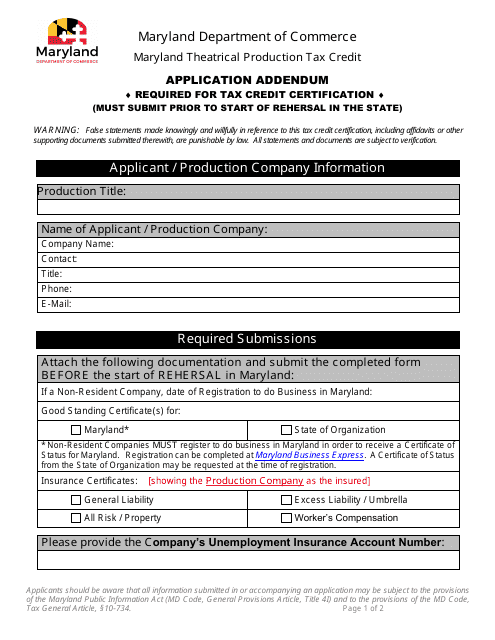

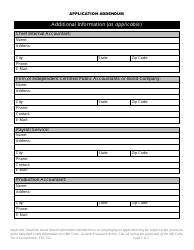

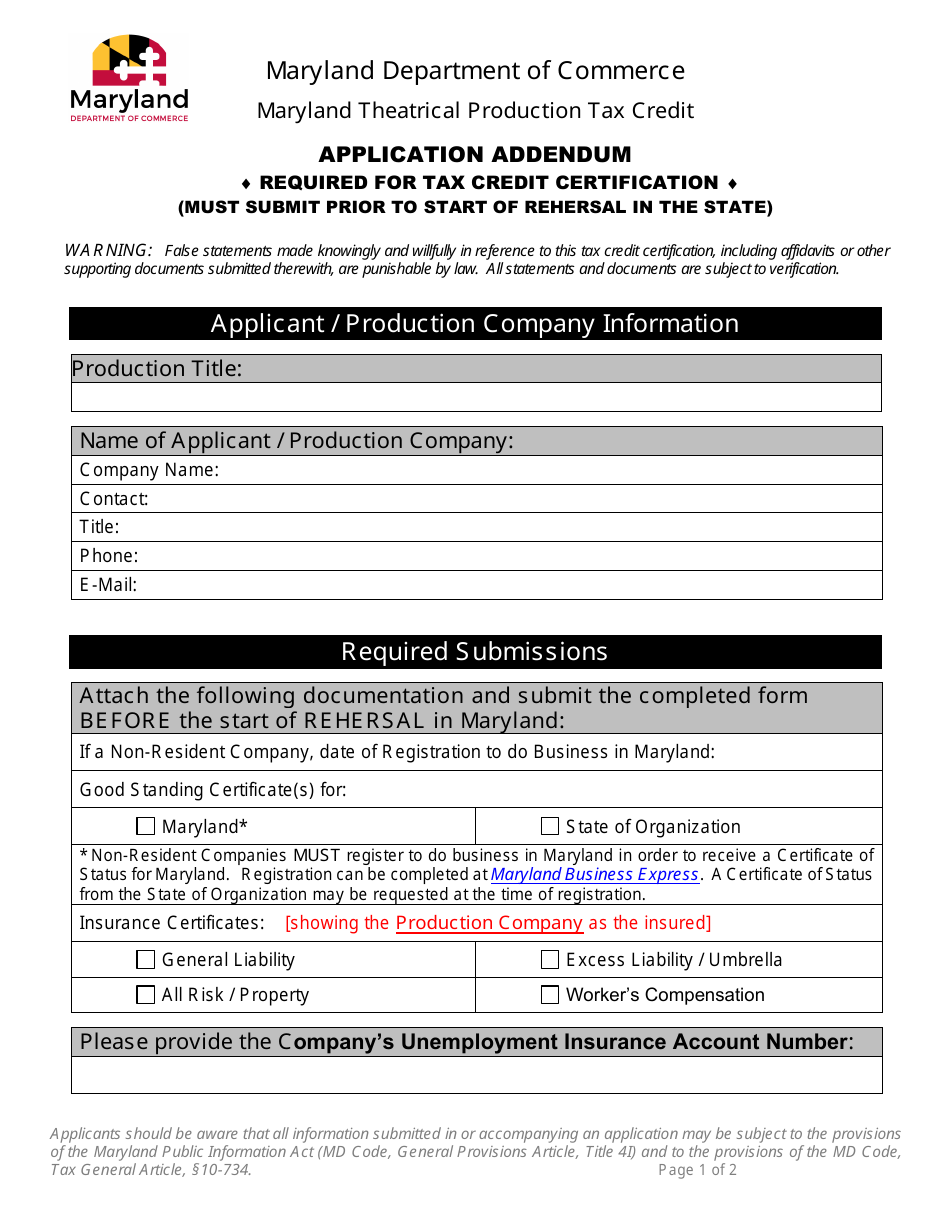

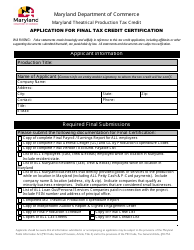

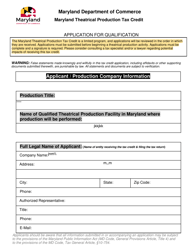

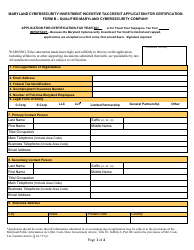

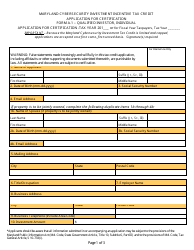

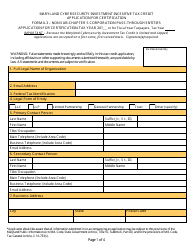

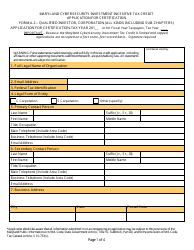

Application Addendum - Maryland Theatrical Production Tax Credit - Maryland

Application Addendum - Maryland Theatrical Production Tax Credit is a legal document that was released by the Maryland Department of Commerce - a government authority operating within Maryland.

FAQ

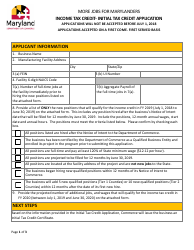

Q: What is the Maryland Theatrical Production Tax Credit?

A: The Maryland Theatrical Production Tax Credit is a tax credit offered by the state of Maryland to encourage the creation of theatrical productions in the state.

Q: Who is eligible for the Maryland Theatrical Production Tax Credit?

A: To be eligible for the tax credit, the production must be engaged in the development, rehearsal, or presentation of a live, scripted, and copyrighted theatrical performance in Maryland.

Q: What are the benefits of the Maryland Theatrical Production Tax Credit?

