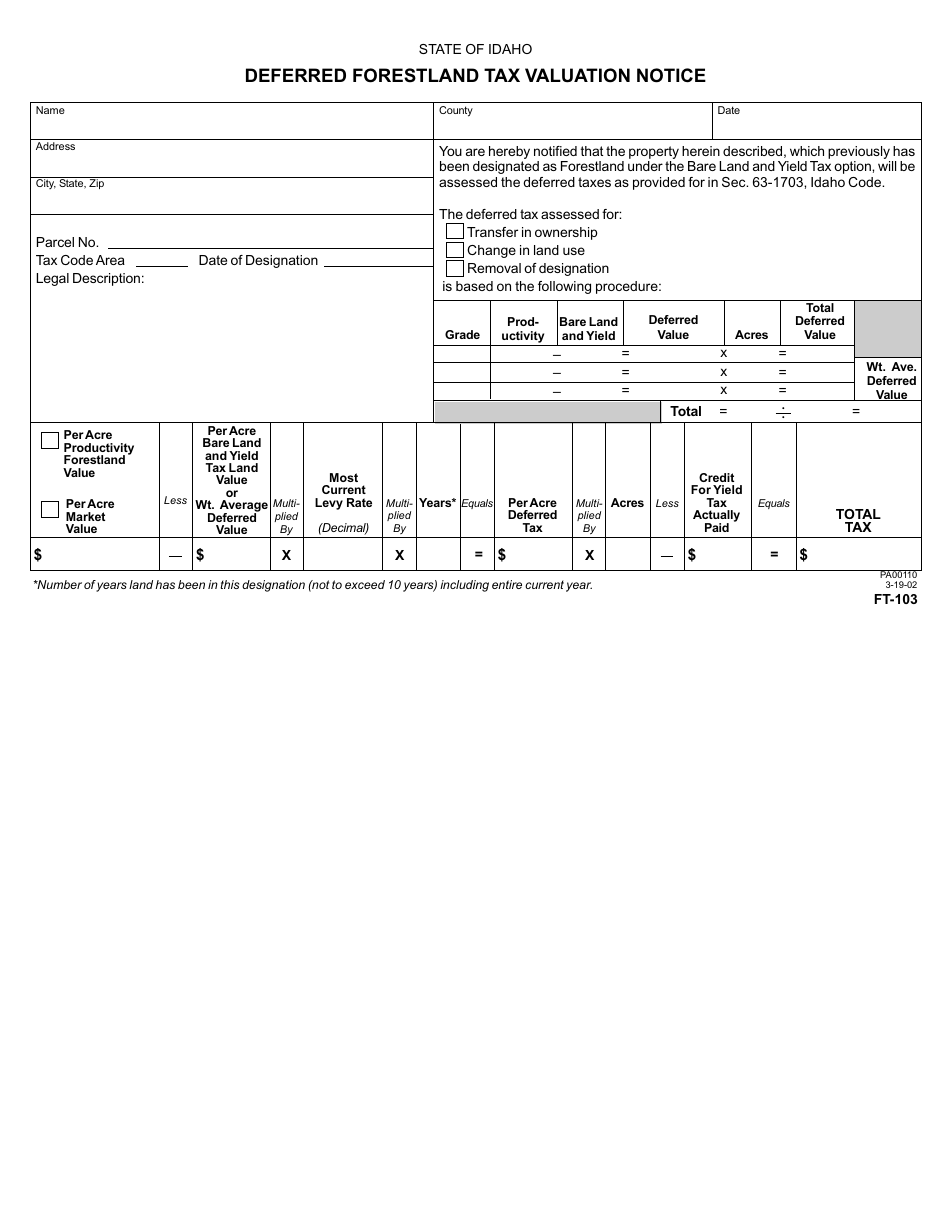

Form FT-103 Deferred Forestland Tax Valuation Notice - Idaho

What Is Form FT-103?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT-103?

A: Form FT-103 is the Deferred Forestland Tax Valuation Notice used in Idaho.

Q: What is deferred forestland tax valuation?

A: Deferred forestland tax valuation is a program in Idaho that allows qualifying forestland owners to receive reduced property taxes.

Q: Who is eligible for deferred forestland tax valuation?

A: Forestland owners in Idaho who meet the program criteria may be eligible for deferred forestland tax valuation.

Q: What is the purpose of Form FT-103?

A: Form FT-103 is used to notify the county assessor's office that the landowner wishes to participate in the deferred forestland tax valuation program.

Q: What information is required to complete Form FT-103?

A: Form FT-103 requires information about the forestland property, including the county, tax code area, and legal description.

Q: Are there any deadlines for submitting Form FT-103?

A: Yes, Form FT-103 must be filed with the county assessor's office between January 1 and April 15 each year.

Q: What are the benefits of participating in the deferred forestland tax valuation program?

A: The benefits of participating in the program include reduced property taxes and the preservation of forestland for future generations.

Q: Can I apply for deferred forestland tax valuation if I own less than 5 acres of forestland?

A: No, the program is only available to forestland owners with 5 or more acres.

Q: What happens if I sell my forestland before the deferred tax is paid?

A: If you sell your forestland before the deferred tax is paid, the remaining balance will become due at the time of sale.

Form Details:

- Released on March 19, 2002;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FT-103 by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.