This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

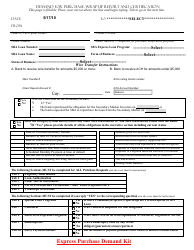

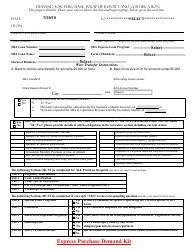

Demand for Filing - North Dakota

Demand for Filing is a legal document that was released by the North Dakota District Courts - a government authority operating within North Dakota.

FAQ

Q: Do I need to file a tax return in North Dakota?

A: Yes, if you meet certain income thresholds or have other filing requirements.

Q: What are the income thresholds for filing a tax return in North Dakota?

A: For single individuals under 65, it's $12,950; for individuals 65 and older, it's $14,600. For married couples, it's $25,900 if both spouses are under 65, or $27,550 if one spouse is 65 or older.

Q: Are there any other filing requirements in North Dakota?

A: Yes, you may also need to file if you have certain types of investment income or if you owe any state taxes.

Q: What is the deadline for filing a tax return in North Dakota?

A: The deadline is typically April 15th, but it may vary slightly depending on weekends and holidays.

Q: What are the consequences of not filing a tax return in North Dakota?

A: If you are required to file a tax return and fail to do so, you may face penalties and interest on any tax owed.

Form Details:

- Released on September 1, 2022;

- The latest edition currently provided by the North Dakota District Courts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the North Dakota District Courts.