A: The tax credit allows eligible productions to receive a credit against the state income tax for a portion of the qualified expenses incurred in Maryland.

Q: How much is the tax credit?

A: The tax credit is equal to 15% of the qualified expenses incurred in Maryland, up to a maximum of $500,000 for each production.

Q: What are qualified expenses?

A: Qualified expenses include certain production costs, such as wages paid to Maryland residents, payments to Maryland vendors, and expenses directly related to the production.

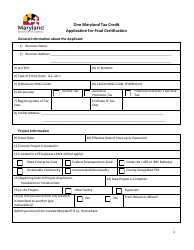

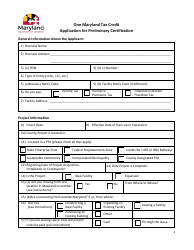

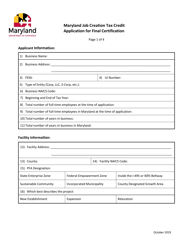

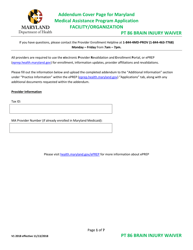

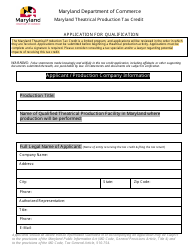

Q: How do I apply for the Maryland Theatrical Production Tax Credit?

A: To apply for the tax credit, you must submit an application, along with supporting documentation, to the Maryland Film Office.

Q: What is the application deadline?

A: The application must be submitted at least 30 days before the first day of production.

Q: Are there any restrictions on the use of the tax credit?

A: Yes, the tax credit cannot be used to offset more than 50% of the taxpayer's Maryland income tax liability in any taxable year.

Form Details:

- The latest edition currently provided by the Maryland Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Commerce.