This version of the form is not currently in use and is provided for reference only. Download this version of

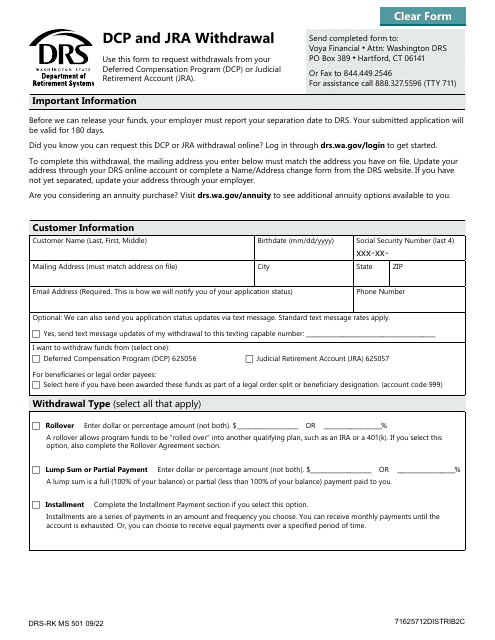

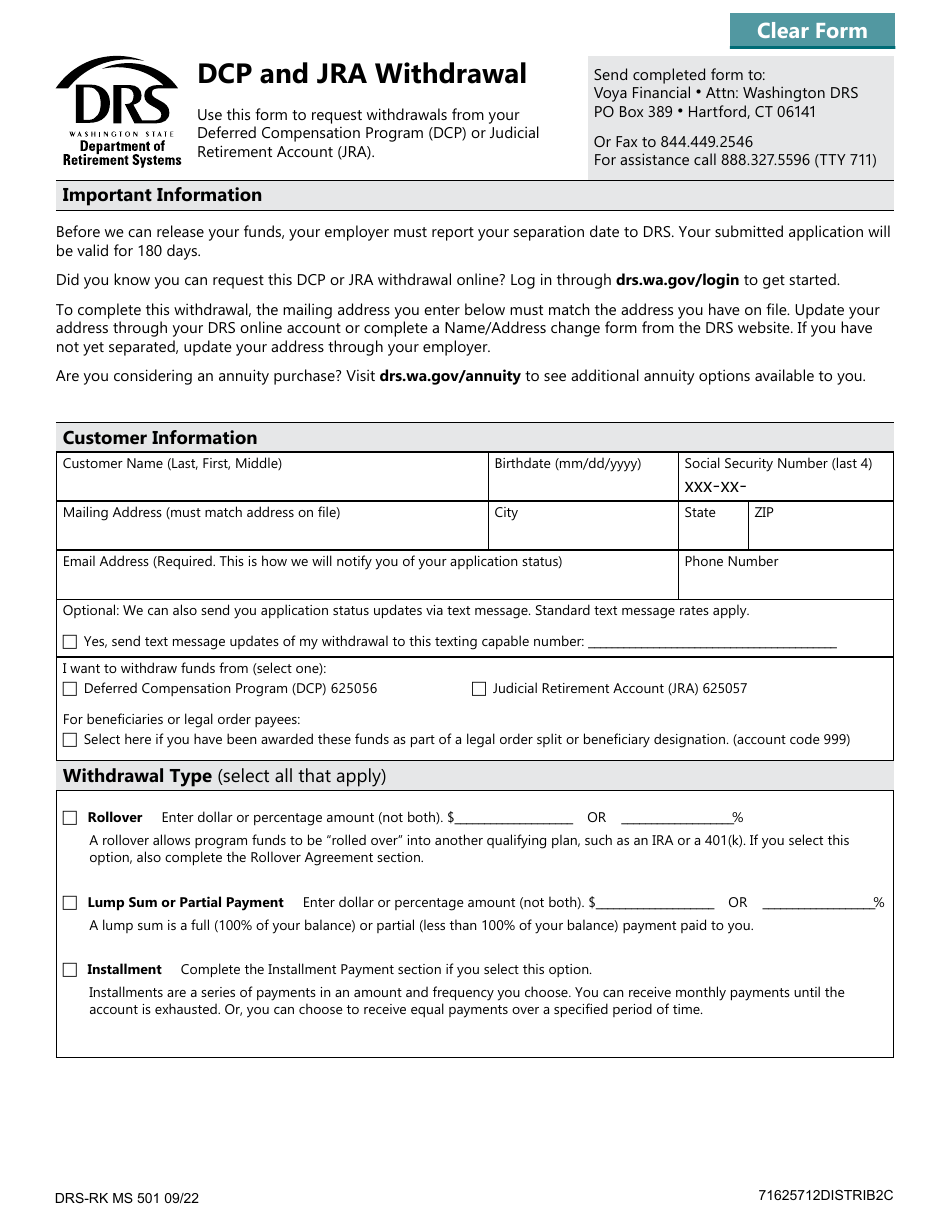

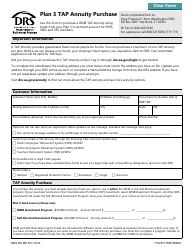

Form DRS-RK MS501

for the current year.

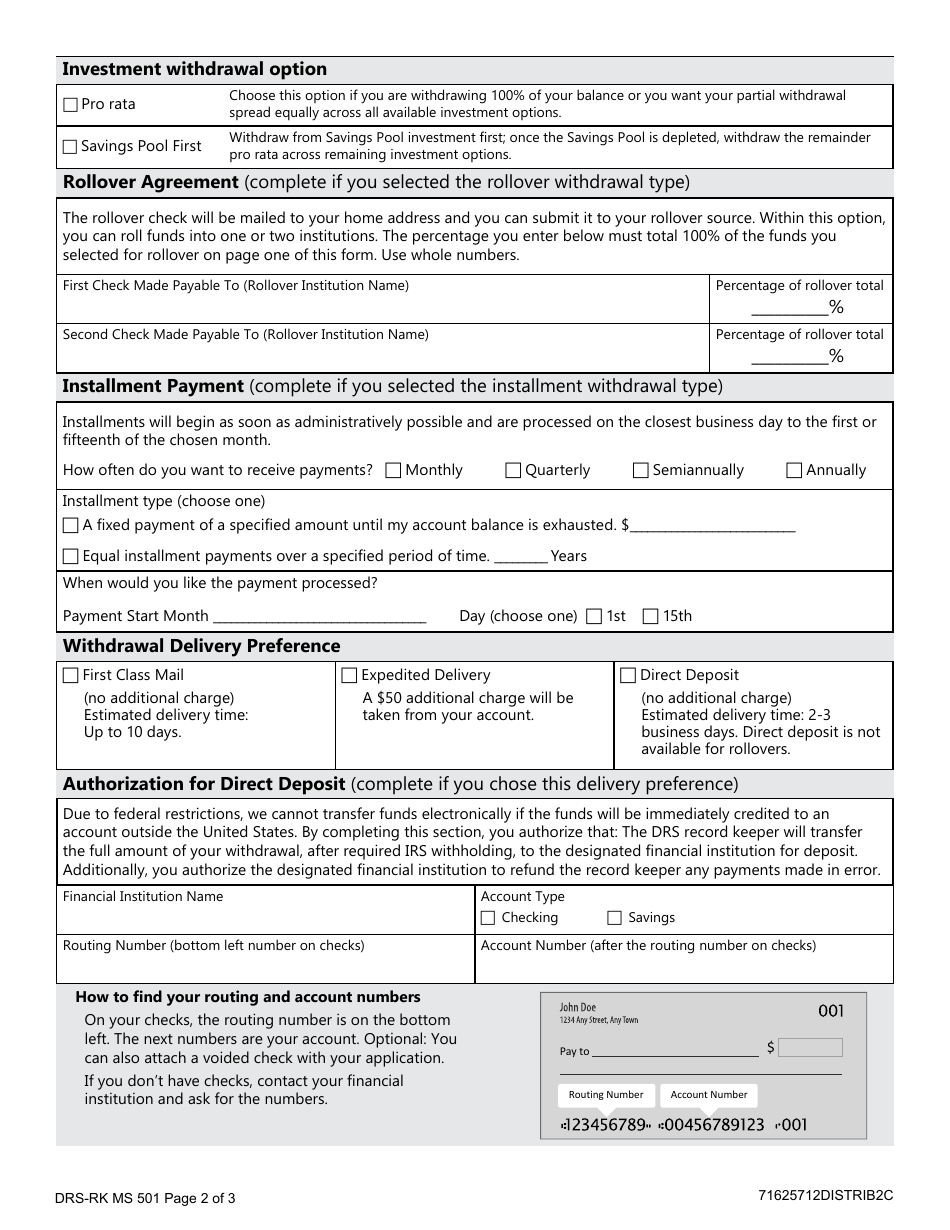

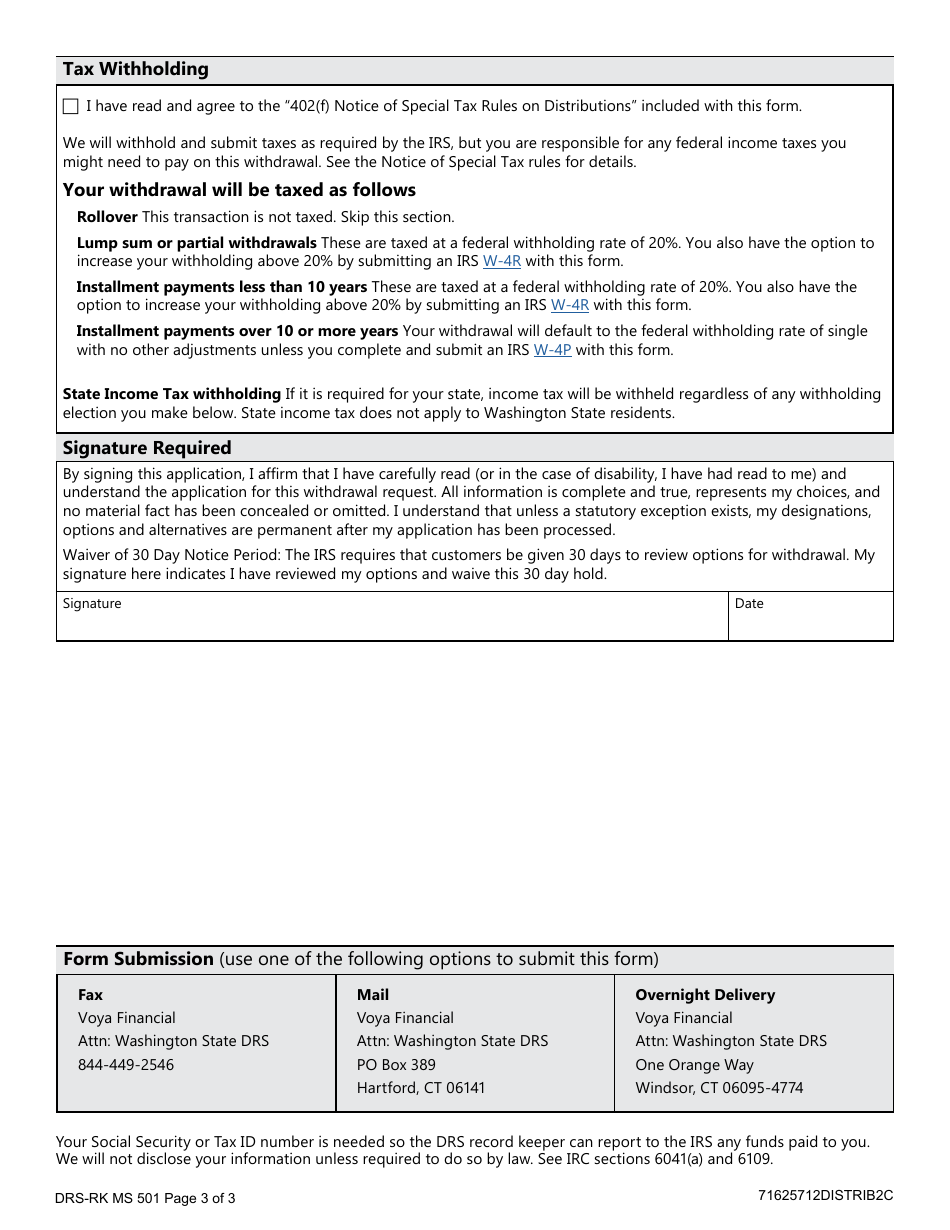

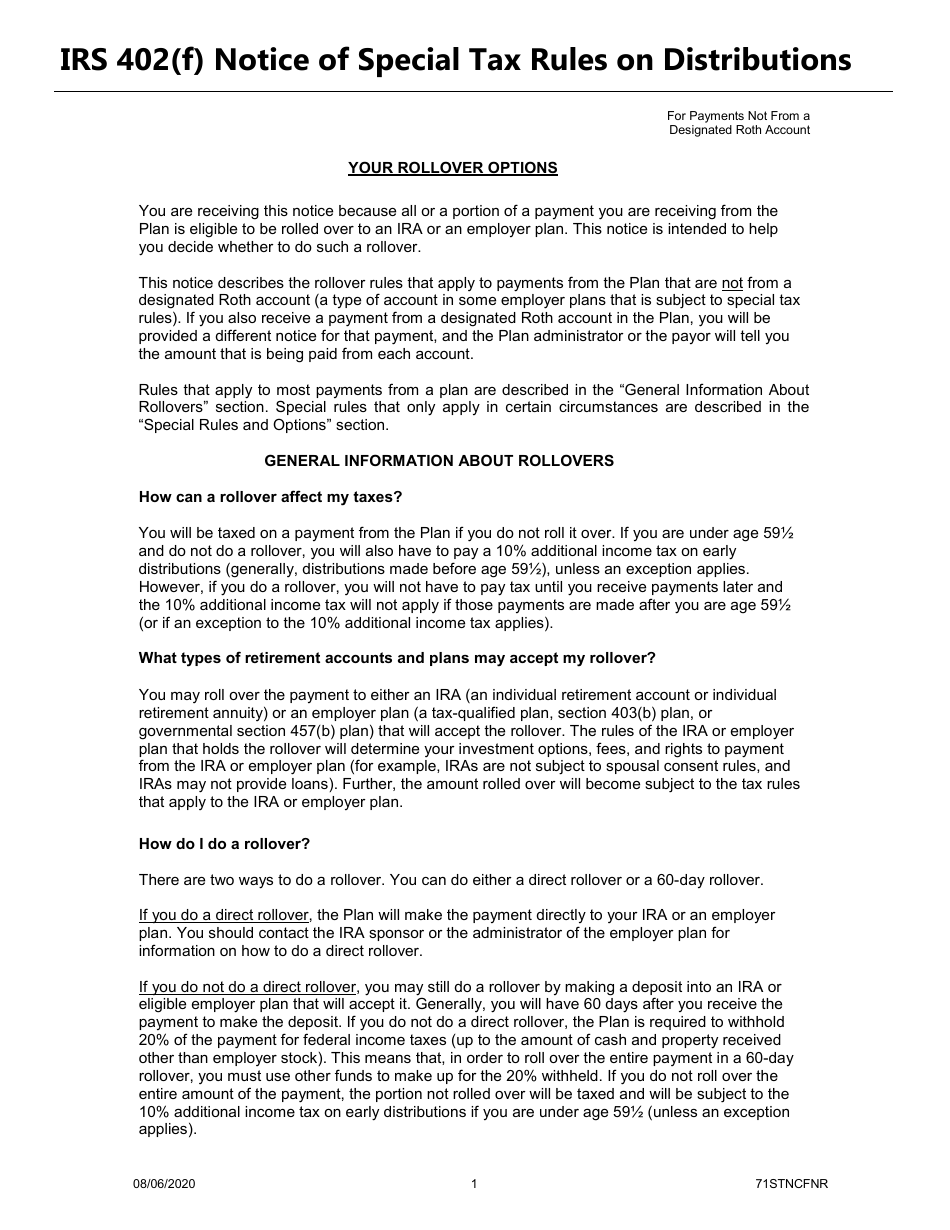

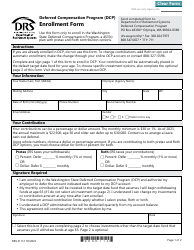

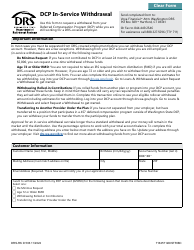

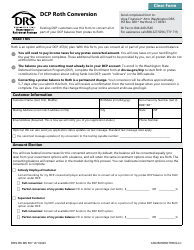

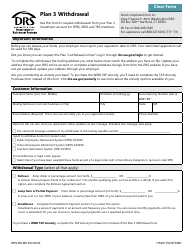

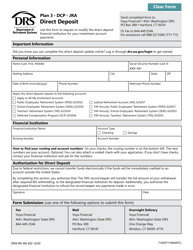

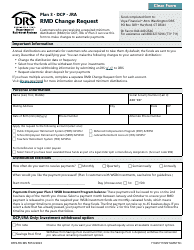

Form DRS-RK MS501 Dcp and Jra Withdrawal - Washington

What Is Form DRS-RK MS501?

This is a legal form that was released by the Washington State Department of Retirement Systems - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DRS-RK MS501?

A: Form DRS-RK MS501 is a form used to request a withdrawal from the Washington state Deferred Compensation Program (DCP) and/or the Judicial Retirement Account (JRA).

Q: What is the Washington state Deferred Compensation Program (DCP)?

A: The Washington state Deferred Compensation Program (DCP) is a voluntary retirement savings program for state and local government employees.

Q: What is the Judicial Retirement Account (JRA)?

A: The Judicial Retirement Account (JRA) is a retirement savings program specifically for judges and justices in Washington state.

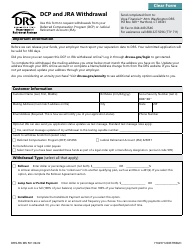

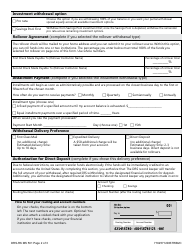

Q: How do I withdraw from the DCP and JRA in Washington?

A: To withdraw from the DCP and JRA in Washington, you need to complete and submit Form DRS-RK MS501, following the instructions provided on the form.

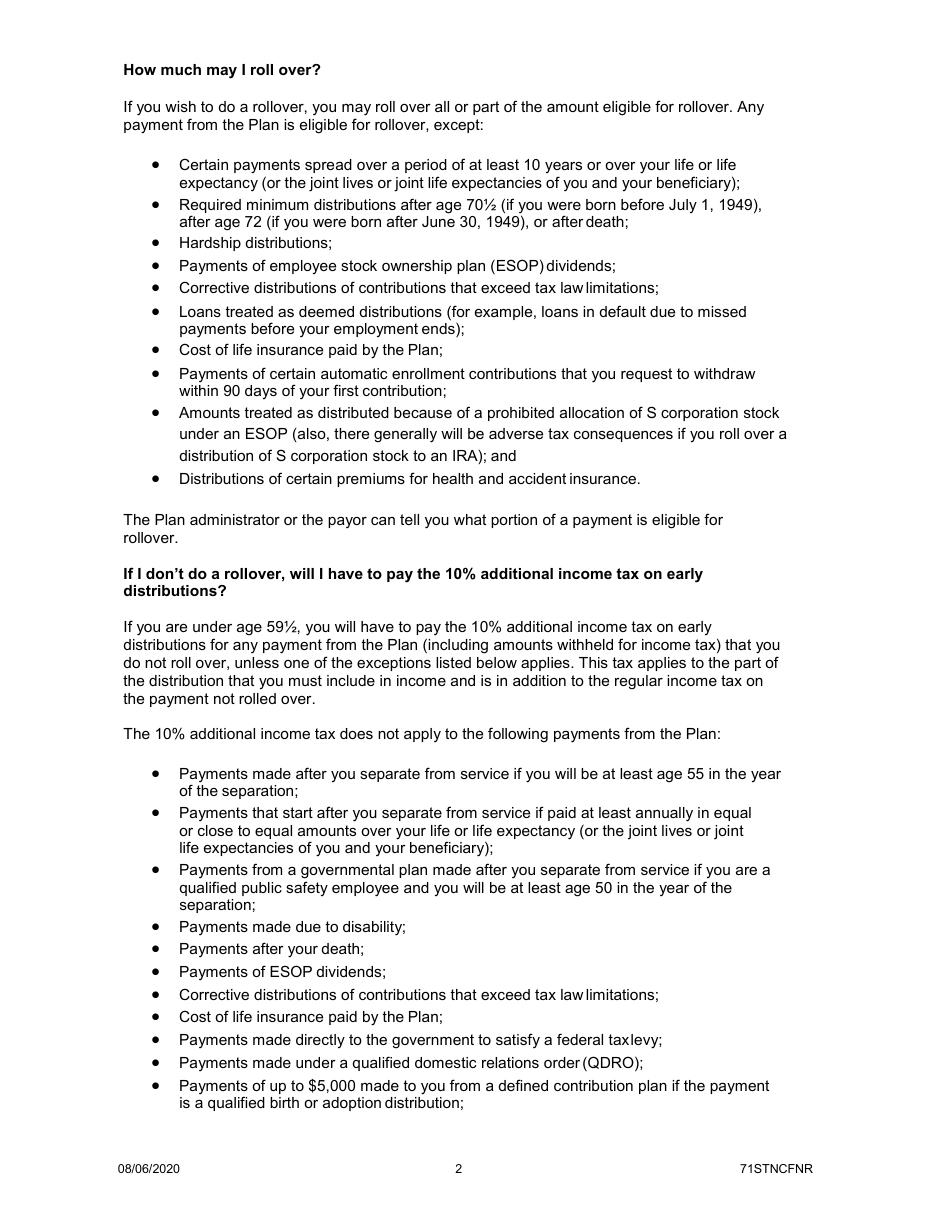

Q: Are there any penalties for withdrawing from the DCP and JRA?

A: Withdrawals from the DCP and JRA may be subject to taxes and early withdrawal penalties. It is recommended to consult with a tax advisor for guidance.

Q: Can I withdraw from the DCP and JRA at any time?

A: Generally, you can withdraw from the DCP and JRA upon termination of employment or retirement. There may be specific rules and restrictions depending on your situation.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Washington State Department of Retirement Systems;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DRS-RK MS501 by clicking the link below or browse more documents and templates provided by the Washington State Department of Retirement Systems